Why should I use PayPal over visa?

What are the pros?

- PayPal is convenient – all your payment information is stored on your account so you don’t have to enter card details every time you pay.

- Your financial details and transactions are encrypted and monitored to help prevent fraud and identity theft. ...

- PayPal says there are regular updates to its systems to help block external threats.

Which is better PayPal or credit card?

Why PayPal is better than credit cards:

- PayPal is a more safe, secure and easier option for payments.

- Using PayPal, you can send money or receive money from anywhere in the world but on the other side with credit cards, you will not have that option.

- You don’t have to pay any type of charges for your PayPal account but you have to pay the credit card charges.

Is PayPal safer than debit card online?

Paying with your debit card through PayPal is safer than just using your debit card. Merchants (as well as hackers, thieves, and employees) only see your email address—your PayPal username—and some personal information when you use PayPal.

Is PayPal Credit a bad idea?

Yes. The PayPal Credit Card is worth it because it has a $0 annual fee and good rewards. It will not be worth it if you do not pay the bill in full every month, however, due to the card’s high interest rate.

See more

Is PayPal a Visa card?

Since then, PayPal has continued to partner with Mastercard and Visa. Each has agreed several times to further highlight one another's various payment capabilities to their prospective customer base. PayPal has also selected Mastercard to run its PayPal-branded credit card and Visa to run its Venmo-branded credit card.

Which is better PayPal or Visa?

PayPal has grown its top line faster and is expected to increase both revenue and earnings at higher rates than Visa. It's quite possible PayPal could have almost as many customer accounts as Visa does cardholders decades from now....Motley Fool Returns.MetricPayPal HoldingsVisaFive-year expected EPS growth18.9%15.8%4 more rows•Oct 19, 2019

Is PayPal like Visa or Mastercard?

The PayPal Cash Card, a MasterCard debit card for use online or in-store. A PayPal credit card, where PayPal offers two cards issued by Synchrony Bank. It also offers a line of credit via Synchrony. 7.

Can I get scammed with PayPal?

Despite its advantages, however, PayPal still has one thing in common with traditional credit card payments: fraud. Like any other payment processor, PayPal faces a ceaseless onslaught of scams and fraud attempts trying to take money out of someone else's pocket.

How do I cash out PayPal?

Log in and go to your Wallet. Click Transfer Funds. Click Transfer to your bank account. Follow the instructions to complete your withdrawal....Here's how to withdraw funds through your PayPal app:Tap PayPal Balance on the home screen.Tap Withdraw Funds.Follow the instructions to complete your withdrawal.

What bank does PayPal use?

Wells Fargo Bank, N.A.PayPal and the PayPal logo are trademarks of PayPal, Inc. Wells Fargo Bank, N.A. Member FDIC.

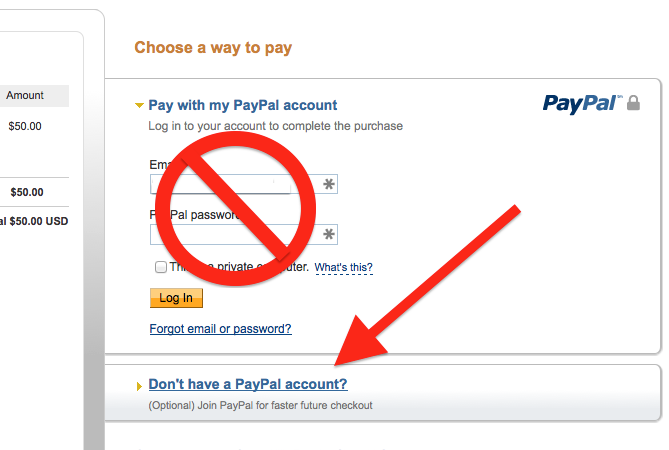

Do you need a bank account for PayPal?

Do You Need a Bank Account for PayPal? No, you don't need a bank account to sign up for PayPal or to receive payments. You can, however, connect your PayPal account to a bank account, a debit card or a credit card account for sending and receiving payments and transferring funds.

Can you use PayPal as a credit card?

PayPal Credit is an open end (revolving) credit card account that provides a reusable credit line built into your account with PayPal giving you the flexibility to pay for your purchases right away or pay over time. It's easy to apply, easy to use and there whenever you need it.

Why is PayPal better than credit cards?

Paying with PayPal gives you an extra level of security and fraud prevention. If you pay for a purchase using PayPal that ends up being fraudulent, PayPal can help get your money back. PayPal encrypts your bank or credit card information, keeping that information safe. No fees for sending money to friends and family.

What are the disadvantages of using PayPal?

Cons of using PayPal for small businessHigh chargeback fees.Higher fees than a typical merchant (credit card processing) account.Account suspension for terms and conditions (T&C) violations that can freeze your funds for months.May take 2 business days to get your money.Customer service can be hard to reach.

Is Visa bigger than PayPal?

First, both companies belong to the largest players in their industry -- PayPal is valued at $220 billion. Visa is even more valuable, trading with a market capitalization of $450 billion today.

What is the partnership between PayPal and Visa?

The partnership puts PayPal and Visa on a new path, with the companies working more collaboratively to accelerate the adoption of safe, reliable and convenient digital payments for consumers and merchants. Further, the arrangement is designed to carry significant benefits for issuing financial institutions, acquirers, and merchants. For issuing institutions, these include a better customer experience, more spending volume on their credit and debit cards, lower operational costs and improved security. Merchants will also benefit from the improved customer experience, efficiency and security, which together will help drive increased sales.

Does PayPal allow Visa?

PayPal will not encourage Visa cardholders to link to a bank account via ACH (Automated Clearing House) PayPal will also support and work with issuers to identify consumers who choose to migrate existing ACH payment flows to their Visa cards.

Does PayPal make it easier to pay with Visa?

Enhanced consumer choice and improved experience for Visa cardholders: PayPal will make it easier for new and existing customers to choose to pay with their Visa cards and ensure a more seamless experience:

How Safe Is PayPal?

All PayPal transaction data are sent with end-to-end encryption designed to thwart any hacker seeking to capture private information as it moves from buyer to seller. This means your financial information isn't revealed even to the recipient. 9

Who Is PayPal Anyway?

PayPal Holdings Inc. is now a public company listed on the Nasdaq. It rolled out its first initial public offering in 2002 but was then acquired by eBay. At one point, PayPal was growing faster than its parent company. EBay decided to spin it off in 2014, and it again became a separate public company. In addition to Xoom, PayPal has acquired several other companies. These include Honey Science Corp., an online couponing site; iZettle, a payments processor; and Braintree, another mobile payment app.

What is PayPal used for?

What PayPal Offers. To this day, PayPal is the default payment option for eBay purchases. But it also is the fifth most-used payment method at all online retailers, after Visa, Mastercard, American Express, and Discover (as of August 2019). 3.

What is PayPal mobile app?

Some of them are: The PayPal mobile app, which enables contactless payments at real-world retailers. 4. The Venmo mobile app, which is primarily used for person-to-person money transfers and routine day-to-day transactions. 5.

What is Xoom app?

Xoom, a person-to-person payment app that is used to make electronic money transfers globally. 6. The PayPal Cash Card, a MasterCard debit card for use online or in-store. A PayPal credit card, where PayPal offers two cards issued by Synchrony Bank. It also offers a line of credit via Synchrony. 7.

How many recommendations does PayPal have?

PayPal lays out six recommendations for businesses to prevent fraud: 10

How many PayPal accounts are there?

But the job keeps growing, and the challenges are never-ending. PayPal now has an estimated 392 million active accounts around the world and offers several products. 1 Each one is designed to make it safe to send or receive money, electronically or in person.

Why is PayPal encrypted?

Payment encryption. Every payment made through PayPal is encrypted so that your details are kept safe. This reduces the risk of personal or payment information being stored in places where you don’t want it.

Which is better, PayPal or credit card?

Both credit cards and PayPal offer a number of security features and benefits when you’re shopping online. That said, they come with potential costs and pitfalls as well. PayPal offers slightly better encryption, which on some websites could help you protect your money.

What time does PayPal open?

PayPal’s customer service hours are 6:00 a.m. PT to 6:00 p.m. PT Monday through Sunday. Yes. American Express, Mastercard and Visa credit cards all offer 24/7 emergency hotlines for lost or stolen cards as well as for suspected fraud. Two-factor authentication. Yes.

What is zero liability?

Zero-liability policies. This feature covers the cost of any fraudulent transactions made on your account so you’re not left out of pocket if your card is compromised.

Is online credit card fraud a risk?

Online fraud risks. Online credit card fraud has been steadily increasing as more people use cards to make purchases via the web.

What is Finder.com?

Finder.com provides guides and information on a range of products and services. Because our content is not financial advice, we suggest talking with a professional before you make any decision.

Can PayPal show billing details?

A transaction that’s processed by PayPal could show its billing details, instead of the details of the company you made your purchase with. If you’re not aware of this, you could mistake the payment for fraud when checking your credit card or bank account transaction history. Acceptance.

What is PYPL partnership?

PYPL partnered with Even on November 17th to improve the financial health of its workforce. Last month, the company announced the launch of a new service that would allow its users to buy, hold, and sell cryptocurrency directly from their accounts.

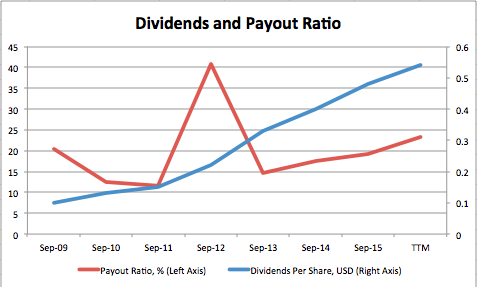

How much will V's revenue increase in 2021?

The market expects V’s revenue to increase by 6.3% in 2021 and 16.7% in 2022. The company’s EPS is expected to grow by 8.3% in 2021 and 24.4% in 2022. Moreover, V’s EPS is expected to grow at a rate of 12% per annum over the next five years. Thus, PYPL has an edge over V here.

How much will PYPL grow in 2021?

The market expects the company’s revenue to increase by 20.5% in 2020 and 18.7% in 2021. PYPL’s EPS is expected to grow by 22.3% in 2020 and 19.3% in 2021. Moreover, its EPS is expected to grow at a rate of 23% per annum over the next five years.

What is the B grade of pypl?

PYPL has a “B” for Trade Grade , an “A” for Buy & Hold Grade, and Industry Rank, and a “C” for Peer Grade. It is currently ranked #12 out of 46 stocks in the Consumer Financial Services industry.

What is Manisha's passion?

Since she was young, Manisha has had a strong interest in the stock market. She majored in Economics in college and has a passion for writing, which has led to her career as a research analyst. More...

Is PYPL a good investment?

Operating for over two decades, both PYPL and V are good investment bets considering their market dominance and huge user base. However, PYPL appears to be a better buy based on its higher earnings growth potential and strategic partnerships.

Is PayPal a fintech company?

PayPal Holdings, Inc. ( PYPL - Get Rating) and Visa Inc. ( V - Get Rating) are two of the world’s largest fintech companies. With people spending more time at home due to the ‘stay-at-home’ trend, both PYPL and V have been witnessing a significant rise in their number of transactions. Moreover, the increased use of e-commerce platforms this holiday season should lead to a significant rise in digital transactions.

What is PayPal cash card?

6 The PayPal Cash Card is a debit card linked to your PayPal Balance account. The PayPal Cash Card is not a credit card. PayPal is not a bank and does not itself take deposits. You will not receive any interest on the funds in your PayPal Balance account. Cash funds held in a PayPal Balance account are not eligible for FDIC pass-through insurance coverage unless you have a PayPal Cash Card, or have enrolled in Direct Deposit, or have bought cryptocurrency. If your PayPal Balance account is eligible for FDIC pass-through insurance, PayPal will deposit your cash funds into one or more custodial accounts maintained for the benefit of eligible customers at one or more FDIC-insured banks. Funds in these custodial accounts are eligible for pass-through FDIC insurance coverage up to applicable limits. See the PayPal Balance Terms and Conditions for additional information.

How much is the daily withdrawal limit for MoneyPass?

8 ATMs must display the Mastercard®, Cirrus®, PULSE® or MoneyPass® acceptance marks. Up to $400 USD daily withdrawal limit applies. Transactions at non-MoneyPass ATMS have a $2.50 ATM Domestic and International Withdrawal Fee. No fee for MoneyPass ATM Withdrawals in the US Foreign Transaction Fee applies for International ATM Withdrawals. ATM operator fees may also apply. See Cardholder Agreement for details.

How many ATMs does MoneyPass have?

Withdraw from ATMs worldwide, including no-cost withdrawals at 33,000+ US MoneyPass® locations. 8

What information is needed to open a new credit card account?

IMPORTANT INFORMATION ABOUT PROCEDURES FOR OPENING A NEW CARD ACCOUNT: To help the government fight the funding of terrorism and money laundering activities, federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens a Card Account. What this means for you: When you open a Card Account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see a copy of your driver’s license or other identifying documents. Terms apply. See Cardholder Agreement for details.

Who makes PayPal cashback cards?

The PayPal Cashback Mastercard is issued by Synchrony Bank pursuant to a license by Mastercard International Incorporated. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Who approves PayPal credit?

PayPal Credit is subject to credit approval as determined by the Lender, Synchrony Bank, and is available to US customers who are of legal age in their state of residence.

Can you earn cash rewards with PayPal?

Purchases subject to credit approval. To earn Cash Rewards, you must have an open account with PayPal in good standing to which your Card Account is linked. If your account with PayPal is closed for any reason, or if your Card Account is no longer linked to PayPal, your Card Account will be closed and any Cash Rewards earned, but not redeemed, will be forfeited.

What is a donation on Generosity?

When you accept the User Agreement or the Generosity Network Terms and Conditions to send or receive funds (using one of the payment types listed below), we call that a "donation". Funds sent or received through other products or services (not set out below) are not "donations" eligible for donations pricing. In such cases the applicable transaction rates will apply and will be subject to the fees disclosed for such products or services on the applicable fees page.

What is PayPal Cash Plus?

PayPal Cash and Cash Plus. PayPal offers two types of balance accounts commonly referred to as PayPal Cash and PayPal Cash Plus. For more information and a complete listing of fees associated, please refer to the PayPal Cash and PayPal Cash Plus Terms and Conditions. Back to top.

What is PayPal payout percentage?

Sending money using PayPal Payouts such that your recipients receive a different currency from the currency in which you pay. 4.00%, or such other amount as may be disclosed to you during the transaction. All other transactions. 3.00%, or such other amount as may be disclosed to you during the transaction.

Is there a fee for crypto?

The exchange rate you’ll see before buying or selling crypto will also include a cryptocurrency conversion spread. There’s no fee for holding crypto in your account.

Is PayPal free to use?

It's free to use PayPal to donate or to pay for a purchase or any other type of commercial transaction unless it involves a currency conversion.

Does PayPal have currency conversion spread?

For any of the following types of transactions involving a currency conversion by PayPal, the transaction exchange rate will also include a currency conversion spread.

Do you have to convert fees to different currencies?

Fees charged in different currencies for sending payments: We will collect the fee from balance in the currency in which the fee is listed. To do this, we may need to convert the fee amount from your sending balance into the currency in which the fee is listed, in which case the fees for "Conversions in all other cases" also apply.

Which is better, PayPal or Venmo?

In general, although both services are owned by PayPal, PayPal is by far the more robust, secure, and safe option for processing online payments. For sending money quickly and easily to friends and family, however, Venmo is the better choice.

How much does PayPal charge?

PayPal charges 2.9% of each transaction plus $0.30 for purchases made with a credit or debit card . Venmo charges 3% per transaction for purchases made with a credit card and no fee for debit card purchases.

What Are Venmo and PayPal?

Venmo and PayPal are digital wallet services that let users make electronic purchases by securely storing payment information and passwords for multiple payment methods. Both allow users to connect their accounts to multiple bank accounts or credit cards.

How Do Venmo and PayPal Work?

Venmo and PayPal process payments using either the existing balance in each account or by drawing on funds from connected bank accounts or credit cards. Both services can be accessed online or through mobile apps. PayPal lets users send or request payments on the web while Venmo only offers this function through its mobile app.

How does Venmo work with PayPal?

Both services can be accessed online or through mobile apps. PayPal lets users send or request payments on the web while Venmo only offers this function through its mobile app.

How long does it take to transfer money from Venmo to PayPal?

Although neither service charges to transfer money to a connected bank account with a standard turnaround (one to three business days for Venmo and one to two business days for PayPal), both services charge a 1% fee with a maximum of $10 for an instant transfer.

How long does it take for a PayPal loan to be funded?

Once approved, loans are funded within minutes. PayPal charges a single fixed fee based on sales volume, account history, the loan amount, and the percentage of sales the business directs toward repayment (10% to 30%). Payments are automatically deducted from a business’s PayPal account until the loan is repaid.