Behind popular real-time payment apps like Square, Venmo

Venmo

Venmo is a mobile payment service owned by PayPal. Venmo account holders can transfer funds to others via a mobile phone app; both the sender and receiver have to live in the U.S. Venmo is a type of payment rail. It handled $12 billion in transactions in the first quarter of 2018.

Can I use Zelle If I already have Zelle®?

If you already have Zelle® through your bank or credit union, follow the steps to enroll and start sending and receiving money. You are ready to safely send money. (And don’t worry. You can still use Zelle® if your bank or credit union isn’t listed below.)

Can I use Zelle with a credit union?

Zelle has a huge list of partner banks and credit unions that can send money to one another seamlessly. If your bank or credit union doesn’t use Zelle, you also have the option of using the Zelle app and connecting a debit card. Things to consider when using Zelle Customers can’t use Zelle with international bank accounts.

Is Zelle® in my bank app?

Zelle® is already in over a thousand banking apps. To find out if Zelle® is in yours, search the list below for the bank or credit union where you already have a bank account.

Why choose Visa Direct over Zelle?

The debit number pairs better than routing and account numbers. And this works around the world. Visa Direct is global, not just domestic like Zelle or Vocalink. Visa and Mastercard are the only ones that work around the world.” Follow me on Twitter or LinkedIn .

See more

Is Zelle Visa direct?

Behind popular real-time payment apps like Square, Venmo and Zelle is Visa Direct. “It's a reversal of the traditional Visa system we think of it as purchase where you can pull money from your account, said Cecilia Frew, SVP Global Commercialization of Visa Direct.

Does Zelle use Visa?

To enroll with the Zelle® app, enter your basic contact information, an email address and U.S. mobile number, and a Visa® or Mastercard® debit card with a U.S. based account. We do not accept debit cards associated with international deposit accounts or any credit cards.

What apps use Visa Direct?

0:001:44Visa Direct - P2P Payment Apps - YouTubeYouTubeStart of suggested clipEnd of suggested clipHere's how it can work Alex uses a third party p2p app to split bills share costs. And pay peopleMoreHere's how it can work Alex uses a third party p2p app to split bills share costs. And pay people back. The app integrates with her phone contacts.

What is Visa Direct payment?

Visa Direct, a real-time payments network for business and person-to-person (P2P) payments, is helping financial institutions and technology companies allow their customers to transfer funds to a debit account in 30 minutes or less.

Can I use Zelle without a debit card?

Can I use Zelle without a debit card? If your bank or credit union is linked with Zelle, you'll just need a bank account to send or receive money. However, if you need to enroll through the Zelle app, you'll need a debit card. It also must be a 'fast funds enabled' card to work with Zelle.

Why is Zelle not accepting my card?

Some debit cards don't yet have the capability to receive money in minutes. Those debit cards that are not 'fast funds enabled' can't be used with Zelle®. Your debit card may work in the future as more and more banks and credit unions are enabling their debit cards to have the ability to receive money in minutes.

How do I send money with Visa Direct?

How does Visa Direct work?Access the service through Netbanking, mobile or ATM.Enter the recipient's 16 digit Visa card number and the amount you want to send.The money will be received into the recipient Visa credit, debit or prepaid card.Recipient can use the received funds at any Visa merchant or ATM.

What payment rails does Zelle use?

Zelle is powered by the Mastercard Send and Visa Direct payment rails, respectively. Modern-day banks almost always use either of the 2 as their payment processor, therefore allowing basically any bank to partake in the Zelle network.

Does PayPal support Visa Direct?

PayPal's new Instant Transfer, powered by Visa Direct, Visa's real-time1 push payments solution, moves money from customers' PayPal accounts to their bank account via their Visa debit cards – providing an experience that offers speed, security and convenience, 24/7/365.

What is Visa Direct service?

With Visa Direct, you can conveniently make payment or send cash to directly to the cardholders' Visa credit, debit and prepaid card in 200 countries (excluding Columbia, Cuba, Iran, Israel, USA, Sudan, Syria and Venezuela). No hidden cost to the recipient, and your money will be credited between 30 minutes to 2 days.

Does Visa Direct ACH?

Visa Direct Payouts is built to help business deliver money to billions of endpoints worldwide through card, ACH, and faster payment networks via a single integration.

How fast is Visa Direct?

Visa Direct enables person-to-person (P2P), business-to-consumer (B2C) and business-to-business (B2B) payments. Backed by one of the major card schemes, the platform facilitates fast debit or prepaid card payments on the Visa network, with the funds reaching the recipient's account within 30 minutes.

What is Zelle payment method?

What is Zelle®? Zelle® is an easy way to send money directly between almost any U.S. bank accounts typically within minutes1. With just an email address or mobile phone number, you can quickly, safely and easily send and receive money with more people, regardless of where they bank.

Can you Zelle with credit card?

Zelle will launch a standalone app later this year. Like other apps, sending and receiving payments typically happens within minutes. Debit cards or checking and savings accounts can be used, but not credit cards.

Can I use Zelle without a bank account?

Although the service is seamlessly integrated as a money transfer service provider into many big-name financial institutions, if you use a more obscure bank or credit union, fret not — all you need is an email address or mobile phone number to take advantage of Zelle, regardless of who you bank with.

Does Zelle charge a fee for credit card?

Does Zelle Charge a Fee? Unlike certain other P2P transfer services, Zelle does not charge any fees. Venmo and Cashapp charge fees if users send money using a credit card, and if users want to immediately deposit funds into their bank account.

How can I find out if my bank or credit union uses Zelle?

Check with your financial institution. Search their website or mobile app, or look under the Transfers menu, to see if Zelle is available at your b...

Can I use Zelle if I don’t have a smartphone?

If your bank or credit union offers Zelle, you can use its online banking website to send or receive Zelle payments, even if you do not have a smar...

Can I get paid via Zelle?

Yes. Zelle isn’t just for sending money, you can also use it to receive disbursements from companies, universities, government agencies or any othe...

Can I use Zelle for my small business, or to pay a small business?

Yes. Zelle can be a great way to get paid as a small business owner, because it’s fast and there are no fees. If your customers’ payment amounts ar...

How long does it take for Zelle to send money?

Enter the amount you want to send. If your recipient is already enrolled with Zelle®, the money will go directly into their bank account, typically in minutes 1. If they aren’t enrolled yet, they will get a notification explaining how to receive the money simply and quickly.

Can you send money to someone with Zelle?

Safely and easily send money to people you know through your trusted banking app - or the Zelle® app if your bank doesn’t currently offer Zelle®.

Does Zelle endorse products?

By selecting “Continue to your bank”, you will be taken to an external interface with different privacy and information security policy. Zelle® is not responsible for and does not endorse the products, services or content that is offered or expressed.

Does Zelle slow you down?

Zelle®. Sending money to friends and family should never slow you down. That’s why we’re working with banks and credit unions to make it fast, free 1, and easy to send money to almost everyone you know, even if they bank somewhere different than you do. 1. Zelle® is already in over a thousand banking apps.

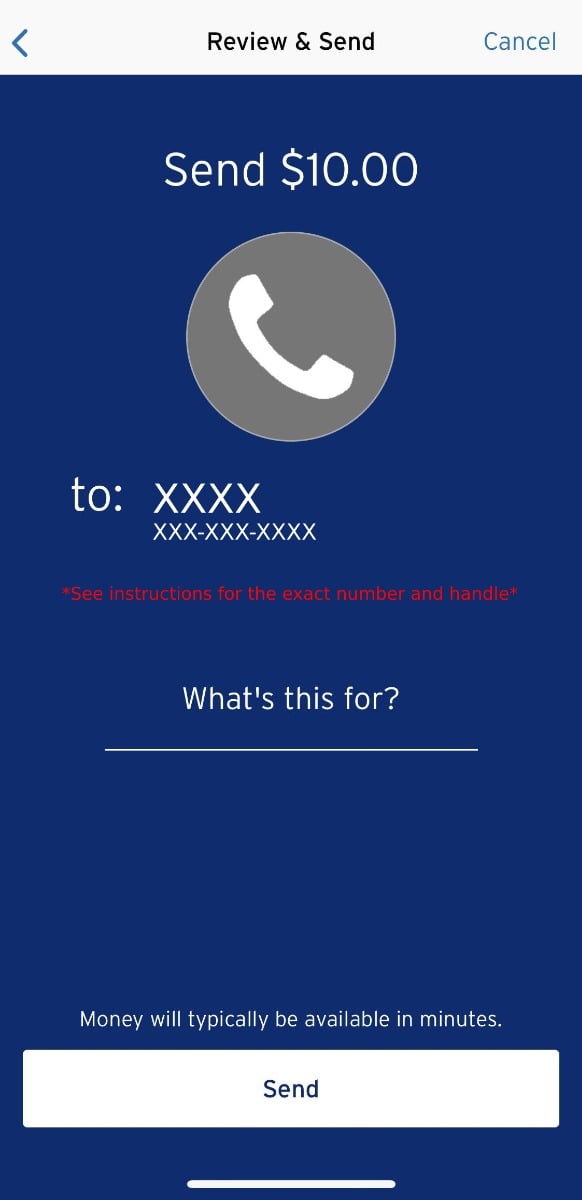

How to send money using Zelle?

To send money using Zelle, simply select someone from your mobile device’s contacts (or add a trusted recipient’s email address or U.S. mobile phone number), add the amount you’d like to send and an optional note, review, then hit “Send.”. In most cases, the money is available to your recipient in minutes 1. To request money using Zelle, choose ...

How to get money from Zelle?

If you have not yet enrolled with Zelle, follow these steps: 1 Click on the link provided in the payment notification you received via email or text message. 2 Select your bank or credit union’s name. 3 Follow the instructions provided on the page to enroll and receive your money. Pay attention to the email address or U.S. mobile phone number where you received the payment notification - you should enroll with Zelle using that email address or U.S. mobile phone number to ensure you receive your money.

What to do if your Zelle payment is pending?

If your payment is pending, we recommend confirming that the person you sent money to has enrolled with Zelle and that you entered the correct email address or U.S. mobile phone number.

How to send money to friends and family with Zelle?

Enroll today and send money to friends and family: 1. Log into the Direct Federal Credit Union app. 2. Select "Send money with Zelle ® ". 3. Enroll your U.S. mobile number or email address. 4. You’re ready to start sending and receiving money with Zelle.

How fast is Zelle?

Zelle is a fast, safe and easy way to send money directly between almost any bank accounts in the U.S., typically within minutes 1. With just an email address or U.S. mobile phone number, you can send money to people you trust, regardless of where they bank 2.

What is Zelle for?

Zelle is a great way to send money to friends, family and people you are familiar with such as your personal trainer, babysitter or neighbor 2.

How to request money from Zelle?

To request money using Zelle, choose “Request,” select the individual from whom you’d like to request money, enter the amount you’d like to request, include an optional note, review and hit “Request” 3.

Why use Visa Direct?

Use Visa Direct to help move money where it needs to go securely and at scale with multi-currency solutions.

Why is Visa Direct 1 important?

That’s why there’s Visa Direct 1, a payment solution that can help businesses move money to billions of endpoints worldwide via card and account rails. With fast or real-time 2 payment capabilities you can help move money when it’s needed most. That means merchants can access cash flow daily, consumers can receive payouts to bank accounts via the cards they know and trust, and families can receive money from loved ones on the other side of the world 3. The businesses helping make these products and services possible can build a stronger relationship with their customers. It’s time for business as usual to get an upgrade.

Is Visa Direct multi-layered?

Feel confident with the Visa Direct multi-layered system of risk and compliance controls available.

What is Zelle?

Zelle is a peer-to-peer, or P2P, money transfer service that allows individuals to send and receive money from each other via connected bank accounts. Most major banks and credit unions are part of the Zelle network, and once you enroll, you just need an email address or phone number to send and receive money electronically.

How do I enroll in Zelle?

To use Zelle, both the sender and recipient must enroll in Zelle through their bank account or with the Zelle app. This process is fairly simple: Zelle will ask for basic information like a phone number and/or email account and walk you through the enrollment process. If you’re using Zelle through your bank, your accounts will be linked. If you’re using the Zelle app, then you’ll have to connect a debit card.

How to send money to another Zelle account?

You can send or request money to or from another Zelle user by entering their email address or phone number. Check with your bank about how much you’re allowed to send at once. Some banks might put lower limits on sending to first-time recipients and then increase those limits once they become an established recipient.

Can a credit union use Zelle?

Zelle has a huge list of partner banks and credit unions that can send money to one another seamlessly. If your bank or credit union doesn’t use Zelle, you also have the option of using the Zelle app and connecting a debit card.

Does Zelle charge a fee?

No cost. Zelle doesn’t charge any fees to send or receive money, and it's unlikely that your bank will charge you a fee to use the service. The company does, however, recommend checking with your bank or credit union to make sure there are no additional fees.

Who is Chanelle Bessette?

About the author: Chanelle Bessette is a personal finance writer at NerdWallet covering banking. She specializes in checking and cash management accounts. Read more

Does Zelle protect your money?

When using Zelle, the onus of protecting your money falls on you, the user . Zelle recommends that you think of the Zelle service like cash: Send money only to people you trust, make sure your recipient’s contact information is correct before you send money, and beware of scams.

/cdn.vox-cdn.com/uploads/chorus_image/image/51479619/20161023-zelle-payment-app-banking.0.jpg)