See more

Is Visa stock undervalued?

Visa Inc has a current Real Value of $227.06 per share. The regular price of the company is $211.33. At this time, the company appears to be undervalued....2022-05-12.LowEstimated ValueHigh209.02210.77212.52

Is Visa a buy sell or hold?

Visa has received a consensus rating of Buy. The company's average rating score is 2.80, and is based on 16 buy ratings, 4 hold ratings, and no sell ratings.

Is Visa stock a good buy?

Latest Visa Inc Stock News Visa Inc's trailing 12-month revenue is $28.1 billion with a 50.8% profit margin. Year-over-year quarterly sales growth most recently was 18.7%. Analysts expect adjusted earnings to reach $7.427 per share for the current fiscal year. Visa Inc currently has a 0.7% dividend yield.

Is Visa fairly valued?

Analysis. Visa's fair value is $221.34.

What will Visa stock be worth in 5 years?

What will the Visa stock be worth in the next 5 years? According to our predictions, the Visa stock can be worth up to $292.98 in the next five years. However, the average price of the stock in five years' time is expected to be $279.37.

What is the forecast for Visa stock?

Stock Price Forecast The 31 analysts offering 12-month price forecasts for Visa Inc have a median target of 261.00, with a high estimate of 296.00 and a low estimate of 220.00. The median estimate represents a +22.64% increase from the last price of 212.81.

Is Visa a value or growth stock?

Visa (NYSE:V) has an annual dividend growth rate over the last 5 years of 17.91% and a low payout ratio of just 21.54%. The company's characteristics make Visa attractive for dividend income investors seeking dividend growth stocks and for investors with a long investment horizon aiming to invest for their retirement.

Is Visa Buy or sell Zacks?

Visa Inc. - Buy. Zacks' proprietary data indicates that Visa Inc. is currently rated as a Zacks Rank 2 and we are expecting an above average return from the V shares relative to the market in the next few months.

What is best stock to invest in today?

Gujarat Polysol IPO.Hemani IPO.Corrtech IPO.Paymate IPO.Rustomjee IPO.Senco Gold IPO.Rainbow IPO.Sterlite IPO.More items...

Is Visa a good stock for inflation?

VISA (V) and Mastercard (MA) are tipped to be a good inflation hedge by professional investors, as consumers look to maintain their standard of living by spending more on their credit cards amid the rising cost of living.

Is Visa or Mastercard a better stock?

6:388:03Visa Stock vs Mastercard Stock | Which is Better? - YouTubeYouTubeStart of suggested clipEnd of suggested clipThat's still very high but mastercard has shown it can use its capital more efficiently. This leadsMoreThat's still very high but mastercard has shown it can use its capital more efficiently. This leads some investors to value mastercard at a higher multiple.

Is Visa a dividend aristocrat?

Visa's now grown the dividend for 13 consecutive years. It's halfway to becoming a Dividend Aristocrat already, and there's a lot to be optimistic about in the future. Below, you can see how rapidly the dividend has risen -- it's grown 24% on average over the past decade.

Which stock is better Visa or Mastercard?

Visa has a higher market share, higher revenues and higher valuation than Mastercard. On the other hand Mastercard has a higher revenue per share, EPS and revenue growth. Both stocks should be bullish in 2022 but Mastercard may provide better profitability because of its opportunities for growth.

Is Apple a buy or sell?

Apple has received a consensus rating of Buy. The company's average rating score is 2.73, and is based on 24 buy ratings, 6 hold ratings, and 2 sell ratings.

Is Mastercard a buy?

Mastercard Incorporated - Hold Its Value Score of C indicates it would be a neutral pick for value investors. The financial health and growth prospects of MA, demonstrate its potential to perform inline with the market. It currently has a Growth Score of B.

Is Visa a blue chip stock?

Visa Inc. One of the best blue-chip stocks to buy according to billionaire Richard Chilton, his hedge fund holds 35,540 shares of the financial services company as of Q1 2022, amounting to a stake of $7.88 million.

Metrics Analysis

V has a trailing twelve month Price to Earnings ( PE) ratio of 40.6. The historical average of roughly 15 shows a poor value for V stock as investors are paying higher share prices relative to the company's earnings. V's high trailing PE ratio shows that the firm has been trading above its fair market value recently.

Summary

All together these valuation metrics paint a pretty poor picture for V at its current price due to a overvalued PEG ratio despite strong growth. The PE and PEG for V are worse than the average of the market resulting in a valuation score of 27.

Visa's Payment Volumes Remain Robust, but for How Long?

For the fourth quarter of Fiscal 2021, Visa revealed some pretty decent results that saw payment volumes rise 17% year-over-year.

Amazon's Disruptive Impact

In what was a tough blow, Amazon recently announced its plans to stop accepting U.K.-issued Visa credit cards. There's no question that there are many retailers in the sea to team up with. That said, all it takes is one big fish like Amazon to turn the tables. Right now, the tables could turn against Visa as the race to partner up intensifies.

Wall Street's Take

Turning to Wall Street, Visa earns a Strong Buy consensus rating. Out of 14 analyst ratings, there are 14 unanimous Buy recommendations.

The Bottom Line on Visa Stock

For now, Visa will need to innovate to maintain its dominance. I don't see a clear pathway for continuing its incredible growth streak. As such, I'm staying on the sidelines, as the recent 20% decline may not be as significant a bargain as some value hunters may think.

TipRanks

TipRanks is the most comprehensive data set of sell side analysts and hedge fund managers. TipRanks' multi-award winning platform ranks financial experts based on measured performance and the accuracy of their predictions so investors know who to trust when making investment decisions.

Why is Visa's valuation higher?

Unlike most credit card issuers and banks, the giant electronic card processor is safeguarded against loan default risks. As a result , Visa’s valuation across the financial sector is elevated.

How much did Visa spend on buybacks in 2020?

This can be seen by the company’s purchase of buybacks during 2020. Visa spent $5.3 billion on share buybacks during the height of the COVID-19 crisis and $10.9 billion on buyback purchases in 2019. These large repurchasing activities influenced Visa’s share price this year.

Is Visa a Good Dividend Stock?

Yes, Visa is a good dividend stock – not at the top of list, but certainly a great company in which to invest your money. You cannot ignore the benefits that support it.

How much is Visa dividend in 2020?

Reaffirming its dividend in 2020, Visa increased its payout for the quarter by 6.7%, resulting in a $1.28 annual yield.

How many credit cards does Visa have?

Visa represents the largest payment network in the world, processing over $9 trillion worth of payments annually. Although the company does not issue Visa cards, approximately 3.5 billion debit and credit cards display the Visa logo.

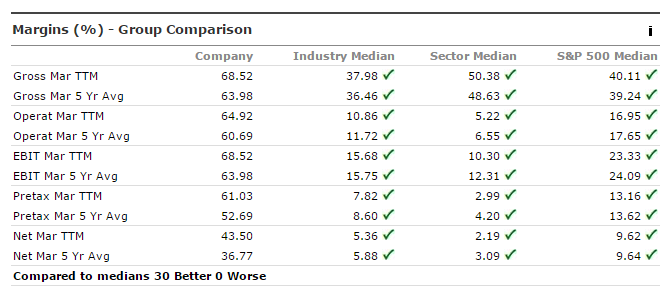

What is the operating margin of Visa?

Visa is known for its high operating margin, which, in Q4 of 2020, was just over 50% . Usually, a margin of 20% is considered attractive.

Is VISA a good buy?

Yes, many financial forecasters regard VIsa as a Buy or even a Strong Buy for stock traders. However, you may want to wait to see if the stock dips in price or its P/E drops before rushing to purchase it.

How much of Visa stock is held by institutions?

80.54% of the stock of Visa is held by institutions. High institutional ownership can be a signal of strong market trust in this company.

When did Visa stock split?

Shares of Visa split before market open on Thursday, March 19th 2015. The 4-1 split was announced on Thursday, January 29th 2015. The newly created shares were issued to shareholders after the market closes on Wednesday, March 18th 2015. An investor that had 100 shares of Visa stock prior to the split would have 400 shares after the split.

What is the ticker symbol for a visa?

Visa trades on the New York Stock Exchange (NYSE) under the ticker symbol "V."

What is the P/E ratio of a visa?

The P/E ratio of Visa is 34.74, which means that it is trading at a more expensive P/E ratio than the Business Services sector average P/E ratio of about 13.89.

Is Visa a buy or sell company?

Visa has received a consensus rating of Buy. The company's average rating score is 2.96, and is based on 25 buy ratings, 1 hold rating, and no sell ratings.