We are global in acceptance of Wells Fargo business credit cards, so it is either a MasterCard or a Visa card. You may use your business credit card worldwide as long as you see the Mastercard or Visa logos, whichever you prefer. It is a good idea to have a spare foreign currency with you when departing the country.

Should I get a Visa credit card or MasterCard?

MasterCard and Visa are both solid credit card choices. Having a card from each company will give you more credit options. And having cards from different banks will get you access to the best reward programs, interest rates, and other benefits. Start looking online today. Then pick out the credit cards that work best for you.

Is visa or MasterCard more widely accepted?

Visa and Mastercard are by far the most widely accepted cards, with Discover slightly behind those brands and American Express in a distant fourth place. Any retailer that accepts card payments likely takes Visa and Mastercard.

Does Wells Fargo have ATM check deposit limit?

There is no limit on the amount you can deposit at a Wells Fargo ATM. Some ATMs have a limit on the number of bills or checks you can deposit in a single transaction, but this is based on the limitations of the ATM itself. You can always do multiple transactions to deposit the amount you want.

What is the best Wells Fargo credit card?

Wells Fargo no annual fee cards

- Wells Fargo Platinum Card

- Wells Fargo Active Cash℠ Credit Card

- Wells Fargo Cash Wise Visa® Card

- Wells Fargo Propel American Express® Card

- Wells Fargo Visa Signature® Card

- Wells Fargo Rewards® Card

- Wells Fargo Cash Back College℠ Card

See more

What type of card does Wells Fargo use?

Compare Bankrate's top Wells Fargo credit cardsCard nameBest forBankrate scoreWells Fargo Reflect CardBalance transfers4.2 / 5 (Read full card review)Wells Fargo Active Cash CardCash rewards4.3 / 5 (Read full card review)Hotels.com Rewards Visa® Credit CardOccasional hotel guestsN/A (Read full card review)Aug 1, 2022

Does Wells Fargo accept Mastercard?

What kind of credit and debit cards can I accept? Common cards you can accept are Visa®, Mastercard®, Discover®, American Express®, and JCB.

Can I withdraw money from my Mastercard at Wells Fargo?

You can access up to $500 per day from your credit card account. These transactions constitute cash advances on your credit card account. Transaction fees will apply and the APR for Cash Advances will be charged. Please see your Customer Agreement and Disclosure Statement.

Can I use my Mastercard at any ATM?

A: Yes. You may withdraw cash against the balance on most Mastercard prepaid and gift cards at any ATM. However, not all prepaid and gift card issuers allow ATM or foreign transactions. Be sure to check with your card issuer to ensure that these types of transactions are permitted.

Can I pay my Wells Fargo credit card with another credit card?

Wells Fargo will only accept online payments through wire transfers from bank accounts, not other credit cards or debit cards.

Why can't you pay a credit card with a credit card?

Typically, you can't simply pay your credit card bill with another card as if you were paying your utility or phone bill. Credit card companies don't usually accept credit cards as a regular form of payment, in part because it opens the door for debt to revolve through your accounts in an infinite loop.

What ATMS can I use with Wells Fargo card?

You can use a contactless debit card to access any Wells Fargo ATM. Tap your contactless debit card near the Contactless Symbol on the ATM. Then enter you card's PIN into the ATM when prompted. Select the transaction you wish to perform.

Can you pay rent with a credit card Wells Fargo?

As the new issuer of the Bilt Mastercard, Wells Fargo can now help renters with the card take their biggest expense and turn it into a rewarding experience, including helping them build a path to homeownership.”

Wells Fargo Active CashSM Card

0% intro APR for 15 months from account opening on purchases and qualifying balance transfers. 14.99%, 19.99% or 24.99% variable APR thereafter. Balance transfers made within 120 days qualify for the intro rate and fee.

Wells Fargo ReflectSM Card

0% intro APR for 18 months from account opening on purchases and qualifying balance transfers. Intro APR extension of up to 3 months with on-time minimum payments during the introductory and extension periods. 12.99% to 24.99% variable APR thereafter. Balance transfers made within 120 days qualify for the intro rate and fee.

What is a Wells Fargo credit card?

Wells Fargo Bank, N.A. issued private label credit cards are typically merchant or industry branded credit cards that consumers apply for through a merchant or service provider. If you are unsure who your credit card issuer is, please consult your cardholder terms or your billing statement.

What is the phone number for Wells Fargo?

Call 1-800-TO-WELLS ( 1-800-869-3557) 24 hours a day, 7 days a week.

How much protection does Wells Fargo give for cell phone bill?

Pay your monthly cell phone bill with your eligible Wells Fargo Consumer credit card and you'll get up to $600 protection (subject to a $25 deductible).

What is a credit card used for?

Your credit card is used for international, gas station, or online purchases.

Does Wells Fargo have an overdraft protection?

If you choose to link your account to your Wells Fargo checking account for Overdraft Protection, please note the following. If you have a joint checking account, you will be responsible for all advances, including interest and charges, from your credit card to cover overdrafts, regardless of who writes the check, makes the debit card purchase, or engages in any other transaction that causes the overdraft. Depending on your account terms, an Overdraft Protection Advance Fee may be charged to your account each day an Overdraft Protection Advance is made, and interest will accrue from the date each advance is made. Your credit card must be activated; if it is not activated, no money will transfer to cover the overdraft. Once your credit card has been activated, please allow up to 3 business days for your Overdraft Protection service to be fully enabled. Refer to the Consumer Credit Card Customer Agreement and Disclosure Statement for details. There may be other options available to protect against overdraft that may be less costly. For additional information on Overdraft Protection using your credit card, please visit www.wellsfargo.com/credit-cards/features/overdraft-protection. For details on other options, please visit www.wellsfargo.com/checking/overdraft-services/.

Does Wells Fargo have a credit open dialog?

Help protect yourself against unexpected overdrafts and bounced checks by linking your Wells Fargo credit Opens Dialog card to your Wells Fargo checking account. Once you sign up for this service, if you happen to spend more than you have in your checking account, we’ll automatically make up the difference with an advance Footnote 3 3 from the available credit Opens Dialog on your Wells Fargo credit card account.

Does Wells Fargo have zero liability?

Your Wells Fargo Credit Card comes with Zero Liability protection at no extra cost. Your credit card has built-in protection features to help ensure you won’t be held responsible for any unauthorized transactions as long as you report them promptly.

What is a Wells Fargo card?

A card with Wells Fargo means access to one of the largest banking networks and robust technology. Interested in earning cash back and other rewards? A wide selection of credit cards and the Wells Fargo Go Far® rewards program can take your spending a long way.

What is Wells Fargo Active Cash?

The Wells Fargo Active Cash℠ Card offers simplicity and versatility with its unlimited 2% cash rewards rate to individuals looking to accumulate rewards on everyday purchases . Plus, the long introductory APR period and attainable sign-up bonus add significant value as well.

How long is the Wells Fargo introductory offer?

Why we picked it : This new card from Wells Fargo now touts one of the longest introductory APR offers on the market, offering up to 21 months from account opening of 0% introductory interest on purchases and qualifying balance transfers. There’s a base 18 months, plus a three-month extension if you make on-time monthly minimum payments for the length of the intro offer (12.99% to 24.99% variable APR thereafter).

How long does Wells Fargo offer 0% APR?

Make on-time monthly minimum payments (a best practice no matter the card) and you can take advantage of one of the longest intro APR offers on the market with this new card from Wells Fargo, which offers 0% introductory APR for up to 21 months from account opening on purchases and qualified balance transfers (then 12.99% to 24.99% variable APR).

What is research methodology Wells Fargo?

Research methodology: We analyzed Wells Fargo’s catalog of credit cards to identify their top offers on the market. While a large number of factors contribute to the quality of a credit card, the following were our most important criteria in evaluating and choosing the best here:

Does Wells Fargo have a cash back card?

Among direct competitors offering flat rate cash back rewards for no annual fee, the new Wells Fargo Active Cash℠ Card is a serious contender. This card offers an unlimited 2% cash rewards, making it easy to maximize rewards on eligible everyday purchases and a sign-up bonus of $200 cash rewards if you spend $1,000 within the first three months of account opening. Cardholders also benefit from the 0% introductory APR on both purchases and qualifying balance transfers (for 15 months from account opening, then 14.99% – 24.99% variable APR) to help manage existing debt or finance a large purchase.

Does Wells Fargo offer cash back?

You get access to My Wells Fargo Deals, which offers cash back in the form of a statement credit when you pay for eligible experiences.

How much back do you get on a credit card?

After the first six months or once you reach that spending cap, whichever comes first, the card drops down to earning just 1 point back per $1 spent. That's below the flat-rate industry standard of 1.5% back on everything, and there's no way to boost it again. You're stuck at that rate for as long as you hold the card.

Does Wells Fargo have cell phone insurance?

The Wells Fargo Visa Signature® Credit Card provides cell phone insurance for devices that have been damaged or stolen, as long as you pay your monthly phone bill with the card. The amount you'll get reimbursed is limited to the repair or replacement of your original phone, less a $25 deductible, with a maximum benefit of $600 per claim and $1,200 per 12-month period.

Is Wells Fargo Visa Signature a card?

The Wells Fargo Visa Signature® Credit Card has a somewhat hidden identity. At first, it may seem like a fairly pedestrian rewards card, whose earnings capabilities start out strong but flame out in half a year. But a closer look shows that it offers big potential for anyone seeking exceptional redemption values on airfare.

Does Wells Fargo have a sign up bonus?

The $0-annual-fee Wells Fargo Visa Signature® Credit Card doesn't offer a traditional upfront sign-up bonus after meeting a minimum spending requirement. But it does earn 5X points on up to $12,500 in combined spending on gas, grocery and drugstore purchases for the first six months of card ownership. All non-bonus-category purchases earn 1X back. That's a pretty stellar rate in multiple everyday spending areas — but it doesn't last.

Do Wells Fargo points expire?

It's also worth noting that points expire after five years — a long time, to be sure, but many credit cards offer rewards that never expire. » MORE: Wells Fargo Go Far Rewards: How to earn and use them. 2. Rewards are worth 50% more when used to book airfare via Wells Fargo.

What is the best card for Wells Fargo?

The Wells Fargo Cash Wise Visa® Card is best for cardholders who want rewards that are easy to use, as it offers cash back rewards that can be simply redeemed for statement credit.

How does Wells Fargo look at credit?

To find out, the bank will look at your entire credit history, including your payment history, how much you currently owe, and how many hard credit inquiries you’ve had in the last two years. Wells Fargo is said to be particularly wary of charged off accounts.

How Can You Get Your Credit Score for Free?

As one of the largest banks in the country, Wells Fargo serves millions of Americans, but its share of the credit card market is limited compared to some of the more prominent names like Chase and American Express. But that isn’t necessarily from lack of trying; Wells Fargo’s stable of credit cards — most with no annual fee — are still competitive offerings in the space.

What is a Wells Fargo Platinum card?

The Wells Fargo Platinum card is a popular card for its long introductory APR deal for new cardholders. It applies to both new purchases and balance transfers, the latter making it appealing to consumers looking to consolidate debt.

How much is the minimum deposit for Wells Fargo secured credit card?

The credit limit will be determined based on the deposit you make, at a 1:1 ratio, with a minimum deposit requirement of $300.

How much is Wells Fargo worth?

In fact, Wells Fargo is the fourth-largest bank in the US, with over $200 billion in market capitalization. Given its ubiquity, it’s little surprise that millions of Americans have — or want to have — a Wells Fargo credit card.

Why is Wells Fargo card rejected?

Some cards require you to have a current Wells Fargo bank account to apply online, and a number of reviewers have reported being turned down for a Wells Fargo credit card because of an insufficient history with the bank. And a poor history with the bank can also get your application rejected.

Why trust us?

Our editorial team and expert review board work together to provide informed, relevant content and an unbiased analysis of the products we feature. The editorial content on our site is independent of affiliate partnerships and represents our unique and impartial opinion. Learn more about our partners and how we make money .

Summary

While being preapproved does not guarantee that you will be approved once you actually apply for a credit card, it can give you a good idea of which cards you are best matched to. Here’s how to score one of these offers with Wells Fargo.

Top Wells Fargo cards for prequalified cards

If you are looking to get preapproved for a Wells Fargo card, here are some of the best Wells Fargo credit cards to look out for:

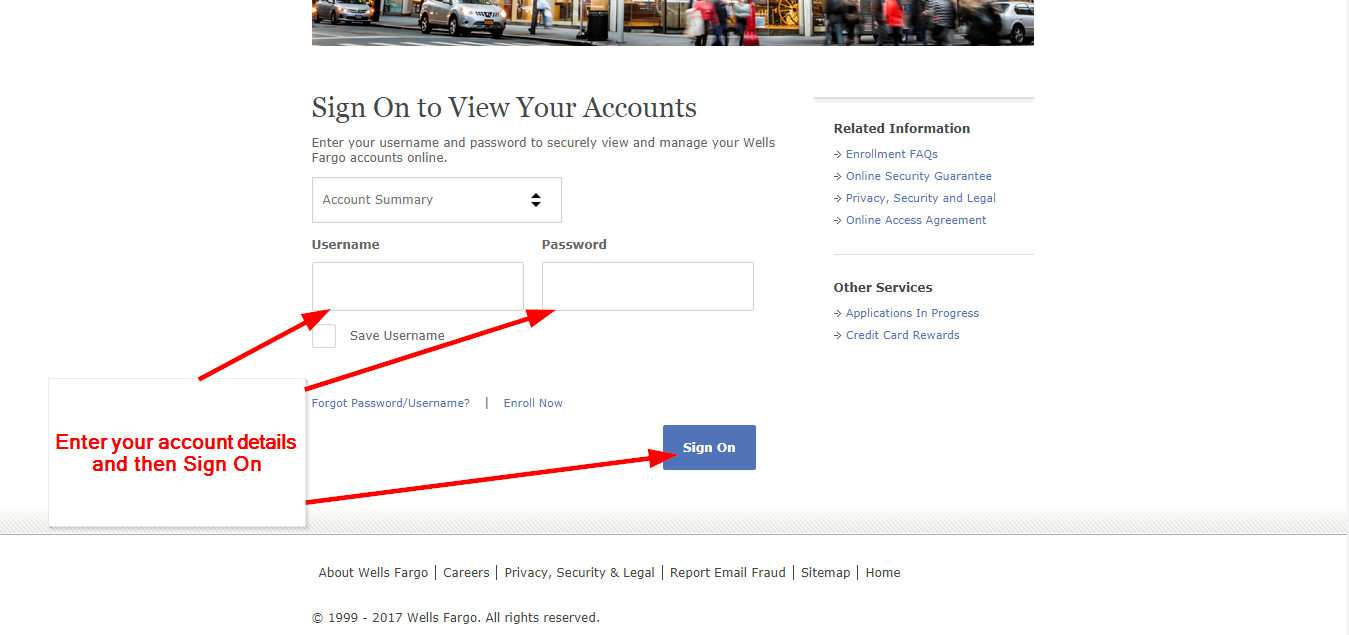

Find preselected offers on the Wells Fargo website

Like many other credit card issuers (see American Express or Citi ), Wells Fargo has a preapproval tool on its website. The Wells Fargo prequalification tool allows you to see if you’re likely to be approved for a specific Wells Fargo card.

Other ways to prequalify

Filling out the online Wells Fargo preapproval form is the easiest way to see if you are prequalified for any Wells Fargo credit cards, but it’s not the only way. Wells Fargo, like many banks and credit card issuers, will sometimes send out electronic or postal credit card offers.

Boost your chances of preapproval

If you have your eyes set on a specific Wells Fargo card, and the Wells Fargo preapproval tool says that you aren’t qualified, don’t fret. You can still take steps to improve your chances of being approved.

Prequalifying does not guarantee approval

You may see some banks talk about being “preapproved” while others mention being “prequalified.” Many banks use the terms prequalified and preapproved interchangeably, while others treat them slightly differently. Some banks use a preapproval to mean that they have taken a deeper dive at your credit history than just a prequalification.

What is a Visa card?

Visa is the payment network on this card. You can use it anywhere that accepts Visa. When you buy something, Visa makes sure that the merchant gets its money and the transaction is reported to your issuer so that it shows up on your statement.

What is the rule for merchants to honor all cards?

Payment networks require merchants to follow a rule called "honor all cards.". What that means is that if a merchant takes Visa, it must take all Visa cards; if it takes Mastercard, it must take all Mastercard cards.

Is a Mastercard a Visa?

But that's not because it's a Mastercard rather than a Visa. It's because it's issued by Citi rather than Chase. There are hundreds of credit card issuers in the U.S., but there are only four major payment networks: Visa, Mastercard, Discover and American Express. (Unlike Visa and Mastercard, American Express and Discover are both card issuers ...

Do Visa and Mastercard issue credit cards?

Visa and Mastercard don't actually issue or distribute credit cards. Instead, they are payment networks — they process payments between banks and merchants for credit card purchases. The bank that issues the card matters much more than the payment network. Interest rates, fees, and most rewards and perks on a credit card are set by ...

Is a Mastercard card accepted worldwide?

Both are widely accepted worldwide, and the benefits that matter most to card users aren't determined by whether it's a Mastercard or Visa card. So when choosing a card, don't spend too much time worrying about the logo. Focus on other features.

Is there a difference between a Visa and a Mastercard?

Although there isn't a lot of difference between Visa and Mastercard, they aren't completely identical. Each payment network makes a suite of benefits available to cardholders. But a couple of caveats apply: It's often up to the issuer whether a particular card will carry a network benefit.

Does Sam's Club accept Visa?

Similarly, Sam's Club used to take Mastercard but not Visa, although it now accepts both. Even so, such exclusions are rare. You're far more likely to run into a merchant that doesn't take AmEx than one that doesn't take both Visa and Mastercard. Payment networks require merchants to follow a rule called "honor all cards.".