- Activate. The bank that issued your Visa card will activate 3-D Secure for you automatically. ...

- One-time password. You will be asked to authenticate yourself in a separate window displayed on the site using your 3-D Secure password or the one-time password issued to you. ...

- Validation.

How do I enable 3D Secure?

How do I set up 3d authentication?

- On the menu, click administration> account settings> order settings.

- In the Payment Gateway section, scroll down to 3D Secure.

- Select the check boxes to enable the types of security you are using: Verified by Visa. MasterCard SecureCode. AMEX SafeKey.

- Scroll to the bottom and click Update.

How do I activate the new 3D Secure?

- In most cases, 3D Secure is automatically activated when the first transaction is performed with a 3D Secure merchant

- With 3D Secure, most cardholders are prompted for a one-time PIN, a static PIN or a password when they make an online purchase

- 3D needs to be enabled at all times and should not be turned off

How can I activate 3D Secure on my credit card?

How do I enable 3d Secure?

- Login to your online banking profile.

- Once logged in select the "My Bank Accounts" tab.

- Next select the "My Cards" tab.

- Find the card you would like to activate.

- Click on the "Activate Now" link in the "Verified by Visa" column.

- Complete the required details.

How to enroll in 3D Secure?

IMPORTANT NOTE: This service can only be accessed via Personal Internet Banking.

- Log into Personal Internet Banking

- Select 3D Secure

- Proceed to enrol your card (s)

- Update your contact details

- Update your security questions

How do I activate 3D Secure on my Visa card?

Log in to internet banking and select the Card/3D Secure menu. Activate 3D Secure for each of your credit cards using your usual LuxTrust codes. This will be completed instantly; you can make online purchases immediately after validation.

How do I get 3D Secure on my card?

For extra fraud protection, 3D Secure (3DS) requires customers to complete an additional verification step with the card issuer when paying. Typically, you direct the customer to an authentication page on their bank's website, and they enter a password associated with the card or a code sent to their phone.

Does Visa support 3D Secure?

Addressing today's complex security needs Visa Secure is Visa's global EMV 3-D Secure program that makes authentication simple, lowers friction for consumers and helps prevent card-not-present fraud.

How do I know if my credit card is 3D Secure?

Only 3D Secure merchant sites will ask for a password for authentication purpose. How would I know if a merchant is 3D Secure compliant? If a merchant is 3D Secure compliant, you will be able to see the Verified by Visa or MasterCard SecureCode logo on the site.

Why is my card not 3D Secure?

This means that the cardholder hasn't entered their details correctly. A 3D secure authentication error could be due to everything from a mistyped card number to an incorrect expiration date. If the error continues, the cardholder will need to contact their credit card issuer for assistance.

How can I check my 3D Secure Visa?

How it worksRegister. Through the bank that issued your Visa card, register for Verified by Visa in just a few minutes. ... One-time password. You will be asked to authenticate yourself in a Verified by Visa window displayed on the site using your Verified by Visa password or the one-time password issued to you. ... Validation.

Is 3D Secure the same as Verified by Visa?

3D Secure ensures liability shifts from the merchant to the issuing bank. This alone may make worldwide implementation of 3D Secure worthwhile for your business. Chargeback protection. Verified by Visa ensures you'll never receive a chargeback on your merchant account.

What is a 3D Secure code?

3D Secure protects a buyer's credit card against unauthorised use when shopping online. This simple service enables buyers to validate transactions you make over the internet by requesting a personal code (usually sent to your cell phone or email address as a one time PIN).

Which US credit cards are 3D Secure?

3D Secure encompasses both Visa and Mastercard's security programs, as well as programs offered by JCB and American Express in select parts of the world. Merchants can add 3D Secure authentication on their site as an additional way to prevent card fraud.

Are all credit cards 3D Secure?

All banks and credit card processing networks in the U.S. require 3D Secure, so your credit cards should be accepted and should not require extra authentication.

How do I unblock my 3D Secure?

3D secure Topics You may also go to Customer Service > Service Requests > Credit Cards > Modification Related > Unblock Credit Card for 3D Secure Services > Select card number > submit.

How do you implement 3D Secure authentication?

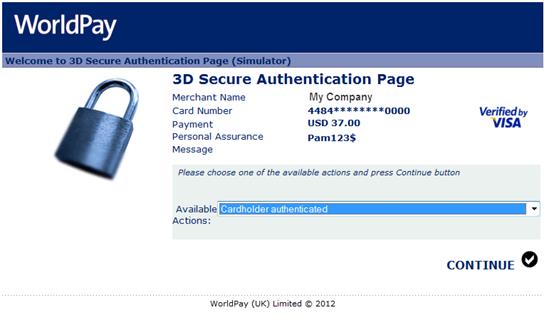

Step 1: The customer enters their card details. Step 2: The customer's bank assesses the request and can complete 3D Secure at this step. Step 3: If required by their bank, the customer completes an additional authentication step.

How do I set up 3D authentication?

Step 1: The customer enters their card details. Step 2: The customer's bank assesses the request and can complete 3D Secure at this step. Step 3: If required by their bank, the customer completes an additional authentication step.

What is 3D Secure code in debit card?

3D Secure is an additional layer of card holder authentication on online card transactions. If a card holder is making a payment online and the bank detects that the transaction might be suspicious, the bank card issuer redirects them to a 3DS page for extra verification.

How do I fix my 3D authentication?

If you receive a "3D Authentication failed" error, it means that you have not entered the required information successfully. Please double check that Caps Lock is disabled and repeat the process making sure there are no typing errors.

Is Nedbank 3D secure?

As a Nedbank customer please ensure you have your mobile phone with you before proceeding as you will be prompted for the OTP (one-time-pin) you are sent. Your Nedbank card is automatically registered for 3D Secure, if you encounter issues please contact your bank.

Do you need to register 3D Secure for ABSA?

ABSA cardholders no longer need to register/activate 3D Secure. Just proceed to checkout and follow the prompts. A One Time Pin (OTP) will be sent to you via SMS or email.

Why use static passwords for Visa?

Static passwords can lead to high authentication challenge abandonment rates, as users may not always have their issuer static passcodes readily available for authentication.

How to verify transactions on 3DS?

Customers verify transactions using a secure code sent by text or email. Issuers can choose which delivery channels to make available for the customer. We recommend providing both to the customer. Once the customer successfully submits the correct OTP, the issuer ACS closes the challenge window and hands control of the experience back to the 3DS Server.

What is Visa Secure?

Visa Secure supports features that enhance authentication functionality and user experience beyond the payment flows. This section covers token identity and verification (ID&V) and trusted beneficiary status with Visa Secure.

Why use white background in HTML?

For Native Interfaces. A white background must be used to maintain consistency, and to avoid color-clashes between issuer and merchant color schemes. For Browser/HTML interfaces. A white background must be used to maintain consistency, and to avoid color-clashes between issuer and merchant color schemes.

What is a 3D secure card?

An e-commerce authentication protocol that enables the secure processing of payment, non-payment and account confirmation card transactions. For more information regarding 3-D Secure, refer to the EMVCo website [https://www.emvco.com/emv-technologies/3d-secure/]

How do customers verify transactions?

Customers verify transactions by answering knowledge-based questions. Issuers can choose which methods to make available for customers.

Can EMV 3DS be trusted?

During a purchase, the merchant’s EMV 3DS Server provider will send a request through EMV 3DS for the Issuer to allow the cardholder to grant trusted beneficiary status for that merchant. The Issuer’s ACS will display the option to grant trusted beneficiary status to the cardholder. If the cardholder agrees to grant trusted beneficiary status to the merchant, then the cardholder will authenticate for both granting trusted beneficiary status and for the payment. Upon success of the authentication, trusted beneficiary status will be granted to the merchant for the cardholder’s primary account number (PAN).

What is 3D secure?

3-D Secure provides extra peace of mind for online shoppers. It is a password-protected authentication system designed to confirm the identity of the cardholder when a Visa card is used online in suspicious or different than usual circumstance (for example, if you're shopping online while travelling). By requesting a password known only to the cardholder, the bank can verify that the genuine cardholder is entering their card details into an ecommerce website. The password may be one that you nominate yourself and must remember, or, it could be a code that your bank sends you via SMS when you are about to make an online payment. It helps to prevent fraudulent transactions and gives all parties in the payment process greater peace of mind, especially when used in conjunction with all the other security features offered by Visa.

Why is Visa important?

It helps to prevent fraudulent transactions and gives all parties in the payment process greater peace of mind, especially when used in conjunction with all the other security features offered by Visa.

Does Visa 3D secure work?

The bank that issued your Visa card will activate 3-D Secure for you automatically. Upon activation, 3-D Secure protects you at every participating online store. When you shop online at a participating merchant, your card will be automatically recognised as protected by 3-D Secure.

What is 3D Secure?

At the same time, other credit card providers have also implemented the security mechanism. For example, 3D Secure is known as “SecureCode” (now “Identity Check”) for MasterCard, “SafeKey” for American Express and “J/Secure” for JCB.

How to use 3D Secure?

For customers, the 3D Secure process should make it easier and better to pay online. Rather than trying the outdated process or abandoning the security check altogether, they can now benefit from a secure and modern process. Customers should be aware of this: 1 Registration: In order to use 3D Secure with your credit card, you have to register with your bank. The bank that issued the credit card is responsible. 2 Installation: It can be assumed that banks will in future use apps to send the 3D Secure code or request biometric data. 3 At the ready: When paying, both the credit card and the smartphone must be available.

What is 3DS2?

The second version of 3D Secure - also known as 3DS2 - addresses these issues and enhances security. The new features also comply with the new EU Payment Services Directives. In addition, the credit card companies are responding to technical developments with the new version. Today, modern devices (e.g. smartphones) use authentication methods with biometric data: by fingerprint or by analyzing facial features.

Why is 3D Secure important?

Phishing and social engineering are common ways in which criminals access data. 3D Secure was developed in order to prevent this .

What were the problems with 3D Secure?

Both customers and online retailers were dissatisfied with the first version of 3D Secure. The website for entering the additional security factor was poorly designed, and the application and use of the required password were unclear. Furthermore, the process could not be easily integrated into mobile apps. Customers were frustrated and cancelled orders, which is never good for business.

When does 3D Secure Payments have to be approved?

The EU’s PSD2 stipulates that from 14 September 2019 online payments must meet special security standards. 3D Secure payments meet the new requirements. In order to be able to use the new procedure, online merchants must contact their payment service provider (PSP).

Is 3DS2 an intelligent system?

In addition, it should be an intelligent system. The authentication method therefore adapts to the risk, which means that lower security requirements apply to small amounts than to large amounts. In addition, 3DS2 can also be used for mobile payments and works with bank apps.