...

Our Verdict.

| Regular APR (%) | 16.24% - 26.24% variable |

|---|---|

| Annual Fee | $0 |

Is paying an annual fee worth it?

An annual fee might be something you’d like to avoid when you’re looking for a credit card, but it’s not always a bad thing. In many cases, paying an annual fee can be worth it if your ultimate goal is to maximize your cash back, earn travel rewards or earn a valuable sign-up bonus.

What is the best credit card with no annual fee?

Here are Select’s top seven cash-back credit cards with no-annual-fee:

- Winner: Chase Freedom Unlimited® Card

- Runner-up: Citi® Double Cash Card

- Best for Rotating Bonus Categories: Chase Freedom Flex℠

- Best for Online Shopping: PayPal Cashback Mastercard®

- Best for Foodies: Capital One® SavorOne® Cash Rewards Credit Card

- Best for Groceries: Blue Cash Everyday® Card from American Express

Can I get refund of annual fee?

Most credit card issuers will issue you a full refund if you cancel the credit card within 30 days (one statement period) from the date the annual fee posts. So even if you goof and forget to cancel the card in time, you generally have some sort of grace period to cancel the card and get the annual fee reimbursed in full.

Is the Citi ThankYou Premier worth the annual fee?

The Citi Premier has a $95 annual fee, but it’s worth it for the welcome bonus and perks. Here are a few reasons why I’ve kept (and will continue to keep) the Citi Premier for so long. Anyone who applies for the card right now, will earn points at the following rates through August 22, 2020,:

How much do you get for 12 months on Select Streaming?

How much back in bitcoins do you get on a card?

Is a Visa prepaid card safe?

Does Visa give compensation?

See 1 more

About this website

Does Visa have any fees?

Getting a Visa card costs as little as $0, depending on the type of Visa card you get. Visa gift cards often have a one-time fee of $2.95 to $6.95 at the time of purchase, based on the gift card's value, whereas most Visa debit cards and credit cards cost nothing to get.

Which card has an annual fee?

Here are Select's picks for the top credit cards with annual fees under $100: Best rewards card: Capital One Venture Rewards Credit Card. Best cash-back card: Alliant Cashback Visa® Signature Credit Card. Best travel card: Chase Sapphire Preferred® Card.

How can I waive my annual Visa fee?

Call your issuer Call the customer service number on your statement or the back of your card, and provide identifying information like your name and account number. Then, ask if you can have a waiver for your annual fee. If this is successful, you're done.

What credit cards do not have an annual fee?

Best No Annual Fee Credit Cards for August 2022: Capital One Quicksilver Cash Rewards Credit Card: Best overall cash back card with no annual fee. Capital One SavorOne Cash Rewards Credit Card: Best for dining & entertainment with no annual fee. Discover it® Cash Back: Best for flexible spenders.

Do I have to pay annual fee on credit card if I cancel?

Usually, yes—many card issuers will refund an annual fee if you close the account and request a refund quickly enough. You usually have about 30 days after an annual fee is incurred—sometimes more, sometimes less. It varies highly by issuer and is not always guaranteed.

Do all credit cards have an annual fee?

Not all credit cards charge an annual fee. In fact, many Capital One cards don't have annual fees. For cards that do charge a fee, the amount can vary. Generally, you might see some annual fees as low as $35 and others as high as $500 or more.

Why is an annual fee Important?

The annual fee for these cards helps reduce the financial risk for the issuer. If you're trying to rebuild your credit and boost your score, then it's usually worth a small annual fee. Just remember that you must also pay all your bills on time and keep low balances on your credit cards to increase your score.

What does an annual fee mean?

An annual fee is a yearly charge by banks and financial institutions to customers for use of their credit cards. The card issuer adds the annual fee to the customer's statement.

Do debit cards have annual fees?

Debit cards themselves typically don't have annual fees, but checking accounts often charge monthly account management fees if balance requirements aren't met. However, there are free checking accounts and debit cards, such as Capital One 360 Checking®.

Does Mastercard have annual fees?

0% Intro APR on balance transfers for 15 months from date of first transfer and on purchases from date of account opening. After that, the variable APR will be 15.74% - 25.74%, based on your creditworthiness....Citi Rewards+® Card.Purchases Intro APR0% intro for 15 months on PurchasesAnnual Fee$01 more row

Does Capital One have an annual fee?

Capital One credit card annual fees range from $0 to $95 per year, depending on the card. Most Capital One consumer credit cards have no annual fee, and the few cards that do have such a fee usually have extensive rewards as well.

Whats an annual fee for a gym?

It's common to pay somewhere around $40-50 per month to join an average gym, or around $500-600 per year — plus initiation fees, annual fees, etc. bringing the total average cost of a commercial gym membership to somewhere around $600-800 per year.

Best No Annual Fee Credit Cards of 2022 - CreditCard.com.au

No Annual Fee Cards 101. A no annual fee card doesn’t charge ongoing yearly fees, which will save you anywhere from $100 or less each year, up to $1,450 depending on the card.. While that seems like an unbeatable bonus, the decision to use a no annual fee card depends on how you’ll use your credit card each day, because they’re often lower in features and perks.

No Annual Fee Credit Cards | American Express

EXPLORE THE PERKS; We’ve made sure every foodie, shopper, globetrotter, music lover and more, can enhance their favorite experiences. Simply browse the Credit Cards above with no annual fee and you’ll find perks across entertainment, shopping, dining, and travel.

Credit Cards with No Annual Fee | Mastercard

Avoid costly annual fees & save money with Mastercard's 0 annual fee credit cards. Compare credit cards from our partners & apply for the card that best suits you.

What is annual fee?

Annual fees are the amount you pay for the benefits that come with your credit card. Not all credit cards have these fees. Generally, the higher the annual fee, the more benefits the credit card provides. 2 .

How Do You Pay an Annual Fee on a Credit Card?

Your credit card issuer will typically charge your annual fee to your billing statement automatically once a year, around the time when you initially opened an account. This will raise your statement balance for that period.

Why is an annual fee important?

Because an annual fee increases the cost of having a credit card, any benefit you're getting from your credit card should exceed that cost. 6 For example, if your rewards credit card has an annual fee, the rewards you earn should exceed the amount you are paying to keep the card open. Otherwise, you are losing money.

How often is a credit card fee charged?

How Your Credit Card Fee Is Charged. The annual fee might be a one-time charge on your credit card during a specific month of the year, such as on the anniversary of the date you opened the card or at the beginning of the calendar year. Some credit providers divide up fees and assess them monthly, but it is common for cards to charge ...

How long do you have to notify credit card companies of new annual fee?

If your credit card issuer decides to impose a new annual fee or raise the current one, they're required by federal law to notify you 45 days before the new annual fee becomes effective. You have the option to reject the new annual fee. 10

How often do credit cards charge annual fees?

Some credit providers divide up fees and assess them monthly, but it is common for cards to charge the annual fee once a year. 7 . Annual fees are a separate charge from any interest payments you might incur on your account.

What happens if you decide the annual fee isn't worth it after the first year of using the card?

If you decide the annual fee isn't worth it after the first year of using the card, you can close the account. Before you do, you should:

How much does a Mexican border crossing card cost?

Border crossing card - under age 15; for Mexican citizens if parent or guardian has or is applying for a border crossing card (valid 10 years or until the applicant reaches age 15, whichever is sooner): $15.00

When is a machine readable visa replaced?

Replacement of machine-readable visa when the original visa was not properly affixed or needs to be reissued through no fault of the applicant: No Fee

What is the form for waiver of visa ineligibility?

Application for Waiver of visa ineligibility, Form I-601 (Collected for USCIS and subject to change)

How much is Opensky credit limit?

So if you open the OpenSky card and receive a $200 credit limit, your available credit will be reduced by $35 to $165. If you no longer want to pay an annual fee for a credit card, there are a few actions you can take, which we list below.

Do credit cards have annual fees?

Many of the highest-earning rewards credit cards have annual fees, which is an important factor to consider both before and after applying.

Do credit card annual fees come on the same bill?

More often than not, credit card annual fees will be billed as a one-time charge on your statement during the same month each year. Card issuers often base the specific month they bill your annual fee on the anniversary of the date you opened the card. For instance, if you opened a card on April 5, 2020, you can expect to receive a bill for ...

Do credit card companies charge annual fees?

Credit card issuers may have different policies for when they charge annual fees, but they generally follow similar rules. More often than not, credit card annual fees will be billed as a one-time charge on your statement during the same month each year. Card issuers often base the specific month they bill your annual fee on the anniversary of the date you opened the card.

Does Opensky have annual fees?

There may be some cases where a card issuer will break up the annual fee into monthly installments, but this is rare. And if you open a card that isn’t from a major issuer, you may have the annual fee deducted from your available credit limit. For instance, the OpenSky® Secured Visa® Credit Card has a $35 annual fee, ...

How much is a checked bag on a one way ticket?

Cardmembers receive a free checked bag for themselves and up to six travelers booked on the same itinerary. A checked bag fee runs $30 for a single bag on a one-way ticket.

How to get value out of Alaska Airlines Visa Signature?

One of the primary ways to get value out of the Alaska Airlines Visa Signature® credit card is by using Alaska's Famous Companion Fare™. This perk is available after you meet the minimum spending requirement and every year thereafter when you pay the annual fee.

Who is eligible to apply for this card?

Anyone who doesn’t currently have the card or hasn’t had the card in the past 24 months. This restriction does not apply if you have the Alaska Airlines Visa® Business card.

Does Alaska Airlines charge foreign transaction fees?

No foreign transaction fees. There are no foreign transaction fees with the Alaska Airlines Visa Signature® credit card. If you are eager to earn Alaska miles, this perk can help because it means you can make international purchases without incurring a surcharge which can run upwards of 3%.

Best Buy Credit Card Benefits

Best Buy Rewards: Best Buy purchases earn you 2.5 points per dollar spent (both in-store and online). When you accumulate 250 points, you're sent a $5 reward certificate that you can use toward future Best Buy purchases. This is effectively a reward rate of 5% cash back.

Who It's Best For

If you're a frequent Best Buy shopper and have a high enough credit score to be eligible for the no fee version of the Visa card, this could be a good supplemental card to have in your wallet. Getting 5% rewards on Best Buy spending is generous if you shop there often, especially if you purchase all your big-ticket home electronics there.

Alternatives

Wary of having only 60 days to redeem the Best Buy rewards? Or is Best Buy not necessarily your go-to store for all things electronic? You may be better off with a rewards credit card that lets you accumulate rewards indefinitely. Consider the following alternatives:

How much back does Amazon Signature Visa give?

When you open an Amazon Signature Visa credit card, you will receive 5% back everywhere you shop on up to $2,500 in purchases for the first three months of owning the card if you have a Prime account. 4 If you tend to buy your groceries at Whole Foods and frequently shop online at Amazon as a Prime member, this card could provide substantial rewards and rebates.

What is the annual percentage rate on a credit card?

The annual percentage rate on your card will depend on your credit history. There’s no introductory APR. Expect a rate between 14.24% and 22.24%, but it will vary based on the prime rate. Balance transfers have the same APR as purchases instead of the higher one many cards impose.

What Kind of Credit is Required for the Amazon Prime Rewards Signature Visa Card?

Unlike the Amazon store card, which only requires fair credit, the Amazon Rewards Signature Visa cards (Prime member or non-member) both require a higher credit score because they are Visa credit cards.

What is Amazon Rewards Visa Signature Card?

The Amazon Rewards Visa Signature Card is nearly identical to the card designed for Prime members. However, cardholders only receive a 3% rebate on purchases.

How much does Amazon Prime cost?

The card does not have an annual fee attached, but if you want the Amazon Prime Rewards Signature Visa, you will have to pay to be an Amazon Prime member, which costs $119 per year. You must be age 18 or older to apply for the card, and credit limits are based on the applicant's credit.

Is Amazon Visa card only for Prime members?

Although the card is only available to Prime members, the rewards structure of either Amazon Visa card might make it useful even for people who only shop at Amazon infrequently. The APR is still higher than most non-retail cards, but this card's terms are attractive in the retail space.

Does Amazon have a visa card?

Not only does it offer a wide variety of goods, but the company also offers a co-branded visa card, especially for its Prime members. The Prime Rewards Signature Visa is similar to its alternative co-branded card, named the Amazon Rewards Signature Visa credit card. Both credit cards can be used anywhere Visa is accepted ...

How much do you get for 12 months on Select Streaming?

Earn $5 per month for 12 months on Select Streaming Subscriptions when you pay on time. *Exclusions Apply

How much back in bitcoins do you get on a card?

Earn 2% back in bitcoin on every purchase over $50,000 of annual spend. Rewards rate increases from 1.5% to 2% after $50,000 of spend has been achieved and resets on the card anniversary date every year.

Is a Visa prepaid card safe?

A Visa prepaid card could be the way to go. Its a more secure, convenient solution to everyday spending.

Does Visa give compensation?

Card information is provided by third parties. Visa may receive compensation from the card issuers whose cards appear on the website, but makes no representations about the accuracy or completeness of any information. Please be sure to carefully review all terms and information in connection with the application process. For more information regarding the terms and conditions of any card, click 'Apply', 'Buy Online' or 'Terms and Conditions'.

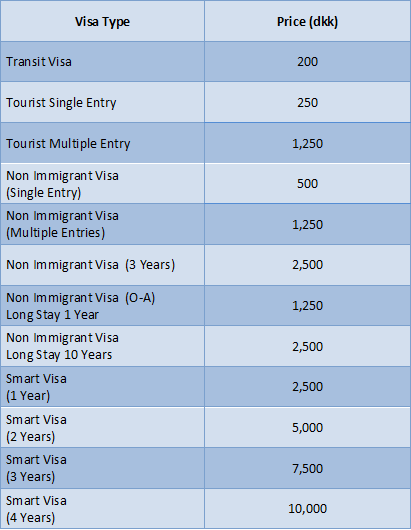

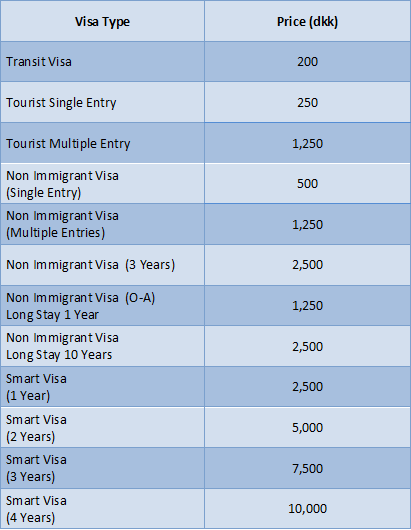

Coming to The United States Temporarily - Nonimmigrant Visa Services

Coming to The United States Permanently - Immigrant Services

- Immigrant visa application processing fees are tiered, as shown below, based on the visa category you apply for. Notice: Every visa applicant must pay the visa application processing fee for the visa category being applied for. Description of Service and Fee Amount (All fees = $ in US currency) Filing an Immigrant Visa Petition(When collected by U....

Special Visa Services

- Description of Service and Fee Amount

Note:These fee charts are based on the Code of Federal Regulations - Title 22, Part 22, Sections 22.1 through 22.7.)