Yes. You can transfer money from a visa gift card to your bank account. To transfer visa gift cards to bank accounts, it is important you understand what type of prepaid card you have.

Can you transfer money from a credit card to a bank?

You can transfer money from your credit card to a bank account with a cash advance, a convenience check, apps such as Venmo, or money transfer services such as Western Union and MoneyGram. But it is expensive to transfer money from a credit card to a bank account because credit cards are designed to be used for purchases – not as cash loans.

How to transfer money from Visa prepaid to bank account?

If you have a Visa Prepaid Card, the process on how to transfer money to your bank account will depend on the type of card you have. To transfer a visa prepaid to a bank account, you have to check with your prepaid card provider if this service is available.

How to transfer Visa gift card balance to bank account?

To transfer your Visa Gift card balance to your bank account, memorize the balance. #3. Spend the Money Quickly If you wish to transfer your gift card balance to a bank account, you should do it as soon as possible.

How can I transfer money from my credit card in 2022?

How can I transfer money from my credit card to a bank account in 2022? You can transfer money from your credit card to a bank account with a cash advance, a convenience check, apps such as Venmo, or money transfer services such as Western Union and MoneyGram.

Can you transfer money from Visa card to bank account?

direct transfer to bank account you can transfer funds from your credit card to your bank account directly using the net banking app or even over the phone. since the daily and monthly transfer limit varies from bank-to-bank, you would need to check that with your bank to get the updated information.

Can I transfer money from my Visa card?

How does Visa Direct work? Access the service through Netbanking, mobile or ATM. Enter the recipient's 16 digit Visa card number and the amount you want to send. The money will be received into the recipient Visa credit, debit or prepaid card.

Can I transfer money from credit card to bank?

There are two methods to transfer your funds from a credit card to a bank account. The first method is via e-wallets, which have now become quite common. The second method is via money transfer services like MoneyGram and Western Union Money Transfer.

How long does Visa money transfer take?

Visa requires some issuers to make funds available to its cardholders within a maximum of 30 minutes of approving the transaction.

What is Visa direct transfer?

Visa Direct, a real-time payments network for business and person-to-person (P2P) payments, is helping financial institutions and technology companies allow their customers to transfer funds to a debit account in 30 minutes or less.

How can I transfer money from my credit card to my bank account for free?

Direct Transfer To Bank AccountGo to your bank's website.Log in to your credit card account.Select the transfer option.Enter the amount you wish to transfer.Enter the necessary details mentioned in the form.Follow the guidelines in the form of prompts to complete the transactions.

How can I transfer money from my credit card to my bank account without a fee?

Related steps are below mentioned:Register with Paytm.Transfer fund from credit card to wallet.Open the Paytm App and go to 'Passbook'Select the option: 'Send money to Bank'Select 'Transfer' option.Enter information regarding the amount, account number, and IFSC.More items...•

Can I pay someone with a credit card?

Yes. There are several platforms you can use to send money with a credit card, from PayPal to Venmo. However, these apps and services charge a fee that is typically a percentage of the amount transacted. For example, Venmo charges 3% when you use your credit card to send money to people.

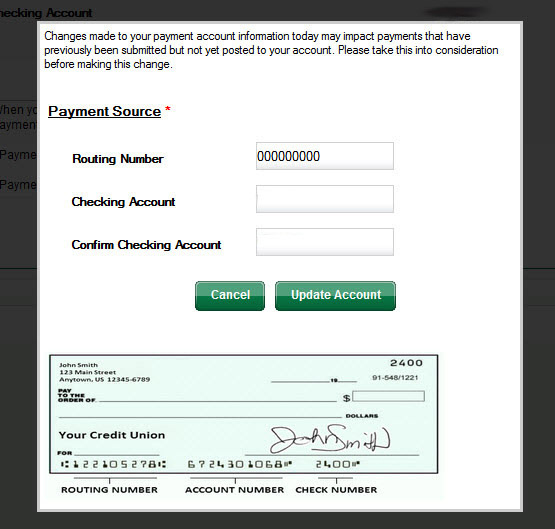

How do I transfer money from a prepaid Visa card?

The process to transfer funds for most prepaid cards is basically the same from one company to the next. For example, with the Netspend® Visa® Prepaid Card, you would link your bank account by entering the routing and account numbers. After that you can initiate the transfer via the website.

How do I transfer my Visa gift card to my bank account 2022?

How to transfer a Visa gift card to a bank account?Add the card to your PayPal or Venmo account and transfer the balance to your own account.Get money for a voucher issued by a Gift Card Exchange Kiosk and then deposit it into your account.More items...•

How can I transfer money from my debit card?

Transfer Money Online Using a Debit Card on Paytm via WalletLog in to the Paytm app using your credentials.Go the ' Paytm Wallet' section on the home screen of your app.Enter the amount that you wish to add from your debit card to your wallet and click on 'Proceed to Add'More items...•

How can I send money from a prepaid card?

Transfer Money From Your Prepaid Card Using MoneyGram.Use Paypal to Transfer Money from your Prepaid Card to Your Bank Account.Transfer Money From Your Prepaid Card To Venmo and Then to Your Bank.If your prepaid card doesn't work on Venmo or PayPal.

1. Transfer Funds to PayPal

One of the easiest and fastest strategies to get the Visa gift card money in your bank account is PayPal. If you’ve completed online transactions in the past, the odds are that you have a PayPal account.

2. Transfer Funds to Venmo or Similar Apps

The following best method would be to transfer your gift card money to Venmo or a similar app that you use. Venmo works a lot like PayPal and is fast and straightforward, so that’s the method that I’ll be discussing here.

3. Use a Gift Card Selling App

Additionally, you can also sell the Visa gift card online. Card Cash is one example, as the site allows you to buy, sell, and even trade your gift cards with other people. It’s convenient when you get gift cards you weren’t expecting and don’t have a use for. Check out our Card Cash review for tips and details.

4. Use the Gift Card on a Money Order

Another way to get the funds off the gift card and into your bank account would be to set up a money order. According to Forbes, a money order is similar to a check, but it can’t bounce since you pay for it.

5. Pay Yourself

Did you know that you could also pay yourself with a gift card? This method isn’t the best opinion for many people since it’s a roundabout way to redeem the funds, but it still works.

6. Try an Exchange Kiosk

Sometimes you can find gift card exchange kiosks in grocery stores or malls. They’re not very common today, although they’re great when you have access to them.

7. Transfer Funds to Square

If you are trying to get your Visa gift card balance to your bank account, you can also use Square. This is a card reader and app that allows you to connect your bank account and use your credit card.

How Do Cash Advances and Balance Transfer Checks Work?

Cash advances provide cardholders access to cash from their revolving credit account. Typically, cash advances are performed using a credit card as one might a debit card at an ATM. Cash advances usually use an assigned PIN, as with a debit card. The amount withdrawn cannot exceed the current available balance on the credit card.

Is It a Good Idea to Use a Cash Advance or Balance Transfer?

Cash advances should only be used in case of emergency, after all other reasonable options have been exhausted. Cardholders should first consider asking for an advance on income, dipping into savings accounts, taking out small personal loans with reasonable rates or even asking friends or family to borrow money.

Bottom Line

Cash advances and balance transfer checks are two ways to transfer money from a credit card to a bank account but should only be used as a last resort. Of the two, a balance transfer check, especially if it carries an 0% APR promo rate, is a much better option.

How to check your Visa gift card balance?

Check your card balance if you do not know it. This can be done either by going to a website or calling a number (both will be on the card). Remember the balance and minimize the number of balance checks. Some issuers of Visa gift cards charge a fee to check the balance, speak with customers service and just about anything else.

How to activate a Visa gift card?

1. Activate your Visa Gift Card online at the website provided on the card. Many cards come pre-activated, so you don't have to worry about this unless the card says that it has to be activated. ...

How long does it take for a gift card to be deposited in Square?

The gift card will be authorized, the card's balance will fall to zero, and the funds will be deposited by Square into your bank account within one business day. If Square does not allow the transfer, you will see a note that it is against their policy to transfer a Visa gift card balance.

How long does it take for Square to deposit money?

This is not typically immediate, and it can take up to two business days according to Square's FAQs.

Can you buy or sell a Visa gift card in Square?

You are not actually buying or selling anything. This creates a transaction record in Square before trying to transfer the Visa gift card balance. It is recommended that you enter an amount in Square that is not too large since it charges a transaction fee.

Do Visa gift cards charge monthly fees?

Transfer the money or spend it quickly. Visa gift cards, along with the similar card from American Express, charge monthly fees just for having a balance. If you plan on spending or trying to get it into your bank account, do it quickly.

Does Square accept Visa gift cards?

1. Appear like a merchant. While Square indicates it accepts Visa gift cards, there are mixed reports that Square will reject a Visa gift card if it believes you are using the service once to transfer a balance. In order to avoid this, you need to convince Square that you are a regular merchant or find a friend that is an established merchant ...

Understanding How Gift Cards Work Matters

Easy transfer of your Visa gift card’s value to your bank account requires some level of understanding of how it works. These cards are non-reloadable one-time use prepaid debit cards.

i. Selling through an App or Website

There are lots of gift card exchange websites where you can sell your Visa gift card for the money.

ii. Linking your Card to Venmo or PayPal

Your PayPal wallet can come in handy when transferring gift cards to your bank account. You’ll need a PayPal address for this transaction.

iii. Getting Money for a Voucher Issued by Gift Card Exchange Kiosk

Gift card exchange kiosks provide an option for exchanging Visa gift card balances to bank accounts.

iv. Purchase Money Order

Another Visa gift card transfer method you can apply is the purchase of a money order.

v. Sell to Interested Persons

Another way to transfer the monetary value of Visa cards to a bank account includes selling them to another person.

How to get cash advance from ATM?

Do a cash advance: You can make an ATM withdrawal with your credit card to turn some of your available credit into cash. You just need to get a PIN from the card’s issuer. You can withdraw up to the “cash advance limit” listed on your statement. But cash advances are expensive – you can expect a hefty fee and a high APR that starts costing you right away. There’s no grace period. You can also get cash from a bank branch by presenting your credit card and a government-issued photo ID to the bank teller, or with a cash advance check sent to you either automatically by the issuer or by your own request .Store credit cards generally do not allow cash advances.

How much cash back do credit cards give?

Earn and redeem rewards: There are lots of cash back credit cards. Typically, they’ll give you at least 1% cash back on all purchases, and sometimes higher rates on specific categories of purchases.

How much does a credit card charge for a cash advance?

If you use a credit card for a cash loan, you’ll normally pay between 3% and 5% as a cash advance fee, plus a high APR on the advance amount that kicks in immediately. Some credit cards provide exceptions to the norm of cash advance fees, however.

How long does it take to send money to a friend on PayPal?

PayPal: They will require the email address for the recipient, and you must choose “Paying for an item or service” to send money from a credit card. Once the recipient receives the money, it usually takes just one business day to transfer it to their bank account. The recipient incurs a fee of 2.9% plus $0.30 for accepting a credit card payment. However, be aware that sending money to yourself from a credit card is against PayPal terms of service, so always send money to a friend if you use this method.

How to use credit card on Venmo?

Here’s how to use a credit card on Venmo: Tap the icon that looks like 3 horizontal lines in the upper left corner of the app. Hit “Settings,” then “Payment Methods.”. Tap “Add bank or card and then tap “Card.”. Enter your card number, expiration and security code manually, or with your phone’s camera.

What is a credit card balance?

A credit card balance is a debt that you owe. A checking account balance is an asset that you own. And a credit card balance transfer is when you use a credit card to pay. off an existing debt, from another credit card or loan, in order to get a reduced interest rate. There is such a thing as a.

Is cash advance an attractive credit card?

So, cash advances are not an attractive option, but there are a ton of attractive cash rewards credit cards on the market.

How to send money from a credit card to a bank account

Here are the most common ways to send money from a credit card to a bank account:

FAQs

How long does it take to transfer money from a credit card to a bank account?

About the Author

Lyle Daly is a personal finance writer who specializes in credit cards, travel rewards programs, and banking. He writes for The Ascent and The Motley Fool, and his work has appeared in USA Today and Yahoo! Finance. He was born in California but currently lives as a digital nomad with a home base in Colombia.

How do prepaid cards transfer to bank account?

Some prepaid card companies help you do transfers to your bank account through their website or app. So your first stop should be the website of your prepaid card provider.

How long does it take to get a bank transfer?

How long the transaction takes depends on your bank. Some transfers can be completed within a few hours or on the same business day.

Is There A Limit When Transferring Money Using MoneyGram?

The limit for sending money online is $10,000 per transaction and up to $10,000 every 30 calendar days.

How Long Does It Take To Transfer Money With MoneyGram?

All of MoneyGram’s transactions occur within the same day , including prepaid card transfers to your bank account.

How to create a Moneygram account?

Go to the MoneyGram website and click “Sign Up” to create an account using your email address. You may have to provide some photo ID to verify that you’re a legitimate person.

Why do people use prepaid debit cards?

10 The Bottomline. Having a prepaid card is a convenient way to pay for products and services whether in-store or online. Instead of carrying cash around, you just load your money on your prepaid debit card, making it safer and more practical. You can also get your paycheck and government benefits on your prepaid card.

How to get money off gift cards?

We’ve found that the only way to get money off a gift card is to sell it on special websites like CardCash.

Why trust us?

Our editorial team and expert review board work together to provide informed, relevant content and an unbiased analysis of the products we feature. The editorial content on our site is independent of affiliate partnerships and represents our unique and impartial opinion. Learn more about our partners and how we make money .

Use a third party service

Another way to cash out your card is to sign up for a third-party service. These separate companies allow you to shift the money you have in a prepaid card into a bank account of your choosing, or sell the card for a percentage of its value.

Bottom line

Transferring cash from a prepaid card into your bank account can be a good way to ensure you get the most from the card when you’d rather not use it as a patent tool. Before you do, though, consider whether you can use the card for transactions instead, since that’s usually the least expensive option. If not, go ahead with the transfer.