- Activate. The bank that issued your Visa card will activate 3-D Secure for you automatically. ...

- One-time password. You will be asked to authenticate yourself in a separate window displayed on the site using your 3-D Secure password or the one-time password issued to you. ...

- Validation.

What are the benefits of 3D Secure?

What are the benefits of using 3-D Secure? The main advantages of using 3D Secure are: Reduced Risk Fraud - with this new technology misuse of cards and loss of payments is significantly reduced.; More Protection - Authorization requires confirmation of identity, code etc. from the card issuer.; Safety against Fraud Loss - it provides merchants security against fraud loss.

How do I activate the new 3D Secure?

- In most cases, 3D Secure is automatically activated when the first transaction is performed with a 3D Secure merchant

- With 3D Secure, most cardholders are prompted for a one-time PIN, a static PIN or a password when they make an online purchase

- 3D needs to be enabled at all times and should not be turned off

Which cards can be registered with 3D Secure?

3D Secure. 3D Secure is a security protocol facilitated by VISA and Mastercard, and used by banks worldwide, to authenticate online card transactions, allowing customers to transact online securely using your BSP VISA and Mastercard. The 3D Secure service protects BSP VISA Debit and BSP Mastercard holders against the fraudulent use of their ...

What does 3D Secure mean?

What does 3D Secure mean?

- The issuer domain is where the cardholder and issuing bank act.

- The acquirer domain is where the gateway and acquiring bank act.

- The interoperability domain is where all the "connecting" services act (Directory Server & ACS).

How do I enroll my card in 3D Secure?

Log in to internet banking and select the Card/3D Secure menu. Activate 3D Secure for each of your credit cards using your usual LuxTrust codes. This will be completed instantly; you can make online purchases immediately after validation.

Do Visa Debit cards have 3D Secure?

Visa worked with other payment brands to develop the next generation of the protocol—EMV 3-D Secure. Visa Secure is Visa's global EMV 3-D Secure program that makes authentication simple, lowers friction for consumers and helps prevent card-not-present fraud.

How do I know if my Visa card is 3D Secure?

If a merchant is 3D Secure compliant, you will be able to see the Verified by Visa or MasterCard SecureCode logo on the site.

What is 3D Secure Visa?

3-D Secure is a protocol designed to be an additional security layer for online credit and debit card transactions. The name refers to the "three domains" which interact using the protocol: the merchant/acquirer domain, the issuer domain, and the interoperability domain.

What cards support 3D Secure?

"3D Secure" is the general term for authentication services provided by each card brands under different names.VISA. Visa Secure.Mastercard. SecureCode.JCB. J/Secure.AMEX. American Express SafeKey.

Why is my card not 3D Secure?

This means that the cardholder hasn't entered their details correctly. A 3D secure authentication error could be due to everything from a mistyped card number to an incorrect expiration date. If the error continues, the cardholder will need to contact their credit card issuer for assistance.

How do I get 3D authentication?

Step 1: The customer enters their card details. Step 2: The customer's bank assesses the request and can complete 3D Secure at this step. Step 3: If required by their bank, the customer completes an additional authentication step.

How do I fix my 3D authentication?

If you receive a "3D Authentication failed" error, it means that you have not entered the required information successfully. Please double check that Caps Lock is disabled and repeat the process making sure there are no typing errors.

How much does 3D Secure cost?

Depends on the provider and transaction volume. 3-D Secure 2.0 can cost anywhere between $. 10 and $. 30 per transaction.

How do I activate my 3D Secure Visa Wells Fargo?

You can activate it online, or from your Wells Fargo Mobile® app. Call 1-877-294-6933 from your home or mobile phone. You can activate the card by using it with your PIN at any Wells Fargo ATM.

Is Chase Visa 3D Secure?

Sad but true. But while the bells and whistles are really cool (especially when you use points to buy tickets) the Chase Sapphire is highly unreliable as it relies on Chase's terrible awful no-good junk approach to 3-D Secure (Verified by Visa) verification.

What Is Verified by Visa?

Verified by Visa (or VbV) is an advanced anti-fraud tool Visa offers to businesses. Similar to MasterCard SecureCode, it requires an additional lev...

What Businesses Should Consider Using Verified by Visa?

Visa specifically designed VbV for online (ecommerce) businesses. With the United States undergoing a shift to EMV chip cards to increase security...

How Do I Implement Verified by Visa?

To start using VbV, contact your credit card processor. You can also check the official Verified by Visa Merchant Implementation Guide for more inf...

How Do My Customers Use Vbv?

Customers using Verified by Visa will have a slightly different process if they’re using version 1 or version 2.0. For example, in version 1, they...

What is a 3D secure card?

An e-commerce authentication protocol that enables the secure processing of payment, non-payment and account confirmation card transactions. For more information regarding 3-D Secure, refer to the EMVCo website [https://www.emvco.com/emv-technologies/3d-secure/]

What is Visa Secure?

Visa Secure supports features that enhance authentication functionality and user experience beyond the payment flows. This section covers token identity and verification (ID&V) and trusted beneficiary status with Visa Secure.

Why use static passwords for Visa?

Static passwords can lead to high authentication challenge abandonment rates, as users may not always have their issuer static passcodes readily available for authentication.

How to verify transactions on 3DS?

Customers verify transactions using a secure code sent by text or email. Issuers can choose which delivery channels to make available for the customer. We recommend providing both to the customer. Once the customer successfully submits the correct OTP, the issuer ACS closes the challenge window and hands control of the experience back to the 3DS Server.

How do customers verify transactions?

Customers verify transactions by answering knowledge-based questions. Issuers can choose which methods to make available for customers.

What languages are not covered by Open Sans?

Noto should be used for all languages not covered by Open Sans (e.g. Chinese, Japanese, Korean, Southeast Asian and Middle Eastern languages). Open Sans Regular or Open Sans Semibold can be used for emphasis or to build hierarchy in communications.

Do you have to verify payment to merchant before placing order?

Before placing your order, you must verify payment to [Merchant] for [Amount].

How to use 3D Secure?

For customers, the 3D Secure process should make it easier and better to pay online. Rather than trying the outdated process or abandoning the security check altogether, they can now benefit from a secure and modern process. Customers should be aware of this: 1 Registration: In order to use 3D Secure with your credit card, you have to register with your bank. The bank that issued the credit card is responsible. 2 Installation: It can be assumed that banks will in future use apps to send the 3D Secure code or request biometric data. 3 At the ready: When paying, both the credit card and the smartphone must be available.

What is 3D Secure?

At the same time, other credit card providers have also implemented the security mechanism. For example, 3D Secure is known as “SecureCode” (now “Identity Check”) for MasterCard, “SafeKey” for American Express and “J/Secure” for JCB.

What is 3DS2?

The second version of 3D Secure - also known as 3DS2 - addresses these issues and enhances security. The new features also comply with the new EU Payment Services Directives. In addition, the credit card companies are responding to technical developments with the new version. Today, modern devices (e.g. smartphones) use authentication methods with biometric data: by fingerprint or by analyzing facial features.

Why is 3D Secure important?

Phishing and social engineering are common ways in which criminals access data. 3D Secure was developed in order to prevent this .

What were the problems with 3D Secure?

Both customers and online retailers were dissatisfied with the first version of 3D Secure. The website for entering the additional security factor was poorly designed, and the application and use of the required password were unclear. Furthermore, the process could not be easily integrated into mobile apps. Customers were frustrated and cancelled orders, which is never good for business.

When does 3D Secure Payments have to be approved?

The EU’s PSD2 stipulates that from 14 September 2019 online payments must meet special security standards. 3D Secure payments meet the new requirements. In order to be able to use the new procedure, online merchants must contact their payment service provider (PSP).

Does 3DS2 take place on another website?

Implement 3DS2: Since the new 3D Secure process no longer takes place on another website but directly in the shop, the technology must be integrated into the online shop.

What does "verified by Visa" mean?

Implementing Verified by Visa can make you eligible for “E-commerce Preferred” interchange. Among other things, transactions that qualify will have an “e-commerce indicator” of either 5 or 6, which refer to the VbV status. (5 indicates that the transaction successfully passed Vbv authentication. 6 indicates that the business is set up for Verified by Visa, but the cardholder or the bank that issused the card are not, and thus the transaction could not be Vbv authenticated.)

When will Visa eliminate static passwords?

Note that Visa will likely eliminated static passwords as part of the next iteration of VbV. Eliminating passwords will take place sometime in 2018. As previously mentioned, in some plugin versions of 3D Secure, a majority of customers won’t need to input passcodes.

How do my customers use VbV?

Customers using Verified by Visa will have a slightly different process if they’re using version 1 or version 2.0. For example, in version 1, they set up a passcode specific to Verified by Visa. The service will prompt them to enter that code when making a purchase online with a busines that utilizes Verified by Visa. Your customers can contact their issuing bank to set up their Verified by Visa passcode for their credit cards.

What is a VBV card?

VbV is what’s known as a 3D Secure fraud prevention tool, meaning 3 parties are involved in the authentication process: the business selling the goods/services, the acquiring bank, and the card network. (In this case, Visa.) 3D Secure is one of the most recent fraud prevention tools card brands offer.

What technology do you use to sell online?

If you sell goods or services online (or sell both online and in a brick-and-mortar store) you may want to consider using Verified by Visa and other 3D Secure technologies for the online portion of your sales.

Does verified by visa reduce chargebacks?

Chargebacks may decrease due to Verified by Visa helping catch fraudulent transactions before they’re authorized. Liability may shift from you to the issuer if you meet certain requirements for attempting to authenticate transactions through Verified by Visa. If your customers are wary of online credit card fraud, VbV may provide confidence that transactions will be secure and encourage sales. You may be able to reduce interchange fees if your business qualifies according to Visa’s CPS program.

Is Visa 3D Secure 2.0?

In 2017, Visa will roll out 3-D Secure 2.0. Version 1 was based on password authentication and required consumers to sign up before they could use it. Version 1 also used a pop-up window that made customers wary and was problematic for mobile browsers to handle. These issues are partly responsible for sluggish adoption of 3D Secure, and version 2.0 seeks to streamline the process.

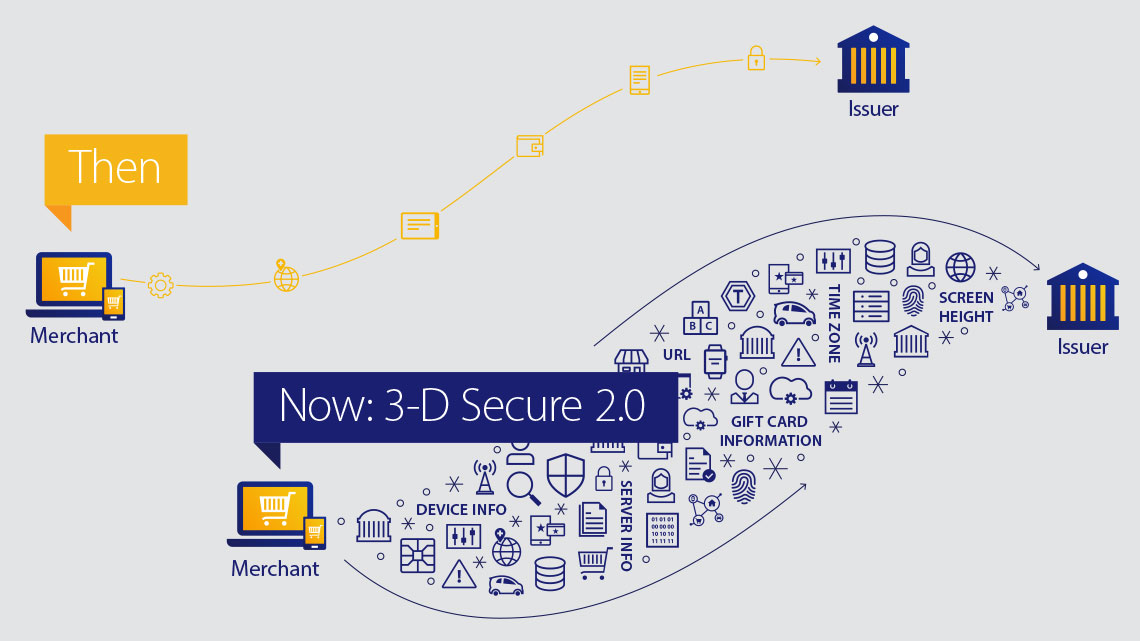

What is Visa 3DS 2.0?

The evolution to the Visa 3DS 2.0 program reflects our commitment to ongoing refinement of fraud prevention tools that both identify fraud and provide a smooth buying experience for cardholders. Visa’s 3DS 2.0 program – now available – offers significant enhancements in e-commerce fraud detection capabilities for issuers and merchants, and can reduce friction for cardholders at checkout.

Why is Visa 3DS 2.0 important?

The proliferation of connected devices has made it easier for consumers to purchase goods and services online, but has also introduced new challenges for combatting online fraud and providing frictionless checkout experiences. Visa’s 3DS 2.0 program addresses these challenges by supporting transactions across a variety of devices while enabling ten times more data to support advanced risk-based decision-making. This can allow for more effective authentication of transactions and lead to higher approval rates and lower shopping cart abandonment. Merchants and issuers can benefit from catching and avoiding fraud more effectively, while consumers can benefit from secure, simple transactions with less friction.

Does Visa have 3D Secure?

Visa has been helping online merchants and issuers identify potentially fraudulent transactions with 3-D Secure (3DS) for nearly 20 years. Since then, a lot has changed when it comes to personal technology, consumer behavior and payments. Mobile phones, tablets and wearables that connect to the Internet have increasingly become omnipresent among consumers globally. Consumers largely enjoy and expect always-on connectivity with mobile devices, which has delivered significant convenience for online shopping and in-the-moment purchase decisions. Lastly, digital payments have accelerated multi-channel e-commerce by enabling simplified payments on hardware and software beyond the PC.

Does Visa have a 3DS test suite?

Additionally, Visa has developed its own 3DS 2.0 Test Suite which vendors will need to complete in order to participate in Visa’s 3DS 2.0 program.

What is 3D secure?

3-D Secure provides extra peace of mind for online shoppers. It is a password-protected authentication system designed to confirm the identity of the cardholder when a Visa card is used online in suspicious or different than usual circumstance (for example, if you're shopping online while travelling). By requesting a password known only to the cardholder, the bank can verify that the genuine cardholder is entering their card details into an ecommerce website. The password may be one that you nominate yourself and must remember, or, it could be a code that your bank sends you via SMS when you are about to make an online payment. It helps to prevent fraudulent transactions and gives all parties in the payment process greater peace of mind, especially when used in conjunction with all the other security features offered by Visa.

Why is Visa important?

It helps to prevent fraudulent transactions and gives all parties in the payment process greater peace of mind, especially when used in conjunction with all the other security features offered by Visa.

Does Visa 3D secure work?

The bank that issued your Visa card will activate 3-D Secure for you automatically. Upon activation, 3-D Secure protects you at every participating online store. When you shop online at a participating merchant, your card will be automatically recognised as protected by 3-D Secure.