How do I reverse a charge on my credit card?

Ask the company if it will reverse the charge. If you’re not satisfied with the merchant’s response, you may be able to dispute the charge with your credit card company and have the charge reversed. This is sometimes called a chargeback.

Can I reverse a debit card charge for dissatisfaction of service?

Can I Reverse a Debit Card Charge for Dissatisfaction of Service? Banks safeguard customers by reversing improper debit card charges. Banks have programs that are designed to prevent debit and credit card fraud by unscrupulous merchants.

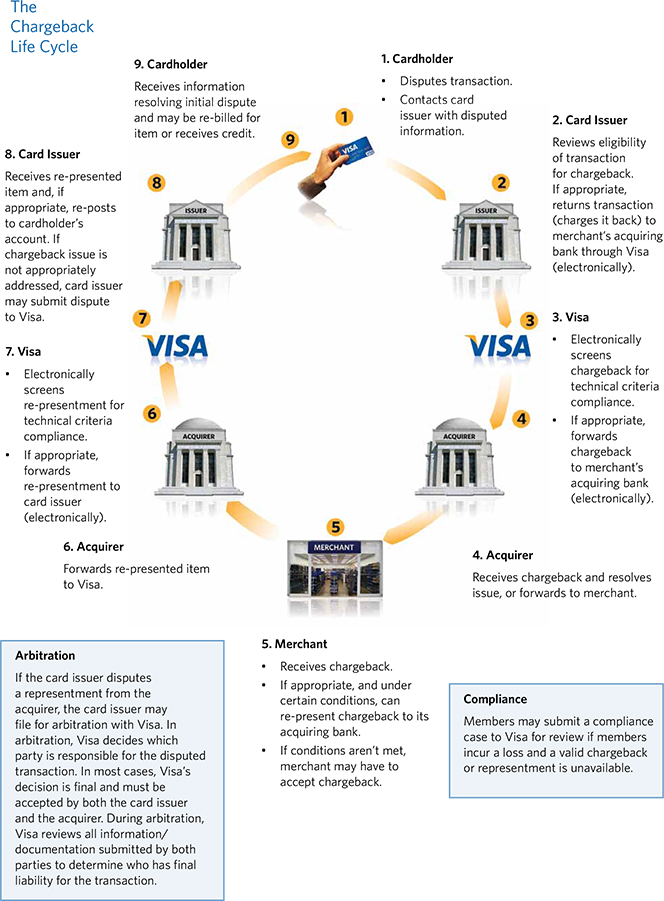

How does chargeback work on a Visa card?

Chargeback allows you to ask your card issuer to reverse a transaction on your credit or debit card. By requesting a chargeback, you’re disputing the transaction in question and asking to get your money back. How can you initiate a chargeback on your Visa card? How to start a chargeback process will depend on your bank.

How do I dispute a chargeback on my Visa card?

With others, it’s best to call their customer service and ask them to walk you through the necessary steps to demand a chargeback. With all Visa cards, the merchant has 30 days to respond to a dispute. If they don’t, he or she will immediately lose the dispute, and they will have to give the money back.

Can a credit card reverse a charge?

If you're not satisfied with the merchant's response, you may be able to dispute the charge with your credit card company and have the charge reversed. This is sometimes called a chargeback. Contact your credit card company to see whether you can dispute a charge.

How long do you have to reverse a Visa charge?

What Are Visa's Chargeback Time Limits? For Visa, the clock starts ticking the day after the transaction processing date. In most cases, cardholders have a 120-day window after that date in which they may dispute a charge.

Can a transaction be reversed?

There are three primary methods by which a transaction can be reversed: an authorization reversal, a refund, or a chargeback.

Can my bank reverse a charge?

If the supplier will not refund your money and you paid using a credit or debit card, your card provider – usually your bank – may agree to reverse the transaction. This is called a chargeback. In order to start a chargeback, you should contact your bank or credit card provider immediately.

How do I cancel a Visa charge?

You can also contact the general Visa customer service number at 1-800-847-2911. Speak to a customer service agent and tell him that you would like to cancel your latest charge.

What to do if a merchant refuses to refund?

If asking the merchant for a refund didn't work, request a chargeback with your credit card issuer. Many card issuers let you dispute transactions by phone, mail or online. You may also be able to submit a dispute directly through your card issuer's mobile app.

What payments can be reversed?

Payment reversal type 3: ChargebackLosing revenue.Paying for shipping fees.Recovering or forfeiting sold products.Eating transaction fees incurred during the fraud.Filing a claim and disputing chargebacks.

What causes payment reversal?

Payment reversal definition They can occur for the following reasons: Item sold out before it could be delivered. The purchase was made fraudulently. The customer changed their mind about the purchase after paying.

Can we reverse an online transaction?

Transactions can be reversed by authorization reversal, by refund, or by chargeback. Meanwhile, merchants can only counteract a reversal through deflection or representment.

What is a Visa debit reversal?

A chargeback is a forced payment reversal initiated by the cardholder's issuing bank, which takes money from the merchant and gives it back to the cardholder. Under the Fair Credit Billing Act of 1974, all payment card issuers must offer a chargeback process to remedy fraud and abuse.

Can I dispute a credit card charge that I willingly paid for?

Can I dispute a credit card charge I willingly paid for? You should never dispute a credit card charge you willingly paid for. Not only is doing so unethical, but you won't be able to keep the initial credit you receive if you don't deserve it.

How long does it take to reverse a transaction?

1-3 daysHow Long Does a Transaction Reversal Take? A transaction reversal takes 1-3 days, depending on the issuing bank.

What are Visa chargeback rules?

Visa's rules allow merchants to fight chargebacks by presenting the charge a second time along with evidence supporting its legitimacy. This process is called representment. If the issuer accepts the merchant's evidence, they will reverse the chargeback.

How long after a credit card transaction can you dispute it?

60 daysYou typically have 60 days to dispute an issue to your credit card company, but it is always best to challenge the charges immediately upon discovering an issue.

What happens if you don't recognize your credit card?

Mistakes on your credit card statement can happen. It may be a transaction you don’t recognize, a direct payment after you’ve cancelled it or an instance where the merchant has double charged you. Whatever the case, you should always immediately bring any inconsistencies in your statement to the bank’s attention, where you’ll be given the opportunity to dispute and reverse incorrect charges. This is especially urgent if you suspect your card has been stolen or breached, since you’d want the account instantly frozen to prevent more fraudulent transactions.

What happens after my dispute is lodged?

You will receive confirmation from the bank once they have received your request for a dispute resolution. At this point, it may be necessary for you to sign a form authorizing their investigation which you will need to return to the bank in a specified time frame. They will also likely ask that you send them certain documentation in order for them to properly investigate the dispute. If you fail to provide them with all necessary information, your dispute will likely be unsuccessful.

How do I lodge a dispute?

The process for lodging a dispute will vary between banks, however you can usually lodge a dispute in one (or more) of three ways:

What transactions can I dispute?

It is your right as a consumer and account holder to dispute a variety of credit card errors that include:

How many stages does a credit card dispute go through?

Once you have lodged your credit card dispute with your bank, it usually goes through three stages:

How long does credit card purchase protection last?

Compare credit cards with fraud protection. While it varies between credit cards, purchase protection usually offers insurance for up to 90 days when products bought with your card are lost, stolen or accidentally damaged.

What is a refund?

Refunds. Refunds or credits that have not been processed, or that were wrongly processed as debits.

How long does it take for a Visa chargeback to be resolved?

They can use this time to try to dispute the transaction again. If a second chargeback is filed, Visa will make the final decision, typically within ten days.

What Is the Visa Chargeback Policy?

In its guide called Chargeback Management Guidelines for Visa Merchants, Visa singled out three main reasons for a chargeback:

What Are the Visa Dispute Categories?

Visa specifies four main dispute categories that come with a subset of specific codes. Each code is assigned to a different reason for a chargeback request.

What is chargeback on Visa?

Chargeback allows you to ask your card issuer to reverse a transaction on your credit or debit card. By requesting a chargeback, you’re disputing the transaction in question and asking to get your money back. How can you initiate a chargeback on your Visa card?

How long does a merchant have to respond to a chargeback request?

They will have up to 120 days if the chargeback request is related to fraud or duplicate processing. After the customer submitted the claim, the merchant will have 30 days to defend themselves and respond with compelling evidence against the chargeback request.

What is a visa?

Visa is a U.S.-based multinational company that specializes in financial services. The firm facilitates transfers of electronic funds worldwide, primarily through their Visa-branded credit cards, debit cards, and prepaid cards. Visa does not issue cards but supplies financial institutions such as banks with payment products that are then offered to that institution’s customers.

What happens if you don't dispute a credit card charge?

If they don’t, he or she will immediately lose the dispute, and they will have to give the money back. If you’re not sure what to do, you can reach the bank’s customer service by dialing the number on the back of your credit card and tell the rep that you want to initiate a chargeback or dispute a charge.

Why Should You Avoid Filing a Chargeback If At All Possible?

If a merchant is in the process of working with you to try to resolve an issue, filing a chargeback is the nuclear option. To the cardholder, it may seem essentially the same as getting a refund, but for the merchant, chargebacks are much more costly and harmful than refunds

What Are Valid Reasons to Dispute a Charge?

There are several valid reasons why you might need to ask for a chargeback:

What Happens After a Dispute is Filed?

If a dispute is accepted by the issuer and becomes a chargeback, the bank will reverse the disputed charge, which may come in the form of a temporary credit that becomes permanent once the chargeback is accepted by the acquirer.

Why do banks reverse debit card charges?

When merchants fail to deliver a product or service that they already charged to a debit card a consumer can complain to her financial institution, which can then reverse the charge. However, while banks take the protection and security of their customers seriously, they also don't want customers abusing the system. Charge reversals require specific criteria and usually a brief investigation to ensure that requests are fair and legitimate.

What does gross negligence mean in a charge reversal?

However, as a general rule, gross negligence or failing to complete a requisite task indicates that a merchant didn't deliver a promised service. For example, a cleaning service that showed up late, stayed for only one out of four promised hours and left the premises mostly uncleaned didn't fulfill its obligation. Similarly, an auto mechanic who didn't successfully repair a vehicle most likely didn't deliver the service he should have.

Can a bank reverse a charge?

Just because a bank doesn't have enough grounds to reverse a charge doesn't mean a customer doesn't have a legitimate gripe. Instead of turning to a bank for a charge reversal, consumers can contact their state attorney general's office or the Better Business Bureau to report poor business practices. Additionally, consumers can file lawsuits -- including small claims -- against offending businesses.

What to do if you are not satisfied with a credit card charge?

If you’re not satisfied with the merchant’s response, you may be able to dispute the charge with your credit card company and have the charge reversed. This is sometimes called a chargeback. Contact your credit card company to see whether you can dispute a charge.

Can you assert a billing error to a credit card company?

Note: You may be able to assert a billing error to the credit card company, for example, if you did not receive what you ordered.

How to dispute a credit card issuer?

Work with the merchant. Before you file a dispute with your card issuer, try to resolve the issue with the merchant first. Explain the issue you have with the transaction, and send any supporting information to back up your cause. In many cases, the merchant will try to work with you on a solution to your issue. If they don’t help within a week, proceed with a dispute since the clock is ticking.

How long do you have to dispute a credit card charge?

However, there’s a catch: you need to dispute charges within 60 days from when the purchase appeared on your statement. Since that’s a relatively small timeline, make sure you regularly review your credit card account for signs of billing errors.

What is an unauthorized credit card transaction?

Unauthorized credit card transactions are a form of fraud and also considered a billing error , according to the FTC. So if someone steals your physical credit card or skims your virtual card number, you can dispute the transaction.

What are the two types of credit card disputes?

There are two main types of credit card disputes: 1) billing errors and 2) complaints about the quality of goods and services. Here’s an overview of each type of issue, then a guide on how to dispute credit card charges.

How to dispute an American Express card?

Depending on the reason for your dispute, you may be required to call. The FTC recommends you mail a letter to your card issuer’s billing department so you can get the dispute started. Include your name, address, account number, a description of the issue, and copies of supporting documents.

How long does a credit card have to be charged after a fraud?

Federal law only protects cardholders for a limited time — 60 days to be exact — after a fraudulent or incorrect charge has been made. Thankfully I noticed the billing error within a few days of it posting to my account and started the dispute process right away.

What to do if credit card statement is inaccurate?

The next time you review your credit card statement, comb through it for any charges that seem out of place. If you notice a charge that isn’t familiar, confirm it’s inaccurate and dispute it.

How long does it take for a merchant to resolve a charge error?

Merchants can resolve charge errors within a few days, where it can sometimes take banks weeks to resolve. Keep track of the date you contact them, who you speak with, and their response. We may ask for these details if you decide to open a dispute later.

What is charge error?

A charge error is a transaction you recognize but appears to be incorrect, such as: A recurring transaction or trial subscription you canceled. A product or service you never received or received late. A one-time purchase you returned or canceled, and you still haven’t received a credit.

What is the phone number for a lost credit card?

If your card is lost or stolen, or you think someone used your account without permission, call us immediately at 1-866-564-2262 for debit card customers, 1-800-955-9060 for credit card customers, and 1–888–269–8690 for business credit card customers.

What is a recurring transaction?

A recurring transaction or trial subscription you canceled. A product or service you never received or received late. A one-time purchase you returned or canceled, and you still haven’t received a credit. A charge higher than the amount on your receipt.