Is Visa (Visa) stock a buy or sell?

Visa has received a consensus rating of Buy. The company's average rating score is 2.83, and is based on 20 buy ratings, 4 hold ratings, and no sell ratings. According to analysts' consensus price target of $265.38, Visa has a forecasted upside of 28.9% from its current price of $205.93.

What are the price targets for Visa's stock?

24 brokerages have issued 12-month price targets for Visa's stock. Their forecasts range from $210.00 to $305.00. On average, they expect Visa's stock price to reach $265.38 in the next year. This suggests a possible upside of 28.9% from the stock's current price.

Should you invest in Visa (V) stock in 2030?

As per Visa stock forecast 2030, investors should expect Visa price to record a minimum value of $401 in 2030 and a maximum value to be in the region of $409.55. Based on these values, the average price of Visa share will be $406.34 in 2030. Your capital is at risk. Other fees apply. Should You Invest In Visa (V) Stock?

Will Visa stock rise or fall in the next 3 months?

Given the current short-term trend, the stock is expected to rise 5.16% during the next 3 months and, with a 90% probability hold a price between $206.44 and $235.65 at the end of this 3-month period. The Visa stock holds buy signals from both short and long-term moving averages giving a positive forecast for the stock.

See more

Is Visa stock a buy sell or hold?

A stock with a P/E ratio of 20, for example, is said to be trading at 20 times its annual earnings. In general, a lower number or multiple is usually considered better that a higher one....Momentum Scorecard. More Info.Zacks RankDefinitionAnnualized Return1Strong Buy24.75%2Buy18.15%3Hold9.70%4Sell5.35%2 more rows

Is Visa stock a buy right now?

Bottom line: Visa stock is not a buy, as no discernible pattern has formed. Keep an eye on the Dow Jones card giant, as it compares favorably with many top-rated large-cap stocks to buy or watch. To find other best stocks to buy or watch, check out IBD Stock Lists and other IBD research.

Is Visa stock a good long term investment?

Latest Visa Inc Stock News Visa Inc's trailing 12-month revenue is $28.1 billion with a 50.8% profit margin. Year-over-year quarterly sales growth most recently was 18.7%. Analysts expect adjusted earnings to reach $7.427 per share for the current fiscal year.

Is Visa stock expected to rise?

Stock Price Forecast The 31 analysts offering 12-month price forecasts for Visa Inc have a median target of 261.00, with a high estimate of 296.00 and a low estimate of 220.00. The median estimate represents a +22.64% increase from the last price of 212.81.

What will Visa stock be worth in 5 years?

What will the Visa stock be worth in the next 5 years? According to our predictions, the Visa stock can be worth up to $292.98 in the next five years. However, the average price of the stock in five years' time is expected to be $279.37.

Why you should buy Visa stock?

Visa (NYSE:V) has an annual dividend growth rate over the last 5 years of 17.91% and a low payout ratio of just 21.54%. The company's characteristics make Visa attractive for dividend income investors seeking dividend growth stocks and for investors with a long investment horizon aiming to invest for their retirement.

Will Visa stock split in 2022?

We will continue to review our capital considerations on an ongoing basis, but we do not have any plans to split the stock at this time. What is Visa doing to combat climate change? Visa is committed to being a global leader operating as a responsible, ethical and sustainable company.

Is Visa undervalued?

Visa Inc has a current Real Value of $239.07 per share. The regular price of the company is $212.82. At this time, the company appears to be undervalued....1.5.LowIncome Per ShareHigh1.311.331.34

What stock should I buy now?

Top 10 Stocks To Buy Right NowApple Inc. (NASDAQ: AAPL)Alphabet Inc. (NASDAQ: GOOG) (NASDAQ: GOOGL)QUALCOMM Incorporated (NASDAQ: QCOM)Shopify Inc. (NYSE: SHOP)Advanced Micro Devices, Inc. (NASDAQ: AMD)SoFi Technologies, Inc. (NASDAQ: SOFI)The Walt Disney Company (NYSE: DIS)The Boeing Company (NYSE: BA)More items...•

Where is Visa stock 5 years?

Based on our forecasts, a long-term increase is expected, the "V" stock price prognosis for 2027-08-13 is 302.669 USD. With a 5-year investment, the revenue is expected to be around +42.22%. Your current $100 investment may be up to $142.22 in 2027. Get It Now!

Is Visa profitable?

The payment processing company said it earned a profit of $3.4 billion, or $1.60 a share, compared to a profit of $2.57 billion, or $1.18 a share, in the same period a year earlier.

Is Visa a good company?

On average, employees at Visa give their company a 4.1 rating out of 5.0 - which is 5% higher than the average rating for all companies on CareerBliss. The happiest Visa employees are Software Engineering Interns submitting an average rating of 4.2 and Senior Systems Administrators with a rating of 4.1.

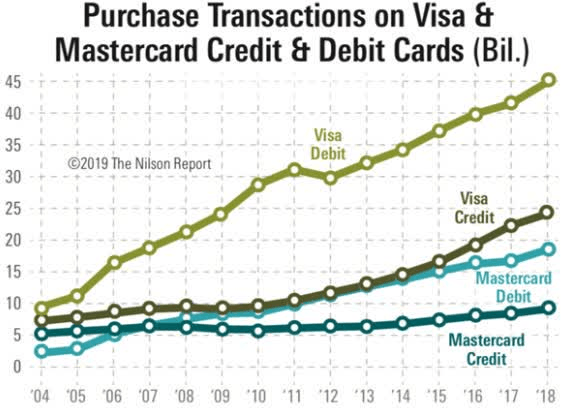

Which stock is better Visa or Mastercard?

Visa has a higher market share, higher revenues and higher valuation than Mastercard. On the other hand Mastercard has a higher revenue per share, EPS and revenue growth. Both stocks should be bullish in 2022 but Mastercard may provide better profitability because of its opportunities for growth.

Is Visa undervalued?

Visa Inc has a current Real Value of $239.07 per share. The regular price of the company is $212.82. At this time, the company appears to be undervalued....1.5.LowIncome Per ShareHigh1.311.331.34

What stock should I buy now?

Top 10 Stocks To Buy Right NowApple Inc. (NASDAQ: AAPL)Alphabet Inc. (NASDAQ: GOOG) (NASDAQ: GOOGL)QUALCOMM Incorporated (NASDAQ: QCOM)Shopify Inc. (NYSE: SHOP)Advanced Micro Devices, Inc. (NASDAQ: AMD)SoFi Technologies, Inc. (NASDAQ: SOFI)The Walt Disney Company (NYSE: DIS)The Boeing Company (NYSE: BA)More items...•

What will Amazon stock be worth in 2025?

Amazon AMZN Stock ForecastYearLower RangeHigher Range2024$237.33$271.722025$299.41$342.792026$376.76$431.362027$463.42$530.576 more rows

How much is Visa stock worth in 2021?

What is Visa Inc?

The Visa Inc stock price fell by -2.76% on the last day (Friday, 26th Nov 2021) from $203.25 to $197.65. During the day the stock fluctuated 3.45% from a day low at $192.55 to a day high of $199.19. The price has been going up and down for this period, and there has been a -6.07% loss for the last 2 weeks. Volume fell on the last day along with the stock, which is actually a good sign as volume should follow the stock. On the last day, the trading volume fell by -1 million shares and in total, 11 million shares were bought and sold for approximately $2.17 billion.

Is Visa stock a sell signal?

Visa Inc., a payments technology company, operates an open-loop payments network worldwide. The company facilitates commerce through the transfer of value and information among financial institutions, merchants, consumers, businesses, and government entities. It operates VisaNet, a processing network that enables authorization, clearing, and settlement of payment transactions; and offers fraud protection for account holders and assured payment fo... Read more

Is Visa Inc stock A Buy?

There are mixed signals in the stock today. The Visa Inc stock holds sell signals from both short and long-term moving averages giving a more negative forecast for the stock. Also, there is a general sell signal from the relation between the two signals where the long-term average is above the short-term average. On corrections up, there will be some resistance from the lines at $200.60 and $216.48. A break-up above any of these levels will issue buy signals. Volume fell together with the price during the last trading day and this reduces the overall risk as volume should follow the price movements. A buy signal was issued from a pivot bottom point on Monday, November 22, 2021, and so far it has risen 1.06%. Further rise is indicated until a new top pivot has been found. Furthermore, there is a buy signal from the 3 month Moving Average Convergence Divergence (MACD).

Is Visa a good business?

The Visa Inc stock holds several negative signals and despite the positive trend, we believe Visa Inc will perform weakly in the next couple of days or weeks. Therefore, we hold a negative evaluation of this stock.

Is Visa Europe a short term overhang?

High Margins : Visa is a great business. It has the lead position in an oligopoly. There are only a few companies that have reasonable market shares within the credit card business. There are massive network effects for companies like Visa. An upstart needs to get millions of cards and thousands of vendors onto its network before it can become even a niche player. New competition is virtually impossible. This is the sort of huge moat you want for long-term winning investments.

How many merchants accept Visa?

Visa Europe: Short-Term Overhang : In the long run, Visa's decision to bring Visa Europe into its corporate umbrella should be positive. In the short run, though, it could be a negative for V stock.

Is there a barrier to new entrants in the Visa industry?

Visa has almost 16,000 financial institution partners, 3.4 billion Visa cards in circulation, and 50 million merchants that accept Visa. Visa also processes roughly twice as many transactions as its closest competitor, Mastercard.

Is Visa Tap to Phone a payment acceptance device?

There is a high barrier to new entrants in the industry. The size of Visa’s merchant network, and the infrastructure required to replicate the company’s offerings would require enormous resources.

Does Visa use cash?

With billions of phones around the world at the ready, the opportunity that comes with lighting them up as payment acceptance devices is enormous. Visa Tap to Phone could be one of the most profound ways to reinvent the physical shopping experience.

Does Visa have tap to pay?

However, 85% of global transactions still use cash as a form of payment. That provides Visa with a long growth runway as it relentlessly expands its operations across the globe.

Is Visa an oligopoly?

Visa has been working to expand tap-to-pay operations. To utilize tap-to-pay, customers touch a card to a credit card terminal. Visa has also extended tap-to-pay to phones and other devices. Aside from ease of use, it provides an additional layer of security, as the device does not leave the hand’s of the consumer.

Is Visa a payment processor?

Visa checks nearly every imaginable box on my investment list. The company operates as a member of an oligopoly, and it is the 500 pound gorilla of the group.

How much of Visa stock is held by institutions?

Visa operates solely as a payment processor. Consequently, it is immune to much of the risk inherent in the lending operations of its peer group. This business model has led to consistent 50% plus profit margins.

When did Visa stock split?

80.54% of the stock of Visa is held by institutions. High institutional ownership can be a signal of strong market trust in this company.

What is the ticker symbol for a visa?

Shares of Visa split before market open on Thursday, March 19th 2015. The 4-1 split was announced on Thursday, January 29th 2015. The newly created shares were issued to shareholders after the market closes on Wednesday, March 18th 2015. An investor that had 100 shares of Visa stock prior to the split would have 400 shares after the split.

What is the P/E ratio of a visa?

Visa trades on the New York Stock Exchange (NYSE) under the ticker symbol "V."

Is Visa a buy or sell company?

The P/E ratio of Visa is 34.74, which means that it is trading at a more expensive P/E ratio than the Business Services sector average P/E ratio of about 13.89.