Capital One is a bank branch network and does not have a Visa or Mastercard connection. Do Capital One Cards Work Everywhere? Whenever a MasterCard is accepted, you can pay with the Capital One Quicksilver card.

Is Capital One visa a good credit card?

When it comes to simplicity and strong rewards, the Capital One Venture Rewards Credit Card is a solid choice for most travelers. You’ll earn earns 2 miles per dollar on every purchase with no bonus categories to memorize, making it an ideal card for those with busy lives.

Is Capital One a bad credit card?

Capital One does have a non-store card for bad credit, though: the Capital One Platinum Secured Credit Card. You can get it with a bad credit score, and there’s a $0 annual fee as well as a $0 foreign transaction fee. You just have to place a security deposit of $49, $99 or $200, depending on your credit history.

Does Capital One online offer visa or MasterCard credit cards?

Unfortunately, there are no Capital One Visa credit cards for people with bad credit available right now. And unless you’re a college student, you won’t be able to get one with limited or fair credit, either. Fortunately, however, there are options for all of those groups among Capital One’s Mastercard credit cards.

Is a capital one card a visa or MasterCard?

Capital One credit cards can be either a Visa or Mastercard since the bank uses both card networks. The same logic also applies to Citibank credit cards, though most Citi cards will use the Mastercard payment network. Some cards feature one specific network, while others depend on when the card is issued. ...

See more

Is Capital One changing from Visa to Mastercard?

The Capital One Spark is one of the most popular small business credit cards on the market today. Now, cardholders are receiving notice from Capital One that the Spark will switch its payment network from Visa to Mastercard.

Is Capital One Platinum a Mastercard or Visa?

MastercardThe Capital One Platinum Credit Card is a Mastercard, not a Visa. You can use your Capital One Platinum Mastercard at nearly 11 million merchants that accept Mastercard nationwide, and you can use it abroad in more than 200 countries and territories.

What credit cards does Capital One Bank?

Capital One QuicksilverOne Cash Rewards Credit Card: Best for fair credit. Capital One Quicksilver Student Cash Rewards Credit Card: Best overall for students. Capital One Venture X Rewards Credit Card: Best for premium travel benefits. Capital One Platinum Secured Credit Card: Best for consumers with bad credit.

Is Capital One Bank a Mastercard?

Mastercard Credit Cards from Capital One.

What's the highest credit limit on Capital One?

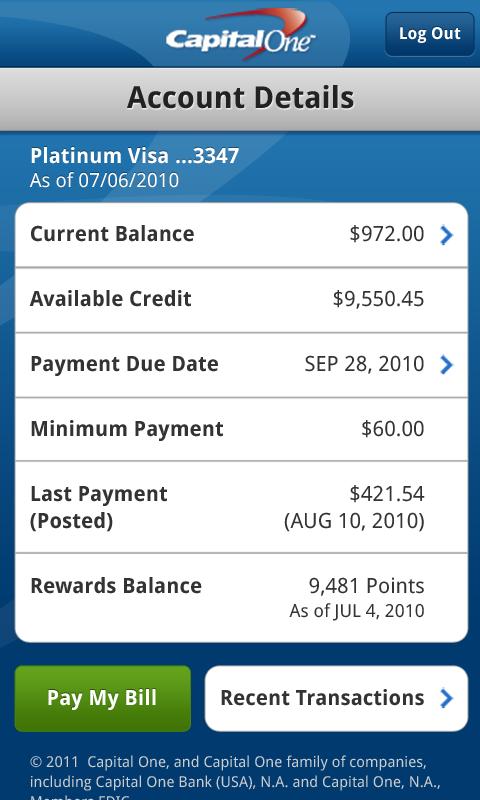

Almost all cardholders have credit limits between $1,000 and $10,000, with over a third at $3,000 or less. The Capital One QuicksilverOne Cash Rewards Credit Card is aimed at consumers with fair credit or worse. Top credit limits probably range from $2,000 to $5,000.

What is the highest credit limit on a Capital One Platinum card?

The Capital One Platinum maximum credit limit can be as high as $3,000 according to online cardholder reports, but it will depend entirely on the specifics of each applicant's credit and their overall financial situation. Most cardholders get credit limits of at least $300, though.

Is Capital 1 a good credit card?

The Capital One Platinum Credit Card is a solid option for those with average credit. It has an annual fee of $0 and also charges no foreign transaction fees. But for many, its standout feature may be that it also offers the chance to earn a higher credit limit after making on-time payments in as little as six months.

Is Capital One a good credit card to build?

Capital One Platinum Secured Credit Card is an extremely good credit card for building or rebuilding your credit score. The Capital One Platinum Secured card does not charge annual or monthly fees, and it reports account information to all three major credit bureaus on a monthly basis.

How many credit cards are too many?

How many credit accounts is too many or too few? Credit scoring formulas don't punish you for having too many credit accounts, but you can have too few. Credit bureaus suggest that five or more accounts — which can be a mix of cards and loans — is a reasonable number to build toward over time.

Is Capital One debit card Visa or Mastercard?

The Capital One Debit Mastercard® is directly connected to your 360 Checking account. Why contactless? The contactless 360 Checking debit card is faster and safer than paying with cash—plus, you don't need to touch surfaces or leave your card inserted. Just tap, pay and be on your way.

What are the cons of Capital One?

Pros and consProsConsStrong digital banking platform Good for travel Competitive savings rates Separate accounts for children Receive paychecks up to 2 days sooner with early direct depositNo money market accounts Might have to deal with out-of-network ATM feesMar 18, 2022

Where is Capital One accepted?

You can use your Capital One credit card almost anywhere they take credit cards as a payment method. Capital One issues Visa and Mastercard credit cards as well, which are the two most widely accepted card networks worldwide. Both can be used in more than 200 countries.

What type of card is Capital One Platinum?

The Platinum credit card by Capital One is a no-annual-fee card without many surprise costs. The fees it does charge, such as for late payments and cash advances, are industry standard.

Is Capital One Platinum Card a credit card?

Capital One Platinum is a great credit card for people who are new to credit because it has a $0 annual fee and reports to the major credit bureaus each month. Responsible use of the Capital One Platinum Card could therefore take you from no credit to good credit at no cost.

Can you withdraw money from a Capital One Platinum credit card?

Yes, you can use your Capital One Platinum at an ATM. You can either do that for cash withdrawals (cash advances) or credit card payments. If you want to use an ATM to get a cash advance, keep in mind that you will need a PIN (Personal Identification Number).

What credit score do you need for Capital One Platinum?

580A: The Capital One Platinum Credit Card is deshigned for fair credit, so you may need a FICO credit score of at least 580 to qualify. But it's possible you'll be approved with a lower score.

How many points do you get for travel on a business card?

Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

How much back in bitcoins do you get on a card?

Earn 2% back in bitcoin on every purchase over $50,000 of annual spend. Rewards rate increases from 1.5% to 2% after $50,000 of spend has been achieved and resets on the card anniversary date every year.

Is a Visa prepaid card safe?

A Visa prepaid card could be the way to go. Its a more secure, convenient solution to everyday spending.

Does Visa give compensation?

Card information is provided by third parties. Visa may receive compensation from the card issuers whose cards appear on the website, but makes no representations about the accuracy or completeness of any information. Please be sure to carefully review all terms and information in connection with the application process. For more information regarding the terms and conditions of any card, click 'Apply', 'Buy Online' or 'Terms and Conditions'.

What is the best Capital One Visa?

The best Capital One Visa is the Capital One Venture Rewards Credit Card. Its initial bonus is 60,000 miles for spending $3,000 in the first 3 months. This card also gives 2 miles per $1 spent on all purchases. Its annual fee is $39.

How much is the Capital One Visa bonus?

It offers a bonus of $300 for spending $3,000 in the first 3 months. And it gives 4% cash back on dining, entertainment and popular streaming services, 3% back at grocery stores and 1% back on all other purchases, as well as 8% back on tickets at Vivid Seats through January 2023. It has a $95 annual fee. The best Capital One Visa is the Capital One ...

What is a major credit card?

Major credit cards are any cards that belong to one of the big four credit card networks: Visa, Mastercard, American Express and Discover. That’s what stores mean by “we accept all major credit cards.”. A major credit card will almost always show the logo of its network on the front. In som.

What is the starting credit limit for Capital One?

What is the starting credit limit for a Capital One credit card? There is no general starting credit limit for all Capital One credit cards. However, some Capital One cards list a minimum credit limit in their terms. For example, the minimum credit limits for the Cabela's Credit Card, the Bass Pro Shops® Credit Card, ...

Where is the credit card logo on my credit card?

You can usually see the logo of your credit card network on the front of your card. Sometimes it is on the back. If there is no logo, you likely have a store card that only works at a specific retailer. Most U.S. merchants accept all major credit cards.

Is a Visa card considered a major credit card?

So a Visa, Mastercard, American Express or Discover card from one of those companies, like Chase or Capital One, might fit the description of a major credit card best.

Is Discover card accepted everywhere?

Visa and Mastercard are accepted virtually everywhere in the world. Discover cards work in 185 countries and territories. American Express cards work in 160+. Discover and Amex aren’t necessarily widely accepted in all the countries that take them, either.

What are the benefits of Capital One Visa?

The benefits of Capital One Visa credit cards include several types of travel insurance, concierge services, purchase protection and extended warranty. To know which perks are included on a specific card, you'll need to call customer service at the number on the back of your card. Alternatively, you can log in to your Capital One online account, select your account and click "Read about Card Benefits" under the "I Want To" menu.

What is the best Capital One Visa card?

The best Capital One Visa credit card has to be the Venture Rewards Card. It’s one of the best overall credit cards from any issuer, earning a perfect 5-star rating from WalletHub’s editors. And it’s obvious why. Venture offers very versatile, lucrative travel rewards and doesn’t charge an arm and a leg for its many perks.

How to file a claim for Capital One Quicksilver?

The number to call and timeline depend on the benefit and the type of card you have. For specific information on your Capital One Quicksilver travel insurance, just log in to your online account, select your card and click "Read about Card benefits" under the "I Want To" menu. Then match the card type to the one listed on your statement. Capital One travel insurance is provided through the card network, so depending on your type of card, you can call Visa ( (800) 847-2911) or Mastercard ( (800) 826-2181) for more information.

What is Capital One?

Capital One (a WalletHub partner) is the fifth largest U.S. credit card issuer, offering cards with great rewards, rates and fees to people of all credit levels. … show more. And Visa is one of only two card networks, along with Mastercard, that offer truly worldwide acceptance.

What is a card network?

A card network is simply the company that helps process credit card transactions and determines where a card is accepted. Having said that, both Visa and Mastercard benefit from the most extensive worldwide acceptance, so you’ll have no problems using your Capital One Quicksilver, regardless of its card network.

Which Capital One card gives the most cash back?

The best Capital One Visa card for cash back is the Capital One Quicksilver Cash Rewards credit card.

How to contact Capital One Travel Insurance?

Capital One travel insurance is provided through the card network, so depending on your type of card, you can call Visa ( (800) 847-2911) or Mastercard ( (800) 826-2181) for more information. show more show less. 5 0.