No, if you have outstanding debts in the form of credit cards or personal loans, there is no reason for this alone to negatively affect your visa application. However, there are some considerations you may need to bear in mind.

Can I get a visa with credit card debt?

Credit cards and loans are civil debts. Unless there are criminal issues involved it should not affect your ability to obtain visas. However it would be wise to negotiate a settlement with the companies involved...

Can my visa be denied due to outstanding debt?

If you have outstanding debt there is no reason for this to be the sole reason for your visa to be denied. However, although very uncommon, debts have can be a contributing factor for having your visa denied. However, it would be more fair to say that such rules for visa application acceptances vary for different people from country to country.

Can a debt affect my immigration status?

The only factor that can affect your immigration status is a history of criminal offences on your record. This means that a debt alone does not have the ability to negatively impact your current immigration status, or a future immigration application. Because of course, being unable to pay off debts is not a crime.

How does credit card debt affect a mortgage application?

How does credit card debt affect a mortgage application? Having debt isn't necessarily a problem. But the amount of debt and your history of repayment could affect the amount you're allowed to borrow, the interest rate you pay and even whether you qualify for a mortgage at all.

Can a visa be denied because of debt?

As far as the law goes, you can be denied a visa for (almost) any or (almost) no reason, including if the consular officer doesn't like the color of your tie. Whether you will be denied a visa for having unpaid credit card debt is therefore not an objective science, but probably not.

Does credit card debt affect immigration?

USCIS will consider an applicant's credit report, credit score, debts and other liabilities as a factor in determining whether the individual is likely to become a public charge. A good credit report is considered a positive factor while a bad credit report is considered a negative factor.

Does debt affect visa applications USA?

The only factor that can affect your immigration status is a history of criminal offences on your record. This means that a debt alone does not have the ability to negatively impact your current immigration status, or a future immigration application.

Does bad credit history affect U.S. visa?

Not to worry. Having a bad credit rating or being in debt has no impact on your right to get an immigrant visa.

Can I get visa if I have loan?

Answers (1) Not paying off a personal loan is not an inadmissibility ground under the Immigration and Nationality Act. You should not face any problem at the U.S. Consulate during your visa interview. However, not paying off your loan may affect your credit ratings in India.

Can I immigrate if I have debt?

Can I still do a financial emigration with debt in place? You can emigrate and not pay your short-term/unsecured debt. When you emigrate, the country you are emigrating to will not do a credit check on the country you were initially a citizen of and check if you have settled your debt.

What are the causes of visa rejection?

What Are the Reasons for Visa Rejection and Refusal?Incomplete Application and Data Mismatch. ... Violating Visa Rules and Documentation Process. ... Incomplete Travel Itinerary. ... Inapplicable Travel Insurance for Specific Destinations. ... Insufficient Reason Explaining the Intent of Travel. ... Status of Your Passport.More items...

Does personal loan affect visa?

They can not do anything in embassy. And CIBIL up-dation has no relevance. You can go whenever you want to.

Can credit card or personal loan debt affect my visa application?

No, if you have outstanding debts in the form of credit cards or personal loans, there is no reason for this alone to negatively affect your visa application.

What happens if you leave a country with debt?

What happens to your debt when you leave the country? Technically, nothing happens to your debt when you leave the country. It's still your debt, and your creditors and collectors will continue trying to get you to pay it back. Just as they would before, those efforts may include phone calls and letters.

Does bad credit follow you overseas?

Key Takeaways. A credit score accrued in the United States has no bearing overseas; it will neither harm nor help you in overseas financial dealings. The technology doesn't yet exist for the possibility of international credit scores; additionally, laws prohibit the sharing of credit information overseas.

Does U.S. debt follow you to another country?

Most debts won't follow you to another country, but staying one step ahead of your creditors might be a lot harder than you think. Debt can feel like a massive weight hanging around your neck.

What happens if you have credit card debt and leave the country?

What happens to your debt when you leave the country? Technically, nothing happens to your debt when you leave the country. It's still your debt, and your creditors and collectors will continue trying to get you to pay it back. Just as they would before, those efforts may include phone calls and letters.

Can a debt stop you from becoming a citizen?

Debts Owed to the Government Owing debts to the government can lead to problems with immigration. Specifically, if you owe back taxes to the IRS, your application for citizenship may be denied and/or you may be deported from the country even if you're here legally.

Does immigration check your bank account?

Yes USCIS may verify information about your bank account with bank.

How many years before credit card debt is written off Philippines?

Amnesty programs in the Philippines provide reduced monthly payments and lower interest rates for those who want to get rid of their credit cards. There is a maximum interest rate of 1.5 percent for all credit card accounts, which means that a debtor will have more time to pay off their debts as long as 10 years.

Can I go to prison for debt?

Your debt ‘alone’ cannot be a cause for you to go to jail. But in case of any fraudulent activity, you could go to prison.

Can I be stopped at the airport for debt?

No. You cannot be stopped, detained, or arrested at the airport for an outstanding due alone. You can only be arrested at the airport on conviction...

How long before debt gets written off in the UK?

Your creditor can chase you for a debt only for six years. After this period, you no longer owe the debt.

Can I get a US green card while on debt in the UK?

Although this wasn’t much of an issue years ago, in 2019, the US announced that for a person to become an immigrant in the US, the financial status...

How does debt affect my credit reports?

If you took a debt and failed to repay it on the chosen deadline, it will have a negative impact on your report. But if you repaid your debt fairly...

What is the greatest risk of debts affecting clients subject to immigration control?

The greatest risk of debts affecting clients subject to immigration control is with nationality applications.

Why should debt advisers treat NHS debts as priority debts for applicants subject to immigration control?

If the client is liable, debt advisers should treat NHS debts as priority debts for applicants subject to immigration control because of the risk of sanctions. Obviously, if your client is unable to obtain or extend their permission to stay in the UK they will be unable to legally work or claim benefits.

What is a DRO in bankruptcy?

That intention to pay off the debt is relevant to a Debt Relief Order (DRO). If the debt is built up recklessly and deliberately then a DRO would prevent an applicant from showing to the Home Office that they had a serious intention of paying off their debts. Bankruptcy, and an individual voluntary arrangement (IVA) where part of the debt was to be written off, might also indicate this, though the latter might go down better if it had to be argued with the Home Office.

What is the attitude to debts short of bankruptcy?

The attitude to debts short of bankruptcy is that “where a person deliberately and recklessly builds up debts and there is no evidence of a serious intention to pay them off, the application will normally be refused. ”. I take this as meaning the debts have to be built up at least recklessly.

What should a debt adviser be alert to?

A debt adviser should also be alert to, for instance, a benefits repayment where the benefit was claimed in breach of a no recourse condition. This, unless made mistakenly, can prevent naturalisation by being a ‘deceitful or dishonest dealing with Her Majesty’s Government’.

What level of immigration advice is Citizens Advice?

All advisers in Citizens Advice are able to give immigration advice at level 1. The advice given here is about basic eligibility and would be level 1. Only if it became more complex would it go above level 1.

What factors will the Home Office look at when deciding a liquidation?

Even then, the Home Office will look at other factors such as the economic circumstances at the time, the scale of debt, culpability in the liquidation, mitigating circumstances and whether the applicant was reckless and irresponsible.

2 attorney answers

Credit cards and loans are civil debts. Unless there are criminal issues involved it should not affect your ability to obtain visas. However it would be wise to negotiate a settlement with the companies involved before you leave. Goodluck.

Ekaette Patty-Anne Eddings

Generally unpaid unsecured debt (such as credit cards) will not be a problem. If however the credit card companies were able to take some sort of criminal action, in other words claiming you somehow broke the law, then it may be a problem, but I don't think they could show any willful criminal action.

What to do if you have debt that is past due?

If your debt is already past-due, there’s still hope. You can work to resolve your debt problems and rebuild your credit. If you can afford to pay or settle your past due debt, you can call the creditor or collection agency who now owns the debt to do so.

What is the Fair Debt Collection Practices Act?

The Fair Debt Collection Practices Act prohibits collectors from threats and retaliatory tactics. Tayne points out that “Debt collectors are barred from making threats about actions that cannot legally be taken for unpaid debt.”. This includes threats of jail time, deportation, physical harm, and more.

Why is it important to have good credit?

To build a life in the United States — and hopefully one day buy a home or pay for college tuition — it’s essential to manage your credit and your debt wisely.

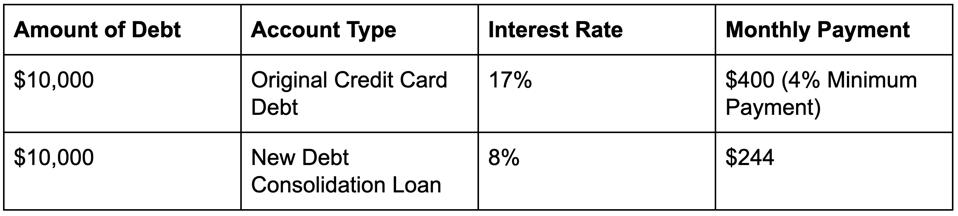

What are the best ways to keep your payments on time?

A well-structured budget, an emergency fund, and automatic payments are three tools that may help you keep your payments on time. If you’re paying high interest rates, debt consolidation may also be worth considering. If your debt is already past-due, there’s still hope.

Can you cosigner on your parents debt?

However, there is one notable exception that Tayne points out. “If you are a cosigner on any of your parents’ debts,” Tayne says, “you will be on the hook for the debt if they leave the country or cannot pay.”.

Can not paying your debts hurt your credit?

In addition to potential immigration problems, not paying your debts can have other consequences. Unpaid debt can damage your credit rating, which can harm you in a few ways: Bad credit can make it hard to qualify for financing, like loans and credit cards.

Can bad debt cause deportation?

In the past, the answer to this question was no. Bad debt didn’t lead to deportation proceedings unless there was some sort of fraud or criminal activity involved.

What is Public Charge

The public charge rule is an additional assessment for granting or extending your visa application, or changing the class of the visa. Starting February 24, 2020, the rule will be used to determine whether an alien has become or is likely to become dependent on the government for their support.

Who Attracts the Public Charge Rule

Aliens who have a nonimmigrant visa and seek to extend their stay in the same nonimmigrant classification.

Additional Documentation

Starting Feb 24, 2020, you should submit the Public Charge Questionnaire, also known as Form DS-5540, and the supporting documentation to the DHS at the time of the adjudication. Using this form, you are required to provide the following categories of information:

Joining the Right Employer is More Crucial than Ever for a Nonimmigrant Student

It is very clear that the already complex US visa regulations are becoming more complicated. Consequently, you need an employer who has employee-centricity as one of their core values. Only such employers can steer your OPT extension, H1-B applications and extensions, and Green Card visa applications efficiently and in accordance with the law.

OPT Stem Extension

We created a detailed training plan that is specific to each employee based on their degree and coursework.

H1B Processing

Did you know that there are a number of H1 regulations that are almost always violated by most employers? Here are some examples:

GC Processing

GC is a long and arduous process. Find an employer willing to get your GC started right away. Ask them about the processes they have in place to overcome the usually restrictive GC requirements like prevailing wages, ability to pay, use of experience gained within the same organization etc.

Can credit card or personal loan debt affect my visa application?

No, if you have outstanding debts in the form of credit cards or personal loans, there is no reason for this alone to negatively affect your visa application. However, there are some considerations you may need to bear in mind.

Can NHS debts affect my visa application?

There are a set of general grounds for refusal which apply to all applications for entry clearance, leave to enter, or variation of leave to enter or remain in the UK.

Can personal debt affect citizenship applications in the UK?

The rules on ‘good character’ (a key requirement for UK citizenship) have quite a lot to say on the matter of debt. As we have established, NHS debt can lead to citizenship refusal, but debt, in general, should not, as long as those debts are being paid off.

How to get out of debt faster?

When you make only the minimum payments on your credit cards, very little of that money goes toward reducing your balance—it’s almost all interest. The more you can direct to your payments each month, the faster you’ll get out of debt.

How does credit score affect mortgage application?

How credit scores affect mortgage applications. Falling behind on minimum credit card payments or carrying a balance that’s more than 35% of your total credit limit can hurt your credit rating. That’s a problem, because lenders use credit scores to determine overall mortgage eligibility as well as the interest rate you’ll pay.

What to do if you max out your credit card?

If you’ve maxed out your credit cards or don’t make your payments on time, check your credit score. If it’s not where you want it to be, take steps to pay off your credit card debt and improve your score before applying for a mortgage.

What to do if your credit score is less than ideal?

Similarly, if your credit score is less than ideal because you’ve maxed out your credit cards or don’t make your payments on time, your best bet is to start paying off that debt to improve your score before applying for a mortgage.

How to get a lower interest rate on credit card?

Get a lower interest rate. Start by asking your current credit card provider (s) if they’ll lower your rate. If you’ve been a long-time customer and they want to keep your business, they might agree. If not, look around for a card offering a balance transfer promotion with a 0% interest rate. Of course, that promoted rate is for a limited time, so find out how long it lasts and what the rate will be once the promotion is over. Remember: this strategy only works if you use the money you save in interest charges to pay off your balance.

Is debt a problem in 2021?

By Tamar Satov on April 6, 2021. Having debt isn't necessarily a problem. But the amount of debt and your history of repayment could affect the amount you're allowed to borrow, the interest rate you pay and even whether you qualify for a mortgage at all. Advertisement.

Does higher interest rate lower mortgage payments?

Higher interest rates translate into higher mortgage payments, which in turn lowers your mortgage loan affordability.