Yes. You can transfer money from a visa gift card to your bank account. To transfer visa gift cards to bank accounts, it is important you understand what type of prepaid card you have. Basically, visa gift cards are the same as Visa credit cards in usage.

Can you transfer money from a credit card to a bank?

You can transfer money from your credit card to a bank account with a cash advance, a convenience check, apps such as Venmo, or money transfer services such as Western Union and MoneyGram. But it is expensive to transfer money from a credit card to a bank account because credit cards are designed to be used for purchases – not as cash loans.

How to transfer money from Visa gift card to bank account?

Transfer Visa Gift Card to Bank Account through MoneyGram. MoneyGram is the second-largest money transfer company. They are fast, affordable, reliable, and most importantly safe. Get ready to transfer money from a visa gift card to your Bank account by visiting the MoneyGram website and following the steps below; #1.

How can I transfer money from my credit card in 2022?

How can I transfer money from my credit card to a bank account in 2022? You can transfer money from your credit card to a bank account with a cash advance, a convenience check, apps such as Venmo, or money transfer services such as Western Union and MoneyGram.

Can you use a credit card to send money?

Before you do, check if the bank allows credit card payments. Also, consider money-transfer services like Western Union and MoneyGram, which allow you to transfer funds with a credit card. Wire transfers and money transfers involving credit cards generally come with relatively high fees.

Can you transfer money from Visa card to bank account?

direct transfer to bank account you can transfer funds from your credit card to your bank account directly using the net banking app or even over the phone. since the daily and monthly transfer limit varies from bank-to-bank, you would need to check that with your bank to get the updated information.

Can we transfer money from credit card to bank account?

There are two methods to transfer your funds from a credit card to a bank account. The first method is via e-wallets, which have now become quite common. The second method is via money transfer services like MoneyGram and Western Union Money Transfer.

Can we transfer money from Visa?

Send money to a family member, share expenses with a friend or pay off a Visa credit card bill. Visa Direct is simple to use for both sender and recipient, whether they are standing in the same room or living half-way around the globe.

How can I transfer money from my credit card to my bank account for free?

Net Banking:Go to your bank's website.Log in to your credit card account.Select the transfer option.Enter the amount you wish to transfer.Enter the necessary details mentioned in the form.Follow the guidelines in the form of prompts to complete the transactions.

How can I transfer money from credit card to bank account without fees?

Related steps are below mentioned:Register with Paytm.Transfer fund from credit card to wallet.Open the Paytm App and go to 'Passbook'Select the option: 'Send money to Bank'Select 'Transfer' option.Enter information regarding the amount, account number, and IFSC.More items...•

How long does Visa money transfer take?

Visa requires some issuers to make funds available to its cardholders within a maximum of 30 minutes of approving the transaction.

How do you withdraw money from a Visa card?

Go to an ATM and insert the credit card. Enter the credit card PIN (call the number on the back of the card to find out the credit card PIN or to set one up). Select the appropriate options if offered: “cash withdrawal” or “cash advance.” If asked to select between “credit” or “debit,” select “credit.”

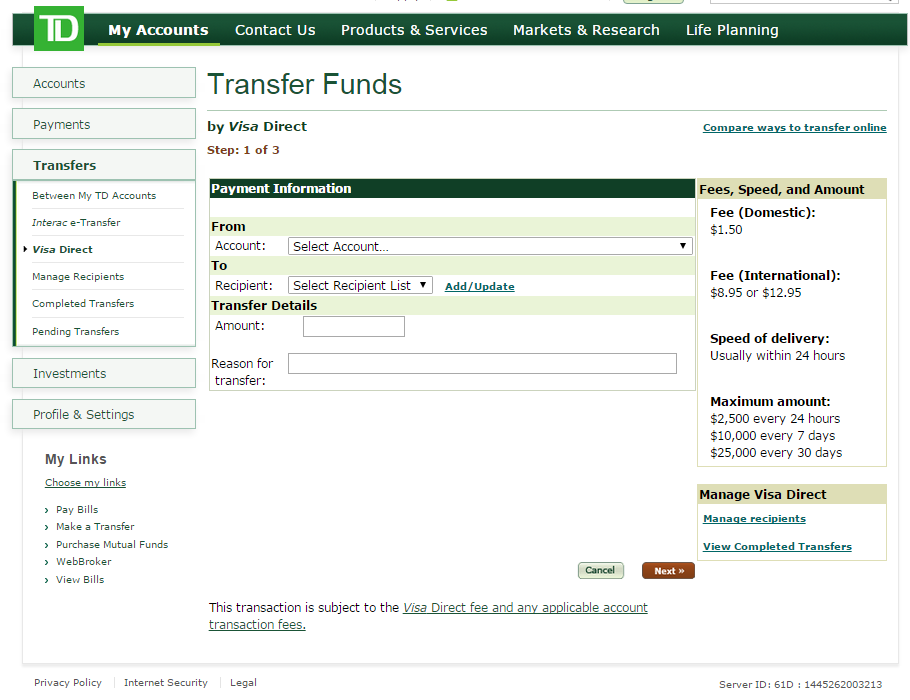

What is Visa direct transfer?

Visa Direct, a real-time payments network for business and person-to-person (P2P) payments, is helping financial institutions and technology companies allow their customers to transfer funds to a debit account in 30 minutes or less.

Can I withdraw money from credit card?

Cash Advance Fees When a person draws cash on a Credit Card, it attracts a fee which is called the Credit Card Cash Advance Fee. This fee, which is a percentage of the amount withdrawn, will appear in the next billing statement, along with the entire amount withdrawn and interest levied on the withdrawn amount.

How long does a money transfer take from credit card to bank account?

about five to seven daysA credit card balance transfer typically takes about five to seven days, but some major card issuers ask customers to allow up to 14 or even 21 days to complete the transaction.

Can we transfer money from credit card to GPAY?

Open Google Pay on your mobile device and log in with your PIN. Go to your profile section and click on 'Add Debit/Credit Card' Enter the card number, expiration date, CVV, as well as the cardholder's name and billing address. Google Pay will now check with your bank to verify the details.

Can I pay someone with a credit card?

Yes. There are several platforms you can use to send money with a credit card, from PayPal to Venmo. However, these apps and services charge a fee that is typically a percentage of the amount transacted. For example, Venmo charges 3% when you use your credit card to send money to people.

What is a cash advance transfer?

When you transfer money from a credit card to a bank account, your transaction will most likely be coded as a cash advance.

How to transfer money from credit card to bank account?

How to transfer funds from a credit card to a bank account 1 Note the fees and/or interest rate for your transfer. 2 Take out cash or a money order. 3 Alternatively, make a wire transfer or a money transfer, or use a credit card convenience check. 4 Deposit the money into your bank account, or wait for your transfer to complete.

How much is a cash advance fee?

A common cash advance fee is $10 or 5% of the transaction, whichever is greater. For example, if you take out $500, the fee could be $25. Look out for the cash advance APR. Cash advances usually have higher APRs than purchases or balance transfers. Your transaction will start accruing interest immediately.

What happens when you write a check?

When you write one, it’s as if you’ve swiped your credit card. The amount you put on the check will be drawn from your credit line — and you have to pay it back eventually. Carefully read your provider’s fine print before using one of these checks. If you’re lucky, you’ll get a promotional interest rate on it.

How long do you have to pay interest on a credit card?

You’ll typically have a grace period of 21 to 25 days to pay your balance.

How to make an indirect transfer?

Note the fees and/or interest rate for your transfer. Take out cash or a money order. Alternatively, make a wire transfer or a money transfer, or use a credit card convenience check. Deposit the money into your bank account, or wait for your transfer to complete. By taking out cash or a money order, you can make an indirect transfer between your ...

What is Finder.com?

Finder.com provides guides and information on a range of products and services. Because our content is not financial advice, we suggest talking with a professional before you make any decision.

Get a cash advance

A cash advance is a feature that's designed for getting cash from a credit card. While it's usually the easiest option, it's also expensive.

Wire money from your credit card

Many money transfer services, such as Western Union and MoneyGram, allow you to send money directly to a bank account and pay by credit card. Here's how to transfer funds this way:

Use a payments app

If you're looking for a way to send money from your credit card to someone else's bank account, there are several payments apps that let you do just that. A few of the most popular ones are:

Redeem cash back

Cash back credit cards earn a percentage back on purchases you make. For example, with a cash back card that offers 2% on all purchases, you'd get $2 back on every $100 you spend. The card issuer typically adds cash back to your rewards balance.

How to get cash advance from ATM?

Do a cash advance: You can make an ATM withdrawal with your credit card to turn some of your available credit into cash. You just need to get a PIN from the card’s issuer. You can withdraw up to the “cash advance limit” listed on your statement. But cash advances are expensive – you can expect a hefty fee and a high APR that starts costing you right away. There’s no grace period. You can also get cash from a bank branch by presenting your credit card and a government-issued photo ID to the bank teller, or with a cash advance check sent to you either automatically by the issuer or by your own request .Store credit cards generally do not allow cash advances.

How much does Venmo charge for a credit card?

If you choose to send money directly through Venmo using a credit card, you’ll pay a fee of 3%. But if you’re using a Visa or Mastercard, be aware that your card issuer may see this as a cash advance, and could charge you accordingly. Bank transfers typically take one business day.

How to pay someone with Venmo?

Venmo: You could pay a friend or family member with a credit card through Venmo, and they could then transfer the money to you, or to a bank account. Or, you could make an outside credit card purchase on their behalf, then have them reimburse you through the app. If you choose to send money directly through Venmo using a credit card, you’ll pay a fee of 3%. But if you’re using a Visa or Mastercard, be aware that your card issuer may see this as a cash advance, and could charge you accordingly. Bank transfers typically take one business day. There’s a weekly rolling limit of $4,999.99 for sending funds through Venmo once you verify your identity.

What is a cash advance?

Tapping into your credit line to get cash and transferring the funds into a checking account is considered a cash advance. One example of this is writing a credit card convenience check to yourself and depositing it in your checking account.

How much does a credit card charge for a cash advance?

If you use a credit card for a cash loan, you’ll normally pay between 3% and 5% as a cash advance fee, plus a high APR on the advance amount that kicks in immediately. Some credit cards provide exceptions to the norm of cash advance fees, however.

How long does it take to send money to a friend on PayPal?

PayPal: They will require the email address for the recipient, and you must choose “Paying for an item or service” to send money from a credit card. Once the recipient receives the money, it usually takes just one business day to transfer it to their bank account. The recipient incurs a fee of 2.9% plus $0.30 for accepting a credit card payment. However, be aware that sending money to yourself from a credit card is against PayPal terms of service, so always send money to a friend if you use this method.

How to make a payment on Square?

Square’s Cash App: After you download the app, link your credit card to the app account. With the phone number of the recipient, you can make a payment by simply tapping the "Pay" button. Using a credit card to send money would incur a 3% fee, which is added to the payment total.

How to check your Visa gift card balance?

Check your card balance if you do not know it. This can be done either by going to a website or calling a number (both will be on the card). Remember the balance and minimize the number of balance checks. Some issuers of Visa gift cards charge a fee to check the balance, speak with customers service and just about anything else.

What happens if Square rejects a gift card?

However, if Square rejected the transaction, you will need to check the balance and make sure the fund were returned to the Visa gift card.

How to activate a Visa gift card?

1. Activate your Visa Gift Card online at the website provided on the card. Many cards come pre-activated, so you don't have to worry about this unless the card says that it has to be activated. ...

How long does it take for a gift card to be deposited in Square?

The gift card will be authorized, the card's balance will fall to zero, and the funds will be deposited by Square into your bank account within one business day. If Square does not allow the transfer, you will see a note that it is against their policy to transfer a Visa gift card balance.

How long does it take for Square to deposit money?

This is not typically immediate, and it can take up to two business days according to Square's FAQs.

How long does it take for Square to recredit?

Check your bank account linked to Square. The transactions you have made are credited to your bank account within two business days. Square will charge transaction fees, so the amount transferred into your bank account will be the amounts you entered less the fees.

How many people edit wikihow?

wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, 20 people, some anonymous, worked to edit and improve it over time. This article has been viewed 598,825 times.

How long does it take for a Visa to make funds available?

Visa requires some issuers to make funds available to its cardholders within a maximum of 30 minutes of approving the transaction.

What is Visa support?

The support of Visa’s trusted expertise and capabilities to help you as you launch, grow, or enhance the payment experience for your customers.

Is Visa Direct real time?

Visa Direct’s real-time¹ payment capabilities open up new, more convenient payment experiences for many different use cases, including: