Visa

Visa Inc. is an American multinational financial services corporation headquartered in Foster City, California, United States. It facilitates electronic funds transfers throughout the world, most commonly through Visa-branded credit cards, gift cards, and debit cards. Visa does not issue cards…

What is a money transfer credit card?

What is a Money Transfer Credit Card? Not to be confused with their similarly named counterparts (balance transfer cards), a money transfer card allows you to borrow money on a credit card by paying a lump sum directly into your bank account. You can then use this cash as a loan or as a way of clearing an existing overdraft.

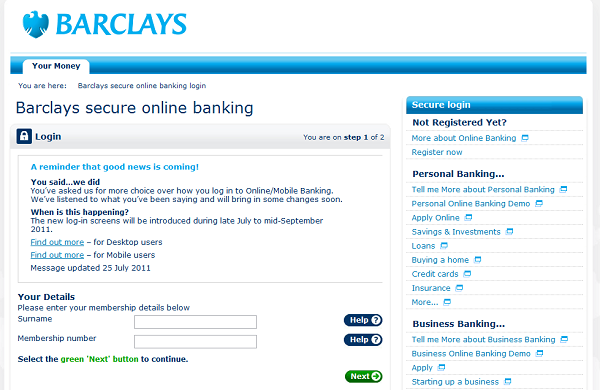

How to make a visa money transfer from bank account?

A customer needs to log into his bank account through net banking service. The customer should enter his login ID and password for logging into his account. For making a Visa money transfer, the customer needs to go to the option of Third party funds transfers and under this option he needs to select Visa Card pay option.

Is visa money transfer the same thing as Visa Direct?

It is so hard to hire strong engineers for my company in San Francisco. Visa Money Transfer and Visa Direct are the same thing, a person to person mechanism for transferring from one Visa account to another.

What are the benefits of visa money transfer?

The simple yet highly advantageous benefits that accrue to a customer by making use of Visa Money transfer is that one can make safe payments at any point of time and from any place. What is the process of Visa Money transfer? As simple and fast as the process of Visa money transfer is, it is also considered quite safe and reliable for use.

See more

How does Visa money transfer work?

0:122:21Visa Direct - P2P Payments for Banks - YouTubeYouTubeStart of suggested clipEnd of suggested clipAccount while traditional methods can take days to process visa direct enables real-time payments 24MoreAccount while traditional methods can take days to process visa direct enables real-time payments 24 7 even on nights weekends and holidays visa direct isn't just for local transactions.

What are the charges for Visa money transfer?

In one transaction, a customer can make a transfer for the value of not more than Rs 49,999. For every transaction completed by the card account of the customer, a transaction fee of INR 5, along with extra taxes, shall be charged to the account of the customer.

Can we transfer money from Visa?

Send money to a family member, share expenses with a friend or pay off a Visa credit card bill. Visa Direct is simple to use for both sender and recipient, whether they are standing in the same room or living half-way around the globe.

How long does a Visa money transfer take?

Visa requires some issuers to make funds available to its cardholders within a maximum of 30 minutes of approving the transaction.

Can you transfer money from Visa card to bank account?

direct transfer to bank account you can transfer funds from your credit card to your bank account directly using the net banking app or even over the phone. since the daily and monthly transfer limit varies from bank-to-bank, you would need to check that with your bank to get the updated information.

What is Visa direct transfer?

Visa Direct, a real-time payments network for business and person-to-person (P2P) payments, is helping financial institutions and technology companies allow their customers to transfer funds to a debit account in 30 minutes or less.

How can I transfer money from my credit card to my credit card?

Step 1: Go to the website of your bank. Step 2: You then have to login into the account of your credit card. Step 3: Choose a transfer method. Step 4: Place the amount you wish to be transferred.

How can I transfer money from my credit card to my debit card?

You can transfer money from a credit card to a debit card quickly and easily. The quickest option is to make a simple bank transfer either online or in person at your local branch, as long as you have the details of both accounts in question.

How Much Does Visa charge for international payment?

1%Usually, MasterCard and Visa charge a foreign currency transaction fee of 1%. However, most credit card companies add an extra percentage on it, making the fee range from 1.5% to 3% or even more. Therefore, this fee differs from one credit card issuer to the other.

Does Visa charge international transaction fee?

Visa and MasterCard levy a 1 percent fee on international transactions, and some banks that issue those cards also tack on a currency conversion fee (additional 1–3 percent). These are similar to the fees associated with using your debit card for ATM withdrawals.

Is there a transaction fee on a Visa credit card?

Credit card processing fees for merchants equal approximately 1.3% to 3.5% of each credit card transaction. The exact amount depends on the payment network (e.g., Visa, Mastercard, Discover, or American Express), the type of credit card, and the merchant category code (MCC) of the business.

Does Visa have international charges?

Payment processing networks like Visa, Discover, Mastercard and American Express may also charge international fees. Card issuers can opt to exclude this fee from card terms but if not, the network's fee will be tacked on to any fee charged by the issuer.

What is a money transfer card?

Not to be confused with their similarly named counterparts (balance transfer cards), a money transfer card allows you to borrow money on a credit card by paying a lump sum directly into your bank account.

How do money transfer credit cards work?

Money transfer cards work by allowing you to transfer funds to other accounts, in order to clear an existing balance or debt. You are then given a set period of interest-free borrowing where you can pay off the total amount. If this introductory period expires, you will then be charged interest on top of the outstanding balance that is left to pay.

Why are money transfer cards so effective?

Check which card you're eligible for. Not to be confused with their similarly named counterparts (balance transfer cards), a money transfer card allows you to borrow money on a credit card by paying a lump sum directly into your bank account.

Can you use money transfer cards to clear an overdraft?

You can then use this cash as a loan or as a way of clearing an existing overdraft. Many money transfer cards come with zero interest periods, so as long you pay all of the money back within the agreed timeframe, you don’t pay interest on the borrowing.

What is a visa?

Visa Inc. (also known as Visa, stylized as VISA) is an American multinational financial services corporation headquartered in Foster City, California, United States. It facilitates electronic funds transfers throughout the world, most commonly through Visa-branded credit cards, gift cards, and debit cards. Visa does not issue cards, extend credit or set rates and fees for consumers; rather, Visa provides financial institutions with Visa-branded payment products that they then use to offer credit, debit, prepaid and cash-access programs to their customers. In 2015, the Nilson Report, a publicat

What is Visa Direct?

Visa Money Transfer and Visa Direct are the same thing, a person to person mechanism for transferring from one Visa account to another. An original credit transaction (OCT) is a mechanism in the Visa and MasterCard system by which firms can make push payments to cardholder beneficiaries. Think international payroll and commission payments, international insurance reimbursements, gaming winnings and many more. I say international because almost all domestic payment (ACH) systems are easy and less expensive although there is no reason why you couldn’t OCT domestically. When you send money by OCT, you eliminate intermediary bank charges and landing fees to the beneficiary. If you push an OCT to a debit card account, the funds drop in the underlying bank account fee free even internationally.

How much does Visa take?

Visa and Mastercard take about 0.10% on every single transaction passed through their brands. Don’t feel sorry for them. There are hundreds of billions of dollars worth of transactions every year.

What is Visa checkout?

On the other side, Visa Checkout is one of Visa’s product. Visa Checkout is an online payments feature that makes online shopping more convenient. At checkout, enter your username and password to make your online shopping experiences easier with a single account that can be used across all your devices. You can store and use any Chase card with Visa Checkout, and there is no need to re-enter your card number or address every time you make a purchase.

Can I pay for a P2P transaction on Visa Direct?

Visa Direct is a product that powers P2P payments for businesses. Therefore, consumers such as you and me will not pay transaction costs on Visa Direct. However, if you are a businesses, then there may be a cost associated with the ability to initiate a Visa Direct P2P transaction. I urge you to reach out to a Visa, and they would be happy to chat with you to discuss the opportunity.

Is B visa a business visa?

Neither term is an official term. Most visitors who enter the US temporarily for tourism or business (not employment, but for example to attend a meeting) have a B visa. B-2 refers to tourism; B-1 refers to business. B-1 and B-2 are pretty much interchangeable.

Does cash withdrawal have higher interest rate than not paying it off?

Note, your cash withdrawal has even higher interest rate than not paying it off, and the interest starts counting the moment you get your money.

How long does it take for a Visa to make funds available?

Visa requires some issuers to make funds available to its cardholders within a maximum of 30 minutes of approving the transaction.

What is Visa support?

The support of Visa’s trusted expertise and capabilities to help you as you launch, grow, or enhance the payment experience for your customers.

Is Visa Direct real time?

Visa Direct’s real-time¹ payment capabilities open up new, more convenient payment experiences for many different use cases, including:

How does a money transfer work?

How a money transfer works in practice 1 You get an unexpected £500 car repair bill, but you don’t have enough money in your bank account. Your garage also doesn’t accept credit cards. 2 You have a credit card with a 0% money transfer interest rate for 12 months and a 3% transfer fee. So you complete a £500 money transfer with a 3% fee, totaling £515 on your credit card. 3 This puts £500 into your current account, so you can pay for the repairs using your debit card. 4 The promotional rate will expire after 12 months. If the balance isn’t fully repaid, any remaining amount will revert to your standard money transfer rate. 5 Remember, the amount of interest you will be charged depends on how quickly you pay it back. Other fees may also apply, depending on your credit card provider.

What happens if you use a money transfer card?

If you use a money transfer card for other purposes such as everyday spending, the standard purchase rate might be higher – meaning you could be charged more interest.

What happens if your credit card isn't accepted?

For example, if your current account balance is low and somewhere doesn’t accept credit cards, a money transfer can provide funds to use from your current account using your debit card.

How long does a credit card promotional rate last?

The promotional rate will expire after 12 months. If the balance isn’t fully repaid, any remaining amount will revert to your standard money transfer rate. Remember, the amount of interest you will be charged depends on how quickly you pay it back. Other fees may also apply, depending on your credit card provider.

How old do you have to be to transfer money to a UK bank account?

Money transfers are only available to UK residents aged 18 or over and are subject to status. A money transfer is one of four ways to use a credit card, including card purchases, balance transfers and cash transactions.

Why do people use money transfers?

For financial flexibility . A money transfer can also be helpful for unplanned expenses and one-off major purchases, letting you use your credit card’s available funds in situations where you can’t use your card.

How much is the fee for transferring money?

This fee is usually a small percentage (up to 5.00%) of the amount you’re transferring into your current account. You’ll most likely be charged each time you make a money transfer.

What is Visa Direct?

Visa Direct is a VisaNet processing capability that allows safe, convenient, real-time 1 funds delivery directly to financial accounts using card credentials. Visa Direct clients use the capability to enable use cases 2 such as person-to-person (P2P) payments, funds disbursements, bill pay, or cross border remittances directly to an eligible debit or prepaid card.

What is the first step in Visa Direct?

The first step in any Visa Direct program is to establish a relationship with a Visa Acquiring Bank who will sponsor the program and provide the acquiring BIN.

What is OCT in Visa?

The original credit transaction (OCT) is a VisaNet Transaction that can be used to send or "push" funds to an eligible card based account, resulting in a credit of funds to the cardholder's account.

What is disbursement in banking?

Disbursement transactions occur when a Business/Corporate (sender) sends money to a cardholder's debit or prepaid card using an OCT. The funding source is the Business/Corporate originating the transaction.

Is Visa a global leader?

As a global leader in payments, Visa can uniquely take advantage of its existing network of financial institutions, merchants and Visa accounts around the world to help its clients to offer secure, convenient and cost-effective money transfer solutions. Because Visa Direct utilizes Visa's existing payment network infrastructure, the platform is highly cost-effective, secure and scalable to markets globally.

How long does it take to get a credit increase?

Earn a credit limit increase in as little as 6 months. Terms and conditions apply.

How many tier qualifying night credits are there?

5 Tier-Qualifying night credits toward status and Milestone rewards for every $10,000 you spend in a calendar year.

How much back in bitcoins do you get on a card?

Earn 2% back in bitcoin on every purchase over $50,000 of annual spend. Rewards rate increases from 1.5% to 2% after $50,000 of spend has been achieved and resets on the card anniversary date every year.

Is a Visa prepaid card safe?

A Visa prepaid card could be the way to go. Its a more secure, convenient solution to everyday spending.

Does Visa give compensation?

Card information is provided by third parties. Visa may receive compensation from the card issuers whose cards appear on the website, but makes no representations about the accuracy or completeness of any information. Please be sure to carefully review all terms and information in connection with the application process. For more information regarding the terms and conditions of any card, click 'Apply', 'Buy Online' or 'Terms and Conditions'.

Better way to send money internationally

We're regulated by authorities all over the world. That's a lot of standards to live up to – so we have to be safe. And our smart tech moves your money faster than banks.

International money transfer fees: How much do they cost?

No big fees, hidden or otherwise. So it's cheaper than what you're used to.

Wise is safe and secure

Wise is an authorised Electronic Money Institution independently regulated by the Financial Conduct Authority (FCA) in the UK.

People love sending money internationally with Wise. See what they have to say

For sure the best and easiest way to transfer money I’ve ever come across. Banks are completely out of the picture for me. Thank you @Wise 🙏🏽 💵 💶

Start saving money with Wise

Send money at the best rate wherever you are. Join Wise for free today.