A dividend is the distribution of a portion of Visa earnings, decided and managed by the Visas board of directors and paid to a class of its shareholders. Note, announcements of dividend payouts are generally accompanied by a proportional increase or decrease in a company's stock price.

Full Answer

What do the different dividend dates mean?

To determine whether you should get a dividend, you need to look at two important dates. They are the "record date" or "date of record" and the "ex-dividend date" or "ex-date." When a company declares a dividend, it sets a record date when you must be on the company's books as a shareholder to receive the dividend.

When is the ex dividend date?

The ex-date or ex-dividend date is the trading date on (and after) which the dividend is not owed to a new buyer of the stock. The ex-date is one business day before the date of record.

What is a dividend payment date?

The payment date is the date on which corporate cash is actually paid to shareholder as a dividend. Depending on the medium through which you own your shares, dividends may be mailed to you as a check, wired into your bank account, or deposited into your brokerage account as cash.

When can I sell stock and still get dividend?

You can sell your stock at any time after the ex-dividend date; that is simply the earliest date on which you can sell your stock and still receive the dividend. Your stock will drop in value on the ex-dividend date, reflecting the lost value of the dividend to future buyers.

See more

What is Visa dividend payout?

Dividend Amount Per Share$0.38. Dividend Yield0.69% Payout Ratio25.26%

How often does Visa pay dividend?

There are typically 4 dividends per year (excluding specials), and the dividend cover is approximately 5.46.

What months does Visa pay dividends?

If you're new to stock investing, here's how to buy Visa stock. What is Visa's Dividend Payment Date? Visa's next dividend payment date is on 2022-09-01, when Visa shareholders who owned V shares before 2022-08-11 will receive a dividend payment of $0.3750 per share.

Which stock has the highest dividend?

25 high-dividend stocksSymbolCompany NameDividend YieldCVXChevron Corp.3.47%CLXClorox Co. (The)3.33%EMNEastman Chemical Co.3.17%AEPAmerican Electric Power Co. Inc.3.17%21 more rows

Should I invest in Visa?

With a compounded annual dividend growth of 17.91% in the last 5 years and a dividend payout ratio of only 21.54%, which still offers scope for future dividend increases, Visa is an excellent fit for investors looking for a dividend growth stock.

What is Amazon stock dividend?

Amazon (NASDAQ: AMZN) does not pay a dividend.

Does Visa offer dividend?

Yes, Visa pays a dividend, which is disbursed 4 times per year – in February, May, August, and November.

Does Microsoft pay a dividend?

Microsoft pays a quarterly dividend of $0.62 per share.

What is Visa's dividend yield?

The current dividend yield for Visa (NYSE:V) is 0.75%. Learn more on V's dividend yield history.

How much is Visa's annual dividend?

The annual dividend for Visa (NYSE:V) is $1.50. Learn more on V's annual dividend history.

How often does Visa pay dividends?

Visa (NYSE:V) pays quarterly dividends to shareholders.

When was Visa's most recent dividend payment?

Visa's most recent quarterly dividend payment of $0.3750 per share was made to shareholders on Wednesday, June 1, 2022.

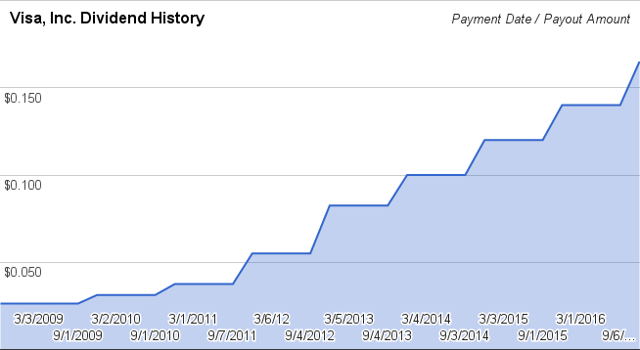

Is Visa's dividend growing?

Over the past three years, Visa's dividend has grown by an average of 14.90% per year.

What track record does Visa have of raising its dividend?

Visa (NYSE:V) has increased its dividend for the past 14 consecutive years.

When did Visa last increase or decrease its dividend?

The most recent change in Visa's dividend was an increase of $0.0550 on Wednesday, October 27, 2021.

What is Visa's dividend payout ratio?

The dividend payout ratio for V is: 23.58% based on the trailing year of earnings 20.95% based on this year's estimates 18.05% based on next yea...

How much is Visa dividend in 2020?

Reaffirming its dividend in 2020, Visa increased its payout for the quarter by 6.7%, resulting in a $1.28 annual yield.

How many credit cards does Visa have?

Visa represents the largest payment network in the world, processing over $9 trillion worth of payments annually. Although the company does not issue Visa cards, approximately 3.5 billion debit and credit cards display the Visa logo.

Is Visa a Good Dividend Stock?

Yes, Visa is a good dividend stock – not at the top of list, but certainly a great company in which to invest your money. You cannot ignore the benefits that support it.

How much did Visa spend on buybacks in 2020?

This can be seen by the company’s purchase of buybacks during 2020. Visa spent $5.3 billion on share buybacks during the height of the COVID-19 crisis and $10.9 billion on buyback purchases in 2019. These large repurchasing activities influenced Visa’s share price this year.

Why is Visa's valuation higher?

Unlike most credit card issuers and banks, the giant electronic card processor is safeguarded against loan default risks. As a result , Visa’s valuation across the financial sector is elevated.

What is the operating margin of Visa?

Visa is known for its high operating margin, which, in Q4 of 2020, was just over 50% . Usually, a margin of 20% is considered attractive.

Is VISA a good buy?

Yes, many financial forecasters regard VIsa as a Buy or even a Strong Buy for stock traders. However, you may want to wait to see if the stock dips in price or its P/E drops before rushing to purchase it.

What is annualized dividend yield?

Dividend Yield is the relation between a stock’s Annualized Dividend and its current stock price. Click here to learn more. Annualized Dividend is a standard in finance that lets you compare companies that have different payout frequencies.

How to determine dividend reliability?

A stock’s dividend reliability is determined by a healthy payout ratio that is higher than other stocks. A company that pays out close to half its earnings as dividends and retains the other half of earnings has ample room to grow its business and pay out more dividends in the future. Dividend Uptrend.

What is the FWD ratio?

Fwd Payout Ratio is used to examine if a company’s earnings can support the current dividend payment amount. It divides the Forward Annualized Dividend by FY1 EPS. Click here to learn more.

How many rows can you stick to a premium member?

Become a Premium Member to “stick” up to 3 rows and access more exclusive benefits.

Is Visa Stock a Buy or Sell?

Whether Visa is a Buy for a dividend investor depends on whether he/she includes capital gains as part of the consideration. It's a Buy if he/she does include capital gains , but not otherwise.

Does Visa Stock Pay A Dividend?

Visa currently pays a dividend of $0.32 per quarter, or $1.28 annualized, equivalent to an 0.6% Dividend Yield.

NYSE: V

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. Learn More

Visa delivered strong revenue and earnings growth in fiscal year 2021 in spite of COVID headwinds. And the company could fare even better in the next fiscal year

It isn't exactly a well-kept secret that when a stock announces a massive dividend increase, investors tend to pay attention. After all, a dividend increase more often than not signals insiders are confident in the direction of their company.

Visa demonstrated the resiliency of its business model

While COVID vaccines only widely became available in the third quarter of its FY '21, Visa recorded double-digit net revenue and non-GAAP earnings per share ( EPS) growth compared to FY '20.

NYSE: V

Visa's net revenue increased 10.3% year over year to $24.11 billion in FY '21, which was driven by across-the-board increases in its business. For one, payments volumes -- the dollar amount of transactions processed by the company -- grew by 16% year over year during the fiscal year.

Positioned to benefit from a return to normalcy

And as hard as it may be to believe after a solid showing for Visa in the past year, the company appears as though it will grow at an even higher clip in its current fiscal year.

A business with low bankruptcy risk

Visa performed well in its previous fiscal year and looks set up to do that once again in the current fiscal year. But is the company in a position to easily cover its interest expenses with earnings before interest and taxes (EBIT)? Let's dig into Visa's interest coverage ratio to answer this question.

A beaten-down growth stock

Despite the fact that Visa is firing on all cylinders, the stock at $195 a share is less than 2% off of its 52-week low and more than 20% away from its 52-week high.

Visa Past Distributions to stockholders

A dividend is the distribution of a portion of Visa earnings, decided and managed by the Visas board of directors and paid to a class of its shareholders. Note, announcements of dividend payouts are generally accompanied by a proportional increase or decrease in a company's stock price.

Your potential positions

Your current and potential positions are the building block of your wealth.

Complementary Tools for Visa Stock analysis

When running Visa Inc price analysis, check to measure Visa's market volatility, profitability, liquidity, solvency, efficiency, growth potential, financial leverage, and other vital indicators. We have many different tools that can be utilized to determine how healthy Visa is operating at the current time.