How to Dispute Visa Debit Charges

- Call the place of business if you authorized the transaction but discovered that you were overcharged or charged for the same item multiple times.

- Call the bank or financial institution that issued the Visa debit card. Be prepared to give your name, account number and detailed explanation of the problem.

- Fill out any paperwork required by the bank/financial institution. The type and amount of paperwork will vary from bank to bank.

- Visa will have up to 60 days to investigate your claim. ...

- Step 1: A cardholder disputes a transaction. A cardholder contacts their issuer to question a charge on their billing statement.

- Step 2: Find the transaction receipt. Your acquirer contacts you for an accurate copy of the transaction record.

- Step 3: Send a copy to your acquirer.

How do I dispute a charge on my credit card bill?

To dispute a charge on your credit card bill, you should call the card company and let them know about the problem right away. Check your credit card agreement to review your rights regarding unauthorized charges.

What are the reasons for disputes on Visa cards?

There are a variety of reasons why someone might dispute a Visa transaction, including fraud, an unresponsive or unhelpful merchant, buyer's remorse, and forgetfulness, among others. Any time a customer is unhappy with a charge and calls their bank to raise objections, a dispute can result.

What happens if I dispute a charge that I already paid?

If you already paid the charge that youre disputing, you can still dispute it. But you probably wont get the money back until the credit card company has decided that you were right. If the card company finds you are correct, the charge must be removed from your bill.

How long does it take to dispute a visa charge?

Other parties, such as acquirers and processors, may also have actions to perform in the same timeframe. They have the power to move up deadlines to give themselves more time. From start to finish, disputing a charge can often take 45 to 90 days. Whenever possible, however, Visa prefers to have customer disputes finalized in a month or less.

How do I dispute a charge on my Visa card?

How to Dispute Credit Card Charges. Fraudulent Charges: Contact your credit card's issuer and ask them to remove the charges and issue you a new card. Billing Errors: Contact the merchant first and ask them to fix the error, then send a dispute letter to your credit card's issuer if needed.

Can I dispute a credit card charge that I willingly paid for?

Can I dispute a credit card charge I willingly paid for? You should never dispute a credit card charge you willingly paid for. Not only is doing so unethical, but you won't be able to keep the initial credit you receive if you don't deserve it.

Can I dispute a charge on my Visa debit card?

Cardholders are only entitled to dispute debit card charges if they're the victim of fraud or abuse. Otherwise, they must work with the merchant to refund any transactions they are unhappy with. Also, the bank might be more hesitant to issue a provisional credit, as the money belongs to the cardholder, not the bank.

How long do you have to dispute a charge on Visa?

within 120 daysIssuer/Cardholder: Visa cardholders can only file a chargeback within 120 days of the original transaction or delivery date, in most cases. Like Mastercard, Visa mandates shorter timeframes for certain disputes. In some cases, for instance, claims must be filed within 75 days of the transaction.

What is a good excuse to dispute a charge?

Valid Reasons to Dispute a Credit Card Charge Legitimate reasons to dispute a credit card charge include being charged twice for the same transaction, being charged for something you returned or something that was never received. Sometimes the credit card issuer fails to credit a payment.

How often are credit card disputes successful?

This can't always be helped. You might not always get a fair outcome when you dispute a chargeback, but you can increase your chances of winning by providing the right documents. Per our experience, if you do everything right, you can expect a 65% to 75% success rate.

Will I get my money back if I dispute a charge?

Ask the company if it will reverse the charge. If you're not satisfied with the merchant's response, you may be able to dispute the charge with your credit card company and have the charge reversed. This is sometimes called a chargeback. Contact your credit card company to see whether you can dispute a charge.

How does a Visa dispute work?

When a cardholder files a dispute with the issuing bank that provides their Visa-branded credit card, the transaction becomes a Visa chargeback, also known as a Visa dispute. The bank debits the transaction amount from the merchant and gives the cardholder a temporary credit.

How do I block a charge on my debit card?

Give your bank a "stop payment order" Even if you have not revoked your authorization with the company, you can stop an automatic payment from being charged to your account by giving your bank a "stop payment order" . This instructs your bank to stop allowing the company to take payments from your account.

Can Visa help me get my money back?

If you've paid with a Visa credit, debit or pre-paid card and your purchase has gone wrong, you may be entitled to ask for a refund. Your first step should always be to contact the seller, but if you're unable to resolve the situation to your satisfaction, your card provider may still be able to help you.

Can a bank deny a dispute?

Yes. If the cardholder doesn't make a compelling enough case to their bank, or doesn't have a valid reason for filing a chargeback, the bank may refuse to open a dispute.

What happens if a merchant does not respond to a chargeback?

If they ignore the chargeback, it will automatically be decided in favor of the cardholder, and they may have to pay an additional non-response fee.

How do I dispute a charge on willingly paid?

If you didn't contact the merchant about the issue first. If they fail to take action, you can go ahead and file a dispute—but you need to give the vendor a chance to make it right first. If you are disputing a fraudulent charge, call your creditor to report it right away.

Can I dispute a charge if Im not satisfied?

If you're not satisfied with the merchant's response, you may be able to dispute the charge with your credit card company and have the charge reversed. This is sometimes called a chargeback. Contact your credit card company to see whether you can dispute a charge.

Can I get in trouble for disputing a charge?

Can you Get in Trouble for Disputing a Charge? Yes. Cardholders can face consequences for abusing the chargeback process.

Can you dispute a non refundable charge?

Can you dispute a non-refundable charge? Yes. Cardholders have the right to dispute a transaction, as long as there is a valid claim.

What is the condition for a dispute with a card processor?

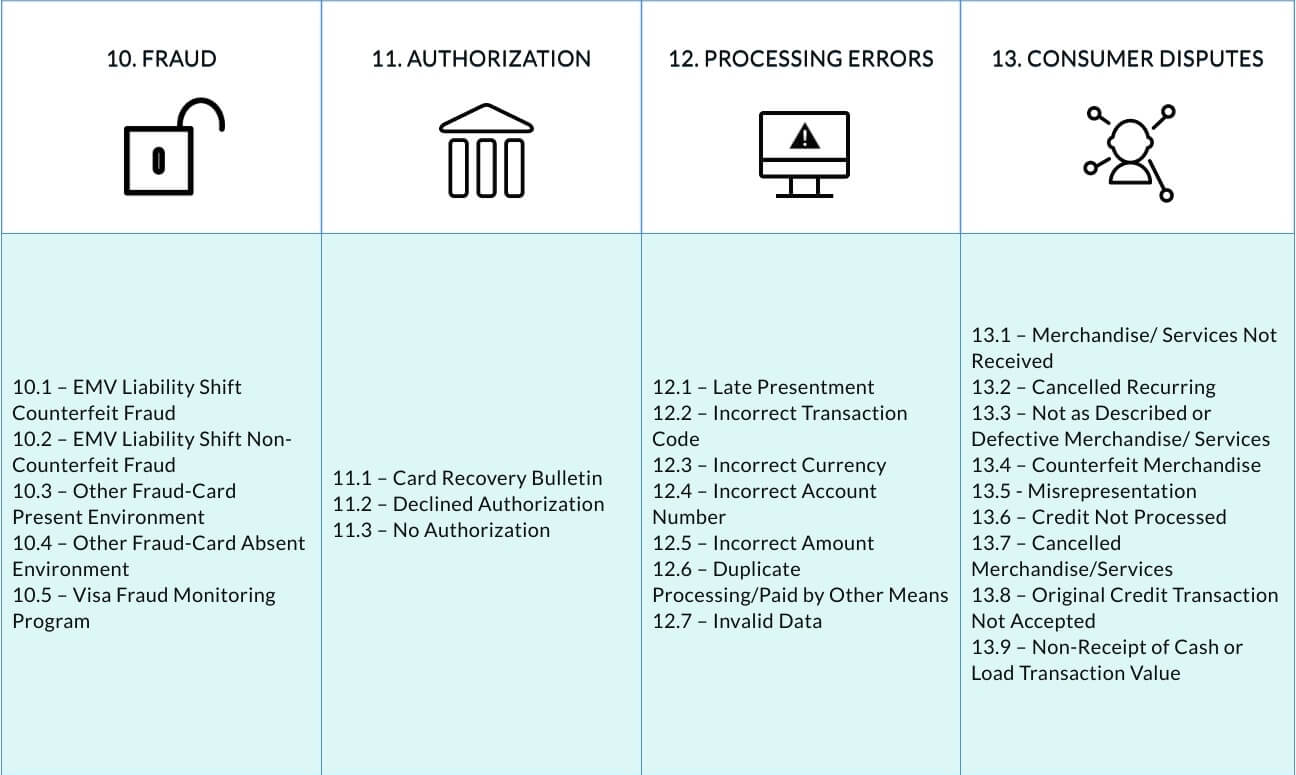

Your card processor has notified you that an issuer is disputing a transaction that you processed. The dispute falls under Condition 11.2, Declined Authorization.

What is the condition for disputing a credit card transaction?

Your card processor has notified you that a cardholder is disputing a transaction that you processed. The dispute falls under Condition 13.6, Credit Not Processed.

What is the condition 12.7 of a credit card?

Your card processor has notified you that a cardholder is disputing a transaction that you processed. The dispute falls under Condition 12.7, Invalid Data.

Do Visa cardholders dispute transactions?

However, every once in a while, a Visa cardholder will dispute a transaction. Whatever the reason might be, when a cardholder questions a transaction on their bill, they typically file a dispute with their bank. This, in turn, begins the dispute resolution process. Image description.

What Are Valid Reasons to Dispute a Charge?

There are several valid reasons why you might need to ask for a chargeback:

What Happens After a Dispute is Filed?

If a dispute is accepted by the issuer and becomes a chargeback, the bank will reverse the disputed charge, which may come in the form of a temporary credit that becomes permanent once the chargeback is accepted by the acquirer.

Why Should You Avoid Filing a Chargeback If At All Possible?

If a merchant is in the process of working with you to try to resolve an issue, filing a chargeback is the nuclear option. To the cardholder, it may seem essentially the same as getting a refund, but for the merchant, chargebacks are much more costly and harmful than refunds

Verify the Transaction

The first step in disputing a charge is to make sure the charge truly is wrong. "Before you go and file a dispute with your credit card provider, make sure you understand the charge," says Rebecca Gramuglia, personal finance expert for cash back website TopCashback.com.

Determine Whether the Charge Is Fraudulent

Fraudulent charges are handled differently than inaccurate charges. If you are the sole user of your credit card and notice a $200 Walmart purchase was made in New Jersey, even though you live in California, your credit card number likely has been compromised.

Ask the Merchant to Correct the Charge

If it's not fraud, most experts recommend that you work with the seller to resolve the dispute before getting your credit card issuer involved. "Go directly to the merchant," Gramuglia says. "You can ask the merchant for a refund or to correct the error by giving them a call, visiting the store or writing a complaint letter."

File a Dispute With Your Credit Card Issuer

If the merchant doesn't resolve the error in a timely manner, get your credit card company involved. Don't wait too long, as there is a limit on how long you have to dispute a charge on your credit card.

Continue Paying Credit Card Bills During a Dispute

You are not responsible for paying the disputed charge or any related charges during an investigation, but these amounts may still apply against your credit limit. Most major credit cards have zero-dollar liability policies to protect cardholders from inaccurate or fraudulent transactions.

How to dispute a charge on a credit card?

To dispute a charge on your credit card bill, you should call the card company and let them know about the problem right away.

How long does it take to dispute a credit card charge?

In order to protect your rights you must also send a written billing error notice to the card company within 60 calendar days after the charge appeared on your statement. If you already paid the charge that you’re disputing, you can still dispute it.

What happens if you are wrong on your credit card?

If the card company finds you are correct, the charge must be removed from your bill. If the card company says that you are incorrect and the bill is correct, the card company must tell you why in writing. It must also tell you how much you owe and when your payment is due.

Can I share my PII?

Please do not share any personally identifiable information (PII), including, but not limited to: your name, address, phone number, email address, Social Security number, account information, or any other information of a sensitive nature.

How do I prevent Visa disputes?

Like most chargebacks, Visa disputes can be prevented with fraud prevention tools, clear policies, and great customer service.

Why do customers dispute Visa transactions?

There are a variety of reasons why someone might dispute a Visa transaction, including fraud, an unresponsive or unhelpful merchant, buyer's remorse, and forgetfulness, among others.

Can Visa reverse a charge?

Typically, in Visa disputes, it is the issuing bank that reverses charges. Visa can set requirements for the process.

How long does it take to dispute a Visa card?

The deadlines are pretty straightforward on the consumer side. From the original transaction or expected delivery date, Visa cardholders have no more than 120 days to file a dispute. There are a few exceptions, which we’ll cover later in this post. In most situations, though, 120 days is the rule.

How Long Do Merchants Have to Respond to a Visa Dispute?

The Visa chargeback process is broken into phases. Merchants must respond within 30 days of day one for each phase. In Visa’s case, day one is the day after each phase is initiated. Merchant time limits have only one exception: if either party wants to escalate a dispute to arbitration, they must do so within 10 days.

What is Visa reason code 13.6?

Visa reason code 13.6 deals with chargebacks stemming from a credit not being processed. Issuers must wait 15 calendar days from the credit transaction receipt date before initiating a dispute, unless doing so would cause the dispute to exceed the time limit.These dispute must be processed no later than 120 calendar days from either:

Do Visa chargebacks only apply to merchants?

Another thing to keep in mind is that the Visa chargeback time limits presented here don’t only apply to merchants. Other parties, such as acquirers and processors, may also have actions to perform in the same timeframe. They have the power to move up deadlines to give themselves more time.

Do Visa chargebacks have time limits?

Are you a merchant fighting an unfair chargeback claim? Or, are you a cardholder dealing with a case of criminal fraud? In either case, Visa chargebacks come with built-in time limits you need to know about. Each phase of the dispute process has a specific deadline for action. Waiting too long could mean than you forfeit your chargeback rights ..

Does Visa chargeback require a response?

Responses are mandatory in all cases. At one point, Visa allowed merchants to ignore the dispute until after the deadline, effectively accepting the chargeback by default. Now, though, Visa imposes a fine on non-response, even if that response is to accept the chargeback.

How long does it take for a merchant to resolve a charge error?

Merchants can resolve charge errors within a few days, where it can sometimes take banks weeks to resolve. Keep track of the date you contact them, who you speak with, and their response. We may ask for these details if you decide to open a dispute later.

What is charge error?

A charge error is a transaction you recognize but appears to be incorrect, such as: A recurring transaction or trial subscription you canceled. A product or service you never received or received late. A one-time purchase you returned or canceled, and you still haven’t received a credit.

What is the phone number for a lost credit card?

If your card is lost or stolen, or you think someone used your account without permission, call us immediately at 1-866-564-2262 for debit card customers, 1-800-955-9060 for credit card customers, and 1–888–269–8690 for business credit card customers.

How to dispute a credit card issuer?

Work with the merchant. Before you file a dispute with your card issuer, try to resolve the issue with the merchant first. Explain the issue you have with the transaction, and send any supporting information to back up your cause. In many cases, the merchant will try to work with you on a solution to your issue. If they don’t help within a week, proceed with a dispute since the clock is ticking.

How long do you have to dispute a credit card charge?

However, there’s a catch: you need to dispute charges within 60 days from when the purchase appeared on your statement. Since that’s a relatively small timeline, make sure you regularly review your credit card account for signs of billing errors.

What is an unauthorized credit card transaction?

Unauthorized credit card transactions are a form of fraud and also considered a billing error , according to the FTC. So if someone steals your physical credit card or skims your virtual card number, you can dispute the transaction.

What are the two types of credit card disputes?

There are two main types of credit card disputes: 1) billing errors and 2) complaints about the quality of goods and services. Here’s an overview of each type of issue, then a guide on how to dispute credit card charges.

How to dispute an American Express card?

Depending on the reason for your dispute, you may be required to call. The FTC recommends you mail a letter to your card issuer’s billing department so you can get the dispute started. Include your name, address, account number, a description of the issue, and copies of supporting documents.

How long does a credit card have to be charged after a fraud?

Federal law only protects cardholders for a limited time — 60 days to be exact — after a fraudulent or incorrect charge has been made. Thankfully I noticed the billing error within a few days of it posting to my account and started the dispute process right away.

What to do if credit card statement is inaccurate?

The next time you review your credit card statement, comb through it for any charges that seem out of place. If you notice a charge that isn’t familiar, confirm it’s inaccurate and dispute it.