Visa does not issue cards, extend credit or set rates and fees for consumers; rather, Visa provides financial institutions with Visa-branded payment products that they then use to offer credit, debit, prepaid and cash access programs to their customers.

What is visa and how does it work?

It facilitates electronic funds transfers throughout the world, most commonly through Visa-branded credit cards, debit cards and prepaid cards. Visa is one of the world's most valuable companies .

How does Visa Debit work in the US?

How Visa Debit Works in the US In the US, Visa Debit allows customers to use the same card to make both their credit and debit purchases. The card runs on the same credit network whether the purchase is for Debit or Credit.

How does a virtual Visa card work?

How does a virtual Visa card work? A virtual card Visa card represents your account but is simply a set of random numbers and a CVV code that can be generated instantly. You can use the virtual card Visa card to make purchases within a few minutes of its creation.

Does visa issue credit or debit cards?

Additionally, while Visa does not issue credit or debit cards, the company does provide credit, debit, and prepaid card services to consumers and businesses. 1 It's Visa's clients that issue the actual cards. 2 Visa makes its profits by selling services as a middleman between financial institutions and merchants.

See more

What does Visa do for banks?

Visa provides much of the necessary infrastructure to support financial institutions in issuing and processing debit and credit cards. Financial institutions like Capital One and your local bank issue credit and debit cards because it makes them money.

Is a Visa card connected to your bank account?

A debit card is connected to a bank account and works like an electronic check. Once a debit card is run by a cashier through a scanner, for example, the payment is deducted directly from a checking or savings account. The bank will electronically verify that the money is available and will approve the transaction.

What bank is behind Visa?

Bank of America (BofA)It was launched in September 1958 by Bank of America (BofA) as the BankAmericard credit card program.

Does Visa make money on debit cards?

Visa collects revenue through four different segments: Data processing revenues – these are approximately 0.13% for credit cards and 0.11% for debit cards. Visa collects these fees for authorizing, clearing, settling, and transaction processing services for the issuer and merchant acquiring banks.

How does Visa card work?

Your Visa Debit card still works like a debit card, not a credit card. If you use your PIN for your Visa Debit card transactions without signing, you may not receive the same security protections for transactions not processed by Visa. You can get cash back when you use your Visa Debit card at many merchant locations.

Is Visa a debit or credit?

Visa Debit is a major brand of debit card issued by Visa in many countries around the world. Numerous banks and financial institutions issue Visa Debit cards to their customers for access to their bank accounts.

Which is better Visa or Mastercard?

For most people, it doesn't really matter whether they get a VISA or a MasterCard. Both are equally secure and offer similar benefits. While VISA has a slightly higher market share and greater amount of transactions worldwide, both VISA and MasterCard are equally well-accepted by merchants.

Why are banks switching from Visa to Mastercard?

Massive change for millions of Visa debit card holders due to war on fees – what you need to know. MILLIONS of people have had their Visa debit cards replaced by Mastercards amid an industry war against the payment giant.

How does Visa make money?

Visa makes its profits by selling services as a middleman between financial institutions and merchants. The company does not profit from the interest charged on Visa-branded card payments, which instead goes to the card-issuing financial institution.

How much do banks pay Visa?

What are the average credit card processing fees for merchants?Payment networkAverage credit card processing feesVisa1.29% + $0.05 to 3.29% + $0.10Mastercard1.39% + $0.05 to 3.29% + $0.10Discover1.58% + $0.05 to 3.28% + $0.10American Express1.5% + $0.10 to 3.15% + $0.10

How much money does Visa make per transaction?

Interchange fees are typically two parts, consisting of a percentage and a transaction fee. For example, 1.51% plus $0.10 is the current Visa interchange fee for a swiped consumer credit card.

Why does Visa charge so much?

Visa and MasterCard set the fees that merchants must pay the cardholder's bank. And higher fees mean higher profits for banks, even if it means that merchants shift the cost to consumers.

Do credit cards have to be linked to bank account?

Do you need to have a bank account to open a credit card? The short answer is no. Credit card companies will only look at your credit score, current employment and income to determine your eligibility for a credit card.

Are all credit cards tied to banks?

Although both types of cards are tied to financial accounts, the accounts they are tied to are different. A credit card is tied to a revolving line of credit that a bank has issued you. A debit card is tied to your bank account.

Are debit cards automatically linked to your checking account?

Such debit cards come automatically with your checking account. Whether being used to obtain cash or to buy something, the debit card functions in the same way: It draws the funds immediately from the affiliated account.

Is your debit card linked to your savings account?

Tips. Typically, debit card transactions are attached to your checking account, not your savings account.

Visa Credit Card Explained in Less Than 4 Minutes

LaToya Irby is a credit expert who has been covering credit and debt management for The Balance for more than a dozen years. She's been quoted in USA Today, The Chicago Tribune, and the Associated Press, and her work has been cited in several books.

Definition and Example of Visa Credit Cards

Visa credit cards allow consumers and businesses to make credit purchases that rely on the Visa network for processing. Visa itself doesn't provide credit or issue credit cards. Instead, the global company operates a network that facilitates money movement between consumers and businesses. 1

How Do Visa Credit Cards Work?

Visa doesn't process credit card applications or provide credit to cardholders. Instead, Visa offers credit card products to banks and credit card issuers —financial institution clients, co-brand partners, fintechs, and affinity partners—that qualify and approve individual cardholders.

Types of Visa Credit Cards

There are three tiers of Visa credit cards—Traditional, Signature, and Infinite—each with different levels of benefits. Visa makes these benefits available for card issuers to include in their programs, but each card issuer ultimately decides which benefits to offer with specific Visa credit cards. 4 5 6 7

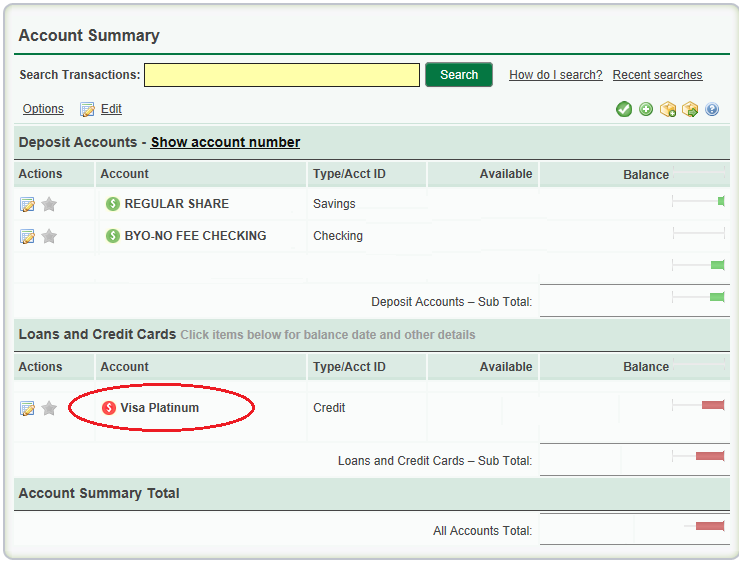

How To Get a Visa Credit Card

Visa credit cards come with different rewards, perks, and pricing depending on the card and the card issuer. Once you've selected a Visa credit card you're interested in, apply directly with a credit card issuer, like a bank or credit union.

What does the lock symbol on a Visa B2B card mean?

Lock symbols, located to the right of Business A and to the left of Business B, indicate that the Visa B2B Connect network is secure, its digital identity feature tokenizing Business A and Business B’s sensitive information.

What is B2B Connect?

Visa B2B Connect is an innovative multilateral payment network, offering you an alternative cross-border solution that can address the unpredictability associated with the current correspondent banking processes.

What is Visa Cloud Connect?

Visa Cloud Connect is a new way to connect to VisaNet that’s built for cloud-native clients.

How many transactions can VisaNet authorize?

VisaNet can authorize more than 76,000 transaction messages per second, settling them to the penny, ruble, rupee, yen, centavo or santang.

What is VisaNet?

As one of the world’s largest electronic payments networks, VisaNet is dedicated to Visa’s vision of providing consumers, businesses and governments with the best way to pay and be paid.

How does Visa make money?

Visa makes its profits by selling services as a middleman between financial institutions and merchants. The company does not profit from the interest charged on Visa-branded card payments, which instead goes to the card-issuing financial institution. 2 Visa so dominates the market that it has only a handful of big rivals, including Mastercard Inc. ( MA ), as well as digital payments companies like PayPal Holdings Inc. ( PYPL ).

What is Visa Inc?

( V) is one of the dominant digital payments brands globally, providing services in more than 200 countries and territories to individual consumers, merchants, financial institutions, and governments. The company provides a broad range of services, which include authorization, clearing, and settlement services for financial institutions and merchants. Additionally, while Visa does not issue credit or debit cards, the company does provide credit, debit, and prepaid card services to consumers and businesses. 1 It's Visa's clients that issue the actual cards. 2

What is the revenue of Visa 2021?

8 In Q1 FY 2021, international transaction revenue was $1.5 billion, or about 19% of gross revenue. Revenue for this component was down 28.1% compared to the same quarter a year ago. 5

How much of Visa revenue will be lost in 2021?

Net revenue from Visa's U.S. business, which comprises about 47% of total net revenue, fell 1.8% in Q1 FY 2021 compared to the year-ago quarter. Net revenue from international sources, which accounts for the remaining 53% of total net revenue, fell 9.5%. 5 Visa indicated that the revenue declines were driven by year-over-year ( YOY) changes in cross-border volume, which was impacted by COVID-19, and higher client incentives. The decrease in net revenues, however, was partly offset by growth in nominal payments volume and processed transactions. 6

What is Visa's revenue segment?

These segments are: Service Revenue, Data Processing Revenue, International Transaction Revenue, and Other Revenue. 7 Visa describes these subsegments as "components" of net revenue, but they are reported gross of client incentives. The sum of the revenue totals for each segment equals gross revenue of about $7.5 billion in Q1 FY 2021. Visa's net revenue of $5.7 billion for the quarter is equal to that gross revenue figure minus client incentives. 5

Is Visa a merger with Plaid?

Visa recently terminated its merger agreement with Plaid Inc. following an antitrust lawsuit filed by the DOJ related to the proposed transaction.

What does Visa tell us?

So once a day, Visa tells us, the Bank of England, how much the customers’ banks owe the card reader providers. Many banks have an account with us that allows them to transfer money to other banks. We move the money between these accounts. The card reader provider can then send the money it received for your coffee from your bank to the shop’s bank.

How long does it take to pay by card?

Whether you’re buying groceries or a laptop, paying by card only takes seconds. Here’s how the money gets from A to B.

What about big payments?

That’s why we run a system called CHAPS. Most people use CHAPS if they buy a house. Football clubs also use it when paying for a player, or art collectors buying a pricey painting. Some of the largest CHAPS payments are worth over a billion pounds .

Does Visa work with bank?

In the meantime, the company providing the card reader tells Visa about the payment. Visa then works with your bank and the company providing the card reader to move your money to the coffee shop’s account.

Where is Visa located?

Visa Inc. ( / ˈviːzə, ˈviːsə /; stylized as VISA) is an American multinational financial services corporation headquartered in Foster City, California, United States . It facilitates electronic funds transfers throughout the world, most commonly through Visa-branded credit cards, debit cards and prepaid cards. Visa is one of the world's most valuable companies .

How many transactions did Visa process in 2014?

In 2015, the Nilson Report, a publication that tracks the credit card industry, found that Visa's global network (known as VisaNet) processed 100 billion transactions during 2014 with a total volume of US$6.8 trillion. It was launched in September 1958 by Bank of America (BofA) as the BankAmericard credit card program.

What is the new name for Visa?

For this reason, in 1976, BankAmericard, Barclaycard, Carte Bleue, Chargex, Sumitomo Card, and all other licensees united under the new name, " Visa ", which retained the distinctive blue, white and gold flag. NBI became Visa USA and IBANCO became Visa International.

What year did Visa change its name?

A 1976 ad promoting the change of name to "Visa". Note the early Visa card shown in the ad, as well as the image of the BankAmericard that it replaced.

How much is Visa worth in 2018?

Visa's shares traded at over $143 per share, and its market capitalization was valued at over US$280.2 billion in September 2018. As of 2018, the company ranked 161st on the Fortune 500 list of the largest United States corporations by revenue.

Why is Kroger not accepting Visa cards?

retailer Kroger announced that its 250-strong Smith's chain would stop accepting Visa credit cards as of April 3, 2019, due to the cards’ high ‘swipe’ fees. Kroger's California-based Foods Co stores stopped accepting Visa cards in August 2018.

What are the different types of visas?

Visa offers through its issuing members the following types of cards: 1 Debit cards (pay from a checking/savings account) 2 Credit cards (pay monthly payments with or without interest depending on a customer paying on time.) 3 Prepaid cards (pay from a cash account that has no check writing privileges)

How do virtual visas help?

How virtual Visa cards can help to prevent fraud and to reduce your risks . Virtual cards are a great way to prevent fraud and to reduce your business’s risk of becoming a fraud victim .

Why are Visa cards so popular?

and 755 million worldwide. Visas are popular because they are almost universally accepted, and ATMs are adapted to be used with Visa cards.

What is a virtual Visa card?

A virtual Visa card is a set of card numbers that are randomly generated. The numbers represent your Visa card or bank account, but thieves can’t use the numbers to get your information or your money. Virtual Visa cards are more secure than using regular debit and credit cards, leading many businesses to use them as a part of their payment processes.

How do virtual cards protect you?

Virtual cards can also protect you by allowing you to restrict their use to specific merchants in set amounts. Once the cards are used, they will not work. Your employees can’t use the cards to make purchases elsewhere for themselves.

Why do businesses use virtual business cards?

Some businesses use virtual business cards to make single purchases and restrict the numbers to the merchant that is selling the items. The businesses may also limit the cards to the purchase price of the item that is being purchased.

How much does a virtual card save?

If you use virtual cards, you can eliminate the typical purchase request and approval process, saving up to 83 percent on your transaction costs. Virtual cards allow your employees to make purchases that you need without having to submit requests.

What to look for when shopping for virtual cards?

Look for cards that come with the ability to control when and where the cards can be used. The cards should also let you set the spending limits that you choose.

What if my U.S. Visa card gets lost or stolen while I’m overseas?

Nobody wants it to happen, but it’s worth thinking about how you’ll cope if your card is lost or stolen when you’re on your vacation.

How much does it cost to use my U.S. Visa card abroad?

Whether you choose to spend abroad using your debit or credit card, you’re going to incur some fees.

What to do if you lose your credit card when you are abroad?

If you lose your card when you’re abroad, you’ll have to contact your card issuer to report the loss. They’ll cancel the card and, depending on their policy, may be able to issue you a temporary card or some emergency funds to make sure you survive while you’re away.

What is the best way to spread the cost of a vacation?

If you need to spread the cost of your vacation over time, a credit card might suit better, as it allows you to do this. Choose the right card, and you could also get cash-back or rewards to help you travel more in future. Be warned, though, you may incur additional interest costs if you don’t pay your bills immediately. Taking cash withdrawals on a credit card is usually not a good idea either, as many banks start to charge interest immediately on these transactions rather than offering any grace period.

What is contactless payment?

Another difference is that contactless payment technology - which allows you to simply ‘tap and go’ - is very popular in Europe, Canada and Australia. Although it hasn’t really caught on in much of the U.S., likely you’ll be seeing it happen more and more in the future. If you have a contactless card already, then you can use it just the same as you do at home. You just need to check that the retailer has the contactless symbol displayed. Some countries, however, haven’t yet adopted contactless technology so you may be out of luck.

What happens if you don't pay your credit card bill?

Some credit cards do come with promotional offers. Which mean that you’ll have a grace period during which your purchases are interest-free. If this is the case, you might pay less overall.

Where to find the number to call on a Visa card?

You’ll find the number to call on your statement, online or on the back of your card - so make a note and keep it separate to your card during your travels. You can find contact numbers and forms for some of the main Visa card issuers here:

How does a Visa debit card work?

How Visa Debit Works in the US. In the US, Visa Debit allows customers to use the same card to make both their credit and debit purchases. The card runs on the same credit network whether the purchase is for Debit or Credit. Because the card operates on the same network whether it’s a debit or credit purchase the cards can be used anywhere you see ...

What is Visa debit?

Visa Debit includes the added benefits of credit cards, including purchase protection and the accessibility of online payments, while still allowing consumers to pay for purchases directly from their bank account.

Why Should Your Business Accept Visa Debit?

Visa Debit gives customers more choice in how they want to pay for items. By increasing the likelihood that a customer can pay using their preferred method then you’re ensuring your business is not going to miss out on any potential sales.

Does Interac debit card work?

Whenever a consumer makes a purchase using swipe or chip and pin technology on their debit card the transaction will be processed as an Interac debit transaction. It is only when a consumer makes an online or phone purchase using the numbers on the front of their card that the card will function as a Visa debit card. These hybrid Canadian debit cards automatically deduct the money from the cardholder’s bank account for all transactions, regardless if the transaction was processed using Visa’s or Interac’s network. If funds are not available, then the transaction will be declined. The card does not ‘borrow’ money the way a credit card does.

Can you use credit card or debit card for a purchase?

A credit purchase uses its available credit card limit while debit will deduct the purchase amount from the available balance in their chequing or savings account. The merchant will then run the card through their payment processing system based on how the customer wants the transaction to be processed.

Do debit cards have to be issued separately in Canada?

In Canada, debit and credit cards must be issued as separate payment cards according to the Code of Conduct for the Credit and Debit Card Industry in Canada. This means Visa Debit operates on a separate network than the Interac network, the network used by almost all debit cards in Canada.

Does everyone have access to a credit card?

3.) Not Everyone has Access to a Credit Card

Visa's Financials

Visa's Business Segments

- Visa reports as a single segment, which is Payment Services.3 But it routinely divides its revenue into four subsegments, which are the major generators of revenue for the company. These segments are: Service Revenue, Data Processing Revenue, International Transaction Revenue, and Other Revenue.7 Visa describes these subsegments as "components" of net revenue, but they ar…

Visa's Recent Developments

- On March 10, 2022, Visa announced that it has completed its acquisition of Tink, a Europe-based open banking platform that enables banks, financial technology companies (fintechs), and startups to develop data-driven financial services.10 Visa first announced its agreement to acquire Tink for 1.8 billion euros ($2.0 billion) in June 2021.1112 On Ma...

How Visa Reports Diversity and Inclusiveness

- As part of our effort to improve the awareness of the importance of diversity in companies, we offer investors a glimpse into the transparency of Visa and its commitment to diversity, inclusiveness, and social responsibility. We examined the data Visa releases to show you how it reports the diversity of its board and workforce to help readers make educated purchasing and i…