Is a Chase Sapphire card a visa or MasterCard?

Since Chase Sapphire Preferred is a Visa, you can use it pretty much everywhere in the world credit cards are accepted. Using a Visa or a Mastercard is the best way to convert currency when traveling internationally, too, thanks to low exchange rates that could save you as much as 9%. Plus, Chase is one of the few major credit card companies that will send you a free replacement if you lose your card while out of the country.

Does Chase Sapphire preferred have cash back?

It earns 5% cash back on rotating quarterly categories (on up to the first $1,500 in purchases, upon activation) in addition to rewards for other spending. You could potentially move the rewards you earn on that card to the Chase Sapphire Preferred® Card.

What is Chase Sapphire foreign transaction fee?

Chase Sapphire Foreign Transaction Fee: Chase Sapphire cards are popular choices for travelers as both Chase Sapphire Preferred and Reserve have $0 foreign transaction fee. Both offer bonus points, extra points for travel and dining, and premium travel benefits.

What is Chase Sapphire Reserve phone number?

There are several methods for contacting Chase customer service for Sapphire cardholders. The Chase Sapphire Reserve customer service phone number is: 1-800-436-7970. You can also call the number on the back of your card.

See more

What type of card is Chase Sapphire?

travel rewards cardCard Summary The Chase Sapphire Preferred Card is a popular travel rewards card – and for good reason. It offers bonus rewards for travel and dining, with options for redeeming points at an outsized value.

Is Chase Sapphire a Visa Signature?

For example, the Chase Sapphire Preferred® Card is a Visa Signature, but its rental car coverage is primary. With primary insurance, you don't have to involve your own issuer at all if a rented vehicle is damaged or stolen. The CDW covers only the rented vehicle.

Is Chase Sapphire a credit card or debit card?

Explore premium dining and travel rewards with a Chase Sapphire® credit card.

Is Chase Sapphire a travel card?

The Chase Sapphire Preferred® Card is one of the best travel cards due to its generous sign-up bonus complemented by good earning rates on travel and dining and points that can be flexibly redeemed for cash or travel.

Is Chase Sapphire a Visa or Mastercard?

VisaA Chase Sapphire card is a Visa. Both the Chase Sapphire Preferred® Card and the Chase Sapphire Reserve® are on the Visa network. First and foremost, that means you can use these cards virtually everywhere in the world as Visa is one of the card networks with the most extensive international acceptance.

How hard is it to get a Chase Sapphire card?

While there is no official score required, it is generally known that the Chase Sapphire Preferred® Card requires a good credit score, which means 690 or higher. This is not a hard and fast rule, however, and those with credit scores lower than 690 could possibly get approved.

What is the minimum credit limit for Chase Sapphire?

$5,000The Chase Sapphire Preferred® Card has a minimum $5,000 credit line. Although a credit score of 700 or above is typical for successful applicants, even college students with limited credit history and income from a part-time job have been approved for this card.

Can I use my Chase Sapphire card as a debit card?

Yes, you can use most credit cards at an ATM to withdraw cash from the card's credit line. The ATM withdrawal will show up as a cash advance on your credit card statement. That means the amount of cash you get at the ATM will be subject to an immediate cash advance APR, and usually a … read full answer.

What is the minimum balance for Chase Sapphire account?

A: There is no minimum balance to maintain the account, but customers with under $75,000 in average monthly balances will be charged a $25 monthly maintenance fee.

What is the highest credit limit for Chase Sapphire?

On our list, the card with the highest reported limit is the Chase Sapphire Preferred® Card, which some say offers a $100,000 limit. We've also seen an advertised maximum credit limit of $100,000 on the First Tech Odyssey Rewards™ World Elite Mastercard®, a credit union rewards card.

What are the benefits of Chase Sapphire?

Travel rewardsA generous sign-up bonus. ... Bonus earnings on travel, dining, select streaming services and online grocery purchases. ... 10% point bonus each year. ... A 25% boost when redeeming for travel via Chase. ... A $50 hotel credit. ... Combine points from multiple cards. ... Transfer points to airline and hotel partners.More items...

What is the difference between Chase Freedom and Sapphire?

Chase Freedom Unlimited is better for everyday use and intro APRs. But Chase Sapphire Preferred is the clear choice for travel rewards and a big initial bonus. Sapphire Preferred also has a $0 foreign transaction fee, while Freedom Unlimited charges 3% of each transaction in U.S. dollars.

Is Chase Sapphire Preferred Visa Signature or Infinite?

While the Sapphire Preferred is a Visa Signature, Chase has upgraded the Sapphire Reserve to Visa Infinite with some added benefits, making the Sapphire Reserve one of only a handful of Visa Infinite cards available in the U.S. The others include The Ritz-Carlton™ Credit Card (no longer open to applications), and the ...

Which Chase cards are Visa Signature?

Bottom Line: The Chase Sapphire Preferred card is a good example of one of the best Visa Signature cards because it not only offers core Visa Signature benefits but also valuable additional Visa Signature benefits that Chase has chosen to include.

How do I know if my card is Visa Signature?

Another way to find out if you have a Visa Signature is by simply looking at it. Most cards have the “Visa Signature” label located somewhere on the physical card. This includes one of the most common Visa Signature cards, the Chase Sapphire Preferred Card (it's on the back, in case you were wondering).

What's the difference between Visa and Visa Signature?

The main difference between Visa vs Visa Signature cards is that Visa Signature cards have more benefits. All Visa credit cards include rental car insurance, roadside assistance, and emergency card replacement.

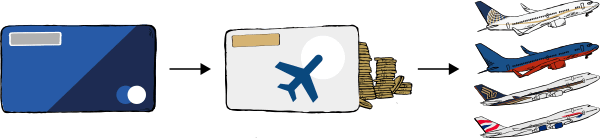

Earn 60,000 bonus points

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. * Same page link to Offer Details That's $750 toward travel when redeemed through Chase Ultimate Rewards ®.

More ways to earn

New! Earn up to $50 in statement credits each account anniversary year for hotel stays purchased through Chase Ultimate Rewards ®. * Same page link to Offer Details

Additional Value with Ultimate Rewards

Get 25% more value when redeemed for travel. For example 60,000 points are worth $750 toward travel when redeemed through Chase Ultimate Rewards ®. * Same page link to Offer Details

My Chase Plan

Eligible cardmembers can break up card purchases of $100 or more into fixed monthly payments with My Chase Plan ®. * Same page link to Offer Details No interest, just a fixed monthly fee.

What does Sapphire cardmember get?

From concerts to sporting events, Sapphire cardmembers get early access to tickets, priority seating and hospitality lounges.

What are the benefits of Sapphire card?

Each Sapphire card comes with several built-in benefits to help you travel and shop confidently, such as Trip Cancellation and Auto Rental coverage, as well as Purchase Protection and Extended Warranty Protection.1

What is Chase Sapphire?

Meet Chase Sapphire, the card that makes every purchase rewarding for you. Now you'll get access to a world of all-new benefits: exclusive culinary events, travel perks for your adventures near and far, and so much more.

Where is the first energy-positive hotel?

Stay in the World’s First Energy-Positive Hotel in Norway

Do your points have more value when you redeem them for statement credits?

Your points have more value when you redeem them for statement credits after making purchases within select rotating categories.

How long is the grace period on Chase credit cards?

The Chase grace period for most credit cards is at least 21 days, from the end of the monthly billing cycle until your payment due date. If you always pay your balance in full during the Chase credit card grace period, you will not owe any interest. Your monthly statement

What happens if you don't pay your Chase credit card balance?

If you do not pay your entire balance in full one month, you will lose your Chase credit card grace period. Interest will accrue daily on the unpaid balance as well as any new purchases you make and any interest you haven’t paid yet. That will continue until you pay your bill in full two months in a row.

What is the difference between Chase Sapphire Reserve and Chase Sapphire Preferred?

Having a Chase Sapphire Preferred or Chase Sapphire Reserve also entitles you to a wide range of VISA benefits. This includes, for example, rental car insurance, travel insurance and low currency conversion rates for international purchases. In particular, you’ll enjoy Visa Signature benefits with Chase Sapphire Preferred, while Chase Sapphire Reserve comes with Visa Infinite benefits. Visa Infinite provides some additional perks, including extended travel insurance and a special concierge.

Which credit card is the most widely accepted?

Visa and Mastercard are the most widely accepted credit card networks. Visa credit cards can be used at 44 million merchant locations in more than 200 countries and territories. Mastercard credit cards are accepted at 37 million merchant locations in more than 210 countries and territories.

Which credit card has the most purchases?

Most Widely Used: Visa has the most credit cards in circulation (about 838 million). American Express has the highest purchase volume, at $14,480 per cardholder annually.

How many merchants accept Visa?

Most Widely Accepted in the U.S.: Visa and Mastercard are both accepted at a little less than 11 million U.S. merchant locations.

What is interest on an unpaid balance?

Interest on an unpaid balance compounds daily, meaning interest is charged on both the principal balance and previous days’ interest charges.

What is Chase Sapphire Reserve?

The Chase Sapphire Reserve® is the higher-end version of the Chase Sapphire Preferred. It carries an annual fee of $550 but it also comes with a slew of perks including a whopping 50% points value boost when booking travel through Chase or using the Pay Yourself Back feature, a $300 annual travel credit, 3 Ultimate Rewards points per dollar spent on travel and dining, Priority Pass Select lounge access and a TSA PreCheck or Global Entry application fee credit. For someone who can fully utilize all of the extra benefits, the price tag may be worth it.

How much does a Chase Sapphire card cost?

For a relatively low annual fee of $95, the card comes jam-packed with juicy rewards and other perks that make it a worthy contender in a field crowded with cards costing hundreds of dollars more a year to own. Use it on its own as a starter or low-cost travel card, or pair it with another in the Chase family to maximize your returns on every dollar spent.

How many points do you get on Lyft?

Plus, through March 2022 you'll earn a total of 5 points per dollar on Lyft rides

What is Sapphire preferred?

The Sapphire Preferred may be a great card for travel, but it also earns strong rewards on dining, too. If your disposable income is spent less on eating and travel and more on dining and doing, the Savor® Rewards from Capital One® * merits a look. You’ll earn unlimited 4% cash back on dining, entertainment and popular streaming services, 3% cash back at grocery stores and 1% on all other purchases. Capital One’s definition of entertainment is expansive and includes movie theaters, sports promoters (professional and semi-professional live events), theatrical promoters, amusement parks, tourist attractions, aquariums, zoos, dance halls, record stores, pool halls and bowling alleys.

How much is 60,000 points worth?

Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Ultimate Rewards®. For example, 60,000 points are worth $750 toward travel.

How much is a statement credit?

Statement credit: When you redeem your points as a statement credit you will get a value of 1 cent per point. Gift cards: Gift cards will provide different values for your points depending on the store and the amount of your purchase, typically 1 cent per point or less.

How long does Purchase Protection last?

Purchase Protection: Covers your new purchases for 120 days against damage or theft up to $500 per claim and $50,000 per account.

Why trust us?

Our editorial team and expert review board work together to provide informed, relevant content and an unbiased analysis of the products we feature. The editorial content on our site is independent of affiliate partnerships and represents our unique and impartial opinion. Learn more about our partners and how we make money .

Summary

While the Chase Sapphire Preferred does come with an annual fee of $95, it’s a great card for frequent flyers, globe-trotters and hotel enthusiasts. It’s also a great card if you’re just starting out on your travel journey.

When is the Chase Sapphire Preferred card worth it?

If you go on vacation often or are planning a trip soon, you should consider this card. Starting off, the Chase Sapphire Preferred offers a welcome bonus of 60,000 points if you spend $4,000 in the first three months. Previously, the Sapphire Preferred had offered a whopping 100,000 points with the same spend requirement.

When is the Chase Sapphire Preferred card not worth it?

If you don’t identify as a frequent traveler or plan on staying close to home for the foreseeable future, then the Sapphire Preferred isn’t the card for you. Much of the card’s benefits are geared towards vacationing, whether it be the no foreign transaction fee its option to transfer points to Chase’s travel partners.

Should you get the Chase Sapphire Preferred?

The Chase Sapphire Preferred is a solid, midrange travel rewards card that is best for people who travel and go out to restaurants – and who like cashing in rewards to cover flights and other travel expenses.

The bottom line

The Chase Sapphire Preferred is worth it, for most cardholders, if you use the card for travel, dining or even regular shopping.

What is Chase Sapphire card?

The Chase Sapphire Preferred® Card is as faithful a travel companion as your well-worn suitcase. In exchange for a $95 annual fee, it offers valuable rewards points, worldwide acceptance and travel protections that can help when that suitcase doesn’t make it to the baggage claim.

How much is Chase Sapphire Preferred?

Instead of the usual penny-per-point rate, you’ll get a value of 1.25 cents each for your points, which can really add up. That's an extra $25 for every $100 worth of points you redeem.

How many points do you get on a Chase Sapphire card?

With the Chase Sapphire Preferred® Card, you'll earn 3 points per dollar spent on dining out, select streaming services and online grocery purchases (excluding Target, Walmart and wholesale clubs). You'll earn 5 points per dollar on travel purchased through Chase Ultimate Rewards and 2 points per dollar on all other travel. All other spending earns 1 point per dollar.

How is NerdWallet rating determined?

NerdWallet's ratings are determined by our editorial team. The scoring formula takes into account the type of card being reviewed (such as cash back, travel or balance transfer) and the card's rates, fees, rewards and other features.

How many bonus points do you get for each anniversary of a credit card?

Each account anniversary, cardmembers will receive bonus points equaling 10% of total purchases that year. So if you spent $25,000, you'd earn an additional 2,500 bonus points.

How much can you get for delayed luggage?

If your luggage is delayed more than six hours, you can get reimbursed up to $100 a day for five days to cover the cost of new toiletries and clothing.

How long is a doorbell camera warranty good for?

You’ll also get an extra year added onto the manufacturer’s warranty on eligible warranties of three years or less.