J-1 visa holders eligible for stimulus checks April 15, 2020 Deana Harley 47 ABC – While millions of Americans woke up to extra money in their bank accounts on Tuesday, questions still loom about who exactly is eligible for a stimulus check. One group of people that is eligible is J-1 visa holders.

Where are my J-1 stimulus checks?

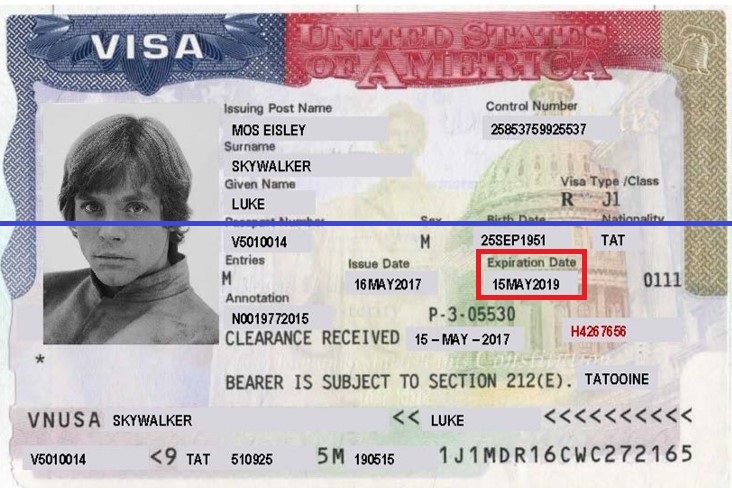

J-1 visas are non-immigrant visas that are often issued to professors, researchers, and students. For those still looking for their stimulus checks, the Internal Revenue Service (IRS) launched an online portal on Tuesday to help you track your payment.

Are J-1 visa holders eligible for Social Security benefits?

A representative from Congressman Andy Harris’s office confirmed on Tuesday that the visa holders are eligible if they have a social security number, are not claimed as a dependent by someone else, and meet the income threshold. J-1 visas are non-immigrant visas that are often issued to professors, researchers, and students.

Are J1 students exempt from the Substantial Presence Test?

Students (F1 students and J1 students) are “exempt individuals” (exempt from the Substantial Presence Test) unless they have been “exempt individuals” for some part of 5 previous calendar years.

Are F-1 visa holders eligible for the US $1-200 payment?

However, Iowa State University’s website states F-1 and J-1 visa holders are considered non-resident for tax purposes and thus not eligible for the US$1,200 payment. “If you filed your taxes as a resident by mistake, you will need to file an amended tax return prior to July 15, 2020, to correct your prior year tax return (s).

Can an international student get stimulus check?

Luckily, financial aid is offered in the form of stimulus checks, and even F1 visa holders can get one.

Do j1 visa holders pay taxes?

J-1 aliens who are U.S. resident aliens for the entire taxable year must report their entire worldwide income on Form 1040, U.S. Individual Income Tax Return, in the same manner as if they were U.S. citizens. If they also paid foreign income tax on foreign-source income, they may be eligible for foreign tax credits.

How much tax do you pay on a j1 visa?

There are different J-1 visa tax rates, depending on factors such as your income. All non-residents must pay 10% on any income tax up to $9,950. If you earn more than this amount on your J-1 program, you must pay 12% in income tax on the amount between $9,951 and $40,525.

Are non resident alien eligible for stimulus check?

Nonresident aliens are not eligible for stimulus payments.

Does J1 visa pay Social Security?

Nonresident alien students, scholars, professors, teachers, trainees, researchers, and other aliens temporarily present in the United States in F-1,J-1,M-1, or Q-1/Q-2 nonimmigrant status are exempt from Social Security / Medicare Taxes on wages paid to them for services performed within the United States as long as ...

Are J1 visa exempt from state taxes?

For tax filing purposes, most J-1 visa holders are considered Nonresident Aliens. As Nonresident Aliens, J-1 exchange visitors must pay federal, state and local taxes.

Can you use J1 visa on TurboTax?

As a J-1 visa holder, you are considered as a non-resident for the first two years since you entered the US. After that if you are more than 183 days within the US while on the J-visa you are considered as a resident for tax purposes. If you are considered a resident then you can use TurboTax.

How much is the tax refund in USA?

The average tax refund by yearTax yearAverage tax refund (end of season numbers)2017$2,8992018$2,8692019$2,4762020$2,8272 more rows•Oct 18, 2021

Are J-1 eligible for second stimulus check?

Are nonresident aliens entitled to avail of the CARES Act? No. Nonresident aliens are not eligible to receive this stimulus.

Who is not eligible for a stimulus check?

You won't get a stimulus check if your adjusted gross income (AGI) is greater than: $80,000, if your filing status was single or married and filing separately. $120,000 for head of household. $160,000, if your filing status was married and filing jointly.

Who is eligible for stimulus check?

Every American adult earning less than $75,000 (or couples earning less than $150,000) is eligible for a stimulus check from the federal government this year.

Can you use J1 visa on TurboTax?

As a J-1 visa holder, you are considered as a non-resident for the first two years since you entered the US. After that if you are more than 183 days within the US while on the J-visa you are considered as a resident for tax purposes. If you are considered a resident then you can use TurboTax.

Can J-1 physicians use TurboTax?

As a J1 visa holder, you should NOT file as a resident. TurboTax and any other resident tax preparation service for residents will assume you understand your residency status, so if you file with them, you may unwittingly file as a resident.

Alexander M. Ivakhnenko

Under the December stimulus bill, non-US citizens, including those who pay taxes, weren't eligible to receive the $600 payment, unlike with the first round of checks. Under the CARES Act, all US citizens and non-US citizens with a Social Security number who live and work in America were eligible to receive stimulus payments.

Donald Edward Smith

You should first check with a tax professional to see if you qualify. My understanding was that temporary residents would not be eligible but I am not a tax professional. If you are eligible, claiming the stimulus payment should not negatively affect your status or ability to adjust status.

Experience getting a spousal green card for my wife (Me: USA, her: South Korea)

Hello everyone, we just did her interview today and got the good news that she was accepted for permanent residency.

Anyone know when US embassies will open up?

Normally its about a month of waiting time but right now the soonest tourism appointments are given for 2022 July. If the staff are vaccinated I wonder why they aren't working in full capacity.

Am I being blackmailed? Is this legal?

I am a teacher in the USA on a J1 visa. I am rapidly approaching the expiration date on this visa (30th June). As I am a teacher, my pay is stretched over 12 months, meaning I am paid throughout the summer for the school year just completed. However, my school is insisting that legally they can't pay me beyond this date.

Tried to Renew Driver's License, Now USCIS is Investigating Lawful Presence

My dad tried to renew his driver's license in April and USCIS is now investigating his lawful presence in the United States. He's passed his citizenship test and has been a U.S. citizen since 1993. Now he is worried that he could possibly be deported. Do you have any advice regarding what we should do next?

Stuck in a bind -- Need to leave US while on OPT without employment

I am an international student on an F1 visa who just graduated last May. My OPT start date was just a few days ago (June 15). I don't have a job yet. My problem is that one of my family members who is in my home country, Nepal, is really sick with Covid and I need to be there for him. So, I need to go back home as fast as possible.

Advice to continue working?

My girlfriend came to the US from Vietnam in November of 2017 on an F1 student visa. She already had a Bachelors degree in English/translation from a Vietnamese university. After a couple years she received her Masters in HR around December 2019.

Who can claim the next stimulus check?

Citizens, permanent residents and residents for tax purposes can claim the next stimulus check under the CARES Act if they meet these requirements: have a valid Social Security Number (SSN) and have filed their 2018 or 2018 tax returns.

Who is not eligible for the ITIN?

Other groups who are not eligible for this payment are: individuals who can be claimed as a dependent by another taxpayer; an estate or trust; or married couples where one partner has an SSN and the other has an ITIN or no number.

Can international students get stimulus checks?

International students may be eligible to claim the next stimulus check if they meet certain requirements. Source: Al Bello/Getty Images/AFP

Why did so many international students end up receiving the stimulus payment?

So how did so many international students end up receiving the stimulus payment? Turns out it was due to a tax glitch.

How do you return the stimulus payment?

So if you’re one of these international students who mistakenly received the stimulus payment of $1,200 — or any other amount — the best thing to do is return it.

What is the stimulus money?

The money is from the historic US$2 trillion stimulus bill to counter the devastating impact of COVID -19 on the US economy. It is to help American workers, small businesses and industries grappling with the economic disruption.

Did the stimulus payments go to non-resident aliens?

Business Insider recently reported that the Internal Revenue Service has issued guidance and confirmed that some stimulus payments were sent by mistake to “nonresident aliens, incarcerated people, and deceased taxpayers”. The distribution stimulus payments were largely based on 2018 and 2019 tax returns.