Are visa fees tax deductible for US citizens?

While you’re out of luck as far as taking a tax deduction for visa application fees or green card cost, most of the same deductions available to U.S. citizens are enjoyed by those with resident alien status. There’s one caveat: To claim these deductions, you must reside in the U.S. for the entire year.

Are immigration fees tax-deductible?

Further, immigration fees are not tax deductible for income tax purposes. If you are seeking citizenship, prepare to pay all related fees out of pocket without the option of deduction or reimbursement. While personal fees and legal expenses are not deductible,...

Are legal fees for filing a petition for a work visa deductible?

The correct answer would depend on the status of the taxpayer and the type of visa. Petitioning employer's legal fees in hiring an employee are likely to be a deductible expense; however employee's legal fees are likely to be a personal non-deductible expense.

Can I deduct my immigration expenses?

Even though you can’t deduct your immigration expenses, there is one major expense related to your relocation to the U.S. that isdeductible. That is the cost of moving to the U.S. from outside of the country because of your job. To qualify for a moving expense deduction, you must meet several tests.

Are foreign expenses tax deductible?

If you paid or accrued foreign taxes to a foreign country or U.S. possession and are subject to U.S. tax on the same income, you may be able to take either a credit or an itemized deduction for those taxes.

What expenses are 100% tax deductible?

Business travel and its associated costs, like car rentals, hotels, etc. is 100 percent deductible. Gifts to clients and employees are 100 percent deductible, up to $25 per person per year. If you're self-employed and pay your own health premiums, you can deduct those at 100 percent.

What qualifies as travel expenses are tax deductible?

Deductible travel expenses while away from home include, but aren't limited to, the costs of: Travel by airplane, train, bus or car between your home and your business destination. (If you're provided with a ticket or you're riding free as a result of a frequent traveler or similar program, your cost is zero.)

Are h1b fees tax deductible?

No, the IRS does not allow you to deduct USCIS fees from your income for tax purposes. Nor can you deduct the cost of legal representation for an immigration matter, as this expense does not meet the IRS guideline: a deductible expense must be directly related to the production of income.

What can I claim on tax without receipts 2022?

How much can I claim with no receipts? The ATO generally says that if you have no receipts at all, but you did buy work-related items, then you can claim them up to a maximum value of $300. Chances are, you are eligible to claim more than $300. This could boost your tax refund considerably.

What are the new tax deductions for 2021?

The standard tax deduction for 2021 and 2022Filing status2021 tax year2022 tax yearSingle$12,550$12,950Married, filing jointly$25,100$25,900Married, filing separately$12,550$12,950Head of household$18,800$19,400

How much travel expenses can I claim without receipts?

If the entire amount of your claimed expenses is more than $300, you are required to produce documented documentation in order to be eligible for a tax deduction. If the total amount of your claimed expenses is less than $300, you are not required to present proof.

What are considered travel expenses?

Examples of travel expenses include airfare and lodging, transport services, cost of meals and tips, use of communications devices. Travel expenses incurred while on an indefinite work assignment, which lasts more than one year according to the IRS, are not deductible for tax purposes.

How much travel allowance can I claim?

Transport Allowance for Salaried Person (Non-Handicapped)- Transport Allowance of Rs. 1,600 per month is tax-free for a salaried employee. Any amount received in excess of Rs. 1600 is taxable.

How does H1B visa save tax?

10 Amazing H1B Tax TipsKeep the W-2 form handy. ... Make investments. ... Claim spousal exemption. ... Pay tax on your worldwide income. ... Declare all your financial interest. ... Declare your dependents. ... Claim your Medicare for the period you were on OPT. ... Claim deductions for moving expenses.More items...

Is green card fees tax deductible?

Generally, no, the fees are not deductible. The green card is a travel document and it is proof of lawful permanent residency status.

Can employer ask employee to pay visa fees?

As an employer, they have the right to set some conditions regarding the fees they advance for you. Like some companies offer relocation packages, visa fees... but they can, if they want to, make you sign a contract that you would have to refund these fees if you are to leave before date X.

Are meals ever 100% deductible?

The Consolidated Appropriations Act of 2020 provided an interesting benefit for businesses in 2021 and 2022. Instead of being limited to a 50% deduction for business meals, businesses can deduct 100% of certain meals provided by restaurants.

What meals and entertainment expenses are 100 deductible?

Modifications to restaurant meals deductions For costs paid or incurred during the 2021 and 2022 calendar years, businesses may claim a deduction for 100% of the cost of meals provided by a restaurant. The temporarily enhanced deduction doesn't apply to entertainment, which remains a disallowed deduction.

Are travel meals 100 deductible in 2022?

Enhanced business meal deduction For 2021 and 2022 only, businesses can generally deduct the full cost of business-related food and beverages purchased from a restaurant. Otherwise, the limit is usually 50% of the cost of the meal.

What deductions can I claim without receipts?

If you don't have original receipts, other acceptable records may include canceled checks, credit or debit card statements, written records you create, calendar notations, and photographs. The first step to take is to go back through your bank statements and find the purchase of the item you're trying to deduct.

Is it a personal advantage to be 100% for the benefit of the business?

Absolutely not since they are not 100% for the benefit of the business, there is personal advantage in it.

Can an employer claim a visa fee?

An employer can claim for a visa fee paid on behalf of a prospective. employee as a business expense in the accounts, provided the sole. purpose in paying the fee is to secure the services of the prospective. employee.".

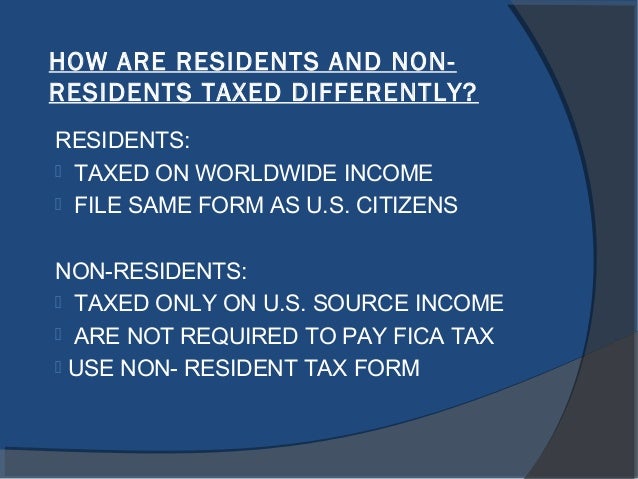

What deductions are eligible for 2017?

Eligible deductions for all taxpayers (resident aliens and U.S. citizens) include: Unreimbursed medical and dental expenses exceeding 7.5 percent of your adjusted gross income (AGI) for tax years 2017 and 2018.

How long can you deduct moving expenses?

These include: Time relation – you can generally deduct moving expenses if they occur within one year from the time you initially reported to work. Distance – your new home must prove closer to your new work location than your prior home.

What is the standard deduction for 2017?

For 2017, the standard deduction is $6,350 for single filers and $12,700 for those married filing jointly. This standard deduction increases to $12,000 for single filers and $24,000 for married couples filing jointly as of 2018 due to recent tax reforms. 00:00.

How much does it cost to get citizenship?

Fees for U.S. Citizen and Immigration Services applications and petitions rose significantly as of December 31, 2016, so if you were engaged in the citizenship application process during 2017, it’s even more costly than before. For example, filing a Form N-400, the application for U.S. citizenship, cost $640 in 2018, along with a $85 biometric fee for most applicants, for a total of $725. Biometrics simply refers to taking fingerprints, getting a photograph and putting an electronic signature on file. Prior to the end of 2016, the fee for filing the N-400 was $595. The biometric fee did not change.

Is immigration tax deductible?

Further, immigration fees are not tax deductible for income tax purposes. If you are seeking citizenship, prepare to pay all related fees out of pocket without the option of deduction or reimbursement. While personal fees and legal expenses are not deductible, certain business expenses are deductible on an employee’s tax return.

Do you have to report income from outside the country?

Because the U.S. requires the reporting of income earned globally, you must include income coming from outside of the country, including any rental or other income generated in your native land. Your income is subject to the same tax brackets and rates as U.S. citizens.

Can you take standard deductions on Schedule A?

Note that you can take these deductions on Schedule A only if you choose to itemize deductions. If your standard deductions are more than your itemized deductions, then your best choice is to just use the standard deduction, and therefore pay less tax.

What are the deductions for 2020?

For the tax year 2020, those deduction amounts are: 1 1 $12,400: single taxpayer (increasing to $12,550 for 2021) 2 $12,400: married taxpayer filing separately ($12,550 for 2021) 3 $18,650: head of household ($18,800 for 2021) 4 $24,800: married taxpayer filing jointly ($25,100 for 2021) 5 $24,800: qualifying widow (er) ($25,100 for 2021)

How much is Schedule A itemized deduction for 2020?

Due to the TCJA standard deductions for U.S. taxpayers increased substantially. For the tax year 2020, those deduction amounts are: 1 . $12,400: single taxpayer (increasing to $12,550 for 2021)

What is the Tax Cuts and Jobs Act?

The Tax Cuts and Jobs Act (TCJA) was signed into law by former President Trump in December 2017 (with the majority of its clauses taking effect in 2018). The TCJA was the biggest overhaul of the tax rules in 30 years. For individuals, it wiped out many of the miscellaneous itemized deductions taxpayers had used in previous years. Some of the most prevalent changes eliminated expenses taken by individuals for business involvement, such as vehicular costs.

What is the IRS 535?

Allowable deductions for businesses are detailed in IRS Publication 535. Businesses have the opportunity to deduct nearly any expense involved with their business throughout the year when they are determining their bottom line for annual taxes.

Can a business deduct credit card processing expenses?

For example, this alleviates an annual fee on a personal credit card but could include finance charges on purchases made with the card. Businesses can also deduct any credit or debit card processing expenses involved with paying their taxes.

Does credit card fees depend on business?

The short answer is, it depends. It largely depends on whether any credit card fees are incurred for business purposes or if the card was for personal use. Below are details for each type of situation.

Is a credit card tax deductible?

In general, pretty much anything pertaining to a credit card is not tax-de ductible as a personal itemized de duction but is tax-deductible for a business .

Settled Status applications

Regardless of the outcome of Brexit negotiations, all EU citizens living in the UK (other than Irish citizens or those with indefinite leave to enter or remain in the UK) who wish to remain in the country after 31 December 2020 will need to apply for Settled Status under the EU Settlement Scheme.

Visa costs

Currently, individuals from outside the EEA or Switzerland who wish to come and work in the UK have to apply for a Visa. If an employer meets the costs of a Visa application, the tax treatment depends on whether or not the individual is already in the UK:

Alex Meyerovich

The correct answer would depend on the status of the taxpayer and the type of visa. Petitioning employer's legal fees in hiring an employee are likely to be a deductible expense; however employee's legal fees are likely to be a personal non-deductible expense.

Thuong-Tri Nguyen

Personal expenses and legal fees for personal situations are generally not tax deductible. Legal fees for actions that result in taxable income may be tax deductible. Unless being paid by a business as ordinary and necessary business expenses...