Prepaid debit cards that work on the Visa network are easy to obtain online through each card issuer’s website or in retail stores nationwide. They’re free to sign up for online, but you’ll be charged a small fee to purchase a prepaid card in-store.

Full Answer

How much money can you put on a prepaid Visa card?

Given below are some of the best no limit/high limit prepaid debit cards:

- PayPal Prepaid Mastercard – $15,000

- Brink’s Prepaid Mastercard – $15,000 Limit

- Netspend Prepaid Visa – $15,000

- NexsCard Prepaid Visa – $20,000 Limit

- CashPass Visa – $20,000 Limit

Where can you buy a prepaid Visa card?

You may want to go online to review this additional information. You can buy prepaid cards at retail locations (such as grocery stores and drug stores), online, over the phone, or from some banks and credit unions. If you buy the card online, you may then be issued a virtual card, or you may receive a physical card in the mail at a later time.

How to transfer money from a prepaid card?

ii) CardCash

- Go to the CardCash website

- Enter the amount to transfer from the prepaid card and choose PayPal Express

- Enter your card number and PIN and connect with your PayPal account by logging in.

- Fill the required fields and click get my PayPal balance

- The money will be in your PayPal account within a few minutes and you can then transfer to your bank account.

What is the best Visa rewards card?

- Capital One VentureOne Rewards Credit Card Capital One VentureOne Rewards Credit Card

- U.S. ...

- Bank of America® Travel Rewards credit card Bank of America® Travel Rewards credit card

- Bank of America® Unlimited Cash Rewards credit card Bank of America® Unlimited Cash Rewards credit card

- Wells Fargo Active Cash® Card Wells Fargo Active Cash® Card

See more

Can you buy a prepaid Visa card in a store?

You can buy prepaid cards at retail locations (such as grocery stores and drug stores), online, over the phone, or from some banks and credit unions. If you buy the card online, you may then be issued a virtual card, or you may receive a physical card in the mail at a later time.

How long does it take to get a prepaid Visa?

Allow 3-4 weeks for delivery. If you haven't received your card within the standard time frame, contact their Support team directly to report it so they can cancel the existing card, confirm your mailing address, and send you a new card.

Can you get an online prepaid Visa?

Prepaid Visa gift cards can be ordered and customized online at Giftcards.com. You can even purchase a Visa prepaid virtual card. Prepaid Visa cards can also be found in many popular retailers: grocery stores, gas stations, department stores, and more.

What do you need to get a prepaid card?

You don't need a bank account to get a prepaid debit card, but it's a requirement for a regular debit card, which is linked to your checking account. For prepaid debit cards, you load the card with money when you get it, then use it to make purchases.

How much money can you put on a prepaid Visa card?

Most Visa prepaid card options will allow you to load up to $15,000 into the card account. If you're accessing a reloadable prepaid card, you can continue to add money to your account when you spend some of your current balance. In either scenario, though, you cannot surpass the $15,000 account balance limit.

What is the best prepaid card to use?

Best prepaid cardsBest for no monthly fee: Bluebird® by American Express.Best for cash back: American Express Serve® Cash Back.Best for cash reloads: American Express Serve® FREE Reloads.Best for families: FamZoo Prepaid Card.Best for Walmart shoppers: Walmart MoneyCard.Best for PayPal users: PayPal Prepaid Mastercard®

Can I get a prepaid Visa card at my bank?

You can buy a prepaid debit card from a retailer, bank, credit card company or other financial services provider.

How do you put money on a prepaid card?

You may be able to:Arrange for a paycheck or other regular payment to be directly deposited onto the card.Transfer money from a checking account or another prepaid card.Buy a “reload pack” to add a certain amount to your card.Add funds at certain retail locations or at the financial institution that provides the card.

How does a prepaid Visa card work?

A prepaid debit card is much like a gift card: It allows you to spend whatever amount of money is stored on the card. Once the balance is used up, you can reload the card online or at an ATM, a participating store, or other physical location.

Are prepaid cards worth it?

Prepaid cards can be a good way to stay out of debt because you can't spend more than the amount you've already deposited. They're also a useful budgeting tool. Even if you have a checking account, you could put a fixed amount on a prepaid card each month for certain spending categories, such as dining out.

Why do people buy prepaid Visa cards?

Prepaid cards are easy to get and can be a convenient alternative to cash, checks or credit cards. Known officially as "general-purpose reloadable" and sometimes as prepaid debit cards or prepaid credit cards, prepaid cards are loaded with cash.

Do prepaid cards report to IRS?

By law, payment card and third-party transactions must be reported to the IRS.

How long does it take for a prepaid card to come in the mail?

You can expect your Turbo prepaid card to arrive in the mail 7-10 days after your return has been filed. If you don't receive it within 10 days, you can contact customer service at (888) 285-4169.

How long does it take to ship a Visa gift card?

How long will it take to receive a Visa gift card? After placing your order, please allow up to 10 business days to receive your Visa gift card. If you requested Express Delivery, you will receive your Visa gift card in 3-5 business days.

Do you have to wait 24 hours to use a Visa gift card?

Is there a Waiting Period on Your Card? Some gift card sellers will not allow gift cards purchased at the store to work for a specified time period–generally 24-48 hours. If your Visa gift card is not working, the card may have a time restriction on it.

How long does it take to load a prepaid card?

Money deposited on your card will typically be available within 10 minutes.

How to get a Visa prepaid card?

Step 1: Activate and load. Getting started with your Visa Prepaid card is easy. All you need to do is: Activate it online or by phone. Load it online or in-person. Set up direct deposit. Watch video.

How to load money into a Visa Prepaid card?

The best option is to direct deposit all or some of your paycheck, government checks or even your tax refund directly to your Visa Prepaid card. You may also be able to load cash at ATMs, bank branches, and retail locations, or add money from checks by using the mobile check deposit feature on your card issuer’s mobile app. Check with your card issuer to confirm which of these features are offered.

What is an all purpose prepaid card?

The all-purpose Visa Prepaid card is a reloadable prepaid card that you can use to withdraw cash, pay bills, or make purchases at participating retailers and service providers, in-person or online. You can fund the reloadable Visa Prepaid card through a variety of ways, such as through direct deposit or with cash at a participating retail location.

What is a reloadable Visa card?

A reloadable Visa Prepaid card is the quick, easy and secure way to pay online or in person. The all-purpose Visa Prepaid card is a prepaid card that you can use to withdraw cash, pay bills or make purchases anywhere Visa Debit cards are accepted, in-person or online.

What is the difference between a prepaid card and a credit card?

credit cards: When you use a credit card you are borrowing money and building up a balance of debt you owe. With prepaid cards, you’re spending money that has already been loaded onto the card. Unlike credit cards, prepaid cards don’t incur interest charges and don’t require a credit check to obtain.

Does Visa have zero liability?

Visa’s Zero Liability policy does not apply to certain commercial card and anonymous prepaid card transactions or transactions not processed by Visa. Cardholders must use care in protecting their card and notify their issuing financial institution immediately of any unauthorized use and for additional details.

Can you spend more money on a prepaid card?

Then each purchase you make is deducted from that balance. In most cases, you can’t spend more money than you have already loaded onto your prepaid card. Overspending or overdrafts can occur in some cases where a prepaid card may be linked with a checking.

What Is a Prepaid Visa Card?

A prepaid Visa card is different from a Visa gift card or a secured credit card in many ways. Unlike a gift card, your prepaid Visa card will link to an online account that allows you to continually add money that you can spend using your card.

How Does a Prepaid Card Work?

This may include visiting a partnered convenience store or grocery store where you can hand money to the cashier and have it instantly added to your card account.

Can a prepaid card help your credit score?

Visa prepaid cards are not tied to a credit account, so they cannot help you build or rebuild your credit score. While a prepaid card is a useful financial tool, it is not one that affects your credit history.

Is a prepaid card a credit card?

But a prepaid card is not a credit card. It is not connected to a revolving line of credit, and you cannot spend more than the amount of money you have loaded into your card account.

Do prepaid Visa cards tie to credit?

In many ways, a Visa prepaid card allows you to maintain a bank account without dealing with a bank. And since these cards do not tie to a credit account, you won’t have to worry about a credit check that uses your credit history or credit score against you.

Do prepaid gift cards expire?

On the other hand, a prepaid gift card is typically a one-use product that expires once you’ve spent the money loaded into the card account.

Does a credit card charge a monthly fee?

Your card may charge a monthly fee or a per-transaction fee to pay for your account maintenance, though some card issuers will reduce or waive this fee if you meet specific guidelines outlined in your cardholder agreement .

What is prepaid card?

Prepaid cards that feature a network brand (like Visa, MasterCard, American Express, or Discover) can be used at any location that accepts that network brand. Other types of cards are good only at a specific store or group of stores, or on your public transportation system.

When will prepaid cards be required to be disclosed?

The Bureau’s rule requiring these fee disclosures came into effect April 1, 2019, although it may take some time before you start seeing the required disclosures on card packages in retail stores due to phase-in rules. ...

What is initial load on a credit card?

When you buy the card, you pay the initial amount that you want to load onto the card, often termed the “initial load”, plus the cost of the card.

Can I share my PII with my employer?

Yes. No. Additional comment (optional) Please do not share any personally identifiable information (PII), including, but not limited to: your name, address, phone number, email address, Social Security number, account information, or any other information of a sensitive nature.

Do you have to pay for a prepaid card online?

When you buy a prepaid card, you’ll have to pay the initial amount that you want to load onto the card, often termed the “initial load”, plus the cost of the card. Some cards require a minimum initial load.

ONE VIP

ONE VIP Supports Black Owned Businesses & donates to charities supporting people of color. Direct deposit your paycheck, benefit payment, stimulus money & tax refund - get it up to 2 days faster 1. No late fees or interest charges because this is not a credit card. No credit check, no overdraft fees, no minimum balance required. Use the ONE VIP Mobile App to access your account virtually anywhere and anytime (message & data rates may apply). Funds are FDIC insured up to $250,000, through Stride Bank, N.A.

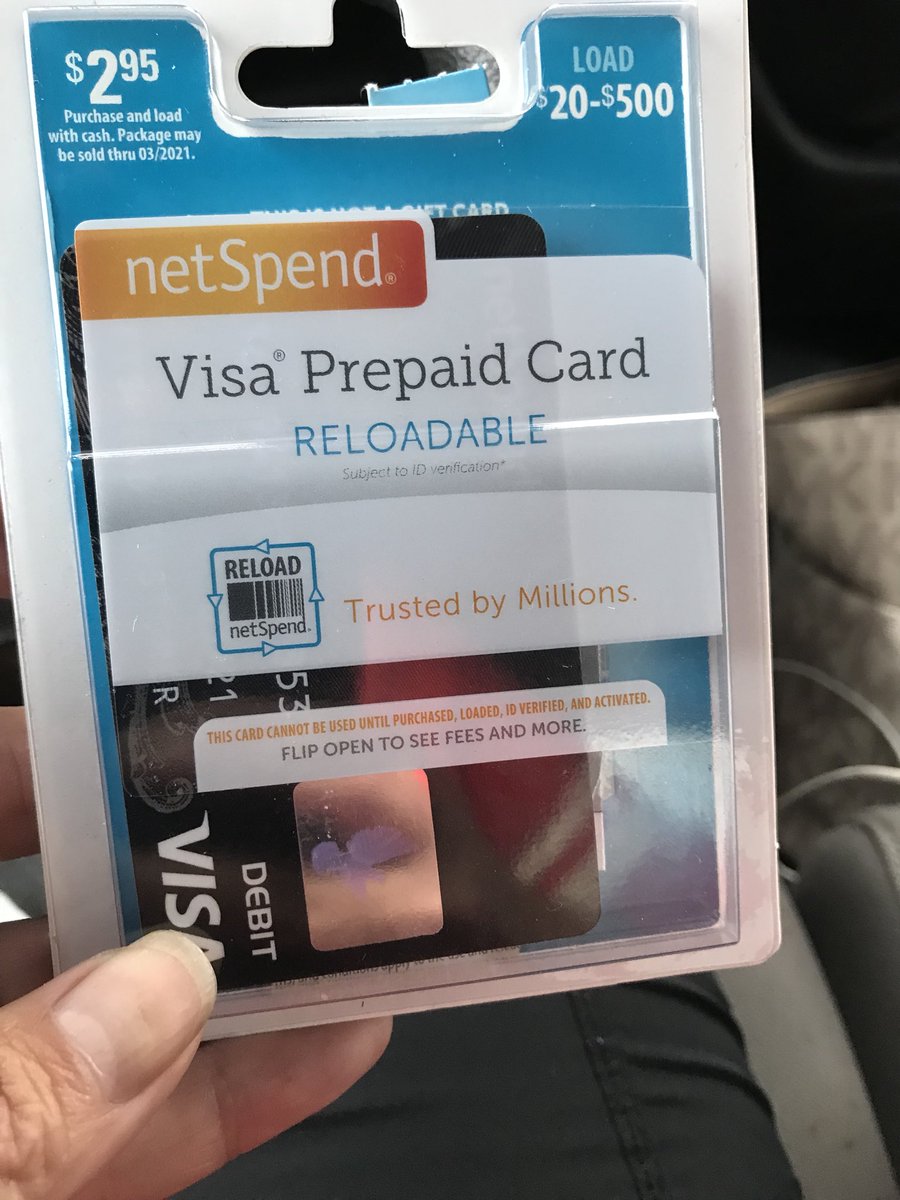

NetSpend Visa Prepaid Card

Get your stimulus payment faster than a paper check in the mail. Direct Deposit your stimulus payment onto a Netspend Visa Prepaid Card. No late fees or interest charges because this is not a credit card. Use the Netspend Mobile App to access your account virtually anywhere and anytime (message & data rates may apply).

ACE Elite Prepaid Debit Card

Direct Deposit your stimulus payment onto a ACE Elite Prepaid Card. Get your stimulus payment faster than a paper check in the mail. No-Fee cash withdrawals up to $100/day at ACE locations with qualifying direct deposit. Get paid up to 2 days faster with direct deposit.

Cashpass Visa Prepaid Card

No Activation or Direct Deposit Fees No Monthly Fee w/ Pay as you go plan Cashpass Mobile App w/ Check Cashing Bill Pay, Text and Email Alerts

Commerce Bank mySpending Card

No monthly service charge. Unlimited Commerce ATM transactions. Free online account access. Available in MO, KS, IL, OK, CO only.

NexsCard Prepaid Visa

NexsCard provides online banking, direct deposit, bill pay and loading locations nationwide.

Reloadable Visa Prepaid Cards

The all-purpose Visa Prepaid card is a reloadable card you can use in-person and online to:

Choose a card to fit your needs

Pay quickly and conveniently online and in stores — plus get your payday funds faster with direct deposit.

Visa Payroll and Healthcare cards

Your employer may offer you a payroll or healthcare prepaid card so you can manage your payday funds more easily — and enjoy many of the advantages of Visa.

Additional Resources

Get your Child Tax Credit payment fast when it’s directly deposited to a Visa Prepaid card.

How to withdraw money from a prepaid card?

Once you have your PIN, you can insert your prepaid card into a compatible ATM, enter the PIN, and withdraw an amount up to either the balance on your card or the maximum daily limit imposed by the card issuer or ATM owner , whichever is less.

How Much Cash Can I Withdraw From a Prepaid Card?

Typically, issuers of prepaid debit cards limit balances, but the maximum balance may be as high as $15,000 to $20,000.

What are the benefits of debit cards?

One of the benefits of debit cards is the ability to get cash back when you make an in-store purchase. This store sets the maximum amount it will allow you to withdraw through this method.

Is MetaBank a Visa prepaid card?

The similarity of this card to the Netspend cards is not surprising, as all are Visa prepaid card offering s issued from MetaBank®, and all offer cash withdrawals at Netspend Reload Network locations across the country.

Do debit cards have overdraft protection?

Prepaid debit cards at least avoid overdraft fees. However, some cards offer optional overdraft protection that may be subject to overdraft fees if the shortfall isn’t quickly corrected.

Do prepaid debit cards charge a fee?

After all, you already pay a monthly or per-use transaction fee, and many prepaid debit cards charge you when you load money. Unfortunately, charging customer fees to add money and to withdraw it is standard procedure in the prepaid card market.

Is a Visa gift card reloadable?

We are limiting our scope to prepaid debit cards issued under the Visa brand. This excludes gift cards (including the Visa gift card) which, while prepaid, are not reloadable and are difficult to convert into cash. We also omitted other types of debit cards, including a stimulus debit card or an EIP card.

What is a prepaid card?

A prepaid credit card, which is really more akin to a debit card, is a piece of plastic that externally resembles a credit or regular debit card in every way. But behind the scenes, prepaid cards tap the cash you deposit into the card account rather than your credit line or checking account.

How do prepaid cards help you?

Prepaid cards teach you to live without debt. Credit cards make it easy to generate debt that requires you to cough up interest charges when you carry balances. Prepaid cards are like training wheels — the money management skills they help you develop can condition you to use credit cards without carrying balances.

Why don't prepaid cards make a dime?

The issuers of prepaid cards don’t make a dime on interest because a cardholder can’t charge purchases on credit. Therefore, issuers must find other ways to make money on these cards, which they do by charging fees.

What is greenlight debit card?

Greenlight is a debit card for kids, managed by parents. Parents set flexible controls and receive real-time alerts while kids monitor their balances, set goals, and learn how to manage money. Receive Mastercard’s Zero Liability Protection. Debit cards are FDIC-insured up to $250,000.

How many fees can a prepaid card extract?

We’ve identified 29 fees that prepaid cards can extract from you.

Which is better, a prepaid card or a debit card?

A prepaid debit card is better, but it implies that, like a Visa debit card, it is backed by a checking account, which it isn’t.

When did the Consumer Financial Protection Bureau introduce prepaid card protections?

The Consumer Financial Protection Bureau introduced prepaid card protections in 2019. The safeguards include:

What is a prepaid card?

A prepaid card is essentially a debit card or a prepaid debit card that you load money onto. Some prepaid cards provide a Purchase Cushion, similar to overdraft protection on a debit card, that allows you to make a purchase for more money than what is available on the card.

How Do I Add Money to a Prepaid Card?

You’d think this would be the easy part since you can’t use your prepaid card without cash on it. And with money loaded on a card, you can then buy things and pay some of the many fees the cards often charge.

What is a Free Prepaid Credit Card?

A credit card is supposed to do just what the name implies: provide credit to buy something now that you repay later.

How much does a MoneyPass card cost?

The card is free to buy online, though it can cost up to $3.95 in retail locations. This card doesn’t charge a monthly fee with direct deposit of $500 or more each month. It has fewer fees than other prepaid cards, with free ATM withdrawals at MoneyPass ATMs.

What is the difference between a debit card and a prepaid card?

The main difference is that a debit card must be connected to a bank account, while a prepaid card isn’t tied to a bank account, but is preloaded with cash through another service.

How much interest does a mango prepaid card pay?

A Mango savings account can be opened with as little as $25 and pays up to 6% annual percentage yield if signature purchases of $1,500 or more per month are made .

Why do people use prepaid cards?

They’re a type of debit card, so retailers that don’t accept credit cards may accept prepaid cards because the funds are withdrawn immediately and don’t include all of the fees that traditional credit cards do.

What is prepaid card?

Prepaid cards are VISA, Mastercard, or American Express cards that come with a preloaded balance. They function as debit cards that you can use anywhere. You can buy them yourself on the gift card rack at many stores, and they are also a common tool for companies to pay out rewards and incentives. In this post, I’m going to show you my hassle-free ...

Why do businesses offer prepaid cards?

Many businesses offer prepaid cards as incentives to sign up for services, buy products, and refer other customers.

What is a bonus tip for a prepaid card?

Bonus tip: Chase rewards down. When a company promises you a prepaid card as an incentive for signing up, referring someone, or completing some activity, make sure you get what they promised. In my experience, it often requires a little follow-up to chase cards down in these situations.

Do you need a prepaid card if you need it later?

First, you might not have the card when you need it later. Second, if a merchant is asking to see the card, they’re security-conscious, and a prepaid card doesn’t inspire confidence in these situations.

Do you have to remember to carry a prepaid card?

If you spend a prepaid card in a single transaction, you’ll never have to think about how much balance remains on the card, and you’ll never have to remember to carry it with you.

Do credit cards have perks?

Many credit cards have perks like extended warranty, travel insurance, or zero foreign transaction fees. Your card may also earn extra points on certain types of purchases. Try to use a prepaid card on transactions where you don’t need these benefits.

Can I use a credit card all at once?

If you’re lucky enough to have a card with a high value, using it all at once might not be possible. In this case, make life easier by sticking a Post-it note to the card to track the remaining balance. I’d still advise that you spend the card down in just two or three large chunks rather than a lot of little transactions.