Yes, hubby can applyf or ITIN even if he has a B2 visa

B visa

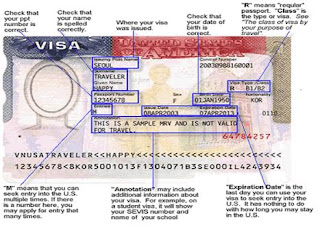

A B visa is one of a category of non-immigrant visas issued by the United States government to foreign citizens seeking entry for a temporary period. The two types of B visa are the B-1 visa, issued to those seeking entry for business purposes, and the B-2 visa, issued to those seeki…

Social Security number

In the United States, a Social Security number is a nine-digit number issued to U.S. citizens, permanent residents, and temporary residents under section 205c of the Social Security Act, codified as 42 U.S.C. § 405(c. The number is issued to an individual by the Social Security Ad…

Do I need an ITIN If I have a visa?

The type of visa, if the person applying has one. The reason why an ITIN is needed. A taxpayer whose ITIN has been deactivated and needs to file a U.S. return can reapply using Form W-7, Application for IRS Individual Taxpayer Identification Number.

How do I get a B2 visa for the USA?

To apply for a US Tourist visa you must go through these simple steps: Submit Form DS-160. Pay visa fees. Schedule your US Tourist Visa interview. Compile your B2 Visa document file. Attend the visa interview.

Can I extend my B2 visa after 6 months?

If you want to stay longer, you can get a B2 visa extension for an additional 6 months. You should apply for a B2 visa extension at least 42 days before the expiration of your I-94 card. Yet, you are not allowed to apply within three months of arrival in the US.

What is the difference between a B1 and a B2 visa?

A difference between many other types of USA visas and the B2 visa is that it has no cap. This means that as long as you qualify and meet the requirements, you can get this visa to visit the US. Different from the B2 visa, the B1 visa allows you to enter the US with the purpose of business,...

Can a tourist visa apply for ITIN?

The visitor must have an ITIN before any payment can be processed. To apply for an ITIN, the visitor should complete a Form W-7 (Application for IRS Individual Taxpayer Identification Number).

Who qualifies for an ITIN number?

An ITIN, or Individual Taxpayer Identification Number, is a tax processing number only available for certain nonresident and resident aliens, their spouses, and dependents who cannot get a Social Security Number (SSN).

Can foreigner apply for ITIN?

For most individuals, their TIN is a social security number (SSN). A foreign person, who doesn't have and can't get an SSN, must use an individual taxpayer identification number (ITIN). A foreign person may be a resident alien for income tax purposes based on his or her days of presence in the United States.

Do you need a visa to get an ITIN?

Applicants will be required to submit (along with the passport) either: If under 6 years of age: A U.S. medical record, U.S. school record, or U.S. state identification card that lists the applicant's name and U.S. address, or a U.S. visa.

How can I get an ITIN number quickly?

You can call the IRS toll-free at 800-829-1040 if you are in the United States or 267-941-1000 (not a toll-free number) if you are outside the United States. This service allows you to check the status of your application seven weeks after submitting Form W-7 and your tax return.

How long does it take to get ITIN?

How long does it take? You will receive a letter from the IRS assigning your tax identification number usually within seven weeks if you qualify for an ITIN and your application is complete.

How long does it take to get an ITIN number 2022?

A11: If you qualify for an ITIN and your application is complete, you will receive a letter from the IRS assigning your tax identification number usually within seven weeks (up to 11 weeks if requested during peak tax time (January 15 through April 30) or from abroad).

Is it hard to get an ITIN?

You don't need to be scared of applying for your ITIN because it's actually quite easy. If you're ready to apply, start filling out the online form. If you have any questions throughout any part of the process, feel free to contact our helpful customer service staff.

How can I get ITIN number without tax return?

(3) In person, you can apply for your ITIN by visiting designated IRS Taxpayer Assistance Centers (TACs). They can verify the original documents and certified copies from the issuing agency. a. Service at TACs is by appointment only, which can be scheduled by calling 844-545-5640.

Can b1 b2 visa holder get SSN?

If you are in B-1 or B-2 status, you are not eligible to obtain a Social Security Number (SSN) or a US driver's license.

Can I get a ITIN number online?

U.S. resident and non-resident aliens, as well as their dependents or spouses, can fill out all the necessary paperwork for an ITIN number online. Applications are accepted by mail or in person at the IRS anytime you need an ITIN number throughout the year.

What is the purpose of ITIN number?

The Individual Taxpayer Identification Number (ITIN) is a tax-processing number issued by the Internal Revenue Service (IRS) to ensure that people—including undocumented immigrants—pay taxes even if they do not have a Social Security number (SSN) and regardless of their immigration status.

How much does it cost to get ITIN?

The cost to apply for your ITIN number is free. If you have already applied for one in the past and are trying to locate a copy of the number, you can call the IRS at 1-800-829-1040.

How long does it take to get an ITIN number 2022?

A11: If you qualify for an ITIN and your application is complete, you will receive a letter from the IRS assigning your tax identification number usually within seven weeks (up to 11 weeks if requested during peak tax time (January 15 through April 30) or from abroad).

What happens if you work on a B1 visa?

Whatever maybe the case, if you work on B1/B2 visa and you are found out, you will be deported and may ruin your chance of ever getting a visa to the USA.

How long is a B1 visa?

B1/B2 is a short stay visa up to max 6 months. there are two visa categories combined in to one.

What does it mean to be on a visitor visa?

Of course, entering on a visitors visa means that when you obtained that visa and upon entering the United States your 'intent' was non-immigrant - that is, your intent was and is to return home after your temporary stay; you've also agreed to abide by your visa's specific limitations and requirements. For example, B-1/B-2 status does not allow employment. That said, in the real world it is fully understood in the law that entrants after they have been here for awhile may have a change of mind about th

How long can you be barred from applying for a visa?

And you will be barred from applying a visa for 10 years.

Can ITIN be used for non-residents?

If you are a non-US resident investing in the US, then you probably do qualify for an ITIN, but that still has no impact on the status of your US taxation. You probably need to have a conversation with a US tax professional to fully understand your specific US reporting obligations.

Do you have to worry about taxes on your worldwide income?

You would not have to be concerned about U.S. taxation of your worldwide income, as that would only be the case of you were a resident alien.

Is a B1 visa issued in your name?

And also note that the B1/B2 visa is issued in your name based on your qualifications and merits. Your company will not be liable

How long before I-94 expires can I apply for a B2 visa?

You should do so at least 42 days before the expiration of your I-94 card. Yet, you are not allowed to apply within three months of arrival in the US. You should submit the following documents when applying for a B2 visa extension: Completed form I-539. Your valid passport.

How to Apply for a US Tourist Visa?

To apply for a US Tourist visa you must go through these simple steps :

What Are the Eligibility Criteria for a Tourist Visa?

To be eligible for a US Tourist visa, the purpose of your visit should be one of the following:

Can I Get a Green Card With a US Tourist Visa?

It is very difficult to get permanent residence or a Green Card if you are a tourist in the United States. Since the B2 visa is a temporary visa, you must prove that you will return to your home country after it expires in order to get it. Also, you are not allowed to look for a job or start studying, which means the easiest paths to a Green Card may not be available for you.

What is VisaExpress?

VisaExpress specializes in assisting visa applicants throughout the whole process.

How much does it cost to get a US visa?

The application fee for the US Tourist Visa is $160. Depending on your country’s relationship with the US, you might have to pay other fees too. These are called visa issuance fees and they vary from country to country. After making the payments, you need to keep the receipts and attach them to your file of required documents.

What is transit visa?

A Transit Visa to USA is a permit to make a shortstop in the US, in order to reach your destination country. The US transit visas allow you to enter the US and stay for a layover. Afterward, when your planned flight or ship leaves for your next destination, you will have to leave the US.

What is a TIN number?

Taxpayer Identification Numbers ( TIN’s) for Foreign Students and Scholars. Generally aliens may apply for either a Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN) for use on tax related documents. Generally, aliens who enter the United States in an immigration status which allows them to be employed in ...

Can an alien apply for an ITIN?

Aliens who are not eligible to apply for a U.S. social security number, or who do not meet the Social Security Administration's evidence requirements for an SSN, may apply for an Individual Taxpayer Identification Numbers (ITIN) from the Internal Revenue Service if they have a valid tax reason for needing an ITIN, as explained in the Form W-7 instructions. Use Form W-7 (in English) or Form W-7SP (in Spanish) to apply for an ITIN. Please refer to IRS Publication 1915 PDF (PDF) for a more detailed explanation of ITINs.