Why is visa a good credit card?

- No fees

- Cashback with timely payments

- Average credit accepted

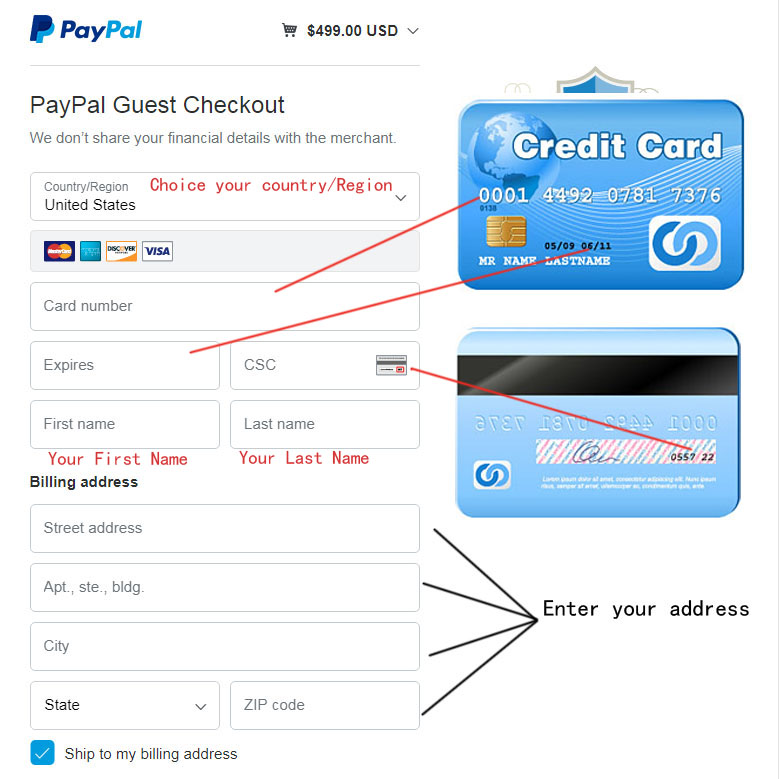

How do I pay my Visa credit card online?

Set up your automatic payment with eBills:

- Sign in, select Bill Pay tab and locate the credit card account you'd like to set automatic payments up on.

- Click the AutoPay link next to the company and bill, select Set Up AutoPay, then Set Up Based on the eBill.

- Select your Pay From account, Amount and Deliver by date on which you'd like the payment sent. ...

- You will receive a confirmation. ...

Does Visa offer a prepaid cash card?

The all-purpose Visa Prepaid card is a prepaid card that you can use to withdraw cash, pay bills or make purchases anywhere Visa Debit cards are accepted, in-person or online. Access your money faster with direct deposit of paychecks, tax refunds, government checks and other recurring checks. Pay bills faster and easier than writing a check.

Can I use my Visa card to get cash?

To get a cash advance from a Visa card, go to an ATM. Find an ATM with the logo of your bank on it, insert your card and pin number, and follow the instructions. If you would prefer not to pay ATM fees, go to the bank where your credit card was issued and ask for a cash advance in person.

What is Visa card pay?

Visa Credit Card Pay is a mode of payment that allows you to transfer funds from any resident bank account to any SBI Visa Credit Card, within India using your bank's Netbanking facility.

Is a pay card the same as a debit card?

A paycard is similar to a debit card. Physically, it's a plastic card that's been loaded with an employee's wages on pay day. The card displays the brand (e.g., Discover, MasterCard, or Visa) provided by the issuer. The issuer is the financial institution providing the paycards.

How does a Visa card work?

Your Visa Debit card still works like a debit card, not a credit card. If you use your PIN for your Visa Debit card transactions without signing, you may not receive the same security protections for transactions not processed by Visa. You can get cash back when you use your Visa Debit card at many merchant locations.

How does a pay card work?

A pay card is a reloadable prepaid card that allows employers to electronically load employees' wages or salary onto the card. Employees who receive their paycheck on a pay card can save, withdraw or spend the money just like they're using a debit card.

Can I put money on my paycard?

But paycards can come with employee-paid fees and are regulated in some states. Here's what you need to know when considering paycards for your employees. Don't confuse paycards with prepaid debit cards. Anyone can purchase a prepaid debit card in a store and continually load funds onto the card.

Can you transfer money from a paycard to a bank account?

0:081:53Fintwist: How to transfer money from the card to a bank account - YouTubeYouTubeStart of suggested clipEnd of suggested clipIs this the first time you're setting up a direct deposit go to card to bank transfers underMoreIs this the first time you're setting up a direct deposit go to card to bank transfers under transfer and pay in the menu. Click add external account in the quick links menu. Enter your bank.

What is the benefit of Visa card?

A Visa credit card doesn't just offer you convenient buying power. It can also offer the opportunity to earn rewards, enjoy travel perks, get cash back and build up your credit history.

How much money can you put on a prepaid Visa?

Most Visa prepaid card options will allow you to load up to $15,000 into the card account. If you're accessing a reloadable prepaid card, you can continue to add money to your account when you spend some of your current balance. In either scenario, though, you cannot surpass the $15,000 account balance limit.

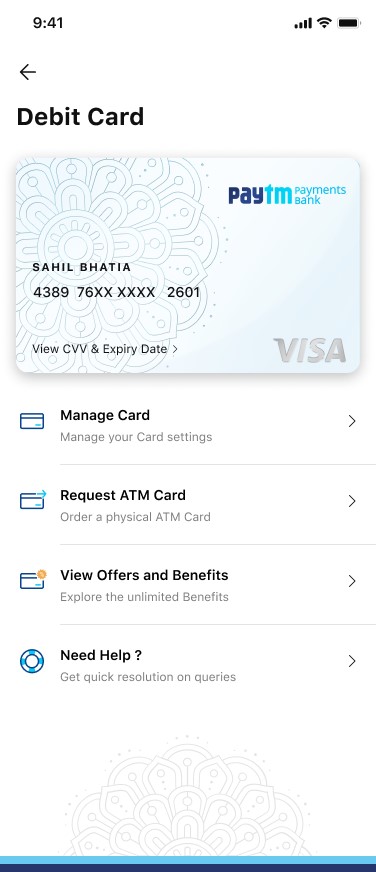

Is Visa a debit or credit?

Visa Debit is a major brand of debit card issued by Visa in many countries around the world. Numerous banks and financial institutions issue Visa Debit cards to their customers for access to their bank accounts.

What are the disadvantages of a payroll card?

List of the Cons of Payroll CardsThere are more fees to pay with payroll cards. ... Payroll cards are sometimes restricted by local laws. ... Lost funds are challenging to recover with payroll cards. ... The fees of payroll cards impact low-income workers the most. ... You can't pay some bills with a payroll card.More items...•

What is a major disadvantage of a payroll card?

Payroll card cons These are some disadvantages of using payroll cards: Bank accounts provide interest, whereas payroll cards do not. Direct deposits cannot be lost or stolen like a payroll card can. Additional fees apply – such as when an employee views their balance.

What are the disadvantages of a payroll card?

List of the Cons of Payroll CardsThere are more fees to pay with payroll cards. ... Payroll cards are sometimes restricted by local laws. ... Lost funds are challenging to recover with payroll cards. ... The fees of payroll cards impact low-income workers the most. ... You can't pay some bills with a payroll card.More items...•

How do I get money off my paycard?

If you accept, you'll receive your paycheck as a direct deposit onto the card instead of getting a physical check or a direct deposit into your bank account at the end of each pay period. You can then use the card for purchases or to withdraw cash from an ATM, similar to a debit card.

Why do companies use pay cards?

Pay cards offer employers a fast and secure way to pay their employees, especially those who do not have a bank account. Steve Shouler, owner of PayNortheast Payroll Company, said employers can deposit wages onto an employee's pay card using the routing and account number associated with the pay card.

Convenience

Your pay is automatically loaded on to the card and is available to use right away, with no check-cashing fees. Plus, you can make purchases everywhere Visa Debit cards are accepted.

Flexibility

Use your Visa Payroll card to make purchases in person, online and through digital payment tools. You can also pay bills quickly and easily.

Control

Easily track your direct deposits and purchases, access your account information and set up balance alerts so you can stay in control of your account.

If your employer offers Visa Payroll cards

You already qualify to get a card through your employer. Tell your manager, HR or payroll department you want to enroll.

If your employer does not offer Visa Payroll cards

Tell your manager, HR or payroll department that Visa Payroll Cards can help save the company money.

What is a pay card?

A pay card, or payroll card, is one way of getting your paycheck. Pay cards are a kind of reloadable debit card — employers can give them to their employees and deposit paychecks onto the cards instead of printing checks or using direct deposit. They’re good for employees who don’t have bank accounts or other reloadable debit cards.

Why do employers use pay cards?

Some employers may prefer using pay cards because it could save them time and money — with pay cards, they don’t have to print and distribute checks.

What are the options for employers to pay payroll?

Employers have many options for payroll, including physical checks, direct deposits into a checking account and pay cards. If your boss is suggesting a pay card, note that it’s not your only option. Employers must offer you at least one alternative to receiving your paycheck on a pay card. Pay cards may seem like a simple solution, but they’re not ideal for everyone. If you decide to go with an alternative to pay cards, take a look at the options below for daily money management.

Why are pay cards not the best way to receive your pay?

But pay cards aren’t always the best way to receive your pay because of potential fees and limitations in how you can manage them.

What happens if you lose a pay card?

If your pay card is lost or stolen, you should notify the financial institution that issued the pay card immediately so that it can issue a replacement card. If you report the loss within two business days of learning of the loss or theft, your liability for fraudulent charges is up to $50, but you may be liable for more if you wait to report the lost card.

Do you need an employer to set up a prepaid debit card?

Prepaid debit cards: Prepaid debit cards are also reloadable debit cards, but they don’t require an employer to set them up — you’d own your debit card yourself. With a prepaid debit card, you can set up direct deposit, make purchases and withdraw cash from ATMs. They have fraud protections similar to what pay cards offer.

Is a pay card good for employees?

They’re good for employees who don’t have bank accounts or other reloadable debit cards. But pay cards don’t give you the range of services and ability to manage your money that bank accounts or other prepaid cards do.

What are the pros to pay cards?

Unbanked employees are unable to use direct deposit and they may incur large check-cashing fees for paper checks. Pay cards let unbanked employees receive their pay and immediately use it.

What are the cons of paying with a pay card?

What are the cons to pay cards? Employees can be hit with many different fees from pay cards. These could include ATM fees, replacement fees, inactivity fees, and balance inquiry fees. With so many fees, employees could lose significant portions of their wages.

Can you use a pay card as a debit card?

Employees can use the pay card like a debit card, or they can withdraw wages through an ATM, bank cashier, or purchase where they receive cash back. A 2012 study found that $34 billion was loaded on 4.6 million active pay cards, which is expected to grow to $68.9 billion loaded on 10.8 million cards by 2017.

Do employers have to use pay cards?

According to the Fair Labor Standards Act ( FLSA ), employees should have an option as to how they receive their pay. Employers cannot require employees to use pay cards.

Is McDonald's paying employees with pay cards illegal?

In June 2015, a judge ruled that paying employees with pay cards that incur fees when trying to withdraw cash is illegal in Pennsylvania.

Who must make the card transaction history available for review by the employee?

The card issuer must make the card’s transaction history available for review by the employee. The employee’s liability for unauthorized card use is limited. Financial institutions must respond to a consumer’s report of errors as long as it is within a certain amount of time.

Do you get paid in full with a payroll card?

Many states also have laws that say workers should receive their pay in full and without reductions. The payroll card regulations have made this payment method controversial since employees cannot always receive their full pay from ATMs and because portions of their pay may be taken away in fees.

What is a pay card?

Paycards operate in a manner similar to traditional debit debit cards that are linked to an employee's checking and/or savings account.

What is payday pay?

On payday, the employer electronically deposits an employee's full net wages into the employee's paycard account. Most paycard accounts are structured as pooled or omnibus accounts with individual subaccounts owned by each employee. Upon deposit into the account, ownership of the funds transfers to the employee.

Do all programs have to pay full wages?

All programs should provide employees with the ability to access their full wages each pay period without cost. This practice enables employers to meet their legal obligation to pay workers their wages "without discount," as required by many state wage and hour laws.

What is a PayCard?

PayCard™ offers a Visa® prepaid card that provides secure and timely electronic payment to publically funded service providers who cannot, or choose not to, open a bank account to receive payment by direct deposit. PayCard™ is the 21st century alternative to cumbersome, expensive paper checks.

How long does it take to implement a PayCard?

The PayCard™ implementation process reduces startup time to only 4 weeks, compared to the standard 6-9 months required for traditional project startup.

What is a pay card?

A pay card, or payroll card, is a payment method where employers load employee net wages onto a prepaid card. Pay cards work similarly to debit cards. However, only your employees’ paychecks can be put on the reloadable cards.

What are the different types of pay cards?

There are two categories of pay cards: Branded pay cards include Visa, MasterCard, American Express, and Discover. Nonbranded pay cards belong to ATM or POS networks, like STAR or Pulse. Most pay cards are branded. One benefit of pay cards is that employees do not need to have bank accounts to receive their wages.

How long can you receive your wages on a pay card?

Employees can receive their wages on a pay card as long as they have full access to their wages at a bank close to work without incurring a fee. Florida. Pay cards are acceptable methods for employees to receive wages, but the card must be supported by sufficient funds for a minimum of 30 days. Georgia.

How long do payroll cards last?

Employees can use payroll cards at no cost and can switch payment options at any time. Pay cards expire after two years.

How many free withdrawals are required for Vermont pay cards?

Vermont. An employee must give written consent after receiving a disclosure on pay cards. Employees must receive branded pay cards, at least three free withdrawals, and one free replacement card per year. No employer fees associated with pay cards can be passed on to employees.

Do pay cards have to be branded?

Most pay cards are branded. One benefit of pay cards is that employees do not need to have bank accounts to receive their wages. According to one survey, 6.5% of Americans were unbanked in 2017. Pay cards could be a convenient alternative to direct deposit for both banked and unbanked employees.

Which states allow pay cards?

Texas. Employers can decide to pay employees via pay cards as long as they notify the employee in writing, give employees a form they can fill out to request an alternate payment method, and obtain necessary information from the employee to pay them via pay cards. Utah.