Assessment fees

- Visa charges a 0.14% assessment fee for every charge made with its credit cards and a 0.13% fee for transactions made with its debit cards.

- Mastercard charges 0.1375% for credit transactions of $1,000 or lower and 0.1475% for those of $1,000 or higher.

- Discover also charges 0.13% as an assessment fee on its credit cards.

| Credit card network | Processing fee range |

|---|---|

| American Express | 2.5 percent to 3.5 percent |

| Discover | 1.56 percent to 2.3 percent |

| Mastercard | 1.55 percent to 2.6 percent |

| Visa | 1.43 percent to 2.4 percent |

Does visa charge fee for international transactions?

Visa and Mastercard, which handle the transactions between foreign merchants or banks and U.S. card issuing banks, typically charge a 1% fee for each foreign transaction. Then, card-issuing banks may tack on their own charges, usually an additional 1% or 2%.

Which bank has no foreign transaction fee?

- Just one choice. Your only option for a no foreign transaction fee card with TD Bank is a travel card. ...

- Annual fee. After your first year, you’ll need to pay $89 annually to use the TD First Class Visa Signature.

- No rewards program. TD Bank’s travel card doesn’t offer a powerful rewards program as you’d find with Amex or Chase.

How are transaction fees calculated?

Transaction fees are based on the pricing outlined in the Exhibit B. In this case, please review your Exhibit B. First, the following formula calculates the costs for each individual debit transaction: (Per Debit Fee x Total # of Debits) + (Total $ Amount of DebitsxDiscount Rate %) = Total FeeOn the other hand, the following formula calculates the costs for each individual credit transaction:

What credit card has no foreign transaction fees?

Best no foreign transaction fee credit cards for fair credit

- Petal® 2 “Cash Back, No Fees” Visa® Credit Card

- Capital One Platinum Credit Card

- Capital One Walmart Rewards® Mastercard®

See more

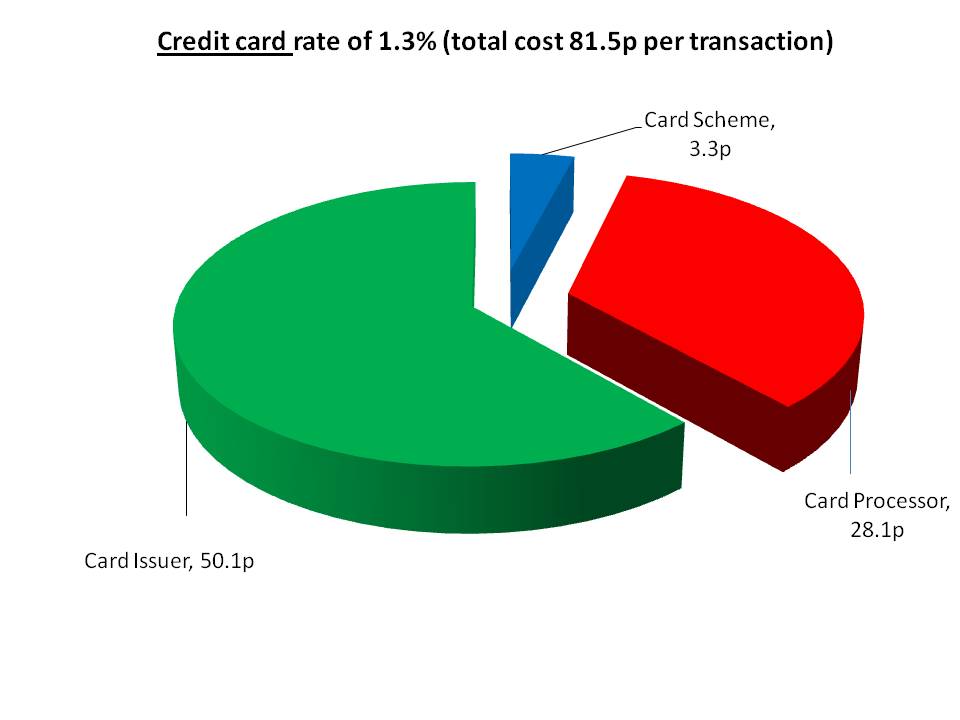

What is the average credit card transaction fee?

But if you're just looking for a general overview, the average costs for credit card processing ranges from 1.5% to 2.9% for swiped cards, and 3.5% for keyed-in transactions.

Does Visa charge for debit transactions?

For example, the lowest possible credit card interchange rates for a Visa supermarket merchant are 1.15% + $0.05 per transaction. These go as high as 2.10% + $0.10 per transaction. Compare those rates to the table above.

Does Visa have any fees?

Getting a Visa card costs as little as $0, depending on the type of Visa card you get. Visa gift cards often have a one-time fee of $2.95 to $6.95 at the time of purchase, based on the gift card's value, whereas most Visa debit cards and credit cards cost nothing to get.

What percentage does Visa charge merchants?

Typical Costs From Major Credit Card CompaniesCredit CardAverage Interchange FeesVisa1.15% + $0.05 to 2.40% + $0.10Mastercard1.15% + $0.05 to 2.50% + $0.10Discover1.35% + $0.05 to 2.40% + $0.10American Express1.43% + $0.10 to 3.30% + $0.10Jul 28, 2022

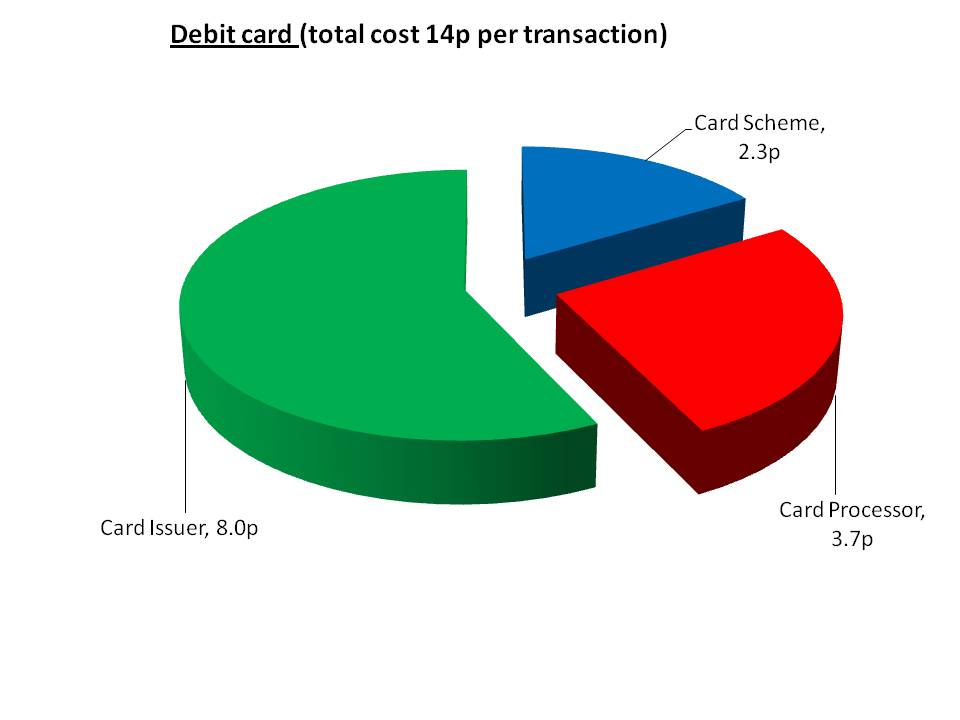

How much do banks charge for a debit card transaction?

On average, you could expect to pay anywhere from 2% to 4% of each transaction's value in overall fees. Please note that these are rough estimates. Charges vary widely according to card type, payment type, industry and the volume of transactions you process.

Why does Visa charge so much?

Most of the fee, or the so-called interchange fee, goes to banks issuing the cards. A much smaller slice goes to Visa and Mastercard solely for the use of their network to process the transaction. Visa and Mastercard say the fees help cover costs related to innovation and preventing fraud.

Does Visa charge international transaction fee?

Visa and MasterCard levy a 1 percent fee on international transactions, and some banks that issue those cards also tack on a currency conversion fee (additional 1–3 percent). These are similar to the fees associated with using your debit card for ATM withdrawals.

How Much Does Visa charge for international payment?

1%Usually, MasterCard and Visa charge a foreign currency transaction fee of 1%. However, most credit card companies add an extra percentage on it, making the fee range from 1.5% to 3% or even more. Therefore, this fee differs from one credit card issuer to the other.

Are there any charges for debit card?

Debit cards: Some banks levy an issuance fee of ₹150-700 plus applicable taxes. Almost all banks charge an annual maintenance fee depending on the type of debit card you have. However, for a basic debit card, most banks charge ₹100-200 plus tax. The maintenance fee can go up if you own a premium debit card.

Do companies get charged for debit card transactions?

The interchange rate merchants are charged for debit card transactions is substantially less than those for credit cards. This is due to a number of factors, chief of which is that debit cards are less of a risk.

How long do you have to notify Visa before surcharging?

Merchants must notify Visa and their acquirer 30 days before they begin surcharging.

What is interchange reimbursement fee?

Visa uses interchange reimbursement fees as transfer fees between acquiring banks and issuing banks for each Visa card transaction. Visa uses these fees to balance and grow the payment system for the benefit of all participants. Merchants do not pay interchange reimbursement fees—merchants negotiate and pay a “merchant discount” to their financial ...

Do merchants pay interchange fees?

Merchants do not pay interchange reimbursement fees—merchants negotiate and pay a “merchant discount” to their financial institution that is typically calculated as a percentage per transaction.

Do merchants have to choose AID for debit?

Visa has updated the Visa Rules to clarify that for covered US debit, merchants are not required to prompt for the cardholder to choose the AID for processing debit transactions.

What Are Credit Card Merchant Fees?

Credit card merchant fees are simply the fees you have to pay to get the proceeds from a credit card transaction. While your merchant account provider determines the total fee, multiple entities will receive a portion of the funds you pay for each transaction.

What is processing fee?

These fees are assessed every time you run a transaction. Your processing fee, for instance, is a transaction fee. Transaction fees usually comprise the biggest cost of accepting payment cards. Credit card transaction fees come in two forms: 1) percentages (e.g., 2.19%, 0.25%), or 2) fixed per-item fees (e.g., $0.20, $0.0195). Often, both forms are charged on a given transaction.

What is a tiered pricing plan?

Tiered pricing plans categorize credit card transactions into one of three categories: qualified, mid-qualified, or non-qualified.

What is FANF fee?

Fixed Acquirer Network Fee: Otherwise known as the FANF, this is a card association fee from Visa. While the exact amount varies based on your business type and monthly volume, it’s still a predictable, flat fee. Your processor chooses how to pass this along to you, but it’s typically assessed once per quarter.

What are processing integrity fees?

Processing Integrity Fees: Whereas the main fees from the card associations are assessed on your every transaction, some fees are only charged as a penalty when you haven’t met the requirements for authorizing and/or settling transactions properly. These card brand fees typically include “integrity” or “misuse” as part of the fee’s name. They resemble transaction fees, as they are just a few cents per instance (Amex’s is a percentage) and tend to be grouped together on a statement with the rest of the more regular credit card transaction fees. It’s common to incur a handful of these charges each month, but watch out if they become excessive.

What is exchange fee?

Interchange Fees: These are the fees the card-issuing banks charge for each transaction. They represent the largest expense merchants (should) pay per sale and per month.

What is the effective rate for credit card processing?

Speaking generally, a good effective rate for credit card processing is around 3-4%, though again, the particulars of your business may mean that your ideal effective rate is different.

What is transaction fee?

Transaction fees are charged every time there's a credit or debit card purchase. This will be the largest part of your payment costs. There are 2 basic types of transactions:

What are the factors that affect the total credit card processing fee?

There are several factors that go into the total credit card processing fee: Transaction fees for each credit/debit card purchase. Account and software fees. One time incidental fees (such as chargebacks) Together, the transactions fees, account fees, and incidentals form the total credit card merchant fees.

What is interchange fee?

The banks work with Visa and Mastercard (the brand) to process the transactions. The interchange fee goes to these banks and credit card companies to cover their operations and risk.

How many pricing models does a credit card company have?

Credit card processing providers have four main pricing models. We go over them below, as well as what kind of business each is best for.

How does an online transaction work?

Online transactions go through one more step. Once the consumer enters the credit card information, it enters the payment gateway, which then sends the info to the payment processor. At this point , the process is the same. The payment processor contacts the issuing bank for approval of the transaction.

How long does it take for a bank to approve an EMV card?

The issuer's bank approves or denies the request and the result is sent back to the merchant. This all happens in the matter of a few seconds (sometimes longer for EMV cards).

What is a merchant bank?

Acquiring bank: Also called a "merchant bank", this is the bank that maintains your merchant account. You actually don't get direct access or contact with this bank.

What is Visa payment?

Visa is a global payments technology company that connects consumers, businesses, financial institutions, and governments in more than 200 countries and territories to fast, secure and reliable electronic payments. And while paying with your card in a store or online is easy and fast, there is a lot more happening behind the scenes.

How long does it take for a Visa card to reimburse a shoe?

The cardholder's bank, or issuer, then reimburses the acquirer, usually within 24 to 48 hours. And finally, the issuer collects from the cardholder, ...

What does it mean when a Visa card is interchanged?

Visa sets interchange in a manner that balances the value and economics among all parties that participate in the Visa network – retailers, financial institutions and cardholders. If interchange is too low, then cardholders' financial institutions won't issue cards; if interchange is too high, retailers won't accept them.

What is an issuer in credit card?

Issuer. An issuer is a financial institution that provides consumers with Visa-branded cards or other Visa-branded products. When a Visa credit card is used, the issuer actually "lends" the consumer the funds to make the transaction.

What is interchange in payment?

Interchange is set in response to dynamic and highly competitive market forces and strikes the right economic balance between participants in the payment network. Among other things, it varies by the type of retailer, cost of the sale, payment, product type, processing technology the retailer uses and region or country. For example, transactions at fuel retailers, quick service restaurants and car rental agencies each possess unique attributes that may require different interchange categories and processing strategies. Similarly, the type of payment product used (e.g., credit or debit) and how that product is used (e.g., face-to-face or over the Internet) affect the interchange rate and processing requirements.

Why do merchants change financial institutions?

Merchants may change financial institutions in search of a better Merchant Discount rate or broader services. Financial Institutions. Retailers' and cardholders' financial institutions pay certain fees to Visa to participate in the system. Visa uses these revenues to maintain Visa's global payments network, strengthen the Visa brand ...

Do people pay with credit cards?

In today’s market, consumers are opting more often to pay with credit and debit cards . Every day, Visa connects thousands of financial institutions, hundreds of thousands of businesses and millions of cardholders to make all of your everyday purchases possible around the globe.

What are the Average Credit Card Merchant Fees?

Different companies set their own credit card processing fees, so the total cost can vary significantly depending on the card network, the type of card used and the business’ merchant category code (this is a 4 digit code used by credit card companies to categorize businesses by type of goods or service they sell).

What is interchange fee?

Interchange Fees - this fee is also known as the discount rate and is paid to the issuing bank of the credit card. For example, if a consumer pays with a Visa card issued by Chase Bank, your interchange fee will be paid to Chase. This fee might be higher or lower depending on the perceived risk of the transaction. The interchange fee is usually the biggest part of your total merchant credit card fee, but you have no control over how much it will be.

What is subscription pricing?

Subscription Pricing - for a monthly fee, a merchant signs up for a membership with a payment processor and then pays just the base transaction costs (charged by the credit card company) plus a small transaction fee. The monthly fee is higher while the transaction fee is lower, making this different from the interchange-plus model. This is a good choice if you have a high volume of sales and can then justify the monthly fee.

Why are debit card fees so low?

Fees are charged for debit cards as well, but because the interchange rate is based on transaction risk, the fees for debit cards tend to be lower because they are lower risk than traditional credit cards.

What is merchant category?

Merchant category - your business is assigned a merchant category code based on your business type and your merchant credit card fees are partially based on that. Riskier businesses will have higher fees, for example.

What is the risk of fraud correlated with?

Processing method - the risk of fraud is correlated with how a card is processed. For example, a card that was physically swiped at a store is likely more secure than an online transaction in which the merchant doesn’t see the actual card. Less secure processing methods come with higher credit card processing fees.

What is flat rate pricing?

Flat Rate Pricing - in this model, the merchant is charged a fixed percentage of each transaction plus a small fee, that is usually between $0.20-$0.30 per transaction. If you choose this model, you can easily estimate what your credit card processing costs will be over a given period of time based on your sales estimates.

What are foreign transaction fees?

Foreign transaction fees, also called international transaction fees, are charged to cardholders when they purchase items while overseas or when they make purchases that use an overseas bank to process the transaction.

Does my card charge foreign transaction fees?

Not sure if your credit card will charge you a fee for foreign purchases? Check your credit card’s terms and conditions, where any potential fees will be listed under “transaction fees.”