Should you buy visa stock now?

Most stock analysts recommend Visa as a good buy for prospective investors. It may not yield a very huge return in the coming years, but it is a pretty solid stock that will not drop below a certain level.

How do I invest in visa shares?

Deposit funds into your account. Place a buy order to add Visa to your stock portfolio. To invest in Visa, you can go through a traditional investment firm, an online brokerage or speak with a financial advisor. How much are Visa shares?

Should you invest in Visa (V) stock in 2030?

As per Visa stock forecast 2030, investors should expect Visa price to record a minimum value of $401 in 2030 and a maximum value to be in the region of $409.55. Based on these values, the average price of Visa share will be $406.34 in 2030. Your capital is at risk. Other fees apply. Should You Invest In Visa (V) Stock?

What are the Buy signals for Visa stock?

The Visa stock holds buy signals from both short and long-term moving averages giving a positive forecast for the stock. Also, there is a general buy signal from the relation between the two signals where the short-term average is above the long-term average. On corrections down, there will be some support from the lines at $213.09 and $208.67.

See more

Is Visa good stock to buy?

Latest Visa Inc Stock News Visa Inc's trailing 12-month revenue is $28.1 billion with a 50.8% profit margin. Year-over-year quarterly sales growth most recently was 18.7%. Analysts expect adjusted earnings to reach $7.412 per share for the current fiscal year. Visa Inc currently has a 0.7% dividend yield.

Is Visa stock a buy sell or hold?

A stock with a P/E ratio of 20, for example, is said to be trading at 20 times its annual earnings. In general, a lower number or multiple is usually considered better that a higher one....Momentum Scorecard. More Info.Zacks RankDefinitionAnnualized Return1Strong Buy24.75%2Buy18.15%3Hold9.70%4Sell5.35%2 more rows

Should I hold my Visa stock?

Is Visa Inc stock A Buy? Several short-term signals, along with a general good trend, are positive and we conclude that the current level may hold a buying opportunity as there is a fair chance for Visa stock to perform well in the short-term.

Is Visa stock expected to rise?

Stock Price Forecast The 31 analysts offering 12-month price forecasts for Visa Inc have a median target of 261.00, with a high estimate of 296.00 and a low estimate of 220.00. The median estimate represents a +22.64% increase from the last price of 212.81.

What will Visa stock be worth in 5 years?

What will the Visa stock be worth in the next 5 years? According to our predictions, the Visa stock can be worth up to $292.98 in the next five years. However, the average price of the stock in five years' time is expected to be $279.37.

Is Visa a value or growth stock?

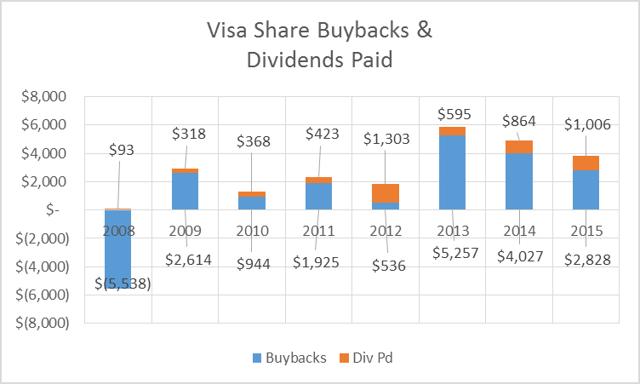

Visa (NYSE:V) has an annual dividend growth rate over the last 5 years of 17.91% and a low payout ratio of just 21.54%. The company's characteristics make Visa attractive for dividend income investors seeking dividend growth stocks and for investors with a long investment horizon aiming to invest for their retirement.

What stock should I buy now?

Top 10 Stocks To Buy Right NowApple Inc. (NASDAQ: AAPL)Alphabet Inc. (NASDAQ: GOOG) (NASDAQ: GOOGL)QUALCOMM Incorporated (NASDAQ: QCOM)Shopify Inc. (NYSE: SHOP)Advanced Micro Devices, Inc. (NASDAQ: AMD)SoFi Technologies, Inc. (NASDAQ: SOFI)The Walt Disney Company (NYSE: DIS)The Boeing Company (NYSE: BA)More items...•

Is Visa undervalued?

Visa Inc has a current Real Value of $239.07 per share. The regular price of the company is $212.82. At this time, the company appears to be undervalued....1.5.LowIncome Per ShareHigh1.311.331.34

Is Visa profitable?

The payment processing company said it earned a profit of $3.4 billion, or $1.60 a share, compared to a profit of $2.57 billion, or $1.18 a share, in the same period a year earlier.

Where is Visa stock 5 years?

Based on our forecasts, a long-term increase is expected, the "V" stock price prognosis for 2027-08-13 is 302.669 USD. With a 5-year investment, the revenue is expected to be around +42.22%. Your current $100 investment may be up to $142.22 in 2027. Get It Now!

Is Visa overvalued?

Is Visa Valuation Too High? Visa's stock price has been hovering around $200 per share for the majority of 2020. This represents an all-time high market cap of over $420 billion. The company also raised its quarterly dividend to $0.30 per share, or a $1.20 annual yield.

Is Google a strong buy?

Google in 2021 finally outperformed high-tech peers once called the "FANG" stocks. But it's in the same boat as Facebook-parent Meta Platforms (FB), Amazon.com (AMZN) and Netflix (NFLX) this year amid a bear market in technology stocks. GOOGL stock jumped 65% in 2021.

Is Visa a sell?

Visa stock is highly traded, with around 6.3 million shares exchanging hands on a typical day. Half of outstanding shares are owned by mutual funds: 5,758 funds owned Visa stock as of June 2022, up from 5,639 in March.

Is Visa overvalued?

Is Visa Valuation Too High? Visa's stock price has been hovering around $200 per share for the majority of 2020. This represents an all-time high market cap of over $420 billion. The company also raised its quarterly dividend to $0.30 per share, or a $1.20 annual yield.

What stock should I buy now?

Top 10 Stocks To Buy Right NowApple Inc. (NASDAQ: AAPL)Alphabet Inc. (NASDAQ: GOOG) (NASDAQ: GOOGL)QUALCOMM Incorporated (NASDAQ: QCOM)Shopify Inc. (NYSE: SHOP)Advanced Micro Devices, Inc. (NASDAQ: AMD)SoFi Technologies, Inc. (NASDAQ: SOFI)The Walt Disney Company (NYSE: DIS)The Boeing Company (NYSE: BA)More items...•

Is Mastercard a buy?

Mastercard Incorporated - Hold Its Value Score of C indicates it would be a neutral pick for value investors. The financial health and growth prospects of MA, demonstrate its potential to perform inline with the market. It currently has a Growth Score of B.

Investing in Visa Inc Stock

Latest Visa Inc ( V) Stock News

Visa Inc. (Visa) is a payments technology company that provides digital payments across more than 200 countries and territories. The Company connects consumers, merchants, financial institutions, businesses, strategic partners and government entities to electronic payments. The Company operates through payment services segment.

Grading Visa Inc Stock

As of February 08, 2022, Visa Inc had a $476.3 billion market capitalization, compared to the Online Services median of $605.3 million.

Other Visa Inc Grades

Stock evaluation requires access to huge amounts of data and the knowledge and time to sift through it all, making sense of financial ratios, reading income statements and analyzing recent stock movement.

Visa Inc Stock: Bottom Line

In addition to Value, Growth and Quality, A+ Investor also provides grades for Momentum and Estimate Revisions.

When did Visa go public?

Overall, Visa Inc stock has a Value Grade of F, Growth Grade of B and Quality Grade of A. Whether this is a good investment depends on your goals and risk tolerance.

How many sectors are there in Zacks?

operates retail electronic payments network worldwide. The company went public in March 2008 via an initial public offering (IPO).

How many X is Zacks?

The Zacks Sector Rank assigns a rating to each of the 16 Sectors based on their average Zacks Rank.

What is VisaNet processing?

The Zacks Industry Rank assigns a rating to each of the 265 X (Expanded) Industries based on their average Zacks Rank.

What are the different grades for stocks?

It provides transaction processing services (primarily authorization, clearing and settlement) to financial institutions and merchant clients through VisaNet, its global processing platform.

What is an X industry?

Within each Score, stocks are graded into five groups: A, B, C, D and F. As you might remember from your school days, an A, is better than a B; a B is better than a C; a C is better than a D; and a D is better than an F.

Is Visa a good stock to buy?

The X Industry (aka Expanded Industry) is a subset of the M (Medium Sized) Industry, which is a subset of the larger Sector category, which is used to classify all of the stocks in the Zacks Universe. The Zacks database contains over 10,000 stocks.

Does Visa need to upgrade?

Since it generally mirrors the state of the economy, which an overwhelming amount of the time expands rather than contracts, Visa is great long-term stock to own. Its top position makes it hard to compete with, and it can provide security and stability to a balanced portfolio.

How much is Visa stock worth in 2021?

Visa needs to upgrade its systems as companies like PayPal Holdings make it easier to send and spend money digitally. Contactless payments are increasing in popularity, and in the U.S. alone Visa customers have more than 370 million tap-to-pay cards. Installment plans have also taken off, with companies such as Afterpay ( recently acquired by Square) and Affirm Holdings demonstrating strong growth, and Visa has launched its own version as well.

What is Visa Inc?

The Visa Inc stock price fell by -2.76% on the last day (Friday, 26th Nov 2021) from $203.25 to $197.65. During the day the stock fluctuated 3.45% from a day low at $192.55 to a day high of $199.19. The price has been going up and down for this period, and there has been a -6.07% loss for the last 2 weeks. Volume fell on the last day along with the stock, which is actually a good sign as volume should follow the stock. On the last day, the trading volume fell by -1 million shares and in total, 11 million shares were bought and sold for approximately $2.17 billion.

What is the UBS rating for V?

Visa Inc., a payments technology company, operates an open-loop payments network worldwide. The company facilitates commerce through the transfer of value and information among financial institutions, merchants, consumers, businesses, and government entities. It operates VisaNet, a processing network that enables authorization, clearing, and settlement of payment transactions; and offers fraud protection for account holders and assured payment fo... Read more

Is Visa stock a sell signal?

On Nov 18, 2021 "UBS Group" gave "$275.00" rating for V. The price target was changed from $202.54 to 1.2% .

Is Visa Inc stock A Buy?

There are mixed signals in the stock today. The Visa Inc stock holds sell signals from both short and long-term moving averages giving a more negative forecast for the stock. Also, there is a general sell signal from the relation between the two signals where the long-term average is above the short-term average. On corrections up, there will be some resistance from the lines at $200.60 and $216.48. A break-up above any of these levels will issue buy signals. Volume fell together with the price during the last trading day and this reduces the overall risk as volume should follow the price movements. A buy signal was issued from a pivot bottom point on Monday, November 22, 2021, and so far it has risen 1.06%. Further rise is indicated until a new top pivot has been found. Furthermore, there is a buy signal from the 3 month Moving Average Convergence Divergence (MACD).

What is Visa's business?

The Visa Inc stock holds several negative signals and despite the positive trend, we believe Visa Inc will perform weakly in the next couple of days or weeks. Therefore, we hold a negative evaluation of this stock.

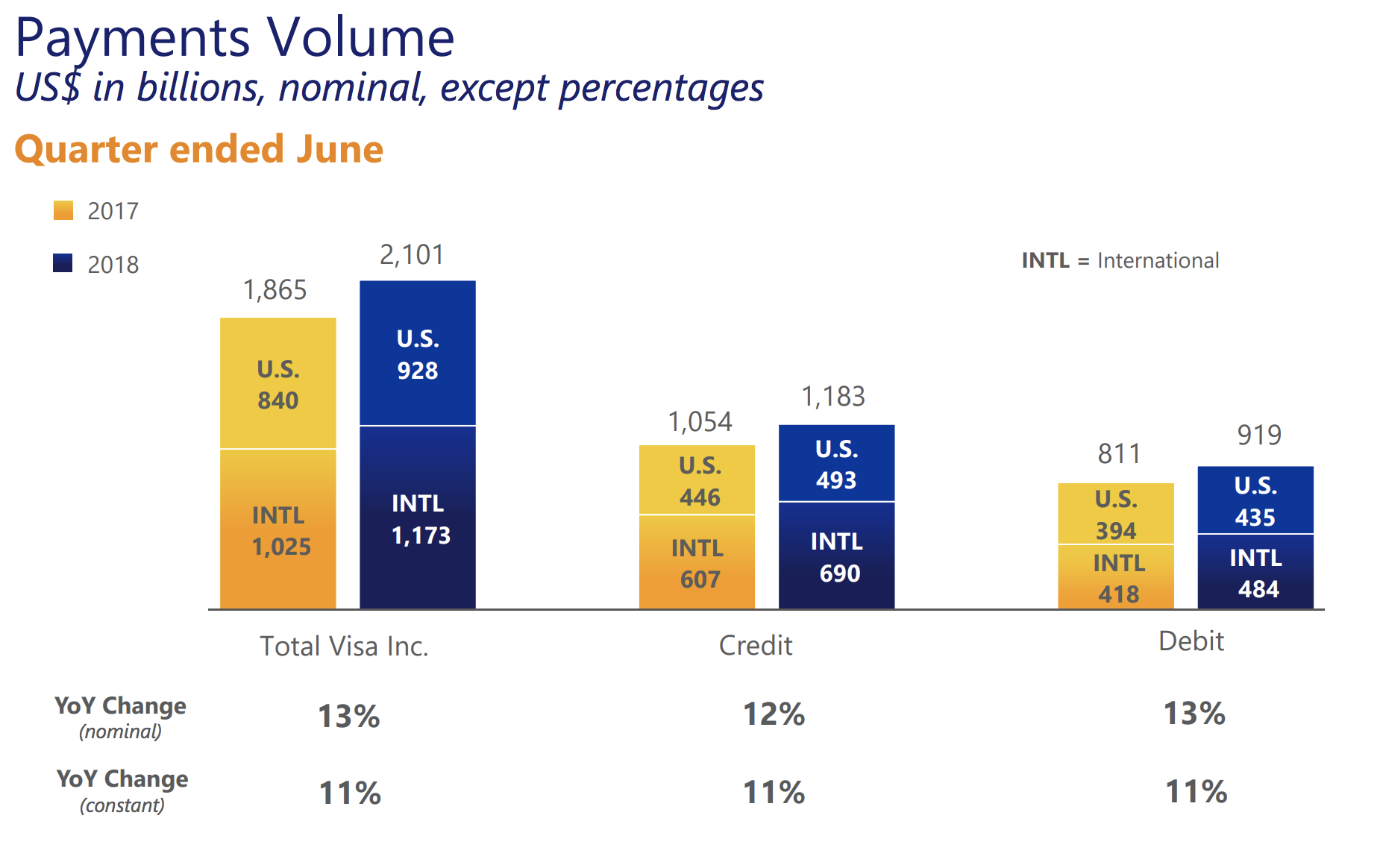

How much did Visa drop in 2020?

Visa is the largest global electronic payment solutions company in the world, which provides a wide range of products and services to support the credit, debit, and related card solutions for institutions in over 200 countries. The company generates revenue by charging fees on transactions and payments volume. Due to the Covid-19 pandemic and the economic uncertainty consumer spending has dropped, negatively affecting the transaction volumes for the payments processing industry. Further, the lockdown restrictions coupled with the travel bans wreaked havoc on the international transaction volumes in the second quarter– the segment contributes 27% of the Visa’s top line. However, as the lockdown restrictions are eased in most of the world, it is likely to help consumer demand. This is also evident from the recently released consumer spending data which suggests an m-o-m growth of 8.5%, 5.6%, and 1.9% in May, June, and July respectively. Despite the recent improvement, the transaction volumes are still likely to be lower than the year-ago period. While the company reported a 17% drop in revenues for Q3 2020 due to higher client incentives and lower international transaction volumes, we believe that Visa’s Q4 results in October will further confirm the hit to its top line.