How can I pay US visa fee online?

The most convenient payment method for your nonimmigrant visa application (NIV) fee is online with a debit card. Once you log into your profile and while on the payment screen, you can select to pay using a debit card. After you pay the visa application fee, print your receipt for your records.

How do I pay my DS-160 visa fee?

You will need a bank routing number and a checking or savings account number from a U.S. based bank. To pay your fee, log into your case in CEAC and click the 'PAY NOW' button under Affidavit of Support Fee or IV Fee on your summary page.

How do I pay for the visa application fee USA?

The fee(s) will be paid to the Embassy's cashier on the day of the visa interview. Fees may be paid in cash – sterling or dollar equivalent, or by Credit Card – Visa, MasterCard, Diners Club, Discover or American Express. The Embassy does not accept any other credit or debit cards, or personal checks.

How do I pay my visa fee at the bank?

You can pay the visa fees at any branch anywhere in the country, irrespective of the consulate your visa appointment will be at. Ask for the cash deposit slip at the bank. Fill it out completely. Make the cash payment of the exact amount indicated on the deposit slip.

What is MRV receipt number for US visa?

The MRV is a government-mandated visa processing fee that is required to be paid whether your visa is approved for travel or not. The MRV fee is non-transferable and non-refundable in nature. The receipt generated from the payment of the Machine Readable Visa (MRV) fee is termed as MRV Receipt number.

How much is DS-160 fee?

$160The DS-160 fee is $160, which covers the cost to submit your DS-160 F-1 visa application to the US government. This fee is separate from the $350 SEVIS I-901 fee that you pay to the Student and Exchange Visitor Program.

Where is the MRV receipt number?

MRV Receipt and MRV Receipt Number The receipt that is generated following the payment of the Machine Readable Visa or MRV tax is known as the MRV receipt. The MRV receipt number is the unique number found on the MRV receipt.

Where can I find US visa fee receipt?

Whether you schedule your appointment online or contact our call center, you will need the 16-digit visa fee receipt number printed on your receipt. The 16-digit visa fee receipt number is labeled as visa reference in the example below.

How much does a 10 year US visa cost?

How much does a U.S. Multiple Entries Visa R B1/B2 cost? The cost for U.S. 10 YEAR MULTIPLE VISA FEES AND APPLICATION R B1/B2 is USD 160.00. NOTE : Additional fees may be added by the United States government after you receive your visa and interview.

How long is DS 160 fee valid?

(1) yearThis receipt is valid for one (1) year from the date of payment and allows you to schedule your interview at the U.S. Consulate. You must schedule your interview while the receipt is valid, which means your interview must be booked within one (1) year of paying your fee.

Where is bank reference number on US visa?

Enter the 10-digit “Bank Reference Number” from your US Visa Fee Receipt. However, after your receipt is activated, your receipt number will automatically be populated here, and you don't have to enter those numbers here.

Can I pay US visa fee using credit card in India?

The bank draft must be issued in the name of “The American Embassy, New Delhi”, and should be payable in Delhi OR in the name of “U.S. Consulate General, Mumbai” and should be payable in Mumbai. The U.S. Consulate General, Mumbai also accepts credit card payments for immigrant visa fees.

Who fills out DS-160 form?

Who needs to complete Form DS-160? Everyone who plans to visit the United States on a temporary visa, or who is coming to the United States on a K-1 visa in order to get married, must complete and file Form DS-160.

How do I book a US visa appointment?

How to Book Your Visa Interview at the EmbassyStep 1: Complete the DS-160 form online! ( ... Step 2 - Find the embassy nearest to you! ... Step 3 - Pay the non-refundable application fee. ... Step 4 - Schedule your visa appointment! ... Step 5 - Attend Your Visa Interview. ... Step 6 - Pick up your passport with visa.

How can I get DS-160 form?

Where can I find the DS-160? Access the DS-160 here, by clicking: Consular Electronic Application Center website. You may wish to preview a sample DS-160 (10.1MB) before beginning.

What's an annual fee?

An annual fee is the yearly fee charged for some credit card products.

What's an annual percentage rate (APR)?

An APR is the interest rate charged on a credit card expressed as an annualized amount. APRs can vary by the type of transaction. Please see your C...

What's a balance transfer fee?

A balance transfer fee may be charged when you move a part or all of the balance from a non-Bank of America account to your Bank of America credit...

What's a late fee?

A late fee is a penalty fee that's charged if the Total Minimum Payment Due shown on your monthly statement is not received on or before the Paymen...

What's a transaction fee?

A transaction fee is a fee charged when making certain cash advance transactions such as bank or ATM cash advances, check cash advances, balance tr...

What's an interest charge, and when does it occur?

An interest charge is the sum of interest on your credit card account. It is broken down by transaction type: Purchases, Cash Advances and Balance...

What's a periodic rate?

A periodic rate is the interest rate that may be charged by a creditor on a balance for a day, week, month or any subdivision (or period) of a year.

What's the Prime Rate?

The Prime Rate is the rate of interest a bank offers to its most creditworthy customers. The U.S. Prime Rate, as published daily by The Wall Street...

What happens when my credit card is charged with a returned payment fee?

A returned payment fee is assessed if a payment on your account is returned for insufficient funds or for any other reason. The Returned Payment Fe...

What are the fees for using a credit card in a foreign country?

Transactions either made in a foreign currency or made in U.S. dollars and made or processed outside of the United States may be subject to a forei...

How to pay for a non-immigrant visa?

The most convenient payment method for your nonimmigrant visa application (NIV) fee is online with an debit card.

How to schedule an appointment after paying visa fee?

After you pay the visa application fee, print your receipt for your records. Save your receipt with the transaction number. The transaction number will be used to schedule your appointment. It cannot be replaced if it is lost. You will not be able to schedule an appointment without your transaction number.

How to pay MRV fees?

You may pay your MRV Fee using your online bank account. Your bank may apply charges to your account for EFT transactions. If you are applying with your family or group, you may pay the MRV fees in one Bulk payment for all the members.

What is the MRV fee?

visa application. This US Government-mandated fee is a visa processing fee that is payable whether or not a visa is issued.

What happens after you receive a payment?

After receiving your payment, the cashier will give you a receipt. Save your receipt as proof of payment.

Is the MRV fee refundable?

The MRV fee is non-refundable and non-transferable. Applicants should first determine whether or not they require a visa to travel to the US before submitting their applications. Examples of individuals that may not require a visa include, but are not limited to: If you are applying for an A or G visa for official travel, ...

Can I make a CGI payment?

Make only one payment per CGI Reference number as the payment is non-refundable. It is critical that you keep the CGI Reference number that you use to make your online bank transfer. You must have this number as proof of payment in order to schedule your visa interview appointment. It is the applicant's responsibility to save this number.

How to schedule an appointment after paying visa fee?

After you pay the visa application fee, print your receipt for your records. Save your receipt with the transaction number. The transaction number will be used to schedule your appointment. It cannot be replaced if it is lost. You will not be able to schedule an appointment without your transaction number.

How to pay visa fee in Slovakia?

In Slovakia you may pay your visa fee online or in person at any bank. You must first register on the applicant site and choose the ‘schedule your appointment’ option to access the payment option details. See below for the steps.

How to pay MRV fees?

You may pay your MRV Fee using your online bank account. Your bank may apply charges to your account for EFT transactions. If you are applying with your family or group, you may pay the MRV fees in one Bulk payment for all the members.

What is the MRV fee?

visa application. This US Government-mandated fee is a visa processing fee that is payable whether or not a visa is issued.

What happens after you receive a payment?

After receiving your payment, the cashier will give you a receipt. Save your receipt as proof of payment.

Can I make a CGI payment?

Make only one payment per CGI Reference number as the payment is non-refundable. It is critical that you keep the CGI Reference number that you use to make your online bank transfer. You must have this number as proof of payment in order to schedule your visa interview appointment. It is the applicant's responsibility to save this number.

Do you have to pay MRV fee for J visa?

If you are applying for a J visa to participate in a U.S. Government-sponsored program (programs beginning with G-1, G-2, G-3, G-7), you do not need to pay the MRV fee.

How to make a payment to Bank of America?

There are several ways to make payments to your Bank of America credit card in Online Banking. You can go to the Transfers tab and make a transfer from your Bank of America checking or savings account. You can also use our optional Bill Pay service to set up payments from your Bank of America checking or savings account.

How to reduce interest on Bank of America credit card?

You can avoid interest charges altogether on your Bank of America credit card by paying your balance in full and on time each month. Bear in mind, interest is charged from the day you withdraw cash from an ATM or bank and there is a cash advance transaction fee associated with cash advances.

What happens if you overpay your credit limit?

If you're over your credit limit, make sure your payment covers the overlimit amount, plus any fees and interest (you can find out what your estimated interest will be from your card statement).

How to avoid late fees?

You can avoid late fees by setting up a Direct Debit which you can do through Online Banking. Please make sure you have sufficient funds in your nominated bank account or you may incur a fee.

Does Bank of America give free credit counseling?

Besides Bank of America, you can also get free help and credit counseling from Bank of America, as well as a wide range of external resources.

Is it good to pay a small amount of credit card debt?

When it comes to managing credit card and unsecured personal loan debt, it's good to be proactive. Paying even a small amount above the minimum payment could make a big difference in reducing your credit card balances. It also can help to pay consistently and on time.

What is balance transfer fee?

The fee is a component of balance transfer offers that may be available for a new card application or with any existing credit cards you may already have, and it can vary.

What is annual fee?

An annual fee is the yearly fee charged for some credit card products.

How to report a surcharge violation?

If you believe you were charged more than the legal amount and/or the merchant did not display or explain its checkout fee practices, you may report the surcharge violation by contacting the respective payment network listed on the front of your card (for example, Mastercard or Visa).

What is a checkout fee?

A checkout fee is an extra fee that a merchant has the option to add to your credit card or prepaid card transaction, subject to state law. Checkout fees can not be added to debit card transactions, even if credit is selected for the transaction. Bank of America doesn't know which specific merchants will add these fees.

How to get a copy of my credit card agreement?

If you're enrolled in Online Banking, you can easily request your Credit Card Account Agreement: Sign in to Online Banking, select your credit card account and go to the Information & Services tab. Select Request a paper copy online and, depending on your paperless settings, you'll receive a copy in the mail or have online access in 3-5 days (once you have access, you'll find the Agreement by selecting Notifications and Letters in the Statements & Documents tab).

What is a transaction fee?

A transaction fee is a fee charged when making certain cash advance transactions such as bank or ATM cash advances, check cash advances, balance transfers or direct deposits. A transaction fee may also be charged if you make a foreign transaction or if you have overdraft protection on a deposit account that's tied to your credit card. ...

What is interest charge?

An interest charge is the sum of interest on your credit card account. It is broken down by transaction type: Purchases, Cash Advances and Balance Transfers.

Where and how to pay the fee?

As per the US visa service process In India, the US visa fees can be paid in following ways.

How to get a receipt for Stanley visa?

Take the completed fee collection slip to the bank when you pay your fee. After receiving your payment, the bank will give you a receipt. The receipt number will be required to setup your visa interview online at Stanley. Applicants are limited to the number of times they can reschedule their appointments. Please plan accordingly so that you are not required to pay another visa application fee. Visa application fees are non-refundable.

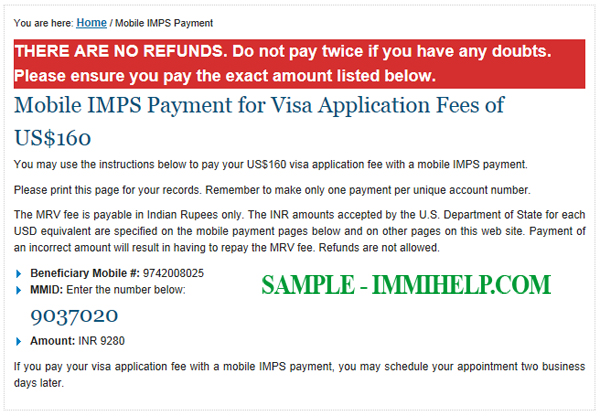

How to initiate IMPS payment?

IMPS payments can be initiated by either sending a text to the bank or via mobile banking application. In order to avoid a delay in scheduling appointments for both interview and fingerprinting, make sure to enter the exact amount as listed on the payment confirmation screen, and correct Beneficiary Mobile Number and Beneficiary MMID number.

How long does it take to schedule an appointment for a visa?

Applicants will be able to schedule their appointment within 3 hours of paying the Visa Fees via IMPS System

Is the visa fee refundable?

USA Visa application fee is non-refundable: Since the US visa is subject to approval, after the visa interview. If your visa is refused, the visa application fee is not refundable. If you want to re-apply you can do so, but must follow the process and resubmit the new application and visa fee.

How long does it take to receive a NEFT?

Please note that under NEFT, the transactions are processed in batches and not real time. Therefore, it may around 2 hours for the recipient to receive the funds.

Do you have to visit the bank to pay for a visa?

Various banks allow either online banking and/or mobile banking facilities. Using this option, you don’t have to visit the bank branch to make your USA visa fee payment. Most banks charge some additional fee for this convenience of NEFT for each transaction.

Do you have to save your credit card number to make a neft payment?

You must have this number as proof of payment in order to schedule your appointment. You must save this number, and it is your responsibility to do so. If you lose that number, you must make another payment.

How much is TSA precheck?

While TSA PreCheck is a little cheaper at just $85, compared with $100 for Global Entry, the Bank of America card was offering a $100 statement credit so it would pay fully for the program.

How much does Global Entry cost?

I had to create a login, pick the program I was interested in, complete my online application, and pay the $100 fee.

How long does it take to get a global entry card?

I was subsequently approved, given my known traveler number immediately, and was told to expect my Global Entry card in the mail within 10 days. That known traveler number also works for TSA PreCheck, which is an added bonus of getting Global Entry.

What credit cards cover global entry?

There are many cards that offer a statement credit for Global Entry, including Chase Sapphire Reserve® various American Express cards, and the Bank of America card I used. There's little reason to pay cash for this out of your own pocket when you could get a credit card that covers it.

Does Austrian Air have TSA precheck?

Finally, a few months later, I was able to use Global Entry for my trip out of the country. Unfortunately, since I was flying Austrian Air and Austrian Air doesn't participate with TSA PreCheck, I still had to go through regular security when departing the country -- Global Entry provided no help at all.

Does top credit card pay interest in 2023?

Top credit card wipes out interest into 2023. If you have credit card debt, transferring it to this top balance transfer card can allow you to pay 0% interest into 2023! Plus, you’ll pay no annual fee. Those are just a few reasons why our experts rate this card as a top pick to help get control of your debt.

What is Bank of America?

Bank of America is one of the biggest retail banks in the United States. As well as its US operations, the bank operates in more than 40 countries around the world. The bank’s wide range of products includes accounts for everyday use, savings accounts, and a range of debit and credit cards. These cover many needs, but some are designed ...

How much does it cost to use an ATM outside the US?

Most of the time, you’ll have to pay $5 every time you use an ATM outside the US. On top of that, there may be a fee from the ATM operator — so costs can quickly add up. One way of saving money is to use one of Bank of America’s international partner banks. If you do this, these fees are waived, though you may still be hit by international transfer fees unless you have certain account relationships.

What is a wise borderless bank account?

We’ll help you decide what will work best for you, including a brief look at a new alternative that works in a different way from a conventional bank account: the Wise borderless account. Without any sign-up and maintenance fees you get access to your own local bank details in the UK, Europe, Australia, New Zealand and the US — so you can get paid and pay like a local. Avoid international transfer fees and keep more of your hard-earned money.

How many currencies can you work with a wise borderless account?

With a Wise borderless account, you can work in over 40 currencies without needing separate accounts, and convert between balances quickly and easily. There’s more about the borderless account a little later, but you can also get the Wise multi-currency debit card.

How many ATMs does Bank of America have?

Bank of America has one of the largest networks of ATMs, with around 16,000 locations at more than 4,000 branches in the US. You can also get fee-free withdrawals abroad if you use an ATM run by one of their partner banks around the world.

What happens when you pay for stuff abroad?

One is the fees charged by the bank upfront, and the other is the exchange rate you’re offered. It’s all too easy to sit back and relax about this, but that can lead to an unpleasant experience once your credit card statement or account summary hit your mat or inbox. Being aware of which exchange rate you’re using while traveling can make things a lot less stressful in the long run.

When you look at an ATM screen, do you always choose to use local currency?

The takeaway from all this is pretty simple: when you’re looking at an ATM screen and you see this choice, always choose to use the local currency.