Is it too late to buy visa stock?

How to Approach Visa Stock HereThose who want to invest in it and own the shares for the long term, the simple answer is that it's not too late to own it. Over the span of years, I don't need to be...

Do Stocks go up after split?

While a stock split doesn't immediately increase shareholder value, investors can see it as a bullish sign for the company that could over time mean a rise in the stock price.

What are the tax implications on a stock split?

Tax Implication of Stock Split. As stock market investors, we are beneficiaries to various corporate actions like bonus shares, rights shares and stock splits. These corporate actions are accompanied by stock price movements in short and long run affecting capital gains whenever we sell shares. As there is an effect on capital gains, tax ...

What happens to stock options after a stock split?

How Stock Splits Affect Call Options

- Stock Split Effects. A stock split increases the number of a company's shares and at the same time reduces the share price.

- Whole Splits and Options. A whole number stock split ratio will result in a proportional increase in call options and a proportional decrease in the option strike price.

- Fractional Stock Splits. ...

- Effects of Splits on Option Values. ...

What price did Visa split?

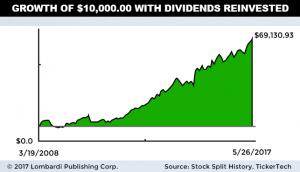

The largest IPO in U.S. history at the time, shares of Visa opened at $44 per share on March 19, 2008 -- right in the middle of the Great Recession. Visa shares performed very well -- closing the first day at $56.50 per share (or $14.13 adjusted for splits -- more on that in just a moment).

When was the last Visa stock split?

March 2015Our last stock split was a 4-for-1 split in March 2015.

Which stock has split the most times?

AppleSo, what stock has split the most in history? The best known stock that has split the most is Apple.

Is Visa a good stock to hold?

On key earnings and sales metrics, Visa stock earns an EPS Rating of 91 out of 99, and an SMR Rating of A. The EPS rating reflects a company's health on fundamental earnings, and its SMR Rating measures sales growth, profit margins and return on equity.

What will Visa stock be worth in 5 years?

What will the Visa stock be worth in the next 5 years? According to our predictions, the Visa stock can be worth up to $292.98 in the next five years. However, the average price of the stock in five years' time is expected to be $279.37.

What stocks will be splitting soon?

Stock splits in 2022CompanyStock Split RatioPayable DateAlphabet (NASDAQ:GOOGL) (NASDAQ:GOOG)20-for-1July 15, 2022Shopify (NYSE:SHOP)10-for-1June 28, 2022DexCom (NASDAQ:DXCM)4-for-1June 10, 2022Tesla (NASDAQ:TSLA)3-for-1August 24, 20221 more row

Is it better to buy a stock before it splits?

It's important to note, especially for new investors, that stock splits don't make a company's shares any better of a buy than prior to the split. Of course, the stock is then cheaper, but after a split the share of company ownership is less than pre-split.

Will Amazon split soon?

By Yaёl Bizouati-Kennedy. Amazon's Board approved the 20-for-1 stock split announced in March at the 2022 Annual Meeting of Shareholders on May 25. The split will enable more investors to afford to invest in Amazon, and it will broaden the company's audience and reach.

Should I buy stock before a split?

Any decision you make — buy, hold or sell — is not likely to have a much different outcome if you make it just before or just after the split. Since a stock split is announced prior to being executed, any post-split bump that the market expects is baked into the price by the time the split actually occurs.

Is Visa a buy sell or hold?

Visa has received a consensus rating of Buy. The company's average rating score is 2.80, and is based on 16 buy ratings, 4 hold ratings, and no sell ratings.

Is Visa undervalued?

Visa Inc has a current Real Value of $237.03 per share. The regular price of the company is $215.3. At this time, the company appears to be undervalued....1.5.LowProjected EPSHigh6.857.027.24

Is Visa a blue chip stock?

Visa Inc. One of the best blue-chip stocks to buy according to billionaire Richard Chilton, his hedge fund holds 35,540 shares of the financial services company as of Q1 2022, amounting to a stake of $7.88 million.

Has Visa ever done a stock split?

Visa (V) has 2 splits in our Visa stock split history database. The first split for V took place on December 11, 2000. This was a 1 for 5 reverse split, meaning for each 5 shares of V owned pre-split, the shareholder now owned 1 share.

When did Apple stock split?

How many times has Apple's stock split? Apple's stock has split five times since the company went public. The stock split on a 4-for-1 basis on August 28, 2020, a 7-for-1 basis on June 9, 2014, and split on a 2-for-1 basis on February 28, 2005, June 21, 2000, and June 16, 1987.

When did Google split?

April 2014It will be the company's first stock split since April 2014, when it split its shares 1,998-for-1,000. The stock split is set to take place after the market's close on July 15.

How many times has Amazon stock split?

Amazon has undergone four stock splits since the company was founded on July 5, 1994. Amazon has decided to split its stock by 20 to 1 after two decades. Many companies have implemented the strategy, including big names like Apple, which split its stock five times since the company went public in 1980.

Why did Visa stock split?

Generally speaking, the main reason for a stock split is a large increase in the underlying share price. In Visa's case, the stock's price had increased from its $44 IPO price in 2008 to about $248 when the 4-for-1 split was announced.

What does a stock split mean?

What a stock split means to investors. It's important to mention that a stock split causes no fundamental change in the stock or the underlying business. Each investor still has the same equity in the company, and the valuation of the stock relative to earnings remains the same.

Does a split increase the price of a stock?

Furthermore, while the split doesn't technically change anything, it can cause a stock's price to rise immediately following the split's completion. Since it does make shares more affordable, investors who avoided the stock because of its high share price can suddenly invest comfortably. This can create more demand, and therefore upward pressure on the stock's price.

Can Visa do a 2-for-1 split?

For example, if the stock were to rise to say, $120, the company could potentially decide to do a 2-for-1 split, or it could decide to never split again no matter how high the stock climbs. There's no way to know for sure until it happens.

Will Visa split again?

Possibly, depending on the stock's performance going forward. Visa trades for approximately $82 as I write this, which means it has increased by 32% since the split was announced. Using the previous pre-split price of $248, this implies Visa would need to rise by another 200% or so before the company would implement another 4-for-1 split.

What is the ratio of a V stock split?

The first row in the V stock split table (shown above) shows the ratio as 4:1. (e.g 2:1). This means every single stock of V was split into 4 (e.g 2)

Why do companies split their stocks?

The reason is simple. In general, a firm will decide to split stocks when the price per share has become too high. High prices have a tendency to put off investors (especially the smaller investors).

What does the first row of the stock split mean?

For example, the first row corresponds to the date 2015-03-19 when the split took place.

Is dividends healthy?

Like stock splits, dividends are also considered healthy by many investors. You may want to have a quick look at the dividends report of V

When did Visa stock split?

On January 28, 2015, Visa’s board of directors approved a 4-for-1 split of Visa’s Class A common stock. On March 18, 2015, each Class A common stockholder of record at the close of business on February 13, 2015, will receive a dividend of three additional shares of Class A common stock for every share of Visa Inc. Class A common stock held on the Record Date. Trading will begin on the New York Stock Exchange (NYSE) on a split-adjusted basis on March 19, 2015. As discussed below, the holders of Class B common stock and Class C common stock will not receive a stock dividend.

When did Visa pay dividends?

On January 28, 2015, Visa announced a regular quarterly cash dividend with a record date of February 13, 2015 and pay date of March 3, 2015. How will that dividend work?

What should I do with my existing Visa Inc. stock certificates?

These stock certificates will continue to represent the same number of shares as shown on their face and should be kept in a secure place. We encourage you to consider converting any stock certificates to paperless form by depositing them into your existing account at EQ Shareowner Services or into a brokerage account. Visa only issues stock certificates in unusual circumstances.

What are the key dates related to the stock split?

The Record Date (February 13, 2015) is the date that determines which Class A common stockholders are entitled to receive additional shares due to the stock split.

How does a 4-for-1 stock split work?

A 4-for-1 stock split means that three new shares of Class A common stock will be issued for each share of Class A common stock outstanding on the Record Date. Immediately after the stock split, since there will be four times as many shares of Class A common stock outstanding, each share will be worth one-fourth of what it was worth immediately prior to the stock issuance, and the overall value of each Class A common stockholder’s investment will remain the same.

How does the stock split work for holders of Class B common stock and Class C common stock?

Class A common stock per share of Class C common stock. Immediately following the stock split, the Class A, Class B and Class C common stockholders will retain the same relative ownership percentages that they had prior to the stock split.

Who will send notice of the stock split to me and where will the notice be sent?

If you hold your shares of Class A common stock in a brokerage account, you will be notified by your broker at the address they currently have on file. Please contact your broker directly to confirm your mailing address or with any questions regarding your brokerage account.

Why stocks split

Generally speaking, the main reason for a stock split is a large increase in the underlying share price. In Visa's case, the stock's price had increased from its $44 IPO price in 2008 to about $248 when the 4-for-1 split was announced.

What a stock split means to investors

It's important to mention that a stock split causes no fundamental change in the stock or the underlying business. Each investor still has the same equity in the company, and the valuation of the stock relative to earnings remains the same.

Will Visa split again?

Possibly, depending on the stock's performance going forward. Visa trades for approximately $82 as I write this, which means it has increased by 32% since the split was announced. Using the previous pre-split price of $248, this implies Visa would need to rise by another 200% or so before the company would implement another 4-for-1 split.

Why did Visa stock split?

Generally speaking, the main reason for a stock split is a large increase in the underlying share price. In Visa's case, the stock's price had increased from its $44 IPO price in 2008 to about $248 when the 4-for-1 split was announced.

Does a stock split change the stock?

It's important to mention that a stock split causes no fundamental change in the stock or the underlying business. Each investor still has the same equity in the company, and the valuation of the stock relative to earnings remains the same.

Does a split increase the price of a stock?

Furthermore, while the split doesn't technically change anything, it can cause a stock's price to rise immediately following the split's completion. Since it does make shares more affordable, investors who avoided the stock because of its high share price can suddenly invest comfortably. This can create more demand, and therefore upward pressure on the stock's price.

Can Visa do a 2-for-1 split?

For example, if the stock were to rise to say, $120, the company could potentially decide to do a 2-for-1 split, or it could decide to never split again no matter how high the stock climbs. There's no way to know for sure until it happens.

Will Visa split again?

Possibly, depending on the stock's performance going forward. Visa trades for approximately $82 as I write this, which means it has increased by 32% since the split was announced. Using the previous pre-split price of $248, this implies Visa would need to rise by another 200% or so before the company would implement another 4-for-1 split.

When does Visa pay dividends?

Ever since Visa became a public company, it has paid a dividend every March, June, September, and December . Management also reviews the dividend once a year in October, boosting the payout each time.

What happens when a stock split occurs?

When a stock split occurs, if affects both the number of shares investors own and the trading price of the stock. For the following examples, pretend there are 100 shares owned and they are trading at $50.00 apiece.

Why Would a Company Go Through a Stock Split?

A company that splits its stock does so for the sake of shareholders. By splitting the shares, they become more affordable, attract more shareholders and broadening the investor base.

How much is dividend after split?

The dividend would be impacted as well. For instance, before the shares ended up splitting, the dividend was a quarterly $0.48 per share. But after the split, the dividend would be divided as the share price was, meaning it would drop to $0.12 per share ($0.48 ÷ 4). Note that since there are more shares owned, there is no effect on the amount of the total dividend.

Why is it important to have a larger investor base?

A larger investor base helps improve the day-to-day volatility of the stock, since more people will hold the shares for a long time. There will also be other investors that trade the shares more actively, which adds to their daily volume. More volume means a small bid-ask spread, which results in the shares being bought or sold at a more favorable price.

What was the stock split in March 2015?

The stock split that occurred in March 2015 was done at a four-for-one ratio. That means, using the earlier example of 100 shares, it would have resulted in owning 400 shares of V stock.

What is Visa?

Visa is a financial technology company with a presence around the world that works with consumers, merchants, financial institutions, businesses, strategic partnerships, and government entities. It is best known for processing electronic payments through its network using a range of products, platforms, and value-added services.