Behind popular real-time payment apps like Square, Venmo and Zelle is Visa Direct. “It’s a reversal of the traditional Visa system we think of it as purchase where you can pull money from your account, said Cecilia Frew, SVP Global Commercialization of Visa Direct.

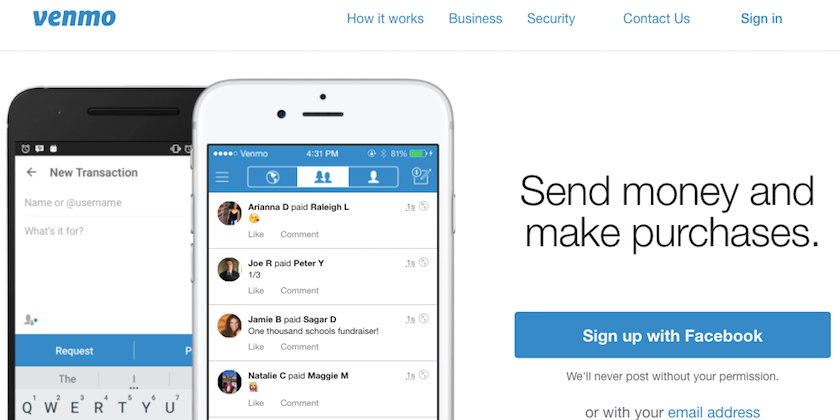

Is Venmo a fraud?

Venmo has other issues, too, lacking the fraud protections you might find with other payment apps. So, here are the five most common Venmo scams, how to spot them, and whether Venmo is safe for users. 1. Venmo Phishing Scams. Venmo users are frequent targets for phishing scams, usually delivered via SMS.

How much does Venmo charge?

Venmo makes money by charging businesses 2.9% of every transaction they make. It’s possible to pay with Venmo at more than two million stores in the United States. Venmo also charges a one percent fee for people who want to withdraw money right away to their linked card.

Does Venmo do direct deposit?

Your Venmo Direct Deposit account can be used to receive Direct Deposit funds from many sources, including the government. You can provide your Venmo Direct Deposit account number to the government for unemployment payments, tax refunds, Social Security payments and more. Venmo’s Direct Deposit feature allows for recurring payments, such as unemployment funds — or one-time payments, such as a stimulus payment or tax return.

What is Venmo and how does it work?

However, Venmo does offer social media-like functionality (such as likes and comments on payments) and purchase protection -- but it's only available in the US. Zelle: Zelle works directly with major banks (including Chase, Wells Fargo, and Bank of America ...

What is Venmo Visa direct charge?

Venmo charges a three percent fee to send money from your credit card, though if you only use your Venmo balance or bank account to send money, there are no fees. Instant transfers to your bank account come with a one percent fee, though standard transfers are free.

Is Venmo Visa direct a credit card?

The Venmo Credit Card is a Visa® credit card issued by Synchrony Bank. You can split Venmo Credit Card transactions with friends on Venmo and use the money in your Venmo account to make payments towards your bill.

What does Visa Direct mean?

What is Visa Direct? Visa Direct is a VisaNet processing capability that allows safe, convenient, real-time1 funds delivery directly to financial accounts using card credentials.

Does Venmo use Visa Direct?

Eligible PayPal customers can pay and get paid by friends, family and businesses, and move money quickly from their PayPal, Xoom and Venmo accounts via Visa Direct to their eligible Visa cards. Real-time access to earnings has become a critical component of improving cash flow for small and microbusinesses.

What is the Venmo credit card limit?

The starting credit limit for the Venmo Credit Card is $250 or more. Everyone who gets approved for this card is guaranteed a credit limit of at least $250, and particularly creditworthy applicants could get limits a lot higher than that.

Can I transfer money from Venmo credit card to my bank account?

Instant transfers with Venmo allow you to send money to any eligible U.S. bank account or Visa/Mastercard debit card, typically within 30 minutes. A 1.75% fee (with a minimum fee of $0.25 and a maximum fee of $25) is deducted from the transfer amount for each transfer.

What is Visa Direct and how does it work?

Visa Direct provides Originators (financial institutions and eligible third parties such as person-to-person payment service providers, merchants, corporations, and other payment service providers) with a way to connect to Visa, get access to information, and push payments directly onto Visa cards.

Who qualifies for Visa direct?

How do I enable Visa Direct? Businesses (Senders) must connect to Visa through a Payment Gateway, Processor or Acquirer and will need to ask their payment service provider for timing. Implementations and timing will vary depending on each client and their level of technical capacity and resources.

How do I send money with Visa Direct?

1:252:21Visa Direct - P2P Payments for Banks - YouTubeYouTubeStart of suggested clipEnd of suggested clipReal-time card network or enter the recipient's bank account and routing numbers to send acrossMoreReal-time card network or enter the recipient's bank account and routing numbers to send across existing domestic ach. And rtp networks visa direct is also backed by the proven.

Should I link my bank account or debit card to Venmo?

To send money on Venmo, you need to link the app to a U.S. bank account, debit card, prepaid debit card or credit card. If you receive money and want to withdraw it from Venmo, you'll need to link a bank account. Link a checking, not a savings, account.

Can someone steal money from Venmo?

A fraudster will fund their Venmo account using a stolen credit card to pay for your item. But once you ship it out, the fraud will be discovered and you'll be required to pay back the stolen money — leaving you robbed of cash and the item you wanted to sell.

How quick is Visa Direct?

With Fast Funds, transactions are approved in real time, and funds can be available1 within 30 minutes after approval, even on nights and weekends.

Is Venmo debit card Visa or Mastercard?

What is the Venmo Debit Card? The Venmo Mastercard® Debit Card is a debit card that operates on the Mastercard network. It is linked to your Venmo account and allows you to spend your Venmo balance funds everywhere Mastercard is accepted in the U.S. and in U.S. territories.

Does Venmo credit card affect credit score?

An approved Venmo Credit Card application will result in a hard credit inquiry, which may impact your credit score. – Venmo.

How does Venmo work with a credit card?

Using a Credit Card on Venmo While you can use a credit card to send payments, you can't transfer funds from your Venmo account to your credit card. Instead, you must transfer funds to your bank account or your debit card, and there's a fee to transfer funds to your debit card.

How to manage Venmo credit card?

There you can: View your Venmo Credit Card balance. View your Rewards activity and balance. Adjust your credit card notification settings. Set up/adjust Autopay.

What is Venmo app?

The Venmo app is your copilot for everything you do with the credit card.

What is the QR code on Venmo?

The QR code printed on the front of your Venmo Credit Card is unique to you. It’s the same personal QR code found in your Venmo app. If another Venmo user scans this code, they’ll be brought to your Venmo profile where they can send or request money from you. The QR code also allows you to activate your card without calling a phone number — just scan the front of your card when you receive it. Easy peasy.

When will Venmo cash back be added?

Your cash back rewards will be automatically added to your Venmo account at the end of each statement period. No points. No calculations. We’ll do the math. Use your rewards to pay your credit card bill, send money to Venmo friends, or treat yourself. Cash back can be used in any manner subject to the terms of your Venmo account. You can learn more about the rewards program here. See Rewards Program Terms for more information.

How to disable a lost Visa card?

Lost or stolen card? Tap in the app to disable your physical card. Tap to enable when you have it back in your hands. The Visa® Zero Liability Policy⁴ keeps you covered the whole time.

Can you pay with Venmo with friends?

Pay with the card, then split the cost easily with Venmo friends – just like regular payments. Choose to apply payments from your friends to your Venmo account or directly to your credit card bill.

Can you buy crypto on Venmo?

Just toggle on the Purchase crypto feature and choose your favorite of four types of crypto. When cash back is transferred to your Venmo account at the end of every month, we’ll use it to automatically purchase crypto without any crypto transaction fee.

Does Uber pay with a visa direct?

In addition to P2P payments, Visa Direct powers B2C, payouts to Uber drivers. Drivers can get paid in real-time for a 50 cents fee to Uber or wait for ACH at no charge. Over 50 percent of Uber and Lyft payments on Visa Direct are real-time; drivers are willing to pay a small charge to get they money right away, said Frew. Insurance carriers can use Visa Direct to pay claims immediately.

Does Visa offer real time payments?

Visa and Mastercard offer real-time payments not only domestically but around the world, she added. The Fed has accepted The Clearing House and Mastercard’s Vocalink technology for a real-time payment network in the U.S. and continues to consider whether it will launch its own real-time payments platform.

What is direct deposit on Venmo?

Direct Deposit is a feature that allows eligible users to add all or a portion of their paycheck to their Venmo account electronically. Setting up Direct Deposit allows you to avoid the hassle of waiting for and cashing paper checks.

How to get direct deposit number on Venmo?

In your Venmo app, tap the "☰" icon, and then click on Settings → Direct Deposit. Tap Show Account Number to get your Venmo account info along with the routing number that appears on the screen. Copy both numbers and use them to fill out your employer’s Direct Deposit form.

What to do if Venmo doesn't receive funds?

If you expected to receive funds in your Venmo account through the Direct Deposit feature and you did not receive such funds, please reach out to your employer to confirm that the payment was sent. We don’t receive this information instantly, so there will be some delay between the payment being sent by your employer and the payment arriving to Venmo. Funds sent through Direct Deposit may be delayed in the event of a federal or bank holiday. Venmo Support is unable to see incoming or pending transfers. If a Direct Deposit fails to reach your Venmo account for any reason, please contact your employer or payroll provider directly.

Where to find my Venmo account number?

Your account number and routing number can be found in the Venmo mobile app. Tap the “☰" icon at the top of the app, and then click Settings. Then tap Direct Deposit to view your account number and routing number. Note: Your Direct Deposit information is only available in the app, and not on the Venmo.com website.

Does Venmo post direct deposit?

Venmo will post funds added through Direct Deposit to your account as soon as we receive notice from your employer. I’m expecting a Direct Deposit but don’t see it. If you expected to receive funds in your Venmo account through the Direct Deposit feature and you did not receive such funds, please reach out to your employer to confirm ...

What is the difference between Venmo debit card and Venmo credit card?

What's the difference between the Venmo Credit Card and the Venmo Debit Card? The Venmo Mastercard® Debit Card is a debit card connected to your Venmo balance. There is no line of credit offered with the Venmo Debit Card. The Venmo Credit Card is a Visa® credit card issued by Synchrony Bank.

Who makes Venmo credit cards?

The Venmo Credit Card is issued by Synchrony Bank pursuant to a license from Visa USA Inc. VISA is a registered trademark of Visa International Service Association and used under license.

How much is Venmo fee?

Similar to other credit cards, the Venmo Credit Card is subject to Venmo’s standard 3% fee when used to make person-to-person payments. I have more questions about the Venmo Credit Card.

When will Venmo cash back be added?

Your cash back rewards will be automatically added to your Venmo account at the end of each statement period. Learn more about the Venmo Credit Card Rewards program.

Can you split a Venmo debit card?

You can split Venmo Credit Card transactions with friends on Venmo and use the money in your Venmo account to make payments towards your bill. The Venmo Credit Card and the Venmo Debit Card also have unique rewards programs specific to each card. You can find more info on the Venmo Debit Card here.