What does it mean to have a Wells Fargo card?

Wells Fargo Credit Cards A card with Wells Fargo means access to one of the largest banking networks and robust technology. Interested in earning cash back and other rewards? A wide selection of credit cards and the Wells Fargo Go Far® rewards program can take your spending a long way.

What is the best Wells Fargo credit card to have?

Best Wells Fargo Credit Cards of 2021. Wells Fargo Propel American Express® card – Best for Travel Rewards; Wells Fargo Cash Wise Visa® card – Best for Unlimited 1.5% Back; Wells Fargo Platinum card – Best for 0% Intro APR

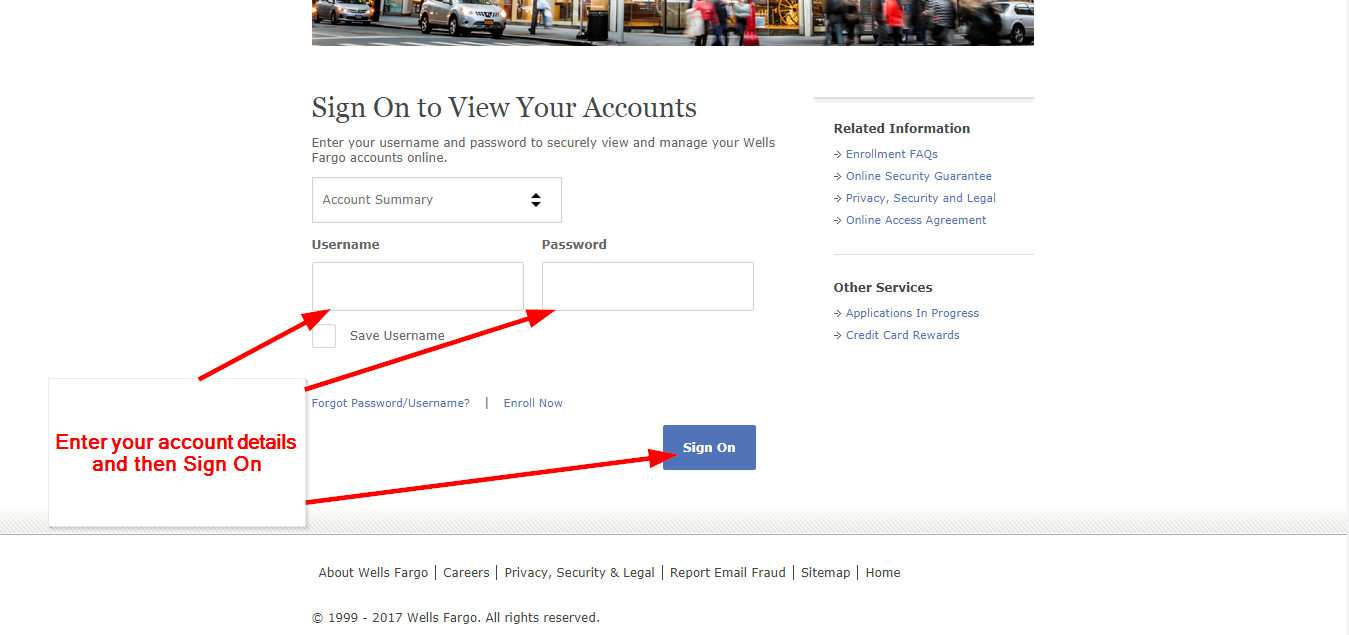

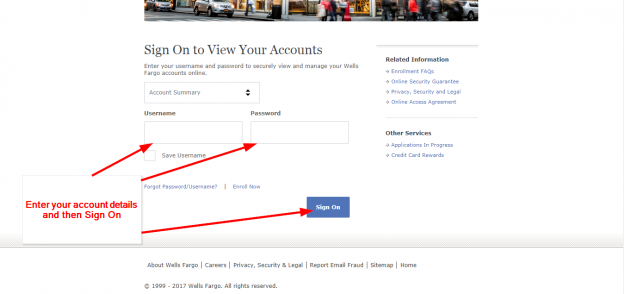

Does Wells Fargo have online customer service for credit cards?

Welcome to Wells Fargo Financial Cards Online Customer Service! Online account access to all of your Wells Fargo Financial credit card accounts including NowLine®, Visa®, MasterCard®, and Cash on Demand® is available 24-hours a day.

What's the difference between a Wells Fargo business secured credit card?

For example, the Wells Fargo Reflect® Card is on the Visa network, while the Wells Fargo Business Secured Credit Card is on the Mastercard network. There are a few differences between Visa and Mastercard credit cards, such as the network-level benefits they offer, but those differences are relatively small.

See more

What type of cards are Wells Fargo?

Choose from these great credit cardsWells Fargo Active Cash® Card. Earn unlimited 2% cash rewards on purchases 4 ... Wells Fargo AutographSM Card. Earn 3X points 2 for many ways to keep life in motion. ... Wells Fargo Reflect® Card. Enjoy our lowest intro APR for up to 21 months. ... Hotels.com® Rewards Visa ® Credit Card.

Is my card a Visa or Mastercard?

The First 6-digits Each major credit card network has its own MII: American Express cards always begin with the number 3- more specifically 34 or 37. Visa cards begin with the number 4. Mastercards start with the number 5.

Does Wells Fargo accept Mastercard?

What kind of credit and debit cards can I accept? Common cards you can accept are Visa®, Mastercard®, Discover®, American Express®, and JCB.

Is Wells Fargo active cash card a Visa or Mastercard?

Note that this coverage is secondary to other insurance policies you may already have, including homeowners or renters insurance. Visa perks: As a Visa card, the Wells Fargo Active Cash® Card grants you access to Visa Concierge, a service that assists you with travel or dining arrangements, event tickets and more.

Which banks use Mastercard?

Here are a list of some of the largest credit card providers that use MasterCard:Amazon.Aqua.Capital One.Halifax.John Lewis.Lloyds Bank.M&S Bank.MBNA.More items...•

How do you tell if a card is a Mastercard?

Visa cards begin with a 4 and have 13 or 16 digits. Mastercard cards begin with a 5 and has 16 digits. American Express cards begin with a 3, followed by a 4 or a 7 has 15 digits. Discover cards begin with a 6 and have 16 digits.

Can I withdraw money from my MasterCard at Wells Fargo?

You can access up to $500 per day from your credit card account. These transactions constitute cash advances on your credit card account. Transaction fees will apply and the APR for Cash Advances will be charged. Please see your Customer Agreement and Disclosure Statement.

Can I use my MasterCard at any ATM?

A: Yes. You may withdraw cash against the balance on most Mastercard prepaid and gift cards at any ATM. However, not all prepaid and gift card issuers allow ATM or foreign transactions. Be sure to check with your card issuer to ensure that these types of transactions are permitted.

Can I use Wells Fargo debit card internationally?

Can I use my Wells Fargo debit card internationally? Yes. You'll be able to use your Wells Fargo card when you travel — just check the network your card is issued on — usually Visa or MasterCard — is accepted by the merchant or ATM you pick.

Is Wells Fargo Cash card a credit card?

Yes, the Wells Fargo Active Cash® Card is a cash back credit card, which gives 2% cash rewards on purchases and has an annual fee of $0. The Wells Fargo Active Cash also offers an initial bonus of $200 cash rewards after spending $1,000 in the first 3 months after account opening.

What is the credit limit on the Wells Fargo active cash credit card?

$1,000 to $20,000The credit limit for the Wells Fargo Active Cash® Card typically ranges from $1,000 to $20,000 or more, based on user reports we reviewed. Credit limits vary by cardholder and depend on several factors, including annual income and credit history.

What is the Wells Fargo active cash Visa card?

The Wells Fargo Active Cash Card has debuted as one of the best flat-rate cash rewards credit cards on the market. The Active Cash is a low-maintenance rewards card with top-rate rewards potential and redemption options that make it an easy fit in any wallet.

What are the first 4 digits of a Mastercard?

If it's a Visa card, it will always start with a 4, while Mastercards generally start with a 5 — although in 2017 Mastercard started issuing some of its numbers starting with 2....First number.First digitCredit card issuer3American Express4Visa5Mastercard6Discover1 more row•Aug 10, 2017

What are the first 4 digits of a Visa card?

The First NumberNumberIndustryLikely Card Network3Travel & EntertainmentAmerican Express4Banking & FinancialVisa5Banking & FinancialMastercard6Merchandising & BankingDiscover5 more rows•Dec 6, 2021

Why does Costco not accept Mastercard?

No, you can't use your Mastercard credit card at Costco, because Costco has a contract with Visa. You can, however, use your Mastercard credit card for purchases made at Costco.com and through the Costco app. For their warehouse locations Costco only accepts cards on the Visa network.

How do I identify a credit card?

Cards that start with a "3" are American Express. Those that start with "4" are Visa credit and debit cards, those that start with "5" are MasterCard credit and debit cards, and those that start with "6" are Discover credit cards. The service fee that is charged to merchants varies between card companies.

Comparing Wells Fargo Credit Card Offers

With a vibrant history and competitive financial products, Wells Fargo is among the banking leaders in the United States and world. This 166-year-o...

Best Wells Fargo Credit Cards at A Glance

1. Get up to $600 protection on your cellphone (with a $25 deductible) against covered damage or theft when you pay your monthly cell phone bill wi...

Wells Fargo Rewards Program and Best Redemption Options

Whether you have a big trip planned or you are making daily purchases at your local Starbucks, you can earn rewards that can be redeemed for that n...

Other Benefits of Having Wells Fargo Cards

From the famous cellphone protection to auto rental collision damage waivers, the Wells Fargo cards offer respectable benefits. Here are what the C...

Wells Fargo Active CashSM Card

0% intro APR for 15 months from account opening on purchases and qualifying balance transfers. 14.99%, 19.99% or 24.99% variable APR thereafter. Balance transfers made within 120 days qualify for the intro rate and fee.

Wells Fargo ReflectSM Card

0% intro APR for 18 months from account opening on purchases and qualifying balance transfers. Intro APR extension of up to 3 months with on-time minimum payments during the introductory and extension periods. 12.99% to 24.99% variable APR thereafter. Balance transfers made within 120 days qualify for the intro rate and fee.

Maria Adams, Credit Cards Moderator

This answer was first published on 12/14/21. For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Editorial and user-generated content is not provided, reviewed or endorsed by any company.

People also ask

Major credit cards are any cards that belong to one of the big four credit card networks: Visa, Mastercard, American Express and Discover. That’s what stores mean by “we accept all major credit cards.” A major credit card will almost always show the logo of its network on the front. In som e cases it’ll be on the back.

What is a Wells Fargo credit card?

Wells Fargo Bank, N.A. issued private label credit cards are typically merchant or industry branded credit cards that consumers apply for through a merchant or service provider. If you are unsure who your credit card issuer is, please consult your cardholder terms or your billing statement.

What is the phone number for Wells Fargo?

Call 1-800-TO-WELLS ( 1-800-869-3557) 24 hours a day, 7 days a week.

How much protection does Wells Fargo give for cell phone bill?

Pay your monthly cell phone bill with your eligible Wells Fargo Consumer credit card and you'll get up to $600 protection (subject to a $25 deductible).

What is a credit card used for?

Your credit card is used for international, gas station, or online purchases.

Does Wells Fargo have an overdraft protection?

If you choose to link your account to your Wells Fargo checking account for Overdraft Protection, please note the following. If you have a joint checking account, you will be responsible for all advances, including interest and charges, from your credit card to cover overdrafts, regardless of who writes the check, makes the debit card purchase, or engages in any other transaction that causes the overdraft. Depending on your account terms, an Overdraft Protection Advance Fee may be charged to your account each day an Overdraft Protection Advance is made, and interest will accrue from the date each advance is made. Your credit card must be activated; if it is not activated, no money will transfer to cover the overdraft. Once your credit card has been activated, please allow up to 3 business days for your Overdraft Protection service to be fully enabled. Refer to the Consumer Credit Card Customer Agreement and Disclosure Statement for details. There may be other options available to protect against overdraft that may be less costly. For additional information on Overdraft Protection using your credit card, please visit www.wellsfargo.com/credit-cards/features/overdraft-protection. For details on other options, please visit www.wellsfargo.com/checking/overdraft-services/.

Does Wells Fargo have a credit open dialog?

Help protect yourself against unexpected overdrafts and bounced checks by linking your Wells Fargo credit Opens Dialog card to your Wells Fargo checking account. Once you sign up for this service, if you happen to spend more than you have in your checking account, we’ll automatically make up the difference with an advance Footnote 3 3 from the available credit Opens Dialog on your Wells Fargo credit card account.

Does Wells Fargo have zero liability?

Your Wells Fargo Credit Card comes with Zero Liability protection at no extra cost. Your credit card has built-in protection features to help ensure you won’t be held responsible for any unauthorized transactions as long as you report them promptly.

What is a Wells Fargo card?

A card with Wells Fargo means access to one of the largest banking networks and robust technology. Interested in earning cash back and other rewards? A wide selection of credit cards and the Wells Fargo Go Far® rewards program can take your spending a long way.

What is Wells Fargo Active Cash?

The Wells Fargo Active Cash℠ Card offers simplicity and versatility with its unlimited 2% cash rewards rate to individuals looking to accumulate rewards on everyday purchases . Plus, the long introductory APR period and attainable sign-up bonus add significant value as well.

How long is the Wells Fargo introductory offer?

Why we picked it : This new card from Wells Fargo now touts one of the longest introductory APR offers on the market, offering up to 21 months from account opening of 0% introductory interest on purchases and qualifying balance transfers. There’s a base 18 months, plus a three-month extension if you make on-time monthly minimum payments for the length of the intro offer (12.99% to 24.99% variable APR thereafter).

How long does Wells Fargo offer 0% APR?

Make on-time monthly minimum payments (a best practice no matter the card) and you can take advantage of one of the longest intro APR offers on the market with this new card from Wells Fargo, which offers 0% introductory APR for up to 21 months from account opening on purchases and qualified balance transfers (then 12.99% to 24.99% variable APR).

What is research methodology Wells Fargo?

Research methodology: We analyzed Wells Fargo’s catalog of credit cards to identify their top offers on the market. While a large number of factors contribute to the quality of a credit card, the following were our most important criteria in evaluating and choosing the best here:

Does Wells Fargo have a cash back card?

Among direct competitors offering flat rate cash back rewards for no annual fee, the new Wells Fargo Active Cash℠ Card is a serious contender. This card offers an unlimited 2% cash rewards, making it easy to maximize rewards on eligible everyday purchases and a sign-up bonus of $200 cash rewards if you spend $1,000 within the first three months of account opening. Cardholders also benefit from the 0% introductory APR on both purchases and qualifying balance transfers (for 15 months from account opening, then 14.99% – 24.99% variable APR) to help manage existing debt or finance a large purchase.

Does Wells Fargo offer cash back?

You get access to My Wells Fargo Deals, which offers cash back in the form of a statement credit when you pay for eligible experiences.

What is NerdWallet credit card?

NerdWallet's credit cards team selects the best cards in each category based on overall consumer value. Factors in our evaluation include fees, promotional and ongoing APRs, and sign-up bonuses; for rewards cards, we consider earning and redemption rates, redemption options and redemption difficulty. A single card is eligible to be chosen in multiple categories.

Does Wells Fargo have rewards?

It doesn't earn ongoing rewards, beyond allowing you to opt into one-time offers through My Wells Fargo Deals. There's also a balance transfer fee.

Is Wells Fargo Platinum good?

You get a nice, long introductory 0% APR period on both purchases and balance transfers, plus no annual fee. There are no rewards, but you get automatic cell phone protection when you pay your wireless bill with the card, so there's a great reason to hold onto it long-term. Read our review.

Does Wells Fargo have cell phone protection?

To do this, use your Wells Fargo debit card at a Wells Fargo-owned ATM. • Cell phone protection. You'll receive up to $600 worth of coverage — after a $25 deductible — if your cell phone is damaged or stolen and you pay its monthly bill with an eligible Wells Fargo credit card.

Does Wells Fargo have a $20 credit card?

Wells Fargo lets its banking customers redeem credit card rewards in $20 bills right at the ATM. To do this, use your Wells Fargo debit card at a Wells Fargo-owned ATM. • Cell phone protection. You'll receive up to $600 worth of coverage — after a $25 deductible — if your cell phone is damaged or stolen and you pay its monthly bill ...

Does Wells Fargo have a cash back card?

Among flat-rate cash-back cards, you'll be hard-pressed to beat the Wells Fargo Active Cash℠ Card. It earns an unlimited 2% back on all purchases, which is excellent. But in addition, the card offers a rich sign-up bonus and a generous 0% intro APR on both purchases and balance transfers. That's an impressive, hard-to-find combination of features on a card with a $0 annual fee. Read our review.

What is the phone number for Wells Fargo?

If you have questions, please call us at 1-800-247-9215, 24 hours a day, 7 days a week.

Does Wells Fargo have online credit card?

Welcome to Wells Fargo Financial Cards Online Customer Service! Online account access to all of your Wells Fargo Financial credit card accounts including NowLine®, Visa®, MasterCard®, and Cash on Demand® is available 24-hours a day.