Visa Token Service

- Powering your token strategy. Build, protect and enrich your digital experiences. ...

- Value-added services. Visa’s value-added services combine with VTS to help you increase authorization, reduce fraud and lead from the front.

- Cloud Token Framework. ...

- Click to Pay. ...

- Wallets and wearables. ...

- Tools and resources. ...

What is visa Token Service (VTS)?

The Visa Token Service (VTS), a new security technology from Visa, replaces sensitive account information, such as the 16-digit primary account number, with a unique digital identifier called a token. The token allows payments to be processed without exposing actual account details. available for use by:

What are the benefits of token service?

Provisioning mobile and digital payments through the use of tokens minimizes the risk of fraudulent use of data if the device or account is compromised. Visa Token Service is based on the EMVCo payment tokenization standard and aligns with EMV technology—the global requirement for secure payments that also protects businesses from fraud liability.

What is a tokenized Visa card?

Visa sends the token, along with the payment card details, to the issuer for authorization. The consumer initiates a payment online, in-store or in-app. Tokenization provides a secure way for consumers to make in-store payments by simply waving their device near the payment terminal.

What are the different parts of the token service?

Visa Token Service comprises three turnkey parts: token management services, Visa Token Vault and Visa Risk Manager. Service Enrollment: Enroll and configure your digital credit and debit products into the token service.

How does Visa token service work?

Visa Token Service, a new security technology from Visa, replaces sensitive account information, such as the 16-digit account number, with a unique digital identifier called a token. The token allows payments to be processed without exposing actual account details that could potentially be compromised.

How do I use my Visa digital token?

When redeeming a Visa® Prepaid Card and Mastercard® Prepaid Card, you typically are provided with what's called a digital token as well as a redemption URL. To claim your reward for a Virtual or a Physical card, click the redemption URL provided by your program or which was provided in the reward email you received.

Is Visa a token service provider?

Visa Token Service (VTS) VTS is the foundational platform for global tokenization. By substituting Visa card numbers with tokens, VTS enables richer, more secure digital payment experiences for millions of customers every day.

How do token payments work?

In credit card tokenization, the customer's primary account number (PAN) is replaced with a series of randomly-generated numbers, which is called the “token.” These tokens can then be passed through the internet or the various wireless networks needed to process the payment without actual bank details being exposed.

What is a digital payment token?

What is a Digital Payment Token? A digital payment token is any cryptographically-secured digital representation of value that is used or intended to be used as a medium of exchange, i.e. cryptocurrency. Examples of digital payment tokens are Bitcoin, Ether, Litecoin and Monero.

How do I Tokenize my credit card?

It's a process where the card number is replaced with unique set of characters referred to as token which secures the customer's card details when the transaction is under process. This enables for frictionless and secure payments in different environments-online, in-store and in-app.

Why is network tokenization important?

What are the benefits of network tokenization? Because network tokenization removes the need for sensitive cardholder data to enter the payments ecosystem, it significantly reduces the risk of payment card fraud and data theft. As a result, it can help decrease declines, chargebacks, and interchange fees.

What is tokenization of debit and credit cards?

Credit and debit card tokenization is the process of replacing sensitive data with a token 2 min read . Updated: 24 Jun 2022, 09:10 PM IST Sounak Mukhopadhyay. The RBI, on June 24, extended the credit and debit card tokenization deadline by three months.

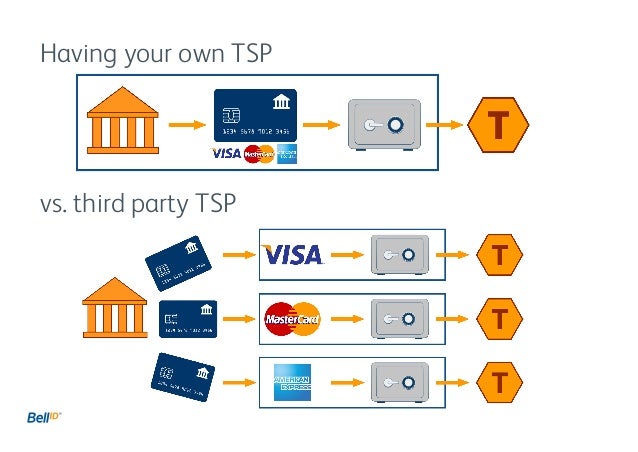

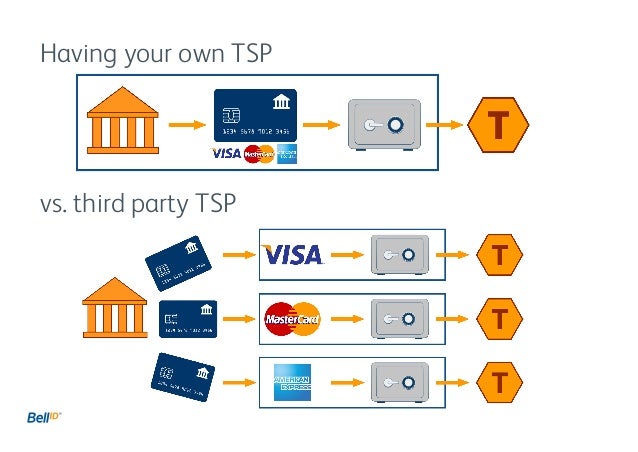

What are token service providers?

A token service provider (TSP) is responsible for the issuance and management of payment tokens. Becoming your own TSP reduces costs and increases security as you avoid tokenization fees and remain the sole guardian of your original card numbers.

What is a token provider?

A token provider in Windows Communication Foundation (WCF) is used for supplying credentials to the security infrastructure. The token provider in general examines the target and issues appropriate credentials so that the security infrastructure can secure the message.

What is Mastercard tokenization?

Tokenization is a mechanism to replace a card number with a token. A token is essentially a 16-digit number that references the original card number, however what makes this type of token unique is that it can be used just like your normal saved card for online payments but only by the merchant that requested it.

What is tokenization in ecommerce?

Tokenization is based on the EMVCo payment tokenization standard and aligns with EMV1 technology (the global standard for secure payments). By participating in tokenization, processing e-commerce transactions comes with minimal risk of fraud, because the technology greatly reduces the likelihood of sensitive payment credentials being exposed. Furthermore, tokens can be limited to a specific mobile device, merchant or number of purchases (say, a limit of 5) before expiring.

What happens if tokenization is unsuccessful?

If tokenization attempt is unsuccessful, all future transactions with this card will be processed using the customer’s sensitive card details (as with a standard non-tokenized payment). However, we will attempt to generate a Visa Token (to tokenize the card details) on these subsequent re-authorisation requests providing they are authorised successfully.

What is a VTS card?

Visa Token Service (VTS) is an innovative security feature provided by Visa. After the customer performs their first successful payment on your site, it replaces the customer’s card number stored on our system with a unique identifier called a token. When the customer returns to your site to make new purchases, the token is used in place of their sensitive payment credentials, reducing the risk of their data being compromised.

Can you use Webservices API to process transactions?

Alternatively, if you want to use our Webservices API to process new transactions using the token, your system can process a new AUTH request that references the stored token . Click here to learn how.

What is Visa token service?

Visa Token Service can help you build and maintain your digital payment experiences while protecting consumers’ sensitive information from fraud.

Why do we need tokens?

Tokens help to simplify the purchasing experience for consumers by largely eliminating the need to enter and re-enter the account number when shopping on a smart phone, tablet or PC. Tokens can also help prevent fraud in e-commerce and m-commerce transactions by removing sensitive card account information from the payment process. Finally, merchants and digital payment providers can store payment tokens in place of payment account numbers, this further enhances payment security.

What is EMVCo in the EMV?

EMVCo, the global standards organization that oversees EMV specifications, has expanded its scope to also develop tokenization specifications. EMVCo has built the framework with input from EMVCo’s members and the industry as we collectively seek to advance availability and adoption of tokens around the world. EMVCo published the initial version of the specification in March 2014.

What is tokenization in payment?

Payment tokenization is the process of replacing the traditional payment card account number with a unique digital token in online and mobile transactions. Tokens can be restricted for transactions with a specific mobile device, merchant, or transaction type. The tokenization process happens in the background in a way that is invisible to the consumer.

What is Visa digital enablement?

Visa’s Digital Enablement Program provides streamlined access to Visa Token Service. Issuers can start offering a wide variety of digital payment options—including Android Pay and Samsung Pay—as they become available.

Why do payment tokens have additional data fields?

Payment tokens can also include additional data fields to provide richer information about the transaction helping to improve transaction efficiency and security, and provide more information about the circumstances under which the transaction was initiated.

Why should merchants and their service providers experience a reduced threat of sensitive payment data being usable by fraudsters?

Merchants and their service providers should experience a reduced threat of sensitive payment data being usable by fraudsters if compromised. Merchants will also have a powerful tool that will allow them to develop innovative retail experiences without the burden of handling this sensitive payment account data.

What is Visa payment tokenization?

Visa’s payment tokenization technologies help you give cardholders the confidence to pay digitally, wherever and however they like.

What is token ID?

Token ID empowers banks, merchants, regional networks and clearing houses to build, manage and control their own tokenization capabilities. Token ID enables you to create new, secure digital payment experiences by expanding tokenization beyond card payments to support automated clearing house (ACH) and real-time use cases.

What is VTS token?

VTS is the foundational platform for global tokenization. By substituting Visa card numbers with tokens, VTS enables richer, more secure digital payment experiences for millions of customers every day. Through VTS, Visa is leading the token transformation by contributing to and implementing industry standards worldwide.

Does Visa support tokenization?

Visa supports the entire payments ecosystem through its diverse tokenization technologies. Each solution is unique, offering you complete flexibility to choose how to integrate, build and manage token services to create richer, more personalized experiences.

What is token ID?

Token ID puts issuers in control of payment tokenization, enabling them to build and manage their tokenization capabilities in the cloud or on-premise and deliver enriched payment options for cardholders.

How does tokenization help banks?

Helping clearing houses and central banks extend tokenization to account-based transactions. Reduce fraud for real-time and ACH payments by replacing sensitive account data with unique tokens, creating the foundation for a safe and secure faster payments framework.

What is a Visa token?

Visa Token Service, a new security technology from Visa, replaces sensitive account information, such as the 16-digit account number, with a unique digital identifier called a token. The token allows payments to be processed without exposing actual account details that could potentially be compromised.

Who shares token requests with Visa?

Visa shares the token request with the account issuer (such as the consumer’s bank).

What does Visa send to the card issuer?

Visa sends the token, along with the payment card details, to the issuer for authorization.

What is tokenization in banking?

Tokenization provides a secure way for consumers to make in-store payments by simply waving their device near the payment terminal.

How to enroll a Visa account?

Consumer enrolls their Visa account with a digital payment service (such as an online retailer or mobile wallet) by entering their primary account number (PAN), security code

Where are tokens routed?

The token and payment authorization are routed back to the merchant's bank, the acquirer.

Does Visa have a NFC token?

Visa shares the token with the token request or for online and mobile (NFC) payment use. A payment token can be limited to a specific mobile device, eCommerce merchant or number of purchases (say, a limit of five) before expiring.