What is the mission Lane Visa® credit card?

The Mission Lane Visa® Credit Card is an unsecured credit card aimed at consumers with fair credit. Unlike a secured credit card, you do not have to deposit collateral to get this card. Mission Lane LLC services the Mission Lane Visa® Credit Card.

What are the best alternatives to the mission Lane visa?

Here are some alternatives to consider: If you have fair credit or higher (a credit score of 580-plus), the Capital One QuicksilverOne card is a great option. Indeed, this cash back credit-building card beats out the Mission Lane Visa in nearly every category.

What happens if I join the mission Lane credit card waitlist?

Mission Lane will send you an email when or if credit card applications become public. Keep in mind, though, joining the waitlist doesn't guarantee you approval for any products they have to offer. How much is the Mission Lane Credit Card annual fee?

How much can I Raise my mission Lane Visa credit limit?

Though you may start out with a credit limit as low as $300 on the Mission Lane Visa (a common starting limit for unsecured credit-building cards), the issuer gives you a chance to increase your credit limit by demonstrating responsible card use.

Who is Mission Lane Visa?

Mission Lane is a new company dedicated to helping everyone have access to fair and clear credit. Mission Lane believes in creating a relationship where everybody wins. You do well when you succeed with its credit cards. The company does well when you prosper.

Is Mission Lane part of Capital One?

SAN FRANCISCO and RICHMOND, Va., Sept. 16, 2019 /PRNewswire/ -- Mission Lane, a purpose-driven credit card company, today announced that it has appointed Capital One veteran and ex-Barclays US Consumer Bank chief Shane Holdaway as its new CEO.

What bank is associated with Visa?

Bank of AmericaIn October 2007, Bank of America announced it was resurrecting the BankAmericard brand name as the "BankAmericard Rewards Visa".

Is Mission Lane credit card Visa or Mastercard?

The Mission Lane Visa® Credit Card offers the chance to build or rebuild credit without paying a security deposit. Unfortunately, the annual fee and high variable purchase APR make this credit card rather risky for the few benefits it offers.

What is the initial credit limit for Mission Lane Visa?

$300The Mission Lane Credit Card starting credit limit is $300. If you only qualify for this amount, keep in mind that your annual fee will be $75, which means your available credit will drop to about $225. Credit limits are generally calculated based on your income and credit history.

What bank is Credit One Bank?

Credit One Bank is an online-only bank that exclusively offers credit cards. It is a technology and data-driven financial services company that is based in Las Vegas. The bank offers American Express and Visa credit cards to millions of customers across the United States.

Why are banks moving from Visa to Mastercard?

First Direct last year told its customers that moving to Debit Mastercard 'means we will be able to improve the digital payment options available to you in our app. ' High street banks have needed to step up their game with their digital offerings given the increasing number of more nimble challenger banks.

How many banks does Visa work with?

Visa is the brand name of Visa International Service Association, a company owned by some 20,000 member banks that are licensed to issue Visa cards under their own names (for example, Bank of America Visa or Wells Fargo Visa).

What credit score is needed for an associated bank card?

Associated Bank Credit Card is a great Credit Card if you have fair credit (or above). Their APR is quite high (above 20%). If you're looking to apply, we recommend at least a 630 credit score. If you're not sure what your Credit Score is, apply for a report, here.

Does Mission Lane do a hard credit pull?

Does the Mission Lane Visa require a hard credit pull? Yes, you'll face a hard pull of your credit when you apply for the Mission Lane Visa card.

Can I use Mission Lane credit card anywhere?

You can use your Mission Lane Credit Card anywhere Visa is accepted, which is basically almost every place that takes credit cards.

How many credit cards are too many?

Owning more than two or three credit cards can become unmanageable for many people. However, your credit needs and financial situation are unique, so there's no hard and fast rule about how many credit cards are too many. The important thing is to make sure that you use your credit cards responsibly.

Can I use Mission Lane credit card anywhere?

You can use your Mission Lane Credit Card anywhere Visa is accepted, which is basically almost every place that takes credit cards.

Is Mission Lane a secured credit card?

Given its relatively low annual fee, the Mission Lane Visa could make sense as a stopgap unsecured credit-building card, but it's probably not your best option overall. While it charges fewer fees than many cards in this category, a secured card with rewards, no annual fee or a lower APR will likely save you more.

Is Mission Lane credit card instant use?

Instant credit decision Get an instant decision on your Mission Lane Visa ® Credit Card application. No more waiting for days or weeks to find out if you're approved.

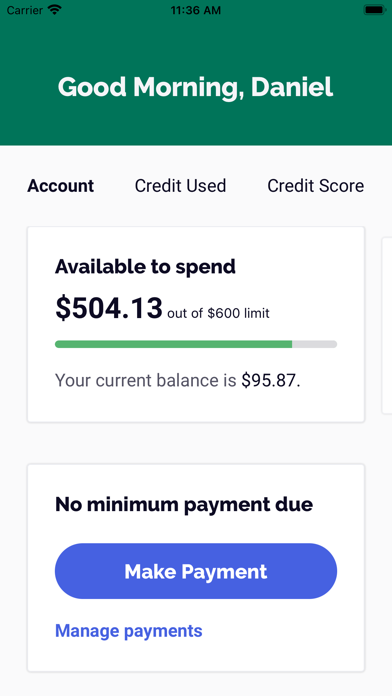

How do I pay my Mission Lane credit card?

The easiest way you can pay your Mission Lane is either online or via the Mission Lane app for iOS and Android. You can also make a payment by calling (855) 570-3732. Ultimately, you can send your payment via mail.

Does the Mission Lane Visa require a hard credit pull?

Yes, you’ll face a hard pull of your credit when you apply for the Mission Lane Visa card. This action may cause a temporary dip in your credit sco...

Does the Mission Lane Visa offer cash back?

No, the Mission Lane Visa card does not offer cash back or any other rewards. Its counterpart, the Mission Lane Cash Back Visa card offers 1 to 1.5...

How long does it take to get approved for a Mission Lane Visa?

You’ll most often get an instant decision when you submit your application for the Mission Lane Visa card.

What credit score do you need for the Mission Lane Visa card?

You can be approved for the Mission Lane Visa card with a bad to fair credit score (a FICO score of 300 to 670). However, if your score is in the f...

Does the Mission Lane Visa require a security deposit?

No, the Mission Lane Visa does not require you to put down a security deposit. There is, however, an annual fee you must pay to hold the card that...

How much does Mission Lane Visa cost?

Most notable is the card’s annual fee, which is set at $59 if you apply through CreditCards.com and are approved (depending on your credit, this could run as high as $75 if you apply another way).

How does the Mission Lane Visa card compare to other credit-building cards?

While the Mission Lane Visa may make sense for cardholders with bad credit who want to work on their score and avoid a deposit, you may be able to find a lower-cost option, especially if you have at least fair credit (or limited credit history). Here are some alternatives to consider:

What is the minimum credit limit for Mission Lane?

Whereas some secured cards let you put down $2,000 or more and get a matching credit limit, the Mission Lane Visa features a minimum starting credit limit of just $300. While this is a pretty standard starting limit for an unsecured credit-building card, it’s worth keeping in mind since such a low limit means that carrying even a small balance could spike your credit utilization ratio. For example, if you had a $300 credit limit and the Mission Lane was your only card, a single $100 charge would put you over 30% credit utilization (a common rule of thumb is to keep your utilization below 30% to avoid hurting your score).

Is Mission Lane a good credit card?

The Mission Lane Visa card probably isn’t your best credit-building option (a secured card will almost certainly be a better deal), but the card’s relatively low fees beat out those of the average unsecured credit-building card. This means if you have bad credit and are set on avoiding a security deposit, the Mission Lane Visa is worth a look.

Is Mission Lane Visa good for bad credit?

The Mission Lane Visa card carries a lower cost than most unsecured cards for people with bad credit, so it could make sense if you want to build credit but can’t afford to tie up hundreds in a security deposit.

Does Mission Lane have credit?

The Mission Lane Visa reports to all three credit bureaus, so if you pay on time and avoid maxing out your card, you should build credit over time.

Does Mission Lane Visa require a deposit?

Having no deposit requirement makes the Mission Lane Visa more accessible for more credit-builders, so our credit-building card rating methodology gives it extra points in the “ease of building credit” category.

Who We Are

Mission Lane is a next-generation financial technology company built for the people. We’re real humans on a mission to make a real impact, with inclusive products, thoughtful customer service, and a commitment to transparency (no surprise fees, no hidden agendas).

Our Leadership

Having helped over 1.5 million Americans access the credit they need, our experienced executive team is poised to redefine the financial industry for the better.

Join the Team

Come work with a bunch of passionate innovators, creative thinkers, and eager collaborators. We’re scaling fast, going far, and having fun while doing it. Learn more about life at Mission Lane.

What is Mission Lane Visa?

As a standard Visa card, the Mission Lane Visa automatically comes with a handful of benefits for cardholders, including zero liability for fraud, a 24/7 pay-per-use roadside dispatch and 24-hour support for lost or stolen cards. These are some of the bare minimum benefits you should expect with a credit card, however, so the Mission Lane Visa doesn’t earn any special praise with their inclusion.

How much money do you need to get a Mission Lane Visa?

Perhaps the Mission Lane Visa’s most appealing feature is its $0 deposit requirement. You’ll get access to a minimum credit limit of $300 without putting down any money beyond the card’s annual fee.

What is Bankrate's mission?

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

Is Mission Lane worth it?

Though the Mission Lane Visa card’s annual fee may be worth it for people with bad credit who want to avoid putting down a deposit in order to build credit, it’s unlikely to be your best option. A few other unsecured credit-building cards are available with no annual fee and some secured cards require a minimum deposit that’s lower than the Mission Lane card’s annual fee.

Does Mission Lane Visa require a deposit?

The Mission Lane Visa card charges a reasonable annual fee compared to most unsecured cards available with bad credit, is laudably free of the hidden fees common among subprime cards and doesn’t require you to put down any money as a deposit.

Is Mission Lane a secured card?

Though it carries a relatively low cost for an unsecured card available with a damaged or limited credit history, the Mission Lane Visa card will fall short of the typical no annual fee secured card for most credit-builders.

Get an instant decision

Find out right now if you're approved for the Mission Lane Visa ®. No more waiting for days or weeks.

Higher credit lines over time

Get a higher credit line if you're in good standing after making your first 6 payments on time!

Transparent pricing with no hidden fees

Security deposit? Monthly maintenance fees? Over-the-limit fees? Nope!

How much is the Mission Lane credit card?

The starting credit limit for the Mission Lane Credit Card is $300. If you only qualify for this amount, keep in mind that your annual fee will be $75, which means your available credit will drop to about $225.

What is the phone number for Mission Lane Credit Card?

Erwin Lozano. @erwin_lozano. The Mission Lane Credit Card phone number for customer service is 1-855-570-3732. You could also contact them online by signing in to your account. They are very responsive on Twitter and Instagram, too.

What is the APR on Mission Lane?

The Mission Lane Credit Card APR is 3.25% - 29.99% (V). The V at the end stands for “variable” and tells you the APR can change based on the Prime Rate.

How to ask Mission Lane to reconsider?

Even if you're denied, it’s important to remember that there’s still hope. You can ask Mission Lane to reconsider your application by calling 1-855-570-373 and making your case. It’s not guaranteed they will change their mind, but it’s definitely worth a try. show more….

How far in advance do you have to send payment to Mission Lane?

Alternatively, you can send your payment via mail, just make sure to send it at least 5 days prior your due date. This way you could avoid being charged with a late fee. The Mission Lane payment address is:

Can you apply for Mission Lane credit card with invitation code?

The biggest downside of the Mission Lane Credit Card is that you can only apply for it with an invitation code. If you haven’t received a pre-approved offer with a code yet, you can join Mission Lane's waitlist. show more…. 1.

Is Mission Lane a good credit card?

Yes, the Mission Lane Credit Card is a good card for people looking to build or rebuild their credit. It doesn’t have any hidden fees, and the issuer offers periodical credit limit increases (if you use your card responsibly). You’re also given many credit-building tools such as: Free access to your credit score.