Can I opt out of Visa Account Updater? Yes, you can to opt out by sending us a secure message in Mobile Banking, giving us a call at 800.562.0999 or stopping by your nearest branch.

What is Visa account updater (Vau)?

What is Visa Account Updater? Visa Account Updater, or VAU, is a service that exchanges updated account information between participating merchants and Visa card issuers. Merchants using stored information for recurring payments can use VAU to boost retention and prevent chargebacks.

Can customers opt out of Visa account updater?

Customers, however, can still opt out. While a buyer may do this out of a misplaced concern for their own privacy, such action could lead to future complications for consumers and merchants alike. One good option is for merchants to notify cardholders upfront about the availability of Visa Account Updater.

Is Visa account updater a good way to protect your credit card?

Avoiding the situation entirely by using Visa Account Updater is a much better strategy. Visa Account Updater is a helpful tool. That’s why, like the Visa Resolve Online system, its use is mandated for card issuers. Customers, however, can still opt out.

What is account updater?

Visa Account Updater ensures that the most accurate billing information is used, not only in the next billing cycle, but in future Visa transactions as well. This process delivers benefits for both merchants and cardholders alike:

See more

Is Visa account Updater legal?

In conclusion, there is no legal requirement for credit unions to provide an opt out option from the Visa Account Updater service for Visa cardholders.

What is card account updater?

Account Updater is a generic term for programs such as Visa's Account Updater or MasterCard Automatic Billing Updater that are offered by the credit card networks to automatically update subscription customer card data when cardholder information changes or goes out of date.

How do I opt out of MasterCard Automatic Billing Updater?

Can I opt out of the Mastercard Automatic Billing Updater? Yes. If you would like to opt out of this service, please call Mission Fed at 800.500. 6328 or visit any branch.

How much does account updater cost?

No charge. You only pay per update. On average, 20-35% of cards update in the first month using Account Updater, with only 7-8% each month after. But in the long run, at only $0.25 per update, your savings should far outweigh the costs.

How does account updater work?

Account Updater is a feature that automatically requests updates for vaulted payment methods in the event that a customer's vaulted card expires or is replaced – helping you avoid failed transactions or gaps in services provided to your customers.

What is real time account updater?

Real time VAU is a new feature in VisaNet that integrates the VAU updates into the VisaNet authorization process for merchant-initiated transactions and enables real-time updates, thereby increasing the value to merchants and improving the cardholder experience by reducing declines.

What is Visa updater?

Visa® Account Updater for Merchants. Visa Account Updater (VAU) is a service that facilitates and encourages customer satisfaction, retention and loyalty by exchanging updated account information between participating merchants and Visa card issuers.

Does MasterCard have account updater?

Mastercard Automatic Billing Updater (ABU) helps card-not-present (CNP) merchants maintain the continuity of card- on-file and recurring payments, increasing customer satisfaction and reducing customer attrition due to payment disruptions.

How does a merchant know my new card number?

How Updater Services Work. Each month, merchants send a list of names and card numbers to their acquirer, or payment processor, who check their data against Visa, MasterCard, American Express and Discover, Lindeen explained. The acquirer lists the cards with updated information, and returns the list to the merchant.

What is Visa phone number?

(800) 847-2911Visa / Customer service

How did Netflix update my credit card?

Sign in to your Account and select Manage payment info. Some payment options will direct you to their website to complete the update process.

Does Wells Fargo have Vau?

USING VISA ACCOUNT UPDATER (VAU) SERVICE We subscribe to the Visa Account Updater Service (VAU Service) and provide updated Card information to the VAU Service.

What is Mastercard Automatic Billing Updater?

Mastercard Automatic Billing Updater (ABU) helps card-not-present (CNP) merchants maintain the continuity of card- on-file and recurring payments, increasing customer satisfaction and reducing customer attrition due to payment disruptions.

What is an updater service?

Updater is a time-saving tool that offers you the ability to forward your mail, update businesses with your new address, share moving announcements with friends and family, connect internet and utilities, and much more – all from one easy-to-use platform.

What is stop payment in VisaNet?

Through this service, issuers can place stop payment instructions in the VisaNet Cardholder Database (CDB) in line with a cardholder's request. When an eligible transaction is matched to a stop instruction during Authorization, a decline response code informs the acquirer that the cardholder has withdrawn their consent for payment to be taken from the card. Acquirers are expected to pass this decline response code through to the merchant, and the merchant is not expected to resubmit the Authorization Request. If the transaction is submitted unauthorized for clearing and settlement, VisaNet will again attempt to match and return the transaction to the acquirer with the corresponding return response code.

What happens if a stop instruction is updated?

A single Merchant or MCC level stop instruction may be updated. If the merchant identifier (such as the CAID) is updated then a new Stop ID will be created. If non-matching criteria (such as Notes) are updated then the original Stop ID will be retained.

What is VSPS in Visa?

The Visa Stop Payment Service (VSPS) enables Visa card issuers to stop card-on-file payments (including recurring and installment payments) from being authorized, cleared, and settled through VisaNet. The service can help to provide Visa issuers with a method for handling cardholder stop payment requests.

How long does a VSPS card last?

This enables a search for VSPS-eligible transactions on a specific card for a defined period of time, from 30 to 180 days. Two years of transaction data are available, to the extent applicable. The data returned will include the merchant identifiers used in previously processed transactions.

Can stop instructions be cancelled?

Existing stop instructions can be cancelled with the help of this API. Used together with the Retrieve Stop Instruction API, this can allow payments for the specified merchant to be restarted and prevent future transactions from being stopped.

Can stop ID be extended?

Can be used to extend the End Date of a stop instruction to keep it active for longer. This may be useful if the merchant is continuing to try to take payment from the card and may help reduce future chargebacks. The original Stop ID will be retained.

What is Visa account updater?

Visa Account Updater ensures that merchants always have access to customers’ current bank information. Using it can save merchants time and hassle while helping maintain customer loyalty. VAU might even play a role in chargeback prevention under certain circumstances.

What happens if your credit card information is outdated?

Outdated account information may lead to declined transactions, cardholder inconvenience…or worse. At the same time, keeping payment information current through any kind of manual processing can be costly, time-consuming, and prone to error.

Why Keep Card Data On-File?

More and more eCommerce merchants are offering to keep customers' payment card data on-file to facilitate future orders. This encourages ongoing purchases with little-to-no effort on either end of the transaction, as well as enabling recurring transactions for regular, passive income.

What happens if a cardholder doesn't inform merchants of a change?

If the cardholder doesn’t make the effort to inform merchants after a change, then subsequent transactions would most likely be denied. This creates a nasty surprise for the merchant, and potentially the cardholder as well. Depending on the situation, the merchant may be forced to confront cardholders.

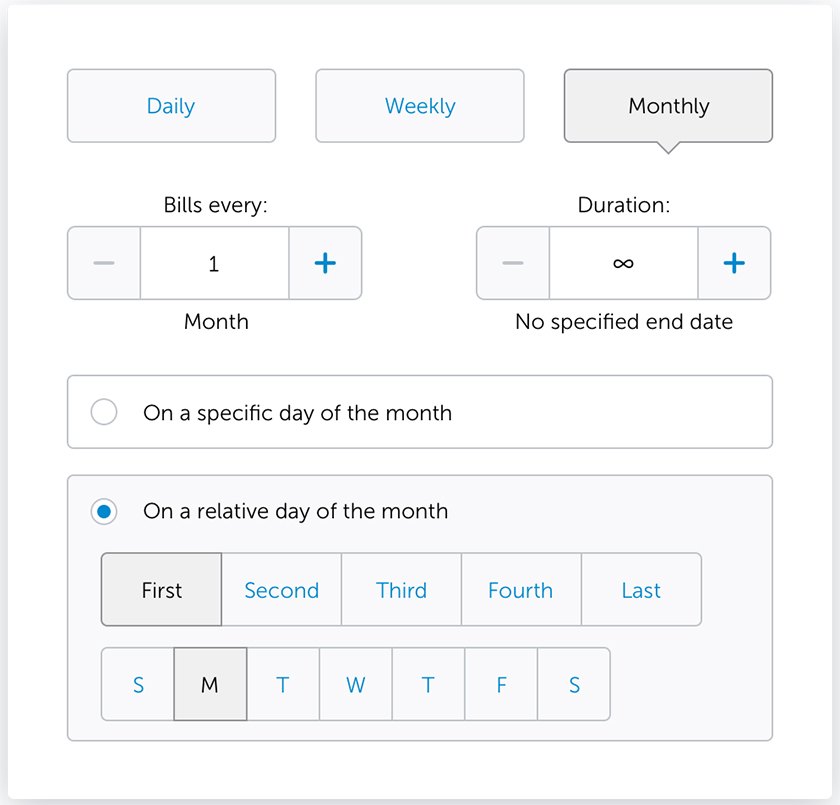

How long does it take for VAU to update billing?

4. VAU forwards the latest data to the requesting merchants, who are then required to update their customer billing files within five days.

Why does my credit card information change?

That can be a problem, as consumer card information changes regularly for many different reasons: The card may have been replaced due to loss or theft. The original card has expired. The cardholder’s account was closed or upgraded. The customer’s name or address changed.

Does Visa account updater affect chargebacks?

Visa Account Updater use generally does not have a direct impact on chargeback volume. There could still be a connection, though, in that VAU can play a significant role in overall customer satisfaction…and unsatisfied customers are much more likely to file chargebacks.