How do I contact Cash App?

How do I call Cash App Support on the phone? If you are unable to get help through Cash App or cash.app/help, you can reach us by calling 1 (800) 969-1940. In addition to, you can reach us by mail at the address below: Cash App. 1455 Market Street Suite 600. San Francisco, CA 94103.

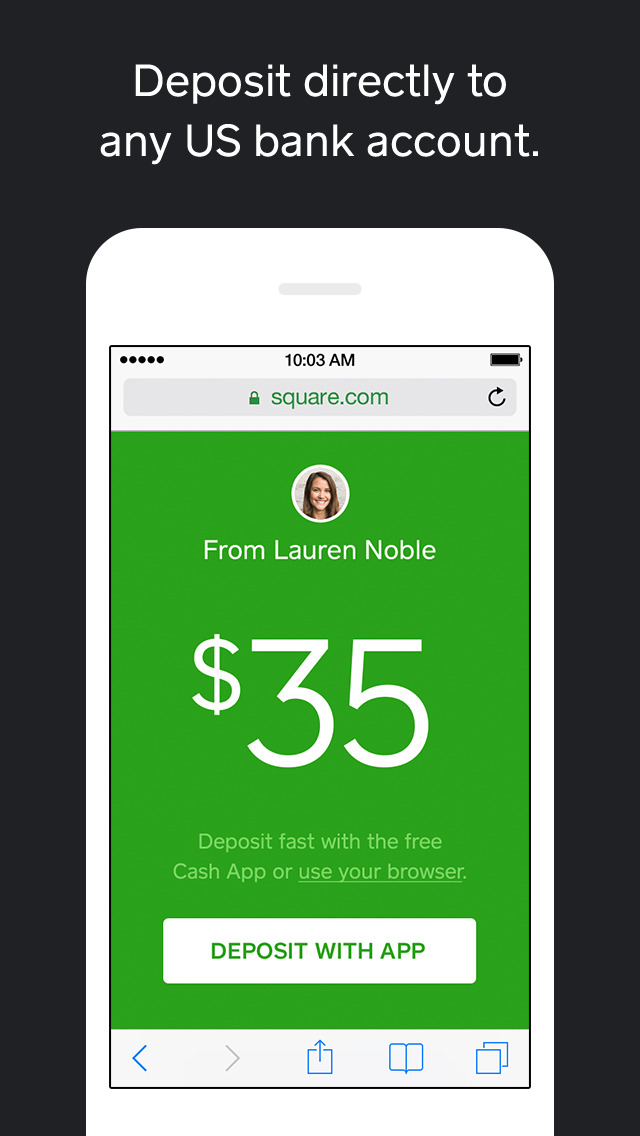

Can I deposit money into cash app?

You can deposit paper money into your Cash App balance at participating retailers. Deposit Locations Paper Money Deposits are currently supported at the following merchants: Walmart (Customer Service Desk/ Money Centers) Walgreens 7-Eleven Family Dollar Sheetz KwikTrip Speedway StopNGo Dollar General

Is Cash App considered a bank?

Cash App’s functionality may walk and talk a bit like a bank, but there is a clear distinction between the app and a bona fide, bank-chartered financial institution.

How do you sign up for Cash App?

- Download the Cash App from your app store

- Create a username and password

- Enter in your personal information (name, email address, birth date)

- Add a bank account so you can start sending and receiving money instantly!

- After adding your bank account, add some funds to get started with $100 or more

- You're ready to start using Cash App today!

Is Cash App Visa or debit?

The Cash App debit card is connected to your balance, and the card can be used anywhere that accepts Visa. If you use your debit card at an ATM, Cash App charges a $2 fee.

What bank does Cash App Visa card use?

The card is issued by Sutton Bank and is unique to a user's Cash App account. It isn't connected to a personal bank account or another debit card. Free ATM withdrawals if you set up direct deposit.

What brand card is Cash App?

Visa debit cardWhat's the Cash Card? The Cash Card is our Visa debit card, issued by Cash's partner banks. You can use it to pay online and in-store from your Cash App balance.

Is Cash App a bank card?

Contact us. Cash App is a financial platform, not a bank. Banking services provided and debit cards issued by Cash's bank partners.

What is the Cash App limit?

Cash App lets you send up to $250 within any 7-day period and receive up to $1,000 within any 30-day period. You can increase these limits by verifying your identity using your full name, date of birth, and the last 4 digits of your SSN.

Can you borrow from Cash App?

Does Cash App Let You Borrow Money? Yes, Cash App makes loans of $20 to $200, according to a 2020 TechCrunch article. Cash App tested the Borrow feature with a limited roll-out to 1,000 users.

Do I need a bank account for Cash App?

You can set up Cash App without a Bank Account, but you will face some drawbacks. Users can get money off Cash App without a typical credit or debit card by using a Cash App Card. Cash app allows for money withdrawal and other services without a bank account or card.

Can you withdraw cash from Cash App card?

You can use the Cash App card, called the Cash Card, at retailers in the US that accept Visa, and to withdraw money from your ATM without an additional fee.

Is Cash App a prepaid card?

“Card” means the Cash App Visa® Prepaid Card issued by Bank through which you can make purchases and cash withdrawals as described in Section 18.

What's the bank name for Cash App?

About Sutton Bank The Bank has full availability of products, including savings and checking accounts, money market accounts, credit cards, IRAs, CDs, and mortgages. Sutton Bank is also the card issuer for Cash App but has also partnered with other fintech companies: Robinhood.

What are the disadvantages of Cash App?

Drawbacks: There's a fee to send money via credit card. Cash App charges a 3% fee to people who use a credit card to send money. A fee for instant deposits.

Why can't I borrow money from Cash App?

If you see the “Borrow” option in your account, it means you're eligible. Beyond that, an official CashApp specialist tells Redditors that these factors could be to blame: State of residence — Cash App Borrow isn't currently available to all US residents.

What banks link to Cash App?

Cash App supports debit and credit cards from Visa, MasterCard, American Express, and Discover. Most prepaid cards are also supported, but depositing to these cards does not work.

What bank is Cash App on plaid?

Lincoln Savings BankThe Cash App platform works through Lincoln Savings Bank as the primary financial institution to connect with Plaid. However, the payment partnership service works with almost every financial institution in the country; it connects with more than 10,000 banks, and some of them are as follows: Acorns.

What prepaid cards work with OnlyFans?

Payment Methods OnlyFans Does Not Accept Moreover, OnlyFans will not accept cards — including prepaid cards — that do not have 3D Secure authentication. This is an advanced security feature that passes data between the merchant, the card issuer, and the cardholder.

Can I log into Sutton Bank with Cash App?

Your Cash App transaction history is NOT accessible through our Online Banking service, as your Cash App account is not held with Sutton Bank.

Design a debit card to match your style

Cash Card is the customizable, fee-free debit card. Use it everywhere to earn instant discounts on everyday spending.

Speed up your direct deposits

With a Cash App account, you can receive paychecks up to 2 days early. Plus, ATM withdrawals are free when you have at least $300 coming in each month. 1

Your money is your own business

Cash App uses advanced security features to protect millions of people and payments each year. From verification locks to data encryption, we take steps to make sure your money and information are safe.

How Cash App works

You can add funds to your Cash App account using a debit card linked to an existing bank account. You can also transfer funds from your Cash App account to your bank account, a process that usually takes two to three days.

How to change your Cash App PIN on an Android or iPhone

Steven John is a freelance writer living near New York City by way of 12 years in Los Angeles, four in Boston, and the first 18 near DC. When not writing or spending time with his wife and kids, he can occasionally be found climbing mountains. His writing is spread across the web, and his books can be found at www.stevenjohnbooks.com.

SEE ALSO: The best iPhone for every type of person and budget

It indicates an expandable section or menu, or sometimes previous / next navigation options.

How long does it take for a cash app card to arrive?

And finito - that’s it! Your card should arrive within no more than 10 business days.¹ “But how do I use my Cash App card?” you might be thinking.

What is Cash App 2021?

Cash App - Additional Cash Terms of Service (Restricted account) All sources checked on 03 June 2021. This publication is provided for general information purposes only and is not intended to cover every aspect of the topics with which it deals. It is not intended to amount to advice on which you should rely.

What to do if your cash card doesn't have a QR code?

If your Cash card doesn’t have a QR code then don’t worry - you can still be part of the gang! What you’ll have to do is activate your Cash App card using the CVV codeinstead. To do that, you’ll need to:

Is Cash App easy to join?

If you want to join the Cash App card club, then you’re in luck - the process is quick and easy.

Do cash cards charge fees?

Overall, there are very few instances where your Cash card will be charged fees. But, for instant deposits and ATM withdrawals you will be liable to pay some fees. Read more about Cash App fees.

What Is Cash App?

Cash App is a mobile app-focused money transfer service. You can send and receive funds directly and quickly, like you could with PayPal or Venmo. But Cash App features a few other functions as well.

How long does it take for cash app to deposit money?

The cash deposits into your debit card instantly, but it can take up to 3 days for a deposit to hit your account.

How does a cash transfer work?

You send the cash, then the person you’re sending to will receive an email or text alert. The recipient chooses how fast the transfer goes through.

Does Cash App have drawbacks?

However, Shuchman notes that Cash App also comes with drawbacks for investors.

Can cash app payments be cancelled?

Cash App payments are encrypted, most payments are made instantly, and usually the payments cannot be cancelled once the money is sent. This definitely leaves room for fraud and other crimes of social engineering.

Is Cash App a cybercrime?

Sattar also notes that Cash App users can be susceptible to some forms of cybercrime, due to the digital nature of the payment service: “As with any internet-based technology, Cash App is susceptible to sniffing attacks. For example, if someone claiming to help you asked you to share your screen, do not do it.

What is Cash App?

Cash App is a peer-to-peer payment app created by Square, Inc. in 2013. The mobile app is available for iOS and Android and is widely popular. In June alone, more than 30 million people used the Cash App for transactions, and it’s ranked No. 1 in the App Store finance category.

How good is Cash App?

Cash App gets high praise from users who give it a 4.5-star rating in the Apple App Store. If you’re thinking about downloading it, this Cash App review will cover how it works, who it’s for, and whether it’s safe to use.

How does Cash App work?

Cash App has four main functionalities: sending money, receiving money, mobile banking, and investing. Here’s how each one works:

What is the best app to send money to a roommate?

Cash App is one of the best money apps for person-to-person transactions between friends and other people you trust. There’s no need to remind your roommate to pay their share of the rent or utilities each month. Instead, you can just send them a Cash App payment request. There is, however, a location limitation.

How long does it take for cash to deposit into your bank account?

A standard deposit shows up in your bank account within one to three business days, whereas an instant deposit to your debit card happens instantly but has a 1.5% rush fee.

What is the best app for money?

Cash App is one of the best money apps for person-to-person transactions between friends and other people you trust. There’s no need to remind your roommate to pay their share of the rent or utilities each month. Instead, you can just send them a Cash App payment request.

How much does it cost to use a cash card at an ATM?

There’s a $2 fee if you use the Cash Card at an ATM, plus the ATM servicer may charge a fee as well.