The Capital One Spark is one of the most popular small business credit cards on the market today. Now, cardholders are receiving notice from Capital One that the Spark will switch its payment network from Visa to Mastercard. Here are all the details of the changes with the Capital One Spark for Business card.

What's the minimum Capital One Spark Business credit limit?

Companies that require regular travel may prefer Capital One Spark Miles for Business to its cash back siblings. The card's minimum credit limit is $5,000, so we expect a maximum limit similar to that of the Capital One Spark Cash for Business, $30,000 to $60,000.

What is Capital One rewards program?

Starting tomorrow, March 24, the issuer will bring “Capital One Entertainment” to life — an all-new online ticketing platform that allows cardholders to find and redeem their rewards for tickets to more than 500,000 events. This is yet another new ...

Is Capital One Quicksilver visa or MasterCard?

Is Capital One Quicksilver a Visa or Mastercard? Capital One Quicksilver could either be a Visa or a Mastercard. Capital One issues cards on both networks, but there is no way to choose which network your new card will be on. The card network for your new card isn't based on your credit score, card terms, rewards or credit limits either.

Why can't I access my Capital One account?

If your Capital One credit card is currently restricted, one reason could be that you’ve spent over the limit. You can check your credit card activity if you have access to online banking or call customer service.

See more

What type of credit card is Capital One Spark?

charge cardThe Capital One Spark Cash Plus Credit Card is a charge card, meaning that there is no predetermined spending limit. However, that does not mean you can spend an unlimited amount on the card. Your spending limits are determined by several factors, including spending history, credit score and more.

Is a Capital One card a Visa card?

Is Capital One Visa or Mastercard? Capital One issues Visa credit cards and Mastercard credit cards both.

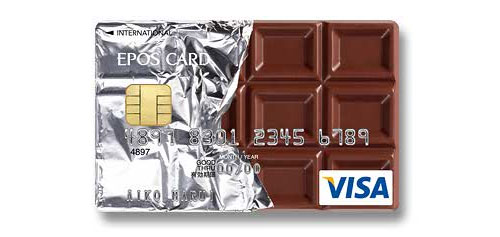

Is Capital One Visa changing to Mastercard?

Some Capital One Visa cards have changed from VISA to Mastercard in recent years, including the Capital One Quicksilver Cash Rewards Credit Card. This change only applies to new accountholders, though, and it is not a universal switch for all Capital One Visa cards.

Which is better Visa or Mastercard?

For most people, it doesn't really matter whether they get a VISA or a MasterCard. Both are equally secure and offer similar benefits. While VISA has a slightly higher market share and greater amount of transactions worldwide, both VISA and MasterCard are equally well-accepted by merchants.

Is Capital One Debit Card Visa or Mastercard?

The Capital One Debit Mastercard® is directly connected to your 360 Checking account. Why contactless? The contactless 360 Checking debit card is faster and safer than paying with cash—plus, you don't need to touch surfaces or leave your card inserted. Just tap, pay and be on your way.

Why has my Visa card changed to MasterCard?

Massive change for millions of Visa debit card holders due to war on fees – what you need to know. MILLIONS of people have had their Visa debit cards replaced by Mastercards amid an industry war against the payment giant.

What is the difference between MasterCard and Visa card?

The only real difference that stands between Visa and Mastercard is that your card works on the payment network that the company operates. A Visa card won't work on Mastercard's network, and vice versa. Ultimately, any other differences in cards come from the specific card you have.

How many credit cards should a person have?

It's generally recommended that you have two to three credit card accounts at a time, in addition to other types of credit. Remember that your total available credit and your debt to credit ratio can impact your credit scores. If you have more than three credit cards, it may be hard to keep track of monthly payments.

Is Walmart Capital One a Visa or Mastercard?

Card Type. The Capital One Walmart Rewards Mastercard* is a co-branded cash back credit card. Unlike some retail cards, you're not limited to only purchases at Walmart. Since it's a Mastercard credit card, you can use it anywhere Mastercard is accepted — and you'll even earn bonus rewards in some non-Walmart categories ...

What type of card is Capital One Quicksilver?

The Capital One Quicksilver Cash Rewards Credit Card is a simple cash back credit card that can rack up a lot in rewards over time. The card offers 1.5% cash back on every purchase, plus a one-time cash bonus of $200 after you spend $500 on purchases within 3 months from account opening.

What kind of card is Capital One Platinum?

The Capital One Platinum Credit Card is a card worth considering for those looking to establish or build credit. It comes with a $0 annual fee and no foreign transaction fee. But without a rewards program or other perks, it's got a limited shelf life once your credit improves.

Maria Adams, Credit Cards Moderator

This answer was first published on 12/14/21. For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Editorial and user-generated content is not provided, reviewed or endorsed by any company.

Capital One Spark Business Credit Cards by Card Network

There are a few differences between Visa and Mastercard credit cards, such as the network-level benefits they offer, but those differences are relatively small. The two card networks have a lot in common, including extensive worldwide acceptance.

Employee Cards

Authorized users can make purchases on behalf of the business. They can track their own spending and monitor their card activity, but they can’t view overall account details.

Explore Employee Card Benefits 1

Manage users from your laptop, tablet or mobile device. Take care of your account while working or even when you're on the go.

Manage Employee Spending

Manage employee spend and cash limits. You can reset an employee’s spend limit at any point during the billing cycle.

Frequently Asked Questions

No, we do not check credit score for authorized users or account managers since they are just being added to the account.

Not what you're looking for?

Take a peek at our Spark business cards to find the right card for your business.

People also ask

Capital One Quicksilver could either be a Visa or a Mastercard. Capital One issues cards on both networks, but there is no way to choose which network your new card will be on.

WalletHub Transparency

We are committed to being fully transparent with our readers. Opinions expressed here are the author’s and/or WalletHub editors'. WalletHub editorial content on this page is not provided, commissioned, reviewed, approved or otherwise endorsed by any company. In addition, it is not any company’s responsibility to ensure all questions are answered.

Popular Content

WalletHub Answers is a free service that helps consumers access financial information. Information on WalletHub Answers is provided “as is” and should not be considered financial, legal or investment advice. WalletHub is not a financial advisor, law firm, “lawyer referral service,” or a substitute for a financial advisor, attorney, or law firm.

What is Spark 2% cash back?

With unlimited 2% cash back on purchases, the Spark 2% Cash Plus * is an excellent business cash-back card for those with strong credit. The annual fee of $150 is palatable compared to many high-end card fees.

How much cash back does Spark Cash Plus give?

The Spark Cash Plus earns 2% cash back for your business on every purchase. There’s also a welcome bonus of $500 after spending $5,000 in the first 3 months of account opening, plus an additional $500 if $50,000 is spent in the first 6 months.

What are the advantages of a charge card vs a credit card?

The pluses include a generous and easy to manage 2% cash back for your business on every purchase which can give you some wiggle room if you need to make a larger-than-usual purchase from time to time (note this is not the same as no credit limit and Capital One will determine how much leeway you’ll get based on a combination of factors).

How much are Chase Ultimate Rewards points worth?

Ultimate Rewards points are worth 1.25 cents each when redeemed for travel through Chase Ultimate Rewards and can also be transferred at a 1:1 ratio to airline and hotel partners like United and Hyatt. Redemption for cash back is possible at a value of 1 cent per point.

Does Capital One Spark Cash Plus have a late fee?

But for anyone looking for extra time to pay off a big purchase, the Capital One Spark Cash Plus card is not a fit. In fact, not only do you have to pay your bill in full at the end of every month, but you’ll also be charged a late fee of 2.99% of your outstanding balance and your account will be considered late until you pay off what you owe. And, know that you’d have to spend $7,500 annually on the Spark Cash Plus to break even with the $150 annual fee.

How many points does Chase Ink Business Preferred have?

Those looking to dive deeper into the rewards-earning space should consider the Chase Ink Business Preferred. It offers 3 points per dollar on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per dollar on all other purchases.

Does Capital One Spark Cash for Business offer cash back?

The Capital One Spark Cash for Business offers unlimited 2% cash back on purchases. This alone makes it a worthwhile choice, but the high-end benefits offered by Capital One only sweeten the deal.

How many Capital One Spark credit cards are there?

There are six different Capital One Spark credit cards, and each of them require a different credit score for approval.

What is Capital One Spark Cash Plus?

The Capital One Spark Cash Plus Credit Card is a business credit card that earns 2% cash back on all eligible purchases and has no pre-determined spending limit. This card is excellent for small business owners who consistently make large purchases and don’t want the fuss of tracking points and miles.

Which is better, Capital One Spark Cash Plus or Chase Ink Business Cash?

If an established credit line is bothersome and you need flexibility to spend as needed, the Capital One Spark Cash Plus is likely the better of the two. If you feel that you can earn more cash back by taking advantage of the cash back categories, consider the Chase Ink Business Cash® card for your wallet.

How many points are there for every $150,000 spent?

3X points for every dollar spent on the first $150,000 spent in combined purchases in the following categories each account anniversary year — Shipping purchases, advertising purchases made with social media sites and search engines, Internet, cable and phone services and travel

Is Chase Ink a good credit card?

The Chase Ink Business Cash® Credit Card is an excellent choice for a business credit card as it earns up to 5% cash back using a tiered cash-back system. As you spend on the card, you will earn:

Can you redeem Capital One cash back?

Redeeming Capital One cash back is extremely simple.

Is the welcome bonus with the card straight forward?

The welcome bonus with the card is straight forward, but requires a large spending budget to maximize it.

How much is Capital One Spark Cash for Business?

The Capital One Spark Cash for Business card comes with a bonus offer of $500 after you spend $4,500 in the first three months. If you include the 2 percent cash back you’ll earn on the way to the sign-up bonus, that pushes your initial earnings to $590 in the first three months ($500 for the bonus and $90 earned via card spend).

How does the Spark Cash Plus card compare to other business cards?

The Spark Cash Plus card delivers terrific value despite its annual fee, offering a generous sign-up bonus, one of the best flat cash back rates you can find on a business card and a terrific annual bonus for big spenders.

What is Spark Cash Plus?

The Spark Cash Plus card is a terrific option for small-business owners looking for a simple way to earn cash back on almost everything they buy. It should be an especially great fit for heavy spenders thanks to its annual bonus and flexible spending limits, but the card’s generous flat cash back rate means even the average small-business owner shouldn’t have much trouble justifying the card’s annual fee.

How often can you redeem Spark Cash Plus?

You can even set cash back to be redeemed automatically once per year on a specified date or when you reach $25, $50, $200, $500 or $1,500 in rewards. Considering some issuers only let you redeem rewards for cash back as a statement credit, the Spark Cash Plus definitely earns points with its redemption variety.

What is a virtual card number?

Virtual card numbers – You can get an added layer of protection against fraud when using your card online with a virtual card number from Capital One. Virtual card numbers allow you to make online purchases without sharing your actual card number or paying through a third-party site like PayPal. This also gives you extra peace of mind in the event of a data breach at a company that’s used your virtual card number.

How much does a credit card charge for foreign purchases?

Most cards charge a 3 percent fee for foreign purchases, which can add up over a long trip. With this card, you can conveniently use your card just as you would at home without having to worry about the extra fees.

What does "See my approval odds" mean?

When you click “See my approval odds” we’ll run a soft credit check to determine if you have Excellent, Good, Low, or Poor odds of being approved for cards on our site. Approval Odds serves as a guide to help you find the right credit card and will never affect your credit score.

What does the N#Company require?

For an item damaged or totally destroyed due to an accident, the #N#Company will require an incident report from the police or First #N#Responder stating that the item claimed was actually damaged #N# or destroyed. #N#

Do I need to file a claim with my insurance company?

If You have personal insurance (i.e., homeowner’s, renter’s, or other insurance applicable to the lost or stolen luggage or contents), You are required to file a claim with Your insurance company and submit a copy of any claim settlement along with Your completed claim form. If the claim amount is within Your personal insurance deductible, the Benefit Administrator may, at its discretion, deem a copy of Your personal insurance Declarations Page to be sufficient.