Is Visa stock a Buy Right Now?

Whether Visa stock is a good buy for investors moving forward depends on many factors, including the global economy and the company's ability to modernize its business. (Leon Neal/Getty Images)

What are the price targets for Visa's stock?

24 brokerages have issued 12-month price targets for Visa's stock. Their forecasts range from $210.00 to $305.00. On average, they expect Visa's stock price to reach $265.38 in the next year. This suggests a possible upside of 28.9% from the stock's current price.

Is visa the best digital payments stock to buy?

The Dow Jones card giant has a commanding share in the fast-growing digital payments market. Visa earnings are rebounding as coronavirus headwinds subside and many people resume travel worldwide. Meanwhile, Visa is also a top payments stock in an industry group that is acting well. To be sure, competition in digital payments is intense.

Should you invest in MasterCard or Visa stock?

Both Mastercard and Visa have strong business models that stand to benefit in the increasingly digitized world. That said, both of these stocks appear to be excellent options for investors who want to profit from the war on cash.

See more

/https://specials-images.forbesimg.com/imageserve/5fd05d3fbd3e14309901fb27/0x0.jpg)

Is Visa a good stock to hold?

On key earnings and sales metrics, Visa stock earns an EPS Rating of 91 out of 99, and an SMR Rating of A. The EPS rating reflects a company's health on fundamental earnings, and its SMR Rating measures sales growth, profit margins and return on equity.

Is Visa a buy hold or sell?

Visa has received a consensus rating of Buy. The company's average rating score is 2.80, and is based on 16 buy ratings, 4 hold ratings, and no sell ratings.

Is Visa stock expected to rise?

The 32 analysts offering 12-month price forecasts for Visa Inc have a median target of 260.00, with a high estimate of 296.00 and a low estimate of 204.00. The median estimate represents a +20.50% increase from the last price of 215.76.

What is a good price for Visa stock?

On average, Wall Street analysts predict that Visa's share price could reach $256.81 by Jul 29, 2023. The average Visa stock price prediction forecasts a potential upside of 24.51% from the current V share price of $206.26.

What will Visa stock be worth in 5 years?

What will the Visa stock be worth in the next 5 years? According to our predictions, the Visa stock can be worth up to $292.98 in the next five years. However, the average price of the stock in five years' time is expected to be $279.37.

Is Visa undervalued?

Visa Inc has a current Real Value of $241.99 per share. The regular price of the company is $215.87. At this time, the company appears to be undervalued....2022-05-12.LowEstimated ValueHigh215.22216.99218.76

Is Visa profitable?

The payment processing company said it earned a profit of $3.4 billion, or $1.60 a share, compared to a profit of $2.57 billion, or $1.18 a share, in the same period a year earlier.

Is Visa a blue chip?

With a firm foothold in the payments processing industry, Visa will likely be a blue chip stock for many years to come.

Is Apple a buy or sell?

Apple has received a consensus rating of Buy. The company's average rating score is 2.70, and is based on 23 buy ratings, 7 hold ratings, and 2 sell ratings.

Why is Visa stock falling?

Inflation, interest rate hikes, recession fears, and geopolitical headwinds have led to a decline of 11% in Visa shares so far this year.

Why is Visa stock up?

“The pandemic has accelerated the adoption of digital payments,” says Visa CFO Vasant Prabhu. Visa stock surged more than 10% Friday after the payments leader reported strong results for the December quarter and gave an upbeat outlook as international travel picks up and as the shift to digital payments intensifies.

Is Visa a dividend stock?

Yes, V's dividend has been stable for the last 10 years. Does Visa have sufficient earnings to cover their dividend? Yes, V's past year earnings per share was $6.78, and their annual dividend per share is $1.45. V's dividend payout ratio is 21.3%, which is sustainable.

Which stock is better Visa or Mastercard?

6:388:03Visa Stock vs Mastercard Stock | Which is Better? - YouTubeYouTubeStart of suggested clipEnd of suggested clipThat's still very high but mastercard has shown it can use its capital more efficiently. This leadsMoreThat's still very high but mastercard has shown it can use its capital more efficiently. This leads some investors to value mastercard at a higher multiple.

Is Mastercard a buy or sell?

Mastercard has received a consensus rating of Buy. The company's average rating score is 2.81, and is based on 14 buy ratings, 1 hold rating, and 1 sell rating.

Should I buy Vstock?

The financial health and growth prospects of V, demonstrate its potential to perform inline with the market. It currently has a Growth Score of B. Recent price changes and earnings estimate revisions indicate this would be a good stock for momentum investors with a Momentum Score of A.

Is Microsoft a buy right now?

Microsoft stock is not a buy right now. It needs to form a new base in the right market conditions before setting a potential buy point. Check out IBD's Big Picture column for the current market direction. In a positive sign, MSFT stock has climbed above its 50-day moving average line.

Is Visa a good stock to buy?

Does Visa need to upgrade?

Since it generally mirrors the state of the economy, which an overwhelming amount of the time expands rather than contracts, Visa is great long-term stock to own. Its top position makes it hard to compete with, and it can provide security and stability to a balanced portfolio.

How much money does Visa spend?

Visa needs to upgrade its systems as companies like PayPal Holdings make it easier to send and spend money digitally. Contactless payments are increasing in popularity, and in the U.S. alone Visa customers have more than 370 million tap-to-pay cards. Installment plans have also taken off, with companies such as Afterpay ( recently acquired by Square) and Affirm Holdings demonstrating strong growth, and Visa has launched its own version as well.

What is the hardest hit category for a visa?

According to its most recent annual report, Visa expects to move $17 trillion in consumer spending and $15 trillion-$20 trillion of business spending to cards and digital formats. Currently, much of that spending is still done in cash and checks.

How much did Visa buy Cyperpunk?

The hardest-hit category for Visa includes travel, fuel, restaurants and entertainment. The segment comprises a third of Visa's U.S. payments volume.

What is the Dow Jones stock?

On Aug. 23, Visa said it had bought a CyperPunk NFT on Aug. 19 for around $150,000 in ethereum. The digital art piece is Visa's first foray into NFTs. A collection of nine rare CryptoPunks that were among the first 1,000 minted sold for nearly $17 million in Christie's auction last May.

Does Visa have interest rate risk?

The Dow Jones stock dominates U.S. credit card networks by transactions and cards in circulation. It has ample room to grow in digital payments, while pursuing new bets in fintech and cryptocurrencies.

Is Visa a stablecoin?

Also, Visa and Mastercard have less exposure to interest-rate risk. Visa neither earns revenue from nor bears risk tied to the interest or fees paid by cardholders. Instead, Visa derives revenue from client services, data processing, cross-border transactions and value-added services, such as licensing fees.

Does Visa accept USD coins?

On March 29, Visa said it would become the first major payments network to settle transactions in USD Coin, a stablecoin backed by the U.S. dollar, over Ethereum.

When did Visa stock take a hit?

Working with Anchorage, the first federally chartered digital asset bank, Visa has launched a pilot that allows Crypto.com to send USD Coin to Visa to settle a portion of its obligations for the Crypto.com Visa card program.

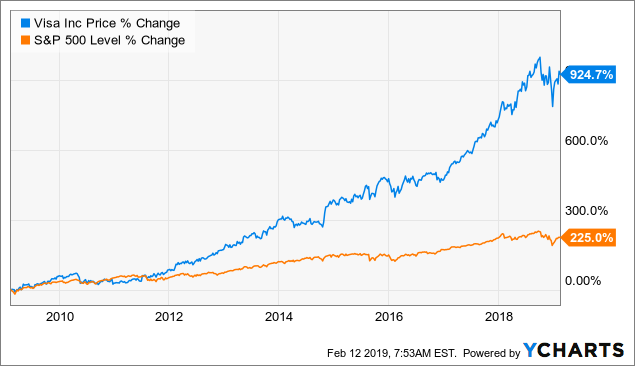

How much did Visa trade up in 2018?

Those facts, however, are already in the rearview mirror. The Visa stock price took a heavy hit in December 2018, and there's no shortage of critics who are wondering if the plastic-wielding powerhouse is capable of standing tall as a new wave of fintech-based digital payment providers sharpens their teeth on Visa’s ankles and look to aim higher in 2019.

How much did the V stock drop in December?

Still, Visa traded up approximately 15 for 2018 (it was up by 30 percent at one point) as business was – and is - robust for the payment colossus.

When will Visa end?

December was a decided downer of a month for V shareholders, as the stock price fell by almost 8 percent for the month, a slightly bigger decline relative to the S&P 500 index, which fell by 7.5 percent over the same time period.

Which is the strongest financial payment company?

Visa had a tough end of 2018, but analysts see clearing skies for the card payment giant in 2019.

Is there a visa headwind in 2019?

Visa is also the strongest financial payments company in terms of digital innovation and is leading the way in evolving toward a digital payment society.

Is Visa stock a good buy?

There are potential headwinds for Visa in 2019, particularly if the economy slows.

How much of Visa stock is held by institutions?

Whether Visa stock is a good buy for investors moving forward depends on many factors, including the global economy and the company's ability to modernize its business. (Leon Neal/Getty Images)

What is the ticker symbol for a visa?

80.54% of the stock of Visa is held by institutions. High institutional ownership can be a signal of strong market trust in this company.

What is the P/E ratio of a visa?

Visa trades on the New York Stock Exchange (NYSE) under the ticker symbol "V."

When did Visa stock split?

The P/E ratio of Visa is 34.74, which means that it is trading at a more expensive P/E ratio than the Business Services sector average P/E ratio of about 13.89.

Is Visa a buy or sell company?

Shares of Visa split before market open on Thursday, March 19th 2015. The 4-1 split was announced on Thursday, January 29th 2015. The newly created shares were issued to shareholders after the market closes on Wednesday, March 18th 2015. An investor that had 100 shares of Visa stock prior to the split would have 400 shares after the split.

What is Visa's business?

Visa has received a consensus rating of Buy. The company's average rating score is 2.96, and is based on 25 buy ratings, 1 hold rating, and no sell ratings.

How much did Visa drop in 2020?

Visa is the largest global electronic payment solutions company in the world, which provides a wide range of products and services to support the credit, debit, and related card solutions for institutions in over 200 countries. The company generates revenue by charging fees on transactions and payments volume. Due to the Covid-19 pandemic and the economic uncertainty consumer spending has dropped, negatively affecting the transaction volumes for the payments processing industry. Further, the lockdown restrictions coupled with the travel bans wreaked havoc on the international transaction volumes in the second quarter– the segment contributes 27% of the Visa’s top line. However, as the lockdown restrictions are eased in most of the world, it is likely to help consumer demand. This is also evident from the recently released consumer spending data which suggests an m-o-m growth of 8.5%, 5.6%, and 1.9% in May, June, and July respectively. Despite the recent improvement, the transaction volumes are still likely to be lower than the year-ago period. While the company reported a 17% drop in revenues for Q3 2020 due to higher client incentives and lower international transaction volumes, we believe that Visa’s Q4 results in October will further confirm the hit to its top line.

Is Forbes opinion their own?

Due to the impact of the Covid-19 crisis, Visa has suffered a 5% y-o-y drop in 2020 driven by lower cross-border volumes and a decline in the growth rate of payments volume & processed transactions on a year-on-year basis. While the company managed to outperform the consensus estimates of earnings and revenues in its first-quarter FY2021 results (FY Oct-Sept), the same trend dominated its revenues. It reported net revenues of $5.7 billion, which was 6% less than the previous year. This could be attributed to a 28% drop in international transaction revenues, partially offset by a 5% y-o-y growth in the services segment and a 6% increase in data processing revenues. Notably, client incentives as a % of revenues increased from 28.9% in the year-ago period to 32.7% in Q1.

How much is Visa revenue in 2021?

Opinions expressed by Forbes Contributors are their own.

How much did MA stock gain in 2020?

On Thursday, Visa reported its first set of quarterly results for the fiscal year 2021. The period saw Visa report net revenue of $5.69 billion, which was 6% lower than the same period last year.

What is PayPal's partnership with Visa?

It’s worth pointing out that MA stock gained 19% in 2020, a decent performance by any measure. It outperformed the S&P 500, which rose 16%. As the pandemic eases and the economy recovers in 2021, Mastercard could be looking at a strong year ahead.

Is Mastercard a crypto?

In particular, the partnership will enable consumers and small-medium enterprises to move their money faster through PayPal and Visa Direct Capabilities. Also, the rapid shift to e-commerce also brings significant value to Visa.

Do Visa and Mastercard pay dividends?

This made it the first native crypto platform to issue Mastercard payment cards. Meanwhile, Mastercard also has a broad range of market-leading services, from insights and analytics to cybersecurity tools. This allows the company to support its partners’ evolving needs in a rapidly changing world. In June, Mastercard announced an agreement ...

Does Mastercard have Finicity?

They each rake in billions in annual revenues and profits even during unprecedented times like this. As a result, it’s not surprising to know that they regularly pay dividends and engage in share buybacks. They remain a favorite of many investors including Berkshire Hathaway ( NYSE: BRK.A ). But if you were going to choose one, which of these titans is the better financial stock to add to your portfolio today?

Is Mastercard a global company?

In June, Mastercard announced an agreement to acquire Finicity, a leading provider of real-time access to financial data and insights, to bolster its open banking platform. By incorporating this into Mastercard’s operations, the company expects to further enhance and grow its banking reach and capabilities.