Do J1 visa holders have to file tax returns?

If you have any tax law questions, contact the IRS directly. For tax filing purposes, most J-1 visa holders are considered Nonresident Aliens. As Nonresident Aliens, J-1 exchange visitors must pay federal, state and local taxes.

Is there age restriction for J-1 visas?

For the J1 Intern Visa, participants must be at least 18 years old, while for the J1 Trainee Visa they must be over 20 years old. The upper age limit is set at 35 years old.

Is it possible to change J1 visa to F1 visa?

It's possible to go from J-1 to F-1 status without leaving the U.S. or remaining outside of it for two years before applying to USCIS. Please answer a few questions to help us match you with attorneys in your area. By clicking “Submit,” you agree to the Martindale-Nolo Texting Terms.

How to apply for J1 US visa?

- Form SS-5: The SSN application form–can be downloaded from the Social Security website.

- Form DS-2019 (Certificate of Eligibility)

- Letter of Sponsorship (printed from their approval email sent by Cultural Vistas)

- I-94 Record Printout: The admission number and electronic I-94 can be accessed online for the duration of the J-1 program here. ...

How do I file taxes with a J-1 visa?

After Your ExchangeReceive your W-2 Form. Your W-2 Form summarizes your earnings and taxes withheld from you the previous year. ... Complete your federal tax return. After you receive your W-2, fill out a 1040NR (Non-Resident Alien) tax form. ... Complete your state tax return. ... Receive your refund. ... Keep all your paperwork.

How much tax do J-1 get back?

There are different J-1 visa tax rates, depending on factors such as your income. All non-residents must pay 10% on any income tax up to $9,950. If you earn more than this amount on your J-1 program, you must pay 12% in income tax on the amount between $9,951 and $40,525.

Do J-1 visa holders pay FICA?

Due to U.S. tax treaties with different nations, J1 visa trainees and interns are generally exempt from taxes from the category of the Federal Insurance Contributions Act (FICA) tax. These include Federal Unemployment, Medicare, and Social Security Taxes.

Is J-1 visa a resident alien?

In general: F and J student visa holders are considered resident aliens after five calendar years in the U.S. J researchers and professors are considered resident aliens after two calendar years in the U.S. H-1, TN, and O-1 visa holders are considered resident aliens once they meet the “substantial presence” test.

Do J-1 students pay taxes?

If you work in the US on a J1 visa, then you'll need to pay tax on income you earn there. The amount of tax you'll pay will depend on how much you earn and will vary by each state. And if you go to the US on a J1 visa, you'll be considered a non-resident alien for tax purposes and taxed as such.

Can you use J1 visa on TurboTax?

As a J-1 visa holder, you are considered as a non-resident for the first two years since you entered the US. After that if you are more than 183 days within the US while on the J-visa you are considered as a resident for tax purposes. If you are considered a resident then you can use TurboTax.

Who is exempt from FICA withholding?

FICA (Social Security and Medicare) taxes do not apply to service performed by students employed by a school, college or university where the student is pursuing a course of study. Whether the organization is a school, college or university depends on the organization's primary function.

Who is exempt from paying Social Security tax?

Members of certain religious groups are often exempt. Most foreign academics and researchers are exempt if they are non-immigrant and non-resident aliens. Self-employed workers who make less than $400 annually do not pay Social Security taxes.

How can I avoid FICA taxes?

The percentage of income for FICA tax that workers pay is determined by federal law and is the same for everyone. The only way to pay less FICA tax (as a dollar amount, not a percentage of pay) is to earn less income.

Do temporary visa holders pay taxes?

If you hold a nonimmigrant visa, you will become a tax resident if you are present in the United States on at least: 31 days during the current year, and. 183 days during the three-year period that includes the current year and the two years immediately before that.

What is a J visa?

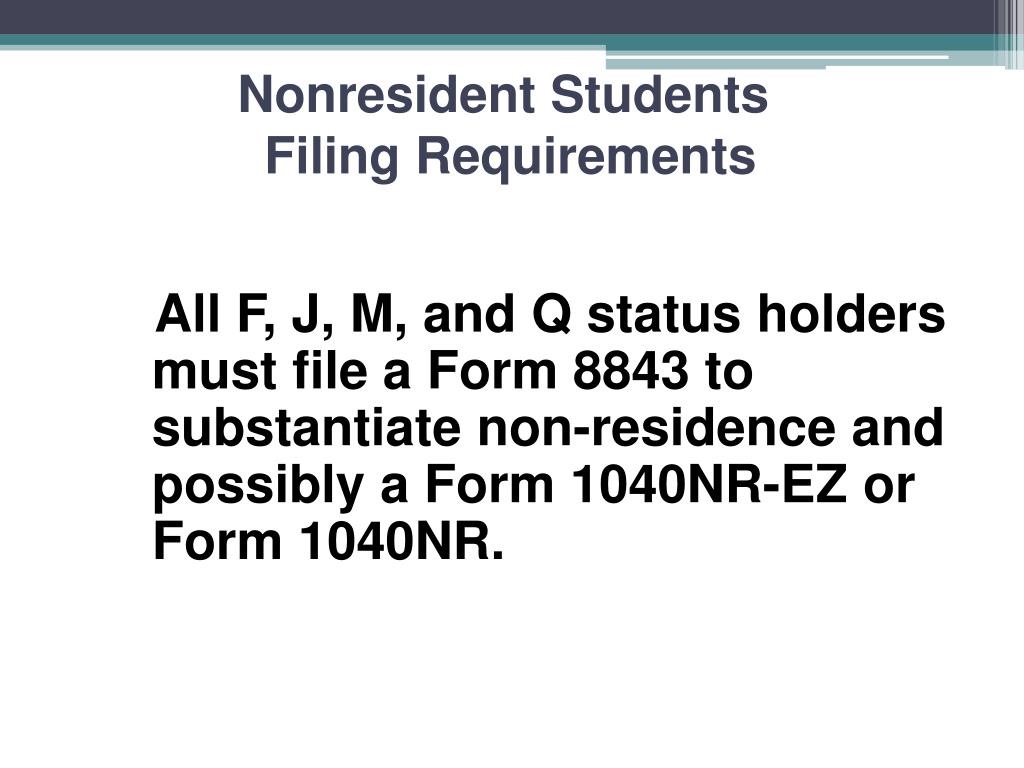

Students are in the U.S. under “J” (exchange visitor) “F,” “M,” (student: academic or vocational) or “Q” (international cultural exchange visitor) visas. These individuals are in the country to study at an academic institution or vocational school. They also must be complying with their visa requirements.

What is an exempt exchange visitor?

As an exempt exchange visitor, you are a nonresident alien individual in the U.S. This label affects whether or not you must pay taxes. Generally, this means that you will not be required to pay taxes on compensation you receive from a foreign employer while you are in the U.S. completing a training or internship program.

What is dual status tax?

You are a dual-status tax payer if, within the same year, you spend time both as a resident alien and nonresident alien. This means that J-1 visa tax rules about what you must pay are different throughout the year. You must figure out your J-1 visa resident status to determine your J-1 visa tax status.

How to claim treaty benefits?

Once you establish that you receive treaty benefits, it’s time to claim them. You can do this by filling out form W-8BEN. Aliens, students, teachers, trainees, and researchers may use form 8233. Sometimes, individuals will need to fill out form 8833. If you are struggling to figure out which J-1 visa tax form you must file, talk to your J-1 visa employer or the university where you are studying. Someone will be able to help you.

Who qualifies as a foreign employer?

Who qualifies as a foreign employer? This could be a nonresident alien individual, as well as a foreign corporation or partnership. It could also be a business or office located in another country, which is operated and/or owned by a U.S.-based corporation, partnership, or individual.

Do non-resident aliens pay taxes?

As a nonresident alien, the taxes you may have to pay could differ from those required by U.S. residents.

Do you have to pay taxes if you have a family member?

If your family is staying with you while you are studying in the U.S., then they are also exempt from paying taxes. These family members include your spouse and unmarried children under 21 who live in your house and are not part of another family.

What are the two major groups of non-citizens?

The United States tax system classifies non-citizen eligible taxpayers into two major groups – resident and non-resident aliens.

What does it mean to be considered guilty of tax evasion?

Tax Evasion: You will be considered to have committed evasion when you deliberately avoid paying a true tax liability. This could mean nonpayment or underpayment of J-1 visa taxes.

Do you have to report foreign investment on your taxes?

If you meet the resident alien requirement, you will be taxed under the same regulations that apply to a U.S. citizen. Resident taxpayers are to report their worldwide income on their U.S. tax return. They are also, in some cases, required to report their foreign investment and bank reports.

Do you have to contribute to Social Security if you are a J-1?

As a J-1 visa holder, if you earn wages in the United States, it is expected of you by law that you contribute a certain percentage of your earnings to the Social Security and Medicare programs. However, your tax payment arrangement will be dependent on whether you are a “resident” or “non-resident” alien.

Is Social Security taxable?

Social Security and Medicare are generally mandatory for anyone who works and earns an income in the U.S. The total taxable amount is 15.3% of the employee’s gross pay. The employee pays half of the amount (7.65%) while the employer pays the remaining half. 6.2% of it goes toward Social Security and 1.45% for Medicare. The Social Security Tax is for retirement benefits required of almost all workers even from those who might not be able to spend enough time in the United States to enjoy the benefits.

Do non-resident aliens have to report income?

While resident aliens are to report their worldwide income, non-resident aliens, on the other hand, are only required to report income received from sources within the U.S. This income can be reported as either of the two following options:

Are There Special Tax Exemptions for J-1 Visa Holders?

If you are already in the U.S. on a J-1 visa, you might be able to avoid certain tax payments if you fall in any of the exemption categories below:

Who can help me with my J-1 visa tax return?

Sprintax is the nonresident partner of choice for TurboTax and the only online federal and state self-prep tax software for nonresidents in the US.

How do I claim J-1 tax back?

Many J-1 international students are entitled to claim refunds on both federal and state taxes. You can do this by filing your tax return.

Can J-1 visa holders avail of tax treaty benefits?

Most J-1 participants (for example work & travel and au pairs) can’t avail of tax treaties.

Can you claim dependents on your J-1 tax return?

Citizens of Canada, Mexico, and South Korea and J-1 students and trainees from India who use the India tax treaty are allowed to claim their dependents on the 1040NR form.

Where do I send my J-1 tax return form?

The address you send your relevant tax forms will depend on where you stayed during your time in the states.

Do J-1 visa holders have to pay taxes in the US?

J-1 holders in the US have to pay tax on any US-sourced income they receive during their stay in the US. How much tax you will pay will depend on a number of factors, such as how much you earn, the rate of tax in your state, and if your country of residence has a tax treaty with the US. All non-residents must pay 10% on any income tax up to $9,950. If you earn more than this amount on your J-1 program, you must pay 12% in income tax on the amount between $9,951 and $40,525.

Are there any tax exemptions for those on a J-1 visa?

As a nonresident, you will be exempt from certain taxes, such as Social Security and Medicare (FICA tax). Your country of residence will also have a bearing on what taxes you will pay, as you may be entitled to tax treaty benefits. It is important to note, as a nonresident J-1 participant, it is ILLEGAL for you to claim American Opportunity Tax Credit (AOTC).

Why is a W-2 important?

The W-2 form is one of the most important parts of the tax claim application because all payments received from your employer and all tax deductions are listed there for the last calendar year. You must enter this data into the tax refund application and attach the W-2 form to your application to be sent to the Internal Revenue Service (IRS). ...

Do you have to pay taxes if you work in the US?

The general rule that everyone who works in the U.S. must pay taxes even if they permanently reside outside the U.S . applies. Anyone residing in the US with a J , F, Q, or M visa, and has any sort of income, is required to pay U.S. taxes.

Do J1 trainees pay taxes?

Therefore, all J1 trainees and J1 interns who receive an income during their internship must expect to pay Federal, State, and Local Taxes. However, you have the option to claim taxes paid in the U.S. depending on your income. Please apply for a tax refund.

Is a J1 visa taxed?

Due to U.S. tax treaties with different nations, J1 visa trainees and interns are generally exempt from taxes from the category of the Federal Insurance Contributions Act (FICA) tax. These include Federal Unemployment, Medicare, and Social Security Taxes. However, these charges are often automatically deducted from your monthly check by your ...

Are you eligible for a refund?

Fill out the form below to receive an email with the next steps to apply for a tax refund.

Who can help J1 participants with their important tax forms?

Sprintax Forms (formerly Sprintax TDS) is developed specifically to ensure that nonresident students, scholars, and professionals are taxed correctly on income earned in the US, so that the correct amount of taxes are withheld from earnings and reported to the IRS.

Are J1 participants entitled to tax treaty benefits?

The US has signed tax treaties with over 60 countries across the world.

Do J1 participants pay FICA tax?

FICA (Federal Insurance Contributions Act) is a US federal payroll tax which funds both the Social Security and Medicare programs.

Are J1 participants residents or nonresidents for tax purposes?

One of the primary deciding factors in evaluating how a J1 worker should be taxed is the determination of their residency status for tax purposes.