Can you start a business as international student?

International students who wish to start a business may only do so with proper employment authorization. See Study in the States – F-1 Students and Entrepreneurship for further information. While you are on an F-1 visa, you must have approved Optional Practical Training in order to start your own business.

Can I be self employed on F1 visa?

An F-1 student on post-completion STEM (the 17 month extension for Science, Technology, Engineering and Mathematics majors) can also continue with self-employment after the initial 12 month OPT period.

Can you register a LLC in F1 status?

In general, international students in F1 status are forbidden from “engaging in business.” However, immigration law does not expressly forbid F1 visa students from establishing their own business because 'preliminary business planning' is not considered 'engagement'.

Can you run a business on a student visa?

And yes, you can open a business on a student visa! What is the formula for entrepreneurial success? Academy of Entrepreneurs interviewed over 1000+ entrepreneurs, from 100+ industries and 50+ countries to answer this BIG question. Step one towards entrepreneurial success is connecting one's passion with strengths.

Can F-1 student open LLC in USA?

Under the F1 program, international students are not allowed to own a business. This means that international students cannot earn revenues or salary derived from a business which they operate.

How can F1 visa earn money in USA?

When studying on an F1 student visa, your ways to earn money are:Working on campus.Applying for CPT.Applying for pre-completion OPT.Staying after you finish your degree and applying for post-completion OPT.Applying for an OPT extension.

Can F-1 student do startup?

Therefore, if you are an F-‐1 student who plans to start your own business in the United States, you must qualify and apply for OPT. Employment on OPT must be directly related to your major field of study.

Can I be a Youtuber on F1 visa?

Can I make money on YouTube while in the US on a F1 Visa or OPT? No, you cannot earn money from your Youtube Channel, Tiktok or any other content platform while you ar present in the US on a F1 Visa or OPT.

How can I go from F-1 to green card?

There are four ways through which an F-1 visa international student can get a Green Card.Self-petition as a Person with Extraordinary Abilities. ... Adjust status to a dual intent visa. ... Become an investor in the US. ... Marry a US citizen.

Can a student start a business?

Is it Possible to Start a Business While Being a Student? Yes. There are no legal, financial, or knowledge reasons that prevent a school, college or university student from starting their own side hustles.

Can I start a business on a student visa in Canada?

If you are a student, and want to start a business while studying, you will have to apply to CIC for a modified study permit to work on your business. A working permit doesn't enable you to become a Canadian Citizen. If you want to be a Canadian, you will have to apply to CIC for citizenship status.

Can international students start a business in UK?

To start your business you'll need the correct visa. The Start-up visa is for non-EEA international graduates (currently on a Tier 4 Visa) with a viable, innovative and scalable business idea that they want to put into practice in the UK.

Can an international student be self-employed?

A student visa does not allow self-employment. This means in order to undertake work you should be given a formal document by the employer such as a 'contract of employment' or a 'worker's agreement' or some other written statement confirming your employment status.

Can an F-1 student be an independent contractor?

Can a student with an F-1 visa work as an independent contractor? Have you been wondering, “Can I work as an independent contractor on OPT?” The short answer: no. If you are in your first year of school on an F-1 visa, you are not allowed to pursue contract jobs or freelance work opportunities.

Can F-1 student have passive income?

Earning an F1 visa passive income is totally legal. You just need to remember to comply with the tax laws. Ask advice from a registered tax practitioner to help you with filing your taxes. People without ways to earn a passive income can always consider CPT and OPT employment to earn a few extra bucks.

Can I work part time on F1 visa?

The AF1 visa international students will be able to work part time for 20 hours per week, but during the summer break or winter break, any longer breaks, students will have the access to work full time.

When does the F1 visa expire?

F1 students whose period of authorized stay expires before October 1 and do not qualify for a cap – gap extension are expected to leave the US or they may lose their status. Upon leaving the US, students must apply for an H1B visa at a consulate abroad and enter the US on H1B status if the petition is approved.

How many H1B visas are there?

Have it in mind that the USCIS maintains certain limitations on the number of H1B visas issued every fiscal year. There is an H1B visa limit of 65,000 visas under the general category and an additional 20,000 visas for those with a masters degree, doctoral degree, or higher. So to successfully obtain an H1B visa for the following fiscal year, you must file your H1B petition on time.

Can an F1 student start a business?

In general, international students in F1 status are forbidden from “engaging in business.” However, immigration law does not explicitly forbid F1 visa students from starting their own business because “preliminary business planning” is not considered “engagement.”

Can you work for your own company without getting paid?

Have it in mind that unless you are legally authorized to work in the United States, you cannot perform work, even if it is for your own company, and even if you are not getting paid. As the company owner, you are allowed to engage in management decision – making such as hiring workers, because these decisions must be made by the business owner. However, you cannot be regularly engaged in administrative work or sales without the appropriate work authorization.

Can an international student invest in their own business?

However, once the business is started, international students and F1 Visa holders are not permitted to operate their own business, engage in business, or receive revenue, compensation, or salary. Howbeit, immigration law allows International Students and F1 visa holders to invest in their own company and receive dividends. An income tax return will have to be filed annually if dividend income is earned. Students are able to receive dividend income because it is passive.

Can I start a business while on H1B?

Yes, you can start a company/business while in H1B Visa. I will let you to explore and figure out how to do that.

Can I invest in a business on an F1 visa?

But, F1 visa rules would allow F 1 students to invest in a business. Investing in Business is different from working for the business. Then students typically think that I can start a business and work for the company without getting paid. Even that’s not allowed.

Can an F1 student invest in a company?

Immigration law allows {International Students, F1 visa students} to invest in their own company and receive dividends. Such investment is entirely legal and permitted, provided that the {International Student, F1 visa student} files an income tax return.

Can foreign students open a business with an F1 visa?

Ultimately, foreign students may not operate a business they have opened merely under an F1 visa status. Please refer to the Department of Homeland Security and the U.S. Citizenship and Immigration Services for steps and further information to obtain additional visa status, of contact us at [email protected].

Can an F1 student start a business?

In general, international students in F1 status are forbidden from “engaging in business.”. However, immigration law does not expressly forbid F1 visa students from establishing their own business because ‘preliminary business planning’ is not considered ‘engagement’.

Can I Start a Business While in the U.S. on a Student Visa?

At The Jacobs Law, we receive many inquiries from entrepreneurs with {a student visa, an F1 visa} into whether they can start a business, run a business, license their ideas or creations, or invest in their business. The answer is not always a simple one.

How to obtain additional status for F1 visa?

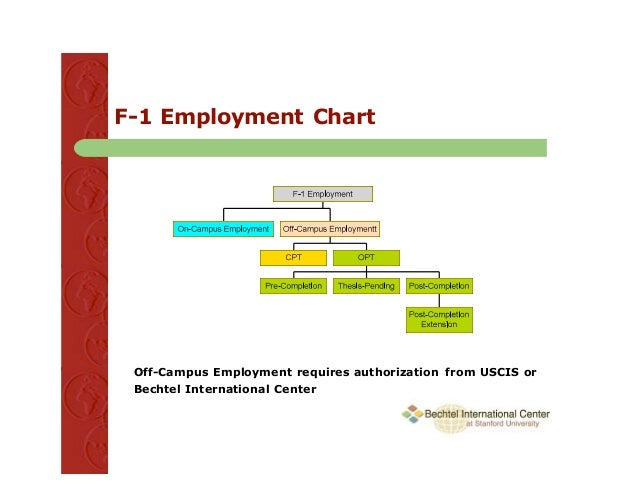

There are several ways to obtain additional status for F1 visa students who wish to operate or engage in their own business: Curricular Practical Training (CPT), Optional Practical Training (OPT), and H-1B are the most common.

Is starting a business a legal issue?

Starting a business and working for it are two entirely separate legal issues. The most important thing you need to know is these separate activities - starting a company on the one hand and working for it on the other - involve very complex laws requiring highly specialized legal expertise.

Can an F1 student invest in a company?

Immigration law allows F1 visa students to invest in their own company and receive dividends. Such investment is entirely legal and permitted, provided that the F1 visa student files an income tax return. However, an F1 visa student still cannot engage in business without obtaining additional visa status.

Is it worth setting up your business incorrectly?

It’s not worth the aggravation of setting up your business incorrectly. Get the right advice. Find a lawy

Is it legal to form a company in Delaware?

In fact, the formation of a company in Delaware can be accomplished easily, through a formation and Registered Agent company, without any discussion of a person’s immigration status. It is perfectly legal and a common practice for persons who live and work outside the USA and ar. Continue Reading.

Can an F1 student start a business?

In general, international students in F1 status are forbidden from “engaging in business.” However, immigration law does not expressly forbid F1 visa students from establishingtheir own business because ‘preliminary business planning’ is not considered ‘engagement’. Once the business is established, however, F1 visa students are not permitted to operate their own business, engage in business, or receive revenue, compensation or salary. This is an extremely important distinction to understand, but one that is not so easily delineated.

How Can an International Student/F1 Visa Student Run Their Own Business Lawfully?

Curricular Practice Training (CPT) – Allows international students (F-1 status) to receive work authorization, which will allow them to work for their own companies. CPT must relate to the students major and the course of study and allows the student to work as many or as little hours as he/she desires.

What is an F-1 student visa?

What is a F-1 Visa? F-1 Student Visa – Issued to international students who are attending a college or university in the United States. Students in the U.S. on F-1 status must maintain the minimum course load for full-time student status.

Can an F1 student start a business?

In general, international students in F1 status are forbidden from “engaging in business.”. However, immigration law does not expressly forbid F1 visa students from establishing their own business because “preliminary business planning” is not considered “engagement.”.

Can an F1 student receive dividends?

Immigration law allows International Students and F1 visa holders to invest in their own company and receive dividends. An income tax return will have to be filed annually if dividend income is earned. Students are able to receive dividend income because it is passive.

How many hours can you work on a F1 visa?

You can only work 20 hours a week while classes are in session and up to 40 hours a week during breaks or when school isn’t in session. The F1 visa on-campus work cannot take a job away from a U.S. worker. The types of on-campus jobs also vary quite a bit.

What are the two ways international students on F1 visas work?

Here are the two most common ways international students on F1 visas work in the U.S, CPT and OPT. Let’s take a look at each one:

Can F1 students make passive income?

The short answer is that a student on an F1 visa can have passive income. Note, this is different than if a student on an F1 visa works. In other words, passive income is money you make without actively engaging in something or being employed by a U.S. company.

How long do you have to be on a F1 visa to get a CPT?

Here’s how immigration rules break down the CPT requirements: 1. You must have been in valid F1 visa status as a full-time student for a one year prior to CPT. (There’s an exception for graduate students when a program requires CPT to start immediately.)

Can an F1 student work?

Many international students in the U.S. ask the same important questions: Can someone on an F1 visa work? Is there such a thing as an F1 visa work permit? Is there such a thing as F1 visa work authorization? The short answer is that an internationals student on an F1 visa can work in the limited circumstances described here. If you’re looking for longer-term options for F1 students to remain in the U.S., or how to go from an F1 to an H1B, we can help you there too. In this article we discuss a host of F1 visa work options, including work done off campus, on campus, freelance, owning a business, investing in stocks, and volunteer work.

Can an F1 student invest in stocks?

An international student on an F1 visa is allowed to invest in the stock market. Thus, F1 students can invest in stocks and day-trade. There is no specific law against this, and it’s considered passive income. But be careful. Immigration could see it differently depending how the income is listed on your tax filings.

Is it risky to start a business on an F1 visa?

Bottom line, starting your own business on an F1 visa can be very risky. You should consult an experienced immigration attorney, your International Student Office and a tax accountant before you do so.