Visa Account Updater is a service that provides automatic payment credential updates when Visa cards change due to expiration, account closure, or other reasons. Implementing Visa Account Updater is mandatory for banks that issue Visa cards, but merchants have to enroll in the service and cardholders can opt out of it if they wish.

What is Visa account updater (Vau)?

What is Visa Account Updater? Visa Account Updater, or VAU, is a service that exchanges updated account information between participating merchants and Visa card issuers. Merchants using stored information for recurring payments can use VAU to boost retention and prevent chargebacks.

What is account updater and how does it work?

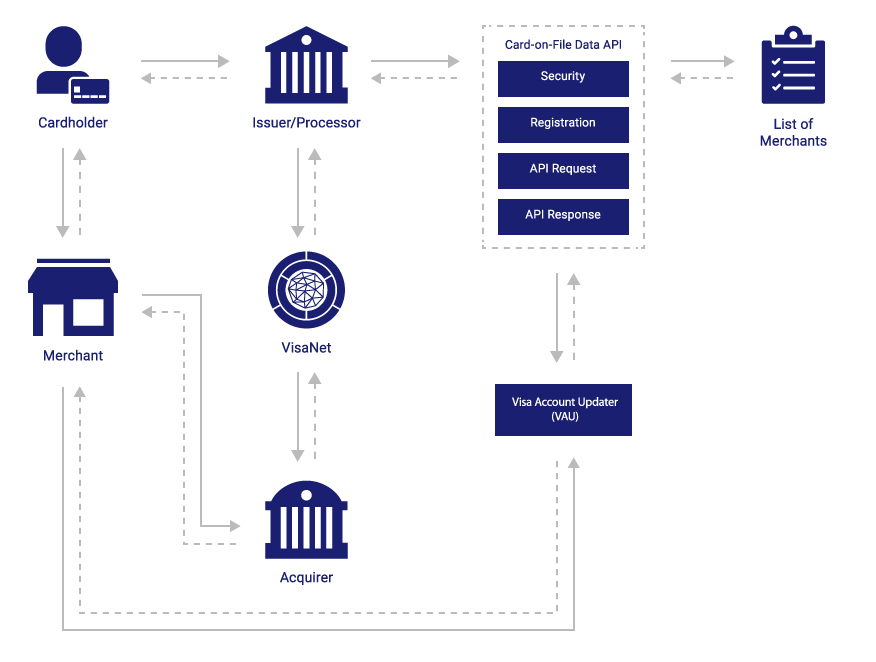

Visa Account Updater enables a secure electronic exchange of account information updates between participating Visa card issuers and acquirers for credential-on-file merchants, which enables a more seamless payment process. Issuer Banks.

What is the Visa account updater issuer Reporting API?

As a VAU participating issuer, the Visa Account Updater Issuer Reporting API provides you with up-to-date information on merchants that have requested updates on your customer's cards.

What is the advantage of using a Visa account updater?

Visa Account Updater can also reduce the risk of seeing chargebacks filed with Visa reason code 12.4 (Incorrect Account Number). If the account information on file is updated automatically, that makes it less likely that the merchant will end up forcing through a transaction which leads to a chargeback.

See more

Is Visa account Updater legal?

In conclusion, there is no legal requirement for credit unions to provide an opt out option from the Visa Account Updater service for Visa cardholders.

How do I remove Visa account Updater?

You may opt out of VAU at any time by contacting USSFCU Card Services at [email protected] or by calling 888.297. 3416.

How does account updater work?

How Does an Account Updater Service Work? This service records changes to credit card account numbers and expiration dates due to mergers, portfolio flips (e.g., Visa to MasterCard), re-issued cards (from loss or security breach), account closures, and product upgrades.

What is real time account updater?

Real time VAU is a new feature in VisaNet that integrates the VAU updates into the VisaNet authorization process for merchant-initiated transactions and enables real-time updates, thereby increasing the value to merchants and improving the cardholder experience by reducing declines.

How do I opt out of automatic billing updater?

Can I opt out of the Mastercard Automatic Billing Updater? Yes. If you would like to opt out of this service, please call Mission Fed at 800.500. 6328 or visit any branch.

What is Automatic Billing Updater?

Mastercard Automatic Billing Updater (ABU) helps card-not-present (CNP) merchants maintain the continuity of card- on-file and recurring payments, increasing customer satisfaction and reducing customer attrition due to payment disruptions.

What is an updater service?

Updater is a time-saving tool that offers you the ability to forward your mail, update businesses with your new address, share moving announcements with friends and family, connect internet and utilities, and much more – all from one easy-to-use platform.

How does a merchant know my new card number?

How Updater Services Work. Each month, merchants send a list of names and card numbers to their acquirer, or payment processor, who check their data against Visa, MasterCard, American Express and Discover, Lindeen explained. The acquirer lists the cards with updated information, and returns the list to the merchant.

How did Netflix update my credit card?

Sign in to your Account and select Manage payment info. Some payment options will direct you to their website to complete the update process.

Why is network tokenization important?

What are the benefits of network tokenization? Because network tokenization removes the need for sensitive cardholder data to enter the payments ecosystem, it significantly reduces the risk of payment card fraud and data theft. As a result, it can help decrease declines, chargebacks, and interchange fees.

Does Wells Fargo have Vau?

USING VISA ACCOUNT UPDATER (VAU) SERVICE We subscribe to the Visa Account Updater Service (VAU Service) and provide updated Card information to the VAU Service.

How did Netflix update my credit card?

Sign in to your Account and select Manage payment info. Some payment options will direct you to their website to complete the update process.

How does a merchant know my new card number?

How Updater Services Work. Each month, merchants send a list of names and card numbers to their acquirer, or payment processor, who check their data against Visa, MasterCard, American Express and Discover, Lindeen explained. The acquirer lists the cards with updated information, and returns the list to the merchant.

What is Vau in banking?

VAU BACKGROUND: Visa Account Updater (VAU) enables a secure electronic exchange of account information updates between participating Visa card issuers and acquirers for credential-on-file (COF) merchants, which enables a more seamless payment process.

What is Vau Abu?

VAU and ABU are services that will provide a way for the bank to communicate the most recent cardholder information to Visa and MasterCard. They will provide updates to merchants who maintain card-on-file (COF) account information to process recurring customer payments, such as subscription or utility companies.

What is Visa account updater?

Visa Account Updater ensures that merchants always have access to customers’ current bank information. Using it can save merchants time and hassle while helping maintain customer loyalty. VAU might even play a role in chargeback prevention under certain circumstances.

How long does it take for VAU to update billing?

4. VAU forwards the latest data to the requesting merchants, who are then required to update their customer billing files within five days.

Why Keep Card Data On-File?

More and more eCommerce merchants are offering to keep customers' payment card data on-file to facilitate future orders. This encourages ongoing purchases with little-to-no effort on either end of the transaction, as well as enabling recurring transactions for regular, passive income.

How does VAU work?

Under VAU rules, issuing banks are required to send an electronic update to Visa when a cardholder’s account information is altered.Visa processes the updated cardholder information and distributes it via the ACH network. 2.

What happens if a cardholder doesn't inform merchants of a change?

If the cardholder doesn’t make the effort to inform merchants after a change, then subsequent transactions would most likely be denied. This creates a nasty surprise for the merchant, and potentially the cardholder as well. Depending on the situation, the merchant may be forced to confront cardholders.

What happens if your credit card information is outdated?

Outdated account information may lead to declined transactions, cardholder inconvenience…or worse. At the same time, keeping payment information current through any kind of manual processing can be costly, time-consuming, and prone to error.

Why does my credit card information change?

That can be a problem, as consumer card information changes regularly for many different reasons: The card may have been replaced due to loss or theft. The original card has expired. The cardholder’s account was closed or upgraded. The customer’s name or address changed.

What is the Visa account updater program?

This program is a convenient way to update your credit card information with participating merchants, helping you avoid uninterrupted card-on-file payments.

Why are my credit cards not included in my account updates?

Cards that have been reissued due to fraud or because of being lost or stolen are not included in the account updates for security reasons. Cards that are reported closed will also be reported closed to participating merchants.

What to do if you aren't sure if a merchant is participating in VAU?

If you aren't sure if a merchant is participating in VAU, be sure to review your stored card information to verify it's been updated and payment is not missed.

What is a VAU?

Visa Account Updater (VAU) is a free service that helps you avoid missed payments when your credit card expires. The VAU service updates your BECU credit card expiration date and account number with participating merchants, such as subscription services, online retailers, or utility companies.

What is Visa Account Updater (VAU)?

Visa Account Updater is a free service that automatically updates your WSECU card numbers and expiration dates with participating merchants and service providers who have your card on file for regular or recurring payments.

How do I encourage my merchant to participate in VAU?

Merchant participation in the Visa Account Updater service is optional. You can reach out to merchants with whom you have your card on file to suggest they ask their merchant services provider about participating in the service. The service is also a merchant benefit to ensure charges or recurring charges they have been authorized to submit on your behalf are processed using the new card information. This will minimize delayed or declined payments.

What are the benefits of this service?

The main benefit of VAU is to maintain uninterrupted service and avoid late payments when your card information has been updated, as well as saving you the hassle of updating your information manually on multiple sites.

Do all merchants participate in VAU?

Not all, but most of the larger ones do. If you’re unsure if a particular merchant or service provider subscribes to this service, either contact them directly or check your account info on their site at least two days after activating a new card.

What is Visa account updater?

Visa Account Updater enables a secure electronic exchange of account information updates between participating Visa card issuers and acquirers for credential-on-file merchants, which enables a more seamless payment process.

What is a VAU?

Visa Account Updater (VAU) enables a secure electronic exchange of account information updates between participating Visa card issuers and acquirers for credential-on-file merchants, which enables a more seamless payment process.

Can VAU get up to date?

VAU participating issuers can obtain up-to-date information on credential-on-file merchants that have requested updates on your customer's cards so you can deliver a better customer experience when your cardholders want to know the merchants that have obtained their new card information.

What is VAU in Visa?

Visa has declared that its Visa Account Updater (VAU) service is mandatory for all card issuers. The service provides a channel to provide changes to card and cardholder information to the parties in a Visa card transaction–the merchant, acquirer, and issuer.

Can credit unions opt out of Visa?

In conclusion, there is no legal requirement for credit unions to provide an opt out option from the Visa Account Updater service for Visa cardholders. Credit unions may choose to offer an opt out to cardholders for business reasons, including the potential for unfair, deceptive, or abusive acts and practices claims and to ensure member ...