What is the credit score needed for Amazon?

Amazon Prime Rewards Visa Signature Card Credit Score. Crediful. August 3, 2020 • Credit. Are you thinking about applying for the Amazon Prime Rewards Visa? The minimum recommended credit score for this credit card is 640. As you can see below, 640 is considered “fair”. Poor: 300 to 579. Fair: 580 to 669. Good: 670 to 739.

Do I have to pay for credit score?

Yet federal law requires you to pay $15 to get it. The fee is a gift to credit scoring companies like Fair Isaac, Choicepoint, TransUnion and Vantage. They don't need the dough; they already collect zillions of dollars from banks, car dealerships and other lenders who buy your score to make sure they're charging you enough to offset their risk.

What is the best Visa credit card?

Types of Visa Cards

- Traditional Visa: Traditional Visa credit cards are the easiest to qualify for, and they tend to come with no annual fee. ...

- Visa Signature: Visa Signature cards may or may not come with an annual fee, but carry a more robust selection of perks. ...

- Visa Infinite: All Visa Infinite cards charge annual fees, with some costing hundreds of dollars per year. ...

Is the Amazon Visa credit card good?

CNN Underscored reviews financial products such as credit cards ... there’s a good chance you’re already a Prime member, in which case this card could be your best option. But if you don’t, you can get the Amazon Rewards Visa Signature Card instead ...

What is the winner of Amazon Prime Rewards?

If youre an Amazon Prime member, the clear winner is the Amazon Prime Rewards Visa Signature Card. Youll earn a $100 Amazon.com gift card, which can go a very long way.

What is a good alternative to Amazon Prime?

Amazon Rewards Visa Signature Card: This card could be a good alternative for nonAmazon Prime members who frequently shop on Amazon and at Whole Foods. for a closer look.

How much does Amazon Prime cost?

The Amazon Prime Rewards Visa Signature Card and the Amazon Prime Store Card do require that you have a current Amazon Prime membership, which runs $119 per year, or $12.99 a month.

What is the best credit card for Amazon Prime?

The Amazon Prime Rewards Visa Signature credit card , with its 5% cash back on purchases at Amazon.com and Whole Foods Market, is best for people who do a lot of their shopping at those retailers.

How does a credit card affect your credit score?

The key to good credit history is being selective about your credit cards and how you use them. Available credit, low card balances, on-time payments and card longevity are some of the factors that affect your credit score most. Canceling a card because it isn’t right for you could negatively impact the average age of your credit card accounts and your overall available credit. Make sure that the Amazon Prime Rewards card will suit your needs for years to come before you apply.

What is the credit limit for Amazon?

The Amazon Store Card credit limit is at least $400 in most cases, and the average credit limit is around $1,500. You can definitely get a higher limit than $1,500 with the Amazon Store Card, but you can also get a lower limit than $400. Some forum users have reported initial credit limits as low as $150.

What is balance transfer?

A balance transfer is a way to move debt from one card to another with the goal of saving money on interest.

How Long Does It Take To Get Approved For Amazon Prime Rewards Visa Signature Credit Card?

Typically, you are approved in a matter of minutes when applying for an Amazon Prime Rewards Visa Signature Card. An exception could be if they require more information to confirm your identity.

What Are The Approval Odds For Amazon Prime Rewards Visa Signature Card?

For the highest approval odds, a credit score of 700+ is required. You also need to be over 18 years old with a valid ID & SSN to qualify.

What Credit Bureau Does Amazon Use When Pulling Your Credit For Amazon Prime Rewards Visa?

Amazon uses Chase for its credit cards. Chase uses all three credit bureaus and the FICO 8 model when making credit decisions.

Does Applying For An Amazon Credit Card Hurt Your Credit?

If you apply for an Amazon Prime Rewards Visa Signature card, it results in a hard inquiry on your credit report . Usually, a hard inquiry causes your score to drop by around 5 points.

What Are The Approval Odds For Amazon Store Card?

Approval odds for the Amazon store card are good — if you have a score above 640. What if your score is too low? Let the reputable credit repair experts at Credit Glory help you dispute (& remove) any negative items — giving your score the boost it needs!

What is credit glory?

Credit Glory is a credit repair company that helps everyday Americans remove inaccurate, incomplete, unverifiable, unauthorized, or fraudulent negative items from their credit report. Their primary goal is empowering consumers with the opportunity and knowledge to reach their financial dreams in 2020 and beyond.

What is Amazon Prime Credit Card?

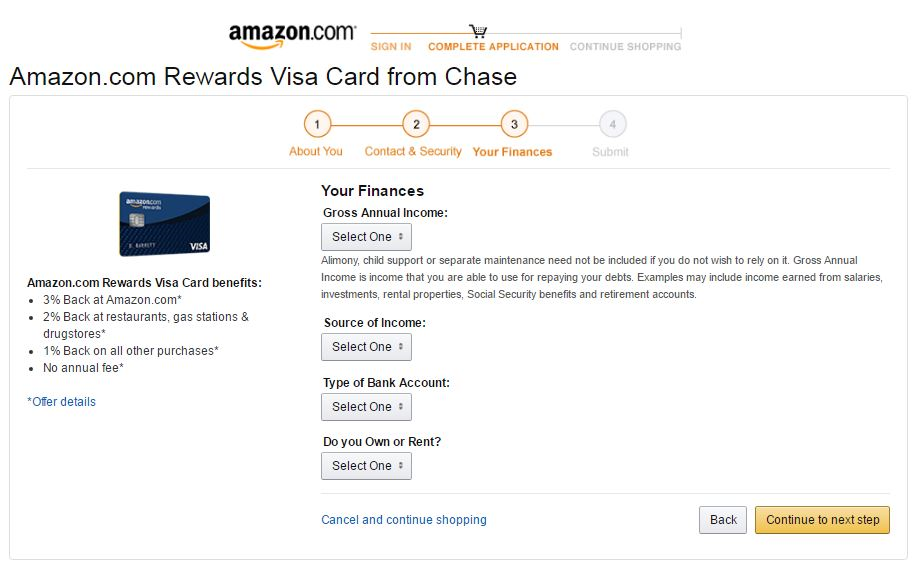

Let’s check out the benefits of Amazon Prime Credit Card, which actually is titled as Amazon Prime Rewards Visa Signature Card.

What happens to Amazon Prime points when it expires?

When your Prime membership expires, your rewards points on Amazon purchases changes from 5% to 3%, and the next time you get a new card for the account, it will be gray instead of black, and say Amazon instead of Amazon Prime.

How long does a hard inquiry stay on your credit report?

It’s a normal part of the process. That hard inquiry stays on there for two years , and factors into most major credit scoring models for one year.

What happens if you get approved for a new credit card?

If you’re approved, you end up with a new account open (good, because credit scoring models like to see more accounts). This will mean a shorter average age of accounts (slightly worse for credit scores) and more available credit (good for credit scores, as long as balances are low).

What is the credit score for a new credit line?

However, credit score with 750 & above is considered as a good score to be eligible for applying credit line.

What to do if you don't use your auto renew?

If you are not using it - then make sure to turn off your auto renew so you don’t pay for next year.

How many people use Wise?

Get the world's most international account. Join 10 million people using Wise.

How long does it take to sign up for credit sesame?

No Hidden Fees. Takes Only 90 Secs. Sign Up 100% Free at Credit Sesame!

Does Amazon have a high APR?

You should always beware of high-interest rate credit cards and the Amazon store credit card does have a high APR.

Does Amazon require a credit card?

A: There are several Amazon credit cards available, but for the Amazon Store Card, your credit doesn’t need to be excellent. Amazon, like most credit card issuers, doesn’t share all of its requirements for qualification, probably because they change from time to time based on whatever is profitable at the moment.

Can you use a Milestone card on Amazon?

The Milestone® card is a Mastercard® which means that it can still be used on Amazon and at millions of merchants around the world. And your application will be considered even if you have a prior bankruptcy.

Amazon prime rewards Visa Credit Score needed?

Great afternoon!! What is the typical score needed for approval? I shop on Amazon "ALOT" and it just makes since for me to go after it. Im already a prime member. According to Amazon i would have made $147 in rewards this year so far. Wow!!!

Re: Amazon prime rewards Visa Credit Score needed?

Its not just score but profile as a whole people with 640's can get approved for it while others in the 700+ range are denied it.. Need to know alot more about your profile such as new accounts, baddies, scores, etc, etc.. Just not about putting a score on it.

Re: Amazon prime rewards Visa Credit Score needed?

My guess is it would be an approval.. although there are no gurantees in the credit world as stated people in 700+ get denied while people say 650 will get approved.. Worse case is it is a loss of 2 inquiries maybe 1 if denied or obviously an approval..

When was wallethub last updated?

@WalletHub • 04/24/21#N#This answer was first published on 07/10/15 and it was last updated on 04/24/21. For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Editorial and user-generated content is not provided, reviewed or endorsed by any company.

Does pre-approval affect credit score?

Pre-approvals are done using a soft inquiry or "soft pull" on your credit report, which means there's no effect on your credit score. However, if you decide to actually apply for a card, Chase will perform a hard inquiry, which may cause a slight dip in your credit score. show less.

Does Chase have a pre-approval tool?

Be sure to check your credit score regularly to assess your chances of meeting the Chase credit card credit score requirements. Chase also has an online pre-approval tool that gives you an indication of how well your credit stacks up without having to formally apply.

Does Chase have a fair credit score?

There are also several Chase credit cards that require excellent credit, including the. Chase Sapphire Reserve® card. Chase does not offer credit cards for fair credit or lower credit scores at this time. It is possible to get approved for a Chase credit card with a credit score lower than 700.

What to do if you don't need a small emergency loan?

So if you don’t need a small emergency loan, the best course of action is to improve your credit inexpensively with a secured card. Secured cards are cheaper than unsecured cards, build credit just as effectively, and offer the closest thing you’ll find to guaranteed approval.

Is WalletHub a legal firm?

WalletHub Answers is a free service that helps consumers access financial information. Information on WalletHub Answers is provided “as is” and should not be considered financial, legal or investment advice. WalletHub is not a financial advisor, law firm, “lawyer referral service,” or a substitute for a financial advisor, attorney, or law firm. You may want to hire a professional before making any decision. WalletHub does not endorse any particular contributors and cannot guarantee the quality or reliability of any information posted. The helpfulness of a financial advisor's answer is not indicative of future advisor performance.

Is Amazon Prime a Chase card?

First, the Amazon Prime Rewards Visa Signature card is a Chase Bank credit card. Therefore , regardless of your credit; if you have acquired 5 new accounts in a 24 month period , you will be denied for this card. Research Chase Bank 5 new cards 24 month period rule

Does Amazon credit card have to be approved by Chase?

However, your credit score is just one part of your creditworthiness. On its own, it does not guarantee approval. Chase Bank, which issues the Amazon.com Credit Card, doesn’t publicly disclose specific approval requirements. But they will review such things as your income, employment status and total amount of debt.

Is editorial content reviewed or endorsed by any company?

Editorial and user-generated content is not provided, reviewed or endorsed by any company.