The truth is both types of cards are widely accepted abroad, and are therefore better choices for international travel than Amex or Discover. As noted above, Mastercard may offer a slightly better exchange rate than Visa, but if you don’t travel frequently, it probably won’t make a huge difference.

Full Answer

Is MasterCard better than visa?

Many investors feel that Mastercard (MA-1.19%) is a better investment than Visa (V-0.75%) simply because it's a little bit smaller and therefore has more room to grow.

What is the difference between MasterCard and visa?

- Visa Inc. ...

- Visa card provides two level benefits to its customers, i.e. ...

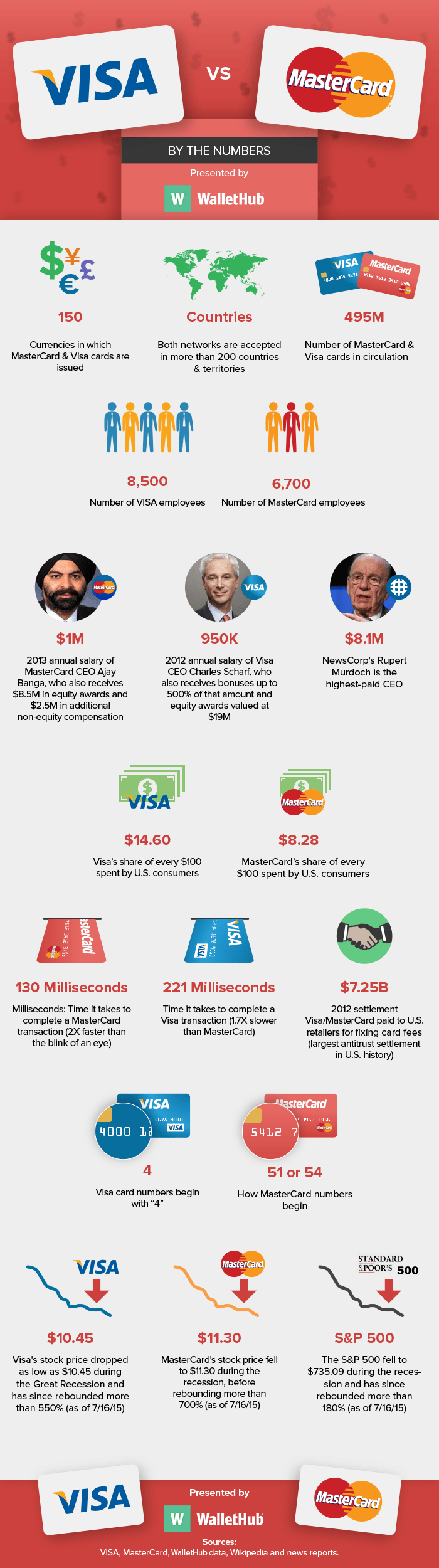

- The overall market capitalization of MasterCard on August 2016, is 106.92 Billion, whereas the total capitalisation of Visa 192.34 Billion.

- The revenue earned by Visa Inc. ...

- The net income of Visa Inc. ...

Is MasterCard or visa more widely accepted?

Worldwide, Visa is more widely accepted. In North America, Visa and Mastercard and Discover are all pretty much equally accepted everywhere. In Northern Europe, Mastercard has the edge while Discover is widely accepted in China on the UnionPay network and in India on the Rupay network. This data is a few years old, but VISA is the clear leader.

How to know if credit card is visa or MasterCard?

The first digit is different for each card network:

- Visa cards – Begin with a 4 and have 13 or 16 digits.

- Mastercard cards – Begin with a 5 and has 16 digits.

- American Express cards – Begin with a 3, followed by a 4 or a 7 has 15 digits.

- Discover cards – Begin with a 6 and have 16 digits.

See more

Is Visa or Mastercard better for international?

There aren't major differences between the two companies. VISA is slightly larger and has a higher transaction volume and a slightly higher level of global acceptance. However, MasterCard is accepted in more countries than VISA is.

Which card is best for international travel?

Best cards for international travelBest overall: American Express® Gold Card.Best for dining: Capital One Savor Cash Rewards Credit Card.Best for hotels: Capital One VentureOne Rewards Credit Card.Best for luxury travel: Chase Sapphire Reserve®Best for bad credit: Discover it® Secured Credit Card.

Is Mastercard good for international travel?

In a sense, any Visa, Mastercard, American Express or Discover card qualifies as an international credit card because you'll be able to use it in most countries outside the U.S. But not all credit cards that work internationally are equally equipped to save you money and aggravation abroad, due to differences in ...

Can Visa and Mastercard be used internationally?

Visa and Mastercard are widely accepted worldwide. If an establishment takes credit cards, it's a good bet that your Visa or Mastercard will work. American Express and Discover have an international presence, too, but they are accepted by fewer merchants.

How do I avoid international transaction fees?

In this article:Watch Out for Conversion and Transaction Fees.Open a Credit Card That Doesn't Have a Foreign Transaction Fee.Exchange Currency Before You Travel.Open a Bank Account That Doesn't Charge Foreign Fees.Pay With the Local Currency.Finding Cards With No Foreign Transaction Fees.

What credit cards have no foreign transaction fees?

Best No Foreign Transaction Fee Credit CardsBank of America® Travel Rewards credit card : Best for no annual fee.Capital One Quicksilver Cash Rewards Credit Card: Best for cash back on international purchases.Capital One VentureOne Rewards Credit Card: Best for foreign travel beginners.More items...

Does Mastercard charge international fee?

Find no foreign transaction fee credit cards from Mastercard.

Does Mastercard have international transaction fee?

But many Mastercards charge up to 3% of each international purchase you make. The Mastercard foreign transaction fee comes in two parts. Mastercard, as the credit card network, always charges a 1% fee. Then, the credit card issuer can choose to add their own fee on top of that, or cover Mastercard's fee for you.

Do you get charged for using Mastercard abroad?

Overall, you should have no problem paying with your Mastercard abroad. It's likely, however, that there will be additional fees to pay when you use your card overseas. Wherever you go, you'll come across places that don't accept cards in any form, such as small local stores or some taxis.

Which debit card is best for international transactions?

Best International Debit Cards Offered by Indian BanksSBI Global International Debit Card.ICICI Bank Sapphiro International Debit Card.Axis Bank Burgundy Debit Card.HDFC EasyShop Platinum Debit Card.Yes World Debit Card.HSBC Premier Platinum Debit Card.

Is it better to use credit card or debit card abroad?

Debit cards vs credit cards while abroad As debit cards usually charge more fees for usage and the exchange rate tends to be uncompetitive. Credit cards do come with higher interest rates however, so it's best to pay off your balance regularly and fully which is usually due on a monthly basis.

How do you spend money internationally?

To spend money abroad, it is necessary to exchange American currency for the currency of the destination country. That is true whether you are using cash, credit and debit cards, or traveler's checks.

Is it best to use credit or debit card abroad?

Debit cards vs credit cards while abroad As debit cards usually charge more fees for usage and the exchange rate tends to be uncompetitive. Credit cards do come with higher interest rates however, so it's best to pay off your balance regularly and fully which is usually due on a monthly basis.

Are all Visa cards International?

Visa debit cards are regarded as the most globally accepted debit cards for all kinds of online and electronic transactions. These cards can be used within and outside India. The VISA ATM network is spread throughout India and abroad.

Do debit cards work internationally?

Yes, your debit card and credit card are accepted internationally! If your ATM card is linked to a checking account, it can also be used at ATMs internationally.

Which credit card is best in India for international travel?

10 Best Credit Cards in India for International UseCredit CardAnnual Fee/Joining FeeForeign Currency Mark-up FeeAxis Reserve Credit CardRs. 50,0001.5%Axis Burgundy PrivateRs. 50,000NilICICI MMT SignatureJoining fee- Rs. 2.500 Annual fee- NIL3.5%HDFC Regalia Credit CardRs. 2,5002%6 more rows•Jun 7, 2022

Which card is better, Visa or Mastercard?

There are some differences between Mastercard and Visa. But these two major card networks are pretty equal in the categories that matter most to co...

Which card network is more widely accepted, Visa or Mastercard?

There isn't much of a difference between Mastercard and Visa when it comes to acceptance. Both card networks are accepted in more than 200 countrie...

Where is Mastercard NOT accepted?

Mastercard is not accepted at retail chains that have an exclusive agreement with another card network. For example, Costco accepts Mastercard onl...

What is the difference between Visa and Mastercard?

The main differences between Visa and Mastercard are that Mastercard is more widely accepted internationally, while Visa offers more standard credi...

Is American Express Visa or Mastercard?

American Express isn't a Visa or a Mastercard . American Express, Visa and Mastercard are three of the four major card networks , but American...

Is Discover a Visa or Mastercard?

Discover is neither a Visa nor a Mastercard . It's more like an American Express card, but they're not exactly the same, either. Discover is...

Are Citi cards Visa or Mastercard?

Most Citibank credit cards are on the Mastercard network, including the Mastercard examples include the Citi Simplicity® Card and the Citi Do...

Is Capital One Quicksilver a Visa or Mastercard?

Capital One Quicksilver could either be a Visa or a Mastercard. Capital One issues cards on both networks, but there is no way to choose which net...

What is the difference between World Mastercard and Visa Signature?

World Mastercard and Visa Signature are two different credit card benefits packages, and World Mastercard perks are usually a bit better than Vi...

Is Visa more accepted than Mastercard?

Visa and Mastercard have equal global acceptance.

Who owns Mastercard?

Mastercard is a publicly traded company as of 2006.

Are Visa and Mastercard owned by the same company?

Both Visa and Mastercard are publicly traded companies.

Is Visa a private or public company?

Visa is a publicly traded company.

Is Visa an American company?

Yes, Visa is an American company that has expanded internationally.

Is American Express an American company?

Yes, American Express is an American financial company.

Is American Express a private or public company?

American Express is a publicly traded company.

Which is better: Visa or Mastercard?

Deciding whether Visa or Mastercard is better depends on which network's benefits you prefer, as they have about equal global acceptance. On the wh...

What are the 4 types of credit cards?

There are four major card networks in the U.S.: Visa, Mastercard, Discover and American Express.

What kind of company is American Express?

American Express is a publicly traded financial company that primarily issues credit cards.

How many countries accept Visa and Mastercard?

Both Visa and Mastercard are accepted in more than two hundred countries. And it is very rare to find a location that will accept one but not the other. Furthermore, both Visa and Mastercard administer certain benefits programs, including rental car insurance and extended warranties. But individual card issuers decide what coverage cardholders receive.

What is the best Capital One Visa?

The best Capital One Visa is the Capital One Venture Rewards Credit Card. Its initial bonus is 60,000 miles for spending $3,000 in the first 3 months. This card also gives 2 miles per $1 spent on all purchases. Its annual fee is $39.

How many levels of credit card benefits are there?

There are three levels of Visa credit card benefits: Traditional, Signature and Infinite. Mastercard has three tiers of benefits, too. Some cards offer one level of benefits to all users. Others give better perks to people approved for a certain credit limit – $5,000+, for example. Visa Traditional Benefits.

What is the largest card network in the world?

Feb 25, 2020. Visa and Mastercard are the two largest card networks in the world, accepted in more than 200 countries and territories worldwide. As card networks, Visa and Mastercard control where credit cards and debit cards can be used, as well as what secondary perks they offer – from $0 fraud liability guarantees to rental car insurance.

How to tell if Discover card is good?

If you look at the front of your Discover card, you should see “Discover” with an orange dot for the “o.” Each network has a logo, so it's easy to tell them apart. And while Discover cards are generally fine to use anywhere in the U.S., you might have trouble in certain countries abroad. So it's probably best to have a backup Visa or Mastercard.

Is there a difference between a Visa and MasterCard?

There isn't much of a difference between Mastercard and Visa when it comes to acceptance. Both card networks are accepted in more than 200 countries and territories. And almost every merchant that takes credit cards accepts both Visa and Mastercard.

Is Chase a Visa or Mastercard?

Chase can be Visa or Mastercard, depending on which Chase credit card you have. Most Chase credit cards are on the Visa network, though there are also a few Chase cards on the Mastercard network, such as the Chase Freedom Flex.

What are the benefits of Mastercard?

Credit cards on the Mastercard network break down into three tiers, with each one containing all of the benefits and perks of the tier below it. In ascending order of exclusivity, these include:

What standard benefits do both Visa and Mastercard provide?

There are certain benefits both Visa and Mastercard provide. Some of these exist due to federal regulations , while others have become industry standards that issuers expect the networks provide for their cardholders.

What is the difference between a Visa and a Mastercard?

On entry level cards, there is very little difference between Visa and Mastercard, as both provide a similar suite of basic features. However, Mastercard includes impressive special luxury offers on its World and World Elite level cards, which can be attractive for big spenders.

Which is better Visa or Mastercard?

Deciding whether Visa or Mastercard is better depends on which network's benefits you prefer, as they have about equal global acceptance. On the whole, Visa offers its cardmembers more benefits than Mastercard.

How long does it take for World Elite to refund?

World and World Elite Mastercard credit cards qualify for price protection. If you make a purchase, and that item’s price is lowered within 60 days of the purchase, the network will refund you the difference up to a certain amount per claim. For World and World Elite Mastercard users, this time is extended to 120 days.

Do Visa and Mastercard have different membership levels?

Both Visa and Mastercard have different levels of card membership that offer different perks and benefits. Here is how these levels compare:

Does a Visa card cover unauthorized purchases?

Both Visa and Mastercard provide protection against unauthorized charges. If your credit card is used to make unauthorized or fraudulent purchases, you can report it to your issuer and have the transactions reversed. In such a scenario, Visa or Mastercard will be the ones to cover the cost.

Should you get a travel credit card?

Not sure you want a travel credit card? Looking for a cash rewards card? Or maybe you want to snag a generous sign-up bonus? Finding the right credit card for you is much simpler if you know your credit score, and can narrow your search to only the cards you know you’ll get approved for. We’ve made it easy for you. If you don’t already know your score, use our quick and free Credit Score Estimator tool – then find the perfect card for you!

What credit card to take abroad?

For years, the Capital One Venture and VentureOne Rewards Credit Cards have been our go-to recommendation for young travelers looking for a credit card to take abroad that offers no foreign transaction fees and a straightforward rewards program.

How much does Capital One Venture Rewards earn?

The Capital One Venture Rewards Credit Card earns 2x miles per dollar spent on all purchases that can be redeemed for any travel at any time. Miles don’t expire and there’s no limit to how much you can earn. As a new cardmember, you can earn 60,000 bonus miles when you spend $3,000 on purchases in the first 3 months from account opening. The card’s annual fee is: $95.

How many points does the Ink Business Preferred credit card give?

The Ink Business Preferred® Credit Card blows you away with a 100,000 point bonus after you spend $15,000 in the first three months and keeps you coming back with 3 points per dollar spent on travel and select business categories for the first $150,000 spent each account anniversary year.

What is the best credit card for international travel?

The best credit card for international travel is a chip-enabled Visa or Mastercard that does not charge foreign currency transaction fees. Going abroad today is easier than ever, especially if you’ve got the flexibility to make your travel arrangements at the last minute to get some of the great deals that are around with airlines, hotels, ...

How much is Sapphire card?

It has a $95 annual fee—still well worth it if you’ll do a bit of spending on the card. It has no foreign transaction fees, plus chip-enabled for enhanced security and wider acceptance when used at a chip card reader. Best yet, Sapphire’s points-based travel rewards program quickly earns you free travel.

How many points can you earn on a preferred reward?

If you're a Preferred Rewards member, you can earn 25% - 75% more points on every purchase. That means you could earn up to 2.62 points for every $1 spent.

Where is Mastercard accepted vs Visa?

Mastercard is accepted at more than 70 million merchant locations in over 210 countries. Visa is also accepted at more than 70 million merchant locations in over 200 countries.

How many levels of cards are there in Visa?

Within each network, there are some differences in the basic benefits that come with certain types of cards. Visa and Mastercard both have three levels of cards, each with different perks. It's here that you'll find the main differences between Visa and Mastercard, but even so, these differences are relatively small.

How many countries accept Mastercard?

Mastercard is accepted at more than 70 million merchant locations in over 210 countries. Visa is also accepted at more than 70 million merchant locations in over 200 countries.

How many types of visas are there?

There are the three main types of Visa cards, each with specific features: 1

Is Mastercard a payment network?

Visa and Mastercard are both payment networks, like Discover and American Express. Payment networks don't create cards directly, but rather they provide a backchannel for your payment to get to the merchant.

Is Visa the same as Mastercard?

The truth is that Visa and Mastercard are very similar to each other. Most merchants in the U.S. accept both. (One notable exception is Costco, which only accepts Visa cards due to a contract with the company.) And while Visa used to have greater acceptance internationally than Mastercard, the two networks are now even in acceptance rates, though you may find it easier to use one or the other in a particular country.

Who designs the features of a credit card?

They provide a baseline amount of benefits, but it's really the card issuer like the bank or the credit union that designs the important features of the card, including the fees, APRs, and rewards. A credit card’s issuing bank also determines acceptance requirements for its cards, including the credit score you need to apply.

How are Visa and Mastercard similar?

The business models of both companies are very similar. Visa and Mastercard do not issue cards directly to the public but rather through partner member financial institutions such as banks and credit unions. The member financial institution then issues cards for individuals and businesses, either directly or in partnership with airline, hotel, or retail brands.

What is a Visa and MasterCard?

Visa and MasterCard are the two largest payment processing networks in the world. Visa and MasterCard do not issue cards directly to the public, as do Discover and American Express, but rather through member financial institutions. Member banks and credit unions issue Visa and Mastercard credit and debit cards directly to their customers ...

How do Visa and Mastercard earn their revenue?

Both Visa and Mastercard earn the majority of their revenue from service and data processing fees , but the two companies characterize these fees differently and have their own fee structures. Service fees are charged to the issuer and based on card volume.

How much money does MasterCard make in 2019?

In 2019, MasterCard generated total revenue of $16.9 billion, with a payment volume of $6.5 trillion. 12 MasterCard’s core products include consumer credit, consumer debit, prepaid cards, and a commercial product business. MasterCard has one reportable business segment known as Payment Solutions which is broken out by geographies across U.S. and other.

How many debit cards do Americans have?

Most Americans today have at least one debit and credit card. 3 Many people have a number of them, seeking to take advantage of all the rewards, cash-back opportunities, and promotional benefits that issuers have to offer.

What is the role of credit card issuer?

For credit cards, the issuing bank is responsible for underwriting, interest rate structuring, and the full development of reward programs. Card issuers can also offer other perks such as identity theft and fraud protection, car rental insurance, or business purchase discounts.

Does MasterCard have a reportable business segment?

MasterCard has one reportable business segment known as Payment Solutions which is broken out by geographies across U.S. and other. Like Visa, MasterCard earns the majority of its revenue from service and data processing fees. However, it characterizes the fees differently.

How much cash back does Discover give?

Cardholders earn a competitive 2% cash back at gas stations and restaurants on up to $1,000 in combined purchases each quarter, then 1%. Plus, you can earn unlimited 1% cash back on all other purchases automatically. The welcome bonus is also unique: For new card members in the first year only, Discover will automatically match all the cash back you’ve earned at the end of your first year. So, if you earn $50 cash back at the end of the first year, Discover will give you an additional $50.

How many points do you get on Lyft in 2022?

10X points on Lyft rides through March 2022, 3X points on travel worldwide (immediately after earning your $300 annual travel credit), 3X points on dining at restaurants including eligible delivery services, takeout and dining out, 1X point per $1 on all other purchases.

How much does a $300 travel credit cover?

You can take advantage of an annual $300 travel credit, which can cover everything from airfare and hotels to parking and tolls. Cardholders earn 3X points on travel worldwide (immediately after earning your $300 annual travel credit) and on dining at restaurants worldwide and 1X point per $1 on all other purchases.

How much are Chase points worth?

Cardholders earn 5X points on air travel and 10X total points on hotels and car rentals when you purchase travel through Chase Ultimate Rewards; 3X points on travel worldwide (immediately after earning your $300 annual travel credit) and on dining at restaurants worldwide and 1X point per $1 on all other purchases. Points are worth 50% more when redeemed for travel via Chase Ultimate Rewards®. For example, 50,000 points are worth $750 redeemed toward airfare, hotels, car rentals and cruises when you redeem through Chase Ultimate Rewards®. This perk is a great way to get the most value for your rewards.

How much security deposit is required for Discover?

This card requires a $200 security deposit, which is fairly standard for secured credit cards. It stands out from the crowd because it gives users a clear path to upgrading to an unsecured card (and getting their deposit back). Starting at eight months from account opening, Discover will automatically review your credit card account to see if they can transition you to an unsecured line of credit and return your deposit. This takes the guesswork out of wondering when you’ll qualify for an unsecured credit card.

How long is the intro 0% APR?

Another perk is the intro 0% APR period, which lasts for 12 months for new purchases (after a 15.49% to 25.49% variable APR). This can come in handy if you want to pay for a vacation over the course of a year and avoid interest charges.

What is Chase Sapphire Reserve?

Who’s this for? The Chase Sapphire Reserve® is geared toward foodies and frequent travelers who are looking for luxurious perks, such as annual travel credits, airport lounge access and complimentary hotel room upgrades. You can take advantage of an annual $300 travel credit, which can cover everything from airfare and hotels to parking and tolls.

How much cash should I travel with?

How much cash you should travel with largely depends on your destination: How much is the cost of living? Is tipping expected? How long will you be staying? Do many of the activities you want to do or places where you want to do business accept credit cards or online booking?

Is it cheaper to use credit cards or cash abroad?

Whether cash or credit is cheaper comes down to exchange rates and transaction fees.

What if my U.S. Mastercard gets lost or stolen while I’m overseas?

Before you take off on your trip, you should make sure you know how you’ll cope if your card is lost or stolen when you’re on your vacation.

What are some good tips for using my U.S. Mastercard abroad?

Banks tend to be quick to block cards, to avoid the losses and hassle incurred by fraudulent activity. Therefore, Mastercard advises that you tell your bank if you’re travelling abroad. However, not all banks insist on this step, so you should check with your local branch or online. Either way, if you plan to be away for a large chunk of time it’s probably worth letting your card issuer know.

What to do if your credit card is missing?

If something happens and your card is missing, you’ll have to contact your card issuer to report the loss. They’ll cancel the card so your money is safe. Depending on their policy, and the card type you hold, the bank may issue you a temporary card or some emergency funds to tide you over while you’re away.

How to find out what fees are charged on a credit card?

To get the exact details about what fees you’ll be charged, you need to check online or on the back of your card statements. The fees below are a guide, but different card types have some variances, including promotions and opening offers.

How to figure out what spending on Mastercard overseas is going to cost you?

Firstly, the bank will use the daily exchange rate set by Mastercard, to change the cost of your purchase into U.S. Dollars (USD).

What is foreign transaction fee?

This is usually done via a charge known as a foreign transaction fee, and calculated as a percentage of the amount you spent.

How to protect your credit card when traveling abroad?

Card protection can be set up via your bank or an insurance company. Of course, if you do take this additional protection, make sure you have all your policy details with you when you travel.