How do I enable 3D Secure?

How do I set up 3d authentication?

- On the menu, click administration> account settings> order settings.

- In the Payment Gateway section, scroll down to 3D Secure.

- Select the check boxes to enable the types of security you are using: Verified by Visa. MasterCard SecureCode. AMEX SafeKey.

- Scroll to the bottom and click Update.

How do I register for 3D Secure?

Register for 3D Secure through your BSP Personal Internet Banking. Log into Personal Internet Banking; Select 3D Secure; Proceed to enrol your card(s) Update your contact details; Update your security questions; If you are not a registered BSP Personal Internet Banking user, we recommend you apply now. Download the Application form and complete.

Does Chase have a secured credit card?

Unfortunately, Chase doesn’t support a secured credit card. But other card providers offer solid secured credit cards with low fees and interest rates. Are there Chase credit cards for poor credit? Unfortunately, no. As of this writing, Chase doesn’t offer a single card that a consumer with poor or even fair credit could obtain.

Which cards can be registered with 3D Secure?

3D Secure. 3D Secure is a security protocol facilitated by VISA and Mastercard, and used by banks worldwide, to authenticate online card transactions, allowing customers to transact online securely using your BSP VISA and Mastercard. The 3D Secure service protects BSP VISA Debit and BSP Mastercard holders against the fraudulent use of their ...

Does Chase Visa use 3D Secure?

But while the bells and whistles are really cool (especially when you use points to buy tickets) the Chase Sapphire is highly unreliable as it relies on Chase's terrible awful no-good junk approach to 3-D Secure (Verified by Visa) verification.

How do I activate 3D Secure on my Visa card?

How it worksActivate. The bank that issued your Visa card will activate 3-D Secure for you automatically. ... One-time password. You will be asked to authenticate yourself in a separate window displayed on the site using your 3-D Secure password or the one-time password issued to you. ... Validation.

How do I register my 3D Secure Visa gift card?

2:505:24How To Activate Secure Spend Prepaid Visa Gift Card - YouTubeYouTubeStart of suggested clipEnd of suggested clipIf you click debit they will ask for a PIN number the way you set the pin number up on these secureMoreIf you click debit they will ask for a PIN number the way you set the pin number up on these secure spend Visa debit gift card is go go to the register.

How do I activate 3D on my credit card?

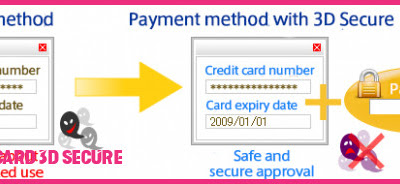

For extra fraud protection, 3D Secure (3DS) requires customers to complete an additional verification step with the card issuer when paying. Typically, you direct the customer to an authentication page on their bank's website, and they enter a password associated with the card or a code sent to their phone.

How do I register for 3D Secure payment?

The steps for 3D Secure registration and how to change your 3D Secure PIN are as shown below. Step 1: Go to online merchant website, select the products and then proceed to the merchant's check-out page. Enter your registered ICICI Bank Debit Card number and submit. You have successfully created your 3D Secure PIN.

How do I know if my Visa card is 3D Secure?

If a merchant is 3D Secure compliant, you will be able to see the Verified by Visa or MasterCard SecureCode logo on the site.

Why is 3D Secure not working?

This means that the cardholder hasn't entered their details correctly. A 3D secure authentication error could be due to everything from a mistyped card number to an incorrect expiration date. If the error continues, the cardholder will need to contact their credit card issuer for assistance.

How does Visa 3D Secure work?

3D Secure is an additional layer of card holder authentication on online card transactions. If a card holder is making a payment online and the bank detects that the transaction might be suspicious, the bank card issuer redirects them to a 3DS page for extra verification.

Which banks use 3D Secure?

What is 3D Secure?VISA. Visa Secure.Mastercard. SecureCode.JCB. J/Secure.AMEX. American Express SafeKey.

How do I activate my Verified by Visa Chase?

Call the number on the card There will be an option for activating your card over the phone by dialing a toll-free number and following instructions from an automated voice operator. You may be instructed to input your credit card number over the phone or a secured PIN to complete the verification process.

Are all credit cards 3D Secure?

All banks and credit card processing networks in the U.S. require 3D Secure, so your credit cards should be accepted and should not require extra authentication.

Why is 3D Secure not working?

This means that the cardholder hasn't entered their details correctly. A 3D secure authentication error could be due to everything from a mistyped card number to an incorrect expiration date. If the error continues, the cardholder will need to contact their credit card issuer for assistance.

How do I activate my 3D secured Visa Wells Fargo?

You can activate it online, or from your Wells Fargo Mobile® app. Call 1-877-294-6933 from your home or mobile phone. You can activate the card by using it with your PIN at any Wells Fargo ATM.

How do I get my Standard Bank 3D Secure code?

in order to set up your 3D secure code, you need to call into our Card Division on our toll free number 0800 020 600 and they will assist with all matters regarding to 3D Secure Code.

What is 3D Secure debit card?

3D Secure is an additional layer of card holder authentication on online card transactions. If a card holder is making a payment online and the bank detects that the transaction might be suspicious, the bank card issuer redirects them to a 3DS page for extra verification.

Visa Secure with EMV 3-D Secure

Visa pioneered the original 3-D Secure protocol more than 15 years ago to protect eCommerce transactions by providing an additional layer of identity verification before authorization.

How it works

Visa Secure with EMV 3-D Secure benefits all stakeholders in an enhanced data exchange. Already in use by issuers and merchants around the world today. Visa Secure will continue evolving to protect new payment channels as they are developed.

Benefits

Supports different payment channels, delivering a unified web and mobile experience.

Resources

Learn more about how EMV 3-D Secure makes eCommerce transactions more secure in real time.

Contact your Visa card issuer directly for more information

Source: ONLINE PAYMENT FRAUD Emerging Threats • Segment Analysis • Market Forecasts 2018-2023, November 2018, Juniper Research.

Do you need to register 3D Secure for ABSA?

ABSA cardholders no longer need to register/activate 3D Secure. Just proceed to checkout and follow the prompts. A One Time Pin (OTP) will be sent to you via SMS or email.

Is Nedbank 3D secure?

As a Nedbank customer please ensure you have your mobile phone with you before proceeding as you will be prompted for the OTP (one-time-pin) you are sent. Your Nedbank card is automatically registered for 3D Secure, if you encounter issues please contact your bank.

How to use 3D Secure?

For customers, the 3D Secure process should make it easier and better to pay online. Rather than trying the outdated process or abandoning the security check altogether, they can now benefit from a secure and modern process. Customers should be aware of this: 1 Registration: In order to use 3D Secure with your credit card, you have to register with your bank. The bank that issued the credit card is responsible. 2 Installation: It can be assumed that banks will in future use apps to send the 3D Secure code or request biometric data. 3 At the ready: When paying, both the credit card and the smartphone must be available.

What is 3D Secure?

At the same time, other credit card providers have also implemented the security mechanism. For example, 3D Secure is known as “SecureCode” (now “Identity Check”) for MasterCard, “SafeKey” for American Express and “J/Secure” for JCB.

What is 3DS2?

The second version of 3D Secure - also known as 3DS2 - addresses these issues and enhances security. The new features also comply with the new EU Payment Services Directives. In addition, the credit card companies are responding to technical developments with the new version. Today, modern devices (e.g. smartphones) use authentication methods with biometric data: by fingerprint or by analyzing facial features.

Why is 3D Secure important?

Phishing and social engineering are common ways in which criminals access data. 3D Secure was developed in order to prevent this .

What were the problems with 3D Secure?

Both customers and online retailers were dissatisfied with the first version of 3D Secure. The website for entering the additional security factor was poorly designed, and the application and use of the required password were unclear. Furthermore, the process could not be easily integrated into mobile apps. Customers were frustrated and cancelled orders, which is never good for business.

When does 3D Secure Payments have to be approved?

The EU’s PSD2 stipulates that from 14 September 2019 online payments must meet special security standards. 3D Secure payments meet the new requirements. In order to be able to use the new procedure, online merchants must contact their payment service provider (PSP).

Does 3DS2 take place on another website?

Implement 3DS2: Since the new 3D Secure process no longer takes place on another website but directly in the shop, the technology must be integrated into the online shop.

Is there a limit to how many cards you can add to your wallet?

Yes, there is no limit to the number of cards you add to the wallet.

Can you add Chase cards to your wallet?

You can add any eligible Chase cards when you Click to Pay, including cards that you may have already loaded into other digital wallets.

Does Chase Visa work with Click to Pay?

Many Chase Visa ® and Mastercard ® credit and debit cards work when you see the Click to Pay icon. While you may use any card when you see Click to Pay, you may not always see the exact card image that matches your physical card. That shouldn't change the way you use and transact when you use Click to Pay. See all eligible cards that work with Click to Pay.

What is 3D Secure?

3-D Secure technologies, which add an additional layer of verification security to online credit card transactions, have been around for more than a decade. Verified by Visa, MasterCard SecureCode, and American Express Safe Key are the most popular examples of 3-D Secure deployments. If you use your credit card to buy online outside the United States, you’ve almost certainly come across these technologies.

Why use Chase Sapphire as primary credit card?

By using the Chase Sapphire as a primary card, you are also increasing the failure rate of your back-up credit cards cards as a result of underutilization (which increases precautionary card suspensions). This could leave you totally screwed when you need to pay for something urgently.

Does Merchant use VBV?

Merchant has opted to use Verified by Visa, so before the transaction is approved, it activates the VbV system.

Is Chase Sapphire good for international travel?

For an international traveler – it’s critical that your card works well with the systems it is interacting with overseas. The Chase Sapphire might have nice bells and whistles, but is an immensely flawed tool for a global traveler – one that is almost certain to bring you lots of frustration, and potentially some awkward and embarrassing moments. You’ve been warned.

Is Chase Sapphire reliable?

But while the bells and whistles are really cool (especially when you use points to buy tickets) the Chase Sapphire is highly unreliable as it relies on Chase’s terrible awful no-good junk approach to 3-D Secure (Verified by Visa) verification. For some reason – whether a genuine corporate cost-benefit decision, ...

Does Chase Sapphire have embossed numbers?

The card also has a few other flaws (no embossed numbers, all family cards with the same number and CVV code), which further weaken the card’s reliability. You cannot count on it to always work abroad or to work when you need it most (e.g. time-sensitive situations where something is about to sell out). By using the Chase Sapphire as ...

Can you use a back up card for VBV?

Having a back-up card with you for VbV transactions certainly can help. But even then, there’s a catch for time-sensitive transactions. Because you probably don’t use your back-up card that often, in a time-sensitive overseas online transaction, there’s a high chance your back-up card may shut down the transaction for fraud. This happened to me with the ferry tickets – it got rejected the first time I tried, and I needed to call Capital One to lift the fraud hold, after which `the transaction (and the VbV) worked.

Does Capital One use Chase?

Card services confirmed Capital One, Barclays, BoA, and Chase do not use it.

Can you get a debit card with no foreign transaction fees?

Schwab for example is a bank that doesn't charge foreign transaction fees btw.