Visa

Visa Inc. is an American multinational financial services corporation headquartered in Foster City, California, United States. It facilitates electronic funds transfers throughout the world, most commonly through Visa-branded credit cards, gift cards, and debit cards. Visa does not issue card…

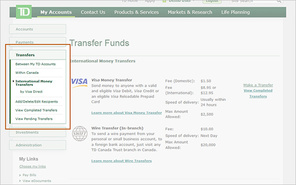

What is visa money transfer and how it works?

What is Visa Money transfer? Visa Money Transfer is a convenient service offered by banks in India which enables its customers to pay for a VISA Credit card bill, by using the Bank’s VISA Card Pay service. Such service does not entail any branch queues, any waiting, and any issuing cheques.

Do money transfer credit cards pay interest?

Many money transfer cards come with zero interest periods, so as long you pay all of the money back within the agreed timeframe, you don’t pay interest on the borrowing. However, to do this type of borrowing right, there are a few rules to follow. Let’s find out the important facts about money transfer credit cards.

Is visa money transfer safe and reliable?

As simple and fast as the process of Visa money transfer is, it is also considered quite safe and reliable for use. The process involved in Visa money transfer is described as follows: A customer needs to log into his bank account through net banking service. The customer should enter his login ID and password for logging into his account.

Why choose visa as your payment provider?

As a global leader in payments, Visa can uniquely take advantage of its existing network of financial institutions, merchants and Visa accounts around the world to help its clients to offer secure, convenient and cost-effective money transfer solutions.

See more

What are the charges for Visa money transfer?

In one transaction, a customer can make a transfer for the value of not more than Rs 49,999. For every transaction completed by the card account of the customer, a transaction fee of INR 5, along with extra taxes, shall be charged to the account of the customer.

How does Visa credit work?

Credit cards offer you a line of credit that can be used to make purchases, balance transfers and/or cash advances and requiring that you pay back the loan amount in the future. When using a credit card, you will need to make at least the minimum payment every month by the due date on the balance.

Can you transfer money from Visa card to bank account?

direct transfer to bank account you can transfer funds from your credit card to your bank account directly using the net banking app or even over the phone. since the daily and monthly transfer limit varies from bank-to-bank, you would need to check that with your bank to get the updated information.

Can we transfer money from Visa?

Send money to a family member, share expenses with a friend or pay off a Visa credit card bill. Visa Direct is simple to use for both sender and recipient, whether they are standing in the same room or living half-way around the globe.

How do I claim on my Visa credit card?

To make a claim, visit your card provider's website and look for details on 'Section 75 claims' or 'payment disputes'. If you can't find it, get in touch with your card provider.

Is my Visa card debit or credit?

Is my card Visa or Visa debit? You can tell if you have a credit card because it will say “Credit” somewhere on the card, usually the right hand side. If you want to know if your card is Visa or Visa Debit, for example, you can look on the top of the card on the right hand side.

Can I withdraw money from my credit card?

Cardholders can use a credit card at nearly any ATM and withdraw cash as they would when using a debit card, but instead of drawing from a bank account, the cash withdrawal shows up as a charge on a credit card. It's a fairly simple transaction but one that comes with serious downsides and usually significant fees.

Can I use a credit card to withdraw cash?

If you're asking yourself “can you use a credit card at the ATM?", the answer is yes. Most credit card companies allow cardmembers to use their credit card at an ATM, which will show up as a cash advance on your credit card statement.

Can you use a credit card to transfer money?

Yes, depending on the type of credit card you've got, it's possible to borrow money from the card and move it into your current account. If you need cash in a hurry - perhaps for an unexpected bill or for an overdraft that's charging you very high interest - a money transfer can help with your cashflow.

How long does Visa money transfer take?

Visa requires some issuers to make funds available to its cardholders within a maximum of 30 minutes of approving the transaction.

What happens if you pay more than minimum balance on your credit card each month?

Paying more than the minimum will reduce your credit utilization ratio—the ratio of your credit card balances to credit limits. (Credit utilization ratio makes up approximately 30% of your overall credit score.)

How much is the annual fee for Visa credit card?

The unsecured Total Visa Credit Card offers an alternative. You can qualify for a credit limit of $300 without a security deposit, and your account activity is reported to the major credit bureaus....Our Verdict.Regular APR (%)16.24% - 26.24% variableAnnual Fee$0Oct 19, 2021

What is the interest rate for Visa credit card?

Visa Credit Card Interest RatesCredit Card Interest Rates and Interest ChargesAnnual Percentage Rate (APR) for PurchasesVisa Signature Rewards 8.75 % Visa Platinum Rewards 8.75 % to 12.75 %, based on creditworthiness Visa Platinum Best Rate 7.75 % to 13.75 %, based on creditworthiness8 more rows

Do Visa credit cards have annual fees?

No fees whatsoever. No late fee, foreign transaction fee, annual fee, or any-other-kind-of-fee, fee. Up to 1.5% cash back on eligible purchases after making 12 on-time monthly payments.

How long does it take for a Visa to make funds available?

Visa requires some issuers to make funds available to its cardholders within a maximum of 30 minutes of approving the transaction.

What is Visa support?

The support of Visa’s trusted expertise and capabilities to help you as you launch, grow, or enhance the payment experience for your customers.

Is Visa Direct real time?

Visa Direct’s real-time¹ payment capabilities open up new, more convenient payment experiences for many different use cases, including:

What is a money transfer card?

Not to be confused with their similarly named counterparts (balance transfer cards), a money transfer card allows you to borrow money on a credit card by paying a lump sum directly into your bank account.

How do money transfer credit cards work?

Money transfer cards work by allowing you to transfer funds to other accounts, in order to clear an existing balance or debt. You are then given a set period of interest-free borrowing where you can pay off the total amount. If this introductory period expires, you will then be charged interest on top of the outstanding balance that is left to pay.

Why are money transfer cards so effective?

Check which card you're eligible for. Not to be confused with their similarly named counterparts (balance transfer cards), a money transfer card allows you to borrow money on a credit card by paying a lump sum directly into your bank account.

Can you use money transfer cards to clear an overdraft?

You can then use this cash as a loan or as a way of clearing an existing overdraft. Many money transfer cards come with zero interest periods, so as long you pay all of the money back within the agreed timeframe, you don’t pay interest on the borrowing.

What is a visa?

Visa Inc. (also known as Visa, stylized as VISA) is an American multinational financial services corporation headquartered in Foster City, California, United States. It facilitates electronic funds transfers throughout the world, most commonly through Visa-branded credit cards, gift cards, and debit cards. Visa does not issue cards, extend credit or set rates and fees for consumers; rather, Visa provides financial institutions with Visa-branded payment products that they then use to offer credit, debit, prepaid and cash-access programs to their customers. In 2015, the Nilson Report, a publicat

What is Visa Direct?

Visa Money Transfer and Visa Direct are the same thing, a person to person mechanism for transferring from one Visa account to another. An original credit transaction (OCT) is a mechanism in the Visa and MasterCard system by which firms can make push payments to cardholder beneficiaries. Think international payroll and commission payments, international insurance reimbursements, gaming winnings and many more. I say international because almost all domestic payment (ACH) systems are easy and less expensive although there is no reason why you couldn’t OCT domestically. When you send money by OCT, you eliminate intermediary bank charges and landing fees to the beneficiary. If you push an OCT to a debit card account, the funds drop in the underlying bank account fee free even internationally.

How much does Visa take?

Visa and Mastercard take about 0.10% on every single transaction passed through their brands. Don’t feel sorry for them. There are hundreds of billions of dollars worth of transactions every year.

What is Visa checkout?

On the other side, Visa Checkout is one of Visa’s product. Visa Checkout is an online payments feature that makes online shopping more convenient. At checkout, enter your username and password to make your online shopping experiences easier with a single account that can be used across all your devices. You can store and use any Chase card with Visa Checkout, and there is no need to re-enter your card number or address every time you make a purchase.

Can I pay for a P2P transaction on Visa Direct?

Visa Direct is a product that powers P2P payments for businesses. Therefore, consumers such as you and me will not pay transaction costs on Visa Direct. However, if you are a businesses, then there may be a cost associated with the ability to initiate a Visa Direct P2P transaction. I urge you to reach out to a Visa, and they would be happy to chat with you to discuss the opportunity.

Is B visa a business visa?

Neither term is an official term. Most visitors who enter the US temporarily for tourism or business (not employment, but for example to attend a meeting) have a B visa. B-2 refers to tourism; B-1 refers to business. B-1 and B-2 are pretty much interchangeable.

Does cash withdrawal have higher interest rate than not paying it off?

Note, your cash withdrawal has even higher interest rate than not paying it off, and the interest starts counting the moment you get your money.

Why use Visa Direct?

Use Visa Direct to help move money where it needs to go securely and at scale with multi-currency solutions.

Why is Visa Direct 1 important?

That’s why there’s Visa Direct 1, a payment solution that can help businesses move money to billions of endpoints worldwide via card and account rails. With fast or real-time 2 payment capabilities you can help move money when it’s needed most. That means merchants can access cash flow daily, consumers can receive payouts to bank accounts via the cards they know and trust, and families can receive money from loved ones on the other side of the world 3. The businesses helping make these products and services possible can build a stronger relationship with their customers. It’s time for business as usual to get an upgrade.

Is Visa Direct multi-layered?

Feel confident with the Visa Direct multi-layered system of risk and compliance controls available.

Can merchants access cash flow?

That means merchants can access cash flow daily, consumers can receive payouts to bank accounts via the cards they know and trust, and families can receive money from loved ones on the other side of the world 3.

What is Visa Direct?

Visa Direct is a VisaNet processing capability that allows safe, convenient, real-time 1 funds delivery directly to financial accounts using card credentials. Visa Direct clients use the capability to enable use cases 2 such as person-to-person (P2P) payments, funds disbursements, bill pay, or cross border remittances directly to an eligible debit or prepaid card.

What is the first step in Visa Direct?

The first step in any Visa Direct program is to establish a relationship with a Visa Acquiring Bank who will sponsor the program and provide the acquiring BIN.

What is OCT in Visa?

The original credit transaction (OCT) is a VisaNet Transaction that can be used to send or "push" funds to an eligible card based account, resulting in a credit of funds to the cardholder's account.

What is disbursement in banking?

Disbursement transactions occur when a Business/Corporate (sender) sends money to a cardholder's debit or prepaid card using an OCT. The funding source is the Business/Corporate originating the transaction.

Is Visa a global leader?

As a global leader in payments, Visa can uniquely take advantage of its existing network of financial institutions, merchants and Visa accounts around the world to help its clients to offer secure, convenient and cost-effective money transfer solutions. Because Visa Direct utilizes Visa's existing payment network infrastructure, the platform is highly cost-effective, secure and scalable to markets globally.

How does a money transfer work?

How a money transfer works in practice 1 You get an unexpected £500 car repair bill, but you don’t have enough money in your bank account. Your garage also doesn’t accept credit cards. 2 You have a credit card with a 0% money transfer interest rate for 12 months and a 3% transfer fee. So you complete a £500 money transfer with a 3% fee, totaling £515 on your credit card. 3 This puts £500 into your current account, so you can pay for the repairs using your debit card. 4 The promotional rate will expire after 12 months. If the balance isn’t fully repaid, any remaining amount will revert to your standard money transfer rate. 5 Remember, the amount of interest you will be charged depends on how quickly you pay it back. Other fees may also apply, depending on your credit card provider.

What happens if you use a money transfer card?

If you use a money transfer card for other purposes such as everyday spending, the standard purchase rate might be higher – meaning you could be charged more interest.

What happens if your credit card isn't accepted?

For example, if your current account balance is low and somewhere doesn’t accept credit cards, a money transfer can provide funds to use from your current account using your debit card.

How long does a credit card promotional rate last?

The promotional rate will expire after 12 months. If the balance isn’t fully repaid, any remaining amount will revert to your standard money transfer rate. Remember, the amount of interest you will be charged depends on how quickly you pay it back. Other fees may also apply, depending on your credit card provider.

How old do you have to be to transfer money to a UK bank account?

Money transfers are only available to UK residents aged 18 or over and are subject to status. A money transfer is one of four ways to use a credit card, including card purchases, balance transfers and cash transactions.

Why do people use money transfers?

For financial flexibility . A money transfer can also be helpful for unplanned expenses and one-off major purchases, letting you use your credit card’s available funds in situations where you can’t use your card.

How much is the fee for transferring money?

This fee is usually a small percentage (up to 5.00%) of the amount you’re transferring into your current account. You’ll most likely be charged each time you make a money transfer.

How to send money overseas with your credit card

There are several ways in which you can use your credit card to send money overseas: the two most prevalent are through banks and using online money transfer services.

When should you use credit cards for sending money abroad?

As we’ll explore below, sending money from credit cards is often an expensive way of transferring money abroad, so it is generally wise to use this payment method sparingly. However, it makes sense to use your credit card when funding international transfers for the following reasons:

Sending money from credit card to credit card

Sending money from card to card is a less popular way of transferring money, and not always the best option.

Pros and cons of sending money with a credit card

As with any payment method, there are advantages and drawbacks to sending money with a credit card. Here’s a quick summary of the pros and cons:

How much does it cost to send money overseas using your credit card?

Sending money overseas using your credit card may not be the cheapest option. There are lots of fees involved and you may not get the best exchange rates.

Possible impact on your credit score when using a credit card for international transfers

It is important to note that using a credit card for larger transactions can also affect your credit score. When you take a large cash advance, you may end up exhausting your credit limit. A poor credit score can make it harder for you to get other loans such as a vehicle loan or a home loan.

What are the alternatives to using credit cards for sending money overseas?

Credit cards can be a convenient way to send money abroad, but there are other ways to save money, including:

Better way to send money internationally

We're regulated by authorities all over the world. That's a lot of standards to live up to – so we have to be safe. And our smart tech moves your money faster than banks.

International money transfer fees: How much do they cost?

No big fees, hidden or otherwise. So it's cheaper than what you're used to.

Wise is safe and secure

Wise is an authorised Electronic Money Institution independently regulated by the Financial Conduct Authority (FCA) in the UK.

People love sending money internationally with Wise. See what they have to say

For sure the best and easiest way to transfer money I’ve ever come across. Banks are completely out of the picture for me. Thank you @Wise 🙏🏽 💵 💶

Start saving money with Wise

Send money at the best rate wherever you are. Join Wise for free today.