Main Differences Between Visa and American Express

- Visa is a payment processing company that acts as a medium among banks, merchants, and customers. ...

- Visa charges processing fees based on its merchants and is less compared to American Express.

- Visa charges low-interest rates to help small and medium-sized organizations to grow their business, While American Express charges high-interest rates.

Which is better visa or American Express?

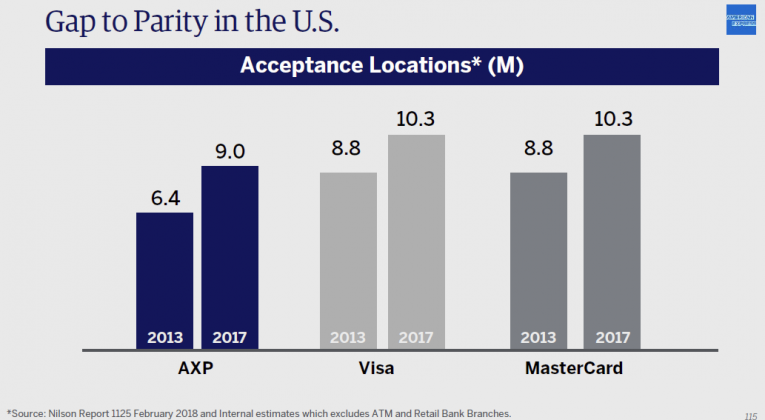

The simplest way to compare American Express vs. Visa as payment networks is their acceptance. The more merchants that accept your card, the better the card network. This is an area where American Express has traditionally been at a disadvantage. American Express has long charged higher credit card processing fees than other payment networks.

Is American Express a visa or MasterCard?

Visa trades under the stock symbol (V), MasterCard (MA), Discover (DFS), and American Express (AXP). American Express issues their own credit cards and they are not related to Visa or MasterCard. When you apply for an American Express card and are approved, the company issues your credit card directly to you. This differs from Visa and MasterCard who use financial institutions such as banks to issue their credit cards.

Is MasterCard or visa more widely accepted?

Worldwide, Visa is more widely accepted. In North America, Visa and Mastercard and Discover are all pretty much equally accepted everywhere. In Northern Europe, Mastercard has the edge while Discover is widely accepted in China on the UnionPay network and in India on the Rupay network. This data is a few years old, but VISA is the clear leader.

Why is American Express good?

“American Express is able to provide such excellent premium service because all American Express Cards carries an annual fee. ” Well, partially. AMEX (and Diners, for that matter) charge at least 1.5% more from merchants when you swipe. That is actually the reason behind excellent customer service and having a fraud protection that actually works.

See more

Is American Express card better than Visa?

Winner: Visa In fact, Visa is one of the most accepted payment networks in the world. American Express is accepted by 99% of the merchants that accept credit cards, but it's still not as widely accepted as Visa. American Express has long charged higher credit card processing fees than other payment networks.

How is Amex different from other credit cards?

Unlike card issuers such as Chase or Bank of America and card networks such as Visa or Mastercard, American Express serves both the role of servicing accounts and processing transactions. Amex also charges higher interchange fees, better known as swipe fees, than the other major card networks.

What is so special about Amex?

Amex is known for the high quality of its customer service, ranking number one in J.D. Power's 2020 U.S. Credit Card Satisfaction Study. Amex cards offer a host of rewards, perks, and cash back on purchases.

Is Amex different from Visa and Mastercard?

American Express is neither Visa, nor Mastercard. Basically, there are 4 big networks in the U.S.: American Express, Visa, Mastercard and Discover. The same way you can't find a "Visa Mastercard", you won't find an Amex "anything." It is a standalone network.

Why is Amex more expensive?

The reason behind this is simple—American Express charges merchants a higher fee than competitors do. To be clear, all credit card issuers charge merchants fees in order to accept their credit cards, yet some card issuers choose to charge a higher fee than others.

Why do people like Amex?

It's known for its top-notch customer service and some of the best rewards available. From ultra-elite business travel cards to everyday rewards, American Express has credit cards that are a good choice for many different types of cardholders.

Is Amex card worth it?

The American Express® Gold Card is great for some, but a money-losing proposition for others. If you're a regular traveler who spends a lot on dining and at U.S. supermarkets, you can easily get more value out of this card than you pay in annual fees.

What is the highest Amex card?

the Centurion cardThe highest level American Express card is the Centurion card, which is also known as the 'black card.

Why is Amex not accepted?

Why Isn't American Express Accepted Everywhere? If you have an American Express card, then you may have visited merchants who accept other credit cards, but not your Amex. The reason has to do with the interchange fees charged by the credit card payment networks such as Visa, Mastercard, Discover and American Express.

Is American Express a hard card to get?

It's generally harder to get an American Express card than it is to get a credit card from many other major issuers simply because all of Amex's credit card offers require good or excellent credit for approval.

Where is American Express not accepted?

Places Where American Express is Not Accepted: Cuba, Sudan, South Sudan, Iran, Syria. Major Retailers That Accept American Express: Amazon, IKEA, Sears, Target, Walmart, Lowe's, Apple, Best Buy, Staples, CVS. Major Retailers That Don't Accept American Express: Costco, small non-chain stores/restaurants.

Is American Express a hard card to get?

It's generally harder to get an American Express card than it is to get a credit card from many other major issuers simply because all of Amex's credit card offers require good or excellent credit for approval.

Is Amex card worth it?

The American Express® Gold Card is great for some, but a money-losing proposition for others. If you're a regular traveler who spends a lot on dining and at U.S. supermarkets, you can easily get more value out of this card than you pay in annual fees.

Why Amex is not accepted everywhere?

Many retailers don't accept American Express because they have their own branded credit cards they'd prefer you to use. In addition, due to a higher fee AMEX charges its retail partners (than Visa or Mastercard), many opt out of accepting an American Express credit card.

What is the difference between Visa and Mastercard?

Visa and Mastercard are accepted at roughly the same number of retailers domestically (99% for both) and internationally (210+ countries and territ...

Is Mastercard accepted everywhere?

Mastercard is accepted at 99% of retailers in the U.S. This means that virtually anywhere that accepts credit cards will accept Mastercard. In addi...

What is the difference between Visa and American Express?

The main difference between American Express and Visa is that American Express is both a card issuer and a payment network. Visa is only a payment...

How widely accepted is American Express?

In the U.S., American Express has virtually the same network size as Mastercard or Visa. This means that anywhere that accepts credit cards usually...

How many digits are on an American Express card?

While most credit card issuers list a three-digit security code on the back of the card, American Express credit cards have a four-digit security code on the front of the card. You may need this card when you're shopping online or paying certain bills where the merchant requires it.

Where is the security code on American Express located?

While most credit card issuers list a three-digit security code on the back of the card, American Express credit cards have a four-digit security code on the front of the card. You may need this card when you're shopping online or paying certain bills where the merchant requires it.

What is a credit card issuer?

A card issuer is a financial institution that provides credit card accounts to consumers with a revolving line of credit. Issuers are typically banks, credit unions, and other lending institutions. When you owe money on a credit card, it's the card issuer that collects payments, charges interest, and provides customer service.

Can credit card benefits vary?

Credit card benefits can also vary by credit card .

Is American Express the same as Visa?

In a lot of ways, American Express and Visa are very different. While American Express functions as both a card issuer and a payment network, Visa only processes credit card transactions.

Is American Express a payment network?

American Express functions as a card issuer and a payment network, while Visa is a payment network only.

Does American Express require good credit?

As a card issuer, American Express generally requires you have good or excellent credit to get approved. Other card issuers may vary, though. For example, the Credit One Bank American Express Card is available to borrowers with average credit. 3

Visa vs American Express

The difference between Visa and American is that Visa is a payment processing network that only processes transactions among the credit card issuers and potential customers, whereas American Express issues credit cards to its customers and also handles payment processes.

What is Visa?

The Visa company was started in 1958 by Dee Hock when Bank of America started a credit card program for small and medium-sized organizations. It then expanded internationally in 1974. It has acquired Visa Europe. Earlier, Visa was known as BankAmericaCard. Today, Visa is accepted in two hundred plus countries and territories.

What is American Express?

American Express was started in 1850 as a freight forwarding company. Later in 1950, it began to provide financial services and travel services. It made purchases convenient through its credit card. American Express is one of the widely accepted payments and credit card issuing companies.

Main Differences Between Visa and American Express

Visa is a payment processing company that acts as a medium among banks, merchants, and customers. On the other hand, American Express is a financial service provider, card issuer and provides travel packages to its customers.

Conclusion

Both Visa and American Express are top competitors in the credit card industry. Visa and American Express companies update their policies, create new schemes, offers to attract their customers. They meet all the governance compliances and also act socially responsible. They protect customers and cards from frauds and scams.

How does Discover and American Express simplify the transaction process?

By operating their own payment networks and issuing their own cards, Discover and American Express simplify the transaction process, reduce the fees they have to pay and collect more fees than they otherwise would. Although their networks are expensive to set up and maintain, the extra fee revenue offsets those costs.

Who is involved in a credit card transaction?

These steps, many of which are instantaneous, involve multiple parties, including you. The participants in a typical transaction are: The cardholder.

How are credit card fees paid?

The whole system is paid for with fees charged on each credit card transaction. Merchants pay these fees and, typically, pass them on to customers the same way they pass on other costs of doing business — in their prices. These fees are divided among the financial institutions handling the transaction: the issuer, the merchant's bank and the payment network. (Rewards cards also kick back some of this money to the cardholder.)

Why should every purchase be on a credit card?

by Virginia C. McGuire, Paul Soucy. Credit cards are convenient and secure, they help build credit, they make budgeting easier, and they earn rewards. And no, you don't have to go into debt, and you don't have to pay interest. Explore Credit Cards.

Does Discover issue Amex cards?

Discover and AmEx issue cards, but they also process transactions, which gives them a bigger cut of fee revenue.

Do Visa and Mastercard issue credit cards?

Visa and Mastercard process credit card transactions, but they don' t actually issue credit cards. Your card might say "Visa" or "Mastercard" on it, but it is issued by a bank, like Chase or Citi. You don't have an account with Visa or Mastercard. You have an account with the bank, which sends you your statement, receives your payments, ...

What is the difference between American Express and Mastercard?

Refer to American Express’s terms and conditions. Card Issuing. When comparing all 3 networks, there is 1 main difference between American Express and Mastercard/Visa. American Express is both a card issuer AND a payment network. Mastercard and Visa are only payment networks.

Which is better, Visa or Mastercard?

Where You Spend Money— If you plan on using your credit card primarily in the U.S., you won’t run into much trouble using a credit card from any of these 3 processing networks. However, if you plan to travel internationally, a Visa or Mastercard may be a better option since they are accepted more places.

How much is American Express swipe fee 2020?

In February 2020, Nilson reported that Visa and Mastercard swipe fees had a weighted average of 2.26% compared to American Express’s average fee of 2.3% — making this only a 0.04% difference. International. Unfortunately, American Express’s international acceptance is much lower than its competitors.

What is a Visa card?

Visa is only a payment network and has cards issued by other banks , like Chase, Bank of America, etc. Mainly this means that you will contact American Express’ customer service department for any issue you have with your card, but if you have a Visa, you will contact your card’s issuer if you have any issues.

How many countries accept American Express?

However, internationally, American Express cards are accepted in 160 countries worldwide, compared to Visa and Mastercard that are both accepted in more than 200 countries.

What companies use American Express?

Examples of other companies that use the American Express payment network include Bank of America, BBVA Compass, Citigroup, U.S. Bank, USAA, and Wells Fargo.

Does American Express have its own card?

This is because, as the card issuer, it offers its own cards and only a limited selection of cards with other card issuers on the American Express payment network. If you want a wider selection of cards to choose from, you’d be better off picking a card in the Mastercard or Visa network.

Which is better: American Express or Visa?

Your personal shopping habits and how you’ll be using the card should point you in the direction of what will better suit your needs. If you use your American Express for 50% of your everyday shopping you’ll get the most value. However, If you want a card that’s more widely accepted and has a lower annual fee, Visa is your pick.

What features and services do American Express and Visa offer?

For example, Amex products uniformly offer features such as purchase protection and travel insurance. These features are mostly issuer-dependent among Visa cards, however. Choosing between the providers just depends on what you value.

What is the interest rate on American Express?

American Express generally charges an interest rate between 11% to 27%. Visa cards can come with either a variable or a fixed interest rate and can range anywhere from 8.25% to 29.99%. Customer service.

Do Amex cards have an annual fee?

Similarly, if you spend a lot and there is a limit on what you can earn, you’re missing out on major points. Annual fee. Many Visa and Amex cards will come with no annual fee or have promotions that waive the annual fee for the first year.

Is Amex better than Visa?

Both American Express and Visa offer credit cards with unique rewards programs that could suit one person over another. For example, if you’re looking for more opportunities to earn rewards points, Amex might suit your needs better. But, if you’re looking for a card with a wider acceptance rate, you might want to try Visa. In the end, both providers offer great features. Choosing between them is just a matter of personal preference.

Does American Express have complimentary insurance?

Complimentary insurance. Both Visa and American Express have credit cards that offer complimentary insurance when you pay for your travel in full with the card. However, it’s important to understand the terms and conditions before you apply.

What is the difference between a Visa and an Amex card?

The difference is that Amex also issues credit cards , Visa does not. With that said, you can use a Visa card almost anywhere, whereas Amex isn't accepted in as many places.

How much less is Amex than Visa?

I think the main difference is in the number of U.S. merchants that accept them. AmEx cards are accepted at about 30% less merchants than Visa.

What is the difference between American Express and Visa?

The difference between Visa and American Express is that American Express is both a card issuer and a payment network, while Visa is only a payment network . Visa is also more widely accepted than Amex, as Visa cards work in over 200 countries and territories, compared to 160+ for American Express cards.

Which credit card companies offer American Express?

Some credit card issuers have American Express, Visa and Mastercard offers. Those issuers include U.S. Bank and Wells Fargo.

Which credit card companies accept Visa and Mastercard?

Some credit card issuers have American Express, Visa and Mastercard offers. Those issuers include U.S. Bank and Wells Fargo. Citi, Chase, Bank of America, Barclays and Capital One issue Visa and Mastercard credit cards but not Amex cards.

How many merchants accept Visa?

Visa and Mastercard are accepted at more than 11 million U.S. merchant locations. American Express added 1.6 million U.S. merchant locations in 2018, now reaching a total of more than 10 million.

Does Amex have two networks?

A credit card never has two networks, so you'll never see an American Express Visa card or an American Express Mastercard. Furthermore, lots of the credit cards on the Amex network are actually issued by American Express itself. The rest come from the likes of Bank of America, USAA, Citibank and BBVA Compass.

What is a credit card processor?

Credit card processors act as the liaison between your bank and a merchant's bank. When a payment is initiated, a processor analyzes the request -- making sure that the request is real and you are the one making it. If everything looks legit, it approves the transaction, takes the money out of your bank (or applies the charge to your credit card) and pays the merchant. Visa, Mastercard and Square are all credit card processors.

Which banks issue credit cards?

Chase, Bank of America and Wells Fargo are examples of credit card issuers. American Express and Discover are the only major processors that also issue cards. If you have a Visa or Mastercard card, it's always going to be linked to an issuing bank such as Capital One or Barclays. American Express and Discover may offer cards through separate ...

What are some examples of credit card issuers?

They also handle customer service: If you ever have a concern about a transaction or want to dispute a payment, call your card issuer using the number on the back of the card. Chase, Bank of America and Wells Fargo are examples of credit card issuers.

How do credit card processors make money?

Credit card processors make money by collecting a percentage of every transaction that comes through their network. Part of the reason that American Express cards aren't accepted as widely as others is that it charges merchants a higher fee on average than others.

Which credit card company has the most merchants?

Still, each of the four major credit card processors do business with millions of merchants in more than 100 countries. According to Nilson Report, both Visa and Mastercard have the most merchants worldwide -- 52.9 million -- while Discover has 44 million and American Express has 25.3 million.

What factors go into choosing a credit card?

Plenty of factors go into choosing a credit card -- finding a low interest rate, calculating your cash-back potential and browsing through rewards. A card's particular processing network isn't likely to be a key part of most people's criteria.

Does American Express have its own card issuer?

American Express and Discover may offer cards through separate issuers, too, but they have the capacity to issue their own cards. For instance, American Express serves as both issuer and processor for its Blue Cash Preferred® Card from American Express * card.

Which has more acceptance: Visa or Amex?

VISA/MasterCard have more acceptance than AMEX across different countries. These are estimated to be accepted at about twice that many merchants as Amex. One of the main reasons that you can hold accountable is higher Discount Revenue which makes merchant more inclined towards VISA/MasterCard.

What is the difference between Amex and Visa?

To state simply, the fundamental difference is Visa/MC are card networks based open network principle and AMEX is closed network who is both network and issuing cards with exceptions. Visa/MC are behind issuers at the max they provide generic offers based on card type. Everything else is controlled by issuers. In case of amex, they control everything like Apple ecosystem vs Android. For end customers, the decision points are mostly acceptance , rewards, cost and customer service of AMEX vs issuing banks not Visa/MC.

What is the Visa Infinite Package?

Visa Infinite Package is the premium package of Visa Card with additional benefits including basic and signature packages. It offers additional premium benefits to the upper class.

What is a Visa card?

Visa Card is a payment card branded by Visa and operated by Visa Network. Although it started with credit cards, now it provides debit, credit, even gift card services, an

What is the name of the mid-range package of Visa cards?

The name of the mid-range package of Visa Card is Signature. Along with the basic package, the benefits that come with the signature are:

Why are gold and platinum cards issued?

Gold, Platinum, even Titanium cards are issued for two reasons - vanity of the cardholders, and profits for the issuers.

Does ICICI issue Amex cards?

But, nowdays ICICI has started to issues some Amex card along with other Visa/MasterCard varients as combo cards.

How are Visa and Mastercard similar?

The business models of both companies are very similar. Visa and Mastercard do not issue cards directly to the public but rather through partner member financial institutions such as banks and credit unions. The member financial institution then issues cards for individuals and businesses, either directly or in partnership with airline, hotel, or retail brands.

What is a Visa and MasterCard?

Visa and MasterCard are the two largest payment processing networks in the world. Visa and MasterCard do not issue cards directly to the public, as do Discover and American Express, but rather through member financial institutions. Member banks and credit unions issue Visa and Mastercard credit and debit cards directly to their customers ...

How do Visa and Mastercard earn their revenue?

Both Visa and Mastercard earn the majority of their revenue from service and data processing fees , but the two companies characterize these fees differently and have their own fee structures. Service fees are charged to the issuer and based on card volume.

How many debit cards do Americans have?

Most Americans today have at least one debit and credit card. 3 Many people have a number of them, seeking to take advantage of all the rewards, cash-back opportunities, and promotional benefits that issuers have to offer.

Which payment processors are the only?

Visa and Mastercard are the only network payment processors involved in all three areas of the payments market. Working exclusively as network processors, these two companies have a unique edge, but they operate differently.

Which payment processors are involved in all three areas of the payments market?

Visa and MasterCard are the only network payment processors that are involved in all three areas of the payments market. Working exclusively as network processors, these two companies have a unique edge but operate differently.

Does MasterCard have a reportable business segment?

MasterCard has one reportable business segment known as Payment Solutions which is broken out by geographies across U.S. and other. Like Visa, MasterCard earns the majority of its revenue from service and data processing fees. However, it characterizes the fees differently.