How do you dispute a charge on Chase Visa?

Here's how: After signing in, find and select the transaction you are concerned about. Review the transaction details and click Dispute Transaction to start the process. Answer a few questions, review your responses and click Submit dispute.

Will I get my money back if I dispute a charge Chase?

What Is the Chase Refund Policy? Chase customers can dispute charges and request refunds in various situations. The most common reasons for disputes include Charge errors and Fraudulent charges.

Can I dispute a charge on my Visa card?

Disputing a credit card charge Fraudulent charges on your bill can be disputed by calling your credit card issuer or filing a dispute online. This is typically a quick process where the issuer will cancel the credit card in question and issue a new one.

What does Chase do when you dispute a charge?

Successful dispute: Chase removes the charge entirely from your statement and performs a chargeback, billing the merchant for the amount of the transaction. Unsuccessful dispute: Chase rebills you for the amount in question. If you want to appeal the decision, you can ask Chase how to start the appeal process.

How long do Chase disputes take?

The time it takes to resolve your dispute depends on the type of dispute and the merchant, but it may take up to 60 days for credit card disputes and 90 days for debit card disputes. Keep in mind, disputes are often resolved more quickly if you contact the merchant first.

Can I dispute a credit card charge that I willingly paid for?

Can I dispute a credit card charge I willingly paid for? You should never dispute a credit card charge you willingly paid for. Not only is doing so unethical, but you won't be able to keep the initial credit you receive if you don't deserve it.

How long do I have to dispute a charge on my Visa card?

60 daysHow long do you have to dispute a charge? You normally have 60 days from the date a charge appears on your credit card statement to dispute it. This time limit is established by the Fair Credit Billing Act, and it applies whether you're disputing a fraudulent charge or a purchase that didn't turn out as expected.

How long do I have to dispute a credit card charge?

You have 60 days to dispute a credit card charge, per the Fair Credit Billing Act of 1974. The 60 days starts from the day the statement containing the erroneous charge was mailed to you or made available online (if you're enrolled in paperless billing).

Does disputing a charge hurt your credit?

Disputing a charge on your credit card will not negatively affect your credit standing, although the credit card company may add a statement to your credit report indicating that the account is currently in dispute.

How much does Chase charge for a chargeback?

What Are Chase Bank's Chargeback Fees? For merchants who process payments through Chase, the fee per chargeback is reportedly as low as $5. That puts them on the more reasonable end of the fee spectrum, but remember that chargeback fees can add up quickly if you're not careful.

What happens if you falsely dispute a debit card charge?

Falsely disputing a credit card charge, accompanied with intent to cause trouble, can result in fines, court fees, time in court, and perhaps even a jail term, as this would be committing a type of fraud.

How long does it take for a refund to go back on your debit card Chase?

Once a refund has been processed, it should take an average of 1-3 working days to reach your account. In some cases it may take up to a week.

What is a Chase claim reversal?

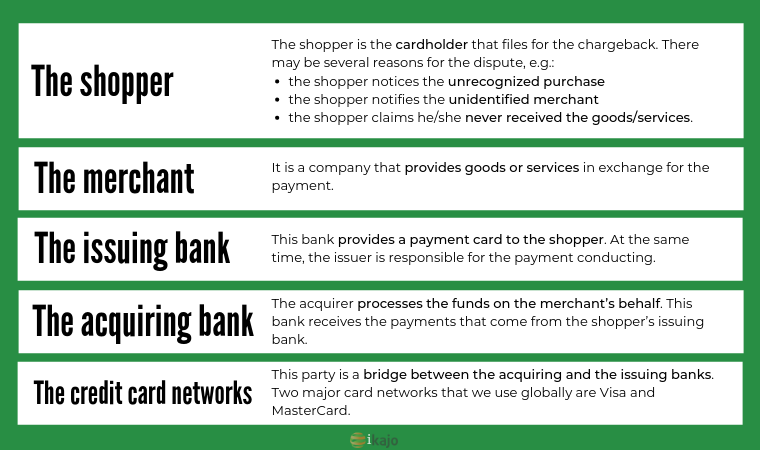

A chargeback occurs during the dispute process when a cardholder disputes charge, fraudulent activity is suspected, or a payment didn't comply with the rules and regulations established by a payment brand, such as Visa®, MasterCard® or debit network.

How do banks investigate disputes on debit cards?

The bank initiates a payment fraud investigation, gathering information about the transaction from the cardholder. They review pertinent details, such as whether the charge was a card-present or card-not-present transaction. The bank also examines whether the charge fits the cardholder's usual purchasing habits.