Can a H1B visa holder get an FHA loan?

FHA Loans for H1B Visa Holders FHA loans are loans backed by the Federal Housing Administration. In order to get an FHA loan, you must be eligible to work in the US. Aside from your work visa, the FHA also requires an Employment Authorization Document (EAD) if you apply for a loan.

What do you need to know about the H1B visa?

The H1B is a specialty visa that allows foreign workers to be employed and work in the U.S. It requires the application of specialized knowledge and a bachelor’s degree or the equivalent of work experience. H1B jobs include, but are not limited to: The H1B visa is valid for three years and extendable for up to six years.

Why did my H1B visa application fail?

One of the most frequent causes of H1B applications failing is because employers fail to meet the requirements outlined by the USCIS. If asked, your employer should be able to provide all documentation to ensure they have filed all relevant tax returns and have the funds available to pay your salary should your application be successful.

What happens if you have more than one employer on H1B?

This also counts if you have more than one employer. The USCIS is likely to reject applications for the same individual with an identical end client project, even if they come from completely different employers. 3. Don’t pay your own fee It is your employer’s duty to pay your H1B application fee.

Does USCIS check credit score for H1B?

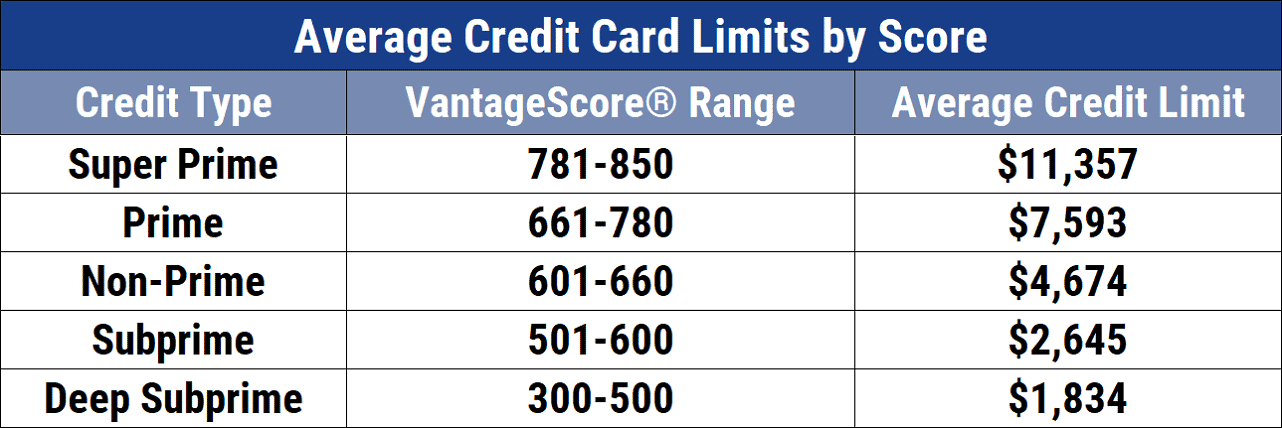

USCIS will consider an applicant's credit report, credit score, debts and other liabilities as a factor in determining whether the individual is likely to become a public charge. A good credit report is considered a positive factor while a bad credit report is considered a negative factor.

Does bad credit history affect U.S. visa?

Not to worry. Having a bad credit rating or being in debt has no impact on your right to get an immigrant visa.

Does credit affect visa?

The USCIS will use the new Public Charge rule, among other rules, to assess if you are a burden to the government (Public Charge) in any form, and potentially deny your visa application.

Does debt affect visa applications?

Debts Owed to the Government Owing debts to the government can lead to problems with immigration. Specifically, if you owe back taxes to the IRS, your application for citizenship may be denied and/or you may be deported from the country even if you're here legally.

Can I be denied visa because of debt?

Whether it be credit card debt or private unpaid loans, if one is indebted, there's only a minuscule chance of their tourist visa getting rejected because of it. As long as one can pay for their travel and stay throughout the trip, the visa will get approved.

Can I get visa if I have loan?

They can not do anything in embassy. And CIBIL up-dation has no relevance. You can go whenever you want to.

Do visa officers check credit score?

No it does not. Visa applications do not require you to share your credit reports and have no affect on the visa outcome.

Does USCIS check your bank account?

Yes USCIS may verify information about your bank account with bank.

Can I immigrate if I have debt?

Can I still do a financial emigration with debt in place? You can emigrate and not pay your short-term/unsecured debt. When you emigrate, the country you are emigrating to will not do a credit check on the country you were initially a citizen of and check if you have settled your debt.

Does credit score affect PR application?

Credit scores have little to no impact on the immigration process. That's because your credit score from your home country—good or bad—won't carry over to Canada. Establishing a strong credit history is nevertheless important once you arrive in Canada.

Can you get deported for debt?

Short answer? No, you can't get a deportation order for debt as an immigrant to the U.S. But debt could hurt you in other ways. Here's what you need to know about how debt can impact your new life in the States – and your immigration status.

Does USCIS check with IRS?

The U.S. Immigration and Citizenship Services (USCIS) is not responsible for making sure you pay your taxes. However, many U.S. federal government agencies share information about people.

Does bad credit follow you overseas?

Key Takeaways. A credit score accrued in the United States has no bearing overseas; it will neither harm nor help you in overseas financial dealings. The technology doesn't yet exist for the possibility of international credit scores; additionally, laws prohibit the sharing of credit information overseas.

Does Indian credit score work in USA?

Here's the good news: Nova Credit has built technology to translate international credit data from countries like Australia, Canada, India, Mexico, the UK and more into the U.S.-equivalent score that newcomers can share with U.S. companies when they apply for credit products here.

Does bad credit affect green card application?

People with bad credit will have a tougher time getting loans. Those with poor or no credit won't be automatically disqualified from getting a green card or an extension on their stay in the U.S., they will find it more difficult than in the past.

Can you pass a credit check with no credit history?

Worried about if you can pass a credit check with no credit history? Don't worry! The concept of “passing” a credit check simply means accessing a credit report with your financial history. Even if you have absolutely no credit history at all, you can still access a credit report and go through a credit check.

What is a Social Security Number (SSN)?

A Social Security Number is a 9-digit tax identification number that is used to report your income to the US government.

Opening a US bank account as an H-1B visa holder

Challenge: You don’t have any credit history when you enter the country. Banks are often reluctant to lend money to non-permanent residents, especially when they are not customers.

Credit product limitations for H-1B visa holders

Challenge: Regardless of the length of time you’ve been developing your local financial history in the US, you’re not going to have the full range of credit products available to you that are available to citizens. Credit products you may have difficulty obtaining are mortgages and other long-term loans.

Credit length limitations for H-1B visa holders

Challenge: Most US lenders and banks will be limited by the expiration date of your current visa. Because of this, you will find it difficult to receive approval for long-term credit opportunities that extend past this time frame.

Getting US credit cards as an H-1B visa holder

Challenge: If you’re totally new to the US, you’re not going to be offered a standard credit card straight away.

Obtaining personal loans on an H-1B visa

Can you get a personal loan on an H-1B visa? The short answer: yes. However, even if you are eligible for a personal loan, you will be limited to credit that you can repay by the time your current visa expires.

Auto and home loan credit for H-1B visa holders

Challenge: Due to time restraints of your visa, you won’t be able to secure a typical home loan that lasts between 20 and 30 years. A long-term car loan for visa-holders may also be more difficult to obtain.

What is Public Charge

The public charge rule is an additional assessment for granting or extending your visa application, or changing the class of the visa. Starting February 24, 2020, the rule will be used to determine whether an alien has become or is likely to become dependent on the government for their support.

Who Attracts the Public Charge Rule

Aliens who have a nonimmigrant visa and seek to extend their stay in the same nonimmigrant classification.

Additional Documentation

Starting Feb 24, 2020, you should submit the Public Charge Questionnaire, also known as Form DS-5540, and the supporting documentation to the DHS at the time of the adjudication. Using this form, you are required to provide the following categories of information:

Joining the Right Employer is More Crucial than Ever for a Nonimmigrant Student

It is very clear that the already complex US visa regulations are becoming more complicated. Consequently, you need an employer who has employee-centricity as one of their core values. Only such employers can steer your OPT extension, H1-B applications and extensions, and Green Card visa applications efficiently and in accordance with the law.

OPT Stem Extension

We created a detailed training plan that is specific to each employee based on their degree and coursework.

H1B Processing

Did you know that there are a number of H1 regulations that are almost always violated by most employers? Here are some examples:

GC Processing

GC is a long and arduous process. Find an employer willing to get your GC started right away. Ask them about the processes they have in place to overcome the usually restrictive GC requirements like prevailing wages, ability to pay, use of experience gained within the same organization etc.

1. Get your application in as quickly as possible

The USCIS accepts applications in April and, believe us, they come in thick and fast. The last thing you want to do is miss the deadline so it’s important to be prepared and has your application ready with plenty of time of time to spare.

2. Only apply once

You might think that having more than one application will give you a better chance of being successful in the lottery system. In theory, you’re probably right and there is no legislation from the USCIS stating that you are not allowed to submit multiple applications, but, there are certain limitations and conditions.

What is an H1B Visa?

The H1B is a specialty visa that allows foreign workers to be employed and work in the U.S. It requires the application of specialized knowledge and a bachelor’s degree or the equivalent of work experience. H1B jobs include, but are not limited to:

What are the jobs that are required for H1B?

H1B jobs include, but are not limited to: Programmer Analyst. Software Engineer. Software Developer. Systems Analyst. Business Analyst. Computer Programmer. Senior Software Engineer.

Can H1B visa holders buy homes?

Even if H1B visa holders can buy homes, it’s important to ask if it makes sense for them to buy homes. And honestly, it really comes down to needs. H1B visa holders can buy and own cars in the U.S., but a foreign worker who lives in a city might not need for a car. It all depends.

Can a H1B visa be rented?

Considering the potential length of stay available to H1B visa holders, a foreign worker on an H1B may be in a housing situation beyond a mere rental agreement.

Is There Such a Thing as an “H1B Visa Mortgage”?

As of this writing, there is no mortgage option specifically for H1B visa holders. That said, there are several viable mortgage options for foreign workers in the U.S. on an H1B visa.

3 attorney answers

A green card cannot be obtained in the E-2 category. You're confusing this either with E-2 nonimmigrant status or an EB-5 investor visa. Generally speaking, a bad credit score in and of itself will not preclude you from adjustment of status.

Jeff L. Khurgel

Your credit score will not have any immigration consequences. Your employer, not you, can apply for an EB-2 green card. To bridge the gap between the end of your OPT and the issuance of a green card your employer must successfully petition for an H1B visa or some other nonimmigrant visa that permits you to work.

Laurence Drew Borten

1. Your credit score has no bearing on your adjustment of status application. 2. If you wish to be employed in the U.S. you need to be in possession of an employment authorization document (EAD) or a non- immigrant visa status that allows you to be employed in the U.S.