What happened to the visa IPO?

Visa's IPO was one for the history books. The largest IPO in U.S. history at the time, shares of Visa opened at $44 per share on March 19, 2008 -- right in the middle of the Great Recession. Visa shares performed very well -- closing the first day at $56.50 per share (or $14.13 adjusted for splits -- more on that in just a moment).

What was the largest IPO in history?

Visa's IPO was one for the history books. The largest IPO in U.S. history at the time, shares of Visa opened at $44 per share on March 19, 2008 -- right in the middle of the Great Recession. Visa...

What was the first step in the visa IPO?

The new company was the first step towards Visa's IPO. The second step came on November 9, 2007, when the new Visa Inc. submitted its $10 billion IPO filing with the U.S. Securities and Exchange Commission (SEC). On February 25, 2008, Visa announced it would go ahead with an IPO of half its shares.

Should you buy more Visa stock after the IPO?

An investor holding eight shares of Visa with a 1,790% return on investment from the IPO will want to purchase additional shares of Visa as the growth will continue for the company -- reaping the many benefits of a low-cost growth company.

See more

What was Visa IPO price?

$44 per shareThe largest IPO in U.S. history at the time, shares of Visa opened at $44 per share on March 19, 2008 -- right in the middle of the Great Recession.

When did Mastercard and Visa go public?

2006Mastercard Worldwide has been a publicly traded company since 2006. Prior to its initial public offering, Mastercard Worldwide was a cooperative owned by the more than 25,000 financial institutions that issue its branded cards.

Why did Visa go public?

By going public, Visa hopes to streamline its operations, invest more nimbly in emerging markets and new payment technologies like those using cellular phones, and insulate its member banks from potentially billions of dollars in legal damages over antitrust and unfair-pricing claims brought by merchants.

When did Mastercard IPO?

Mastercard went public on May 25, 2006, issuing a little less than half of its 135 million shares to the public at a price of $39 per share. The company raised $2.4 billion that day, at a total market capitalization of $5.3 billion.

Which bank owns Visa card?

Bank of America (BofA)It was launched in September 1958 by Bank of America (BofA) as the BankAmericard credit card program....Visa Inc.Headquarters at Metro Center in Foster City, CaliforniaKey peopleAlfred F. Kelly Jr. (CEO)ProductsCredit cards Payment systemsRevenueUS$24.11 billion (2021)Operating incomeUS$15.8 billion (2021)14 more rows

When did Visa have a stock split?

The first split for V took place on December 11, 2000. This was a 1 for 5 reverse split, meaning for each 5 shares of V owned pre-split, the shareholder now owned 1 share. For example, a 1000 share position pre-split, became a 200 share position following the split. V's second split took place on March 19, 2015.

What is the highest Visa stock has ever been?

Visa - Stock Price History | VThe all-time high Visa stock closing price was 250.93 on July 27, 2021.The Visa 52-week high stock price is 247.83, which is 16.8% above the current share price.The Visa 52-week low stock price is 185.91, which is 12.4% below the current share price.More items...

How many stock splits has Visa had?

Visa stock has split once since its 2008 IPO; here are the details. Almost exactly seven years after its 2008 IPO, Visa (V 0.36%) decided to split its shares 4-for-1, effective March 18, 2015. In its short public history, Visa's shares had already gained more than 460%, and the price had swelled to nearly $250.

Is Visa a Fortune 500?

N.A. N.A. Figures are for fiscal year ended Sept. 30, 2011....Our annual ranking of America's largest corporations.Rank # of Fortune 500 CompaniesCalifornia53Texas52New York50

What was PayPal's IPO?

PayPal's IPO listed under the ticker PYPL at $13 per share and generated over $61 million.

Which is better Visa or Mastercard?

For most people, it doesn't really matter whether they get a VISA or a MasterCard. Both are equally secure and offer similar benefits. While VISA has a slightly higher market share and greater amount of transactions worldwide, both VISA and MasterCard are equally well-accepted by merchants.

Where will Mastercard stock be in 5 years?

Based on our forecasts, a long-term increase is expected, the "MA" stock price prognosis for 2027-08-13 is 531.438 USD. With a 5-year investment, the revenue is expected to be around +50.01%. Your current $100 investment may be up to $150.01 in 2027.

Why are banks changing from Visa to Mastercard?

Massive change for millions of Visa debit card holders due to war on fees – what you need to know. MILLIONS of people have had their Visa debit cards replaced by Mastercards amid an industry war against the payment giant.

Is Visa publicly traded?

Understanding Visa and Mastercard Visa and Mastercard are both publicly traded. Visa (trading symbol V) commands a $497.5 billion market capitalization, while Mastercard (trading symbol MA) follows closely behind at $359.8 billion (market caps as of May 18, 2021).

Are Visa and Mastercard owned by the same company?

They're different companies, and they were founded at different times. Originally known as the BankAmericard credit card program, Visa launched in 1958. Mastercard began as Master Charge: The Interbank Card when it emerged as a BankAmericard competitor in 1966.

What was Visa called before Visa?

BankAmericardIn 1970, BankAmericard was spun off into National BankAmericard, Incorporated, an interbank card association that issued and managed credit cards. In 1976, National BankAmericard, Inc. became Visa. In 1979, Mastercard was formed.

How much did Visa raise?

NEW YORK (Reuters) - Visa Inc V.N burned its name into the record books for U.S. initial public offerings on Tuesday, raising $17.9 billion as investors seized on its growth potential and lack of direct exposure to the global credit crisis.

Will Visa give a boost to banks?

The Visa offering will give a much-needed boost to bank stakeholders, whose coffers have been raided by higher credit costs and losses from subprime mortgage bets.

When was the IPO open?

Just as the IPO window was open to Visa in 2008, the regulatory window was wide open in 2009 and 2010. On May 13, 2010, the Durbin Amendment to the Dodd-Frank Act was revealed, which, if passed, would have directed the Federal Reserve to ensure that debit interchange fees were "reasonable and proportional to the processing costs incurred."

When did Visa start trading?

On March 19, 2015, Visa began trading after completing a 4-for-1 split in which shareholders saw the shares they owned multiplied by four. After closing at $267.67 per share prior to the split, shares closed the following day at $66.81 each.

How long did JPMorgan Chase lease Visa?

On Feb. 26, 2013, TheWall Street Journal reported that Visa and JPMorgan Chase quietly agreed to a 10-year deal that would allow JPMorgan to effectively lease Visa's network for its cards.

When did Visa and MasterCard share price rise?

Shares of Visa and MasterCard surged on Oct. 29, 2014, as China's announcement that it would loosen rules gave UnionPay an effective monopoly on transaction volume inside its borders. The news was compounded by Visa's and MasterCard's positive earnings releases and reports that the economy was growing at the fastest pace since the Great Recession -- 3.5% during the third quarter of 2014.

What do investors like most about visas?

What investors like most about Visa is that it isn't a lender. It doesn't make credit card loans, and it certainly wasn't issuing mortgages that caused the crisis in the first place.

Is Visa a member of the Dow Jones Industrial Average?

Visa joined a very exclusive list on Sept. 23, 2013, when it became one of just 30 companies included in the Dow Jones Industrial Average . Shortly thereafter, its biggest competitor, MasterCard (NYSE: MA) , announced that it would split its shares 10-for-1 in what might have amounted to an effort -- albeit a late one -- to be the payment network of choice in the Dow 30.

Does Visa work with JPMorgan?

The bank wasted no time in putting Visa's network to work. Its merchant processing volume ramped up quickly as its customers began to work directly with JPMorgan for payment processing. In 2012, the bank processed $655 billion of merchant volume, which grew to $949 billion in 2015.

What is the largest IPO ever?

The San Francisco-based credit card processor became the largest IPO ever, surpassing the $11 billion record held by AT&T ( T, Fortune 500) wireless as well as its own $37 to $42 a share price range.

Is it hard for Visa to outrun a down market?

In the immediate future, it may be hard for Visa to outrun a down market. "When markets turn around IPOs outperform the overall market, but untested companies fall out of favor when markets are down," says Kathy Smith, a principal at Renaissance.

When will Visa be acquired?

The acquisition is pending regulatory approval with an expected decision between March 2020 and June 2020, and if approved, will strengthen Visa's position within the fintech sector.

What is the Visa acquisition?

This deal was well-timed as an increasing number of consumers are using fintech applications to transfer money between accounts. Visa's press release said, "75% of the world's internet-enabled consumers used a fintech application to initiate money movement in 2019 versus 18% in 2015" -- creating a positive narrative behind the $5.3 billion investment.

How much did Visa repurchase in 2020?

During the first quarter of 2020, Visa repurchased $2.52 billion shares and paid $671 million in dividends, paying shareholders a total of $3.19 billion in shareholder value during the first quarter. Shareholders can expect share repurchases to continue as Visa just approved a $9.5 billion in share repurchases over the next two years -- continuing to help earnings-per-share growth in the future and propping up shareholder gains in the long-term.

What is the forward price to earnings ratio of Visa?

Visa's forward price-to-earnings ratio of 32.67 is in line with the top competitor, Mastercard ( NYSE:MA), with a forward P/E of 35.99. Visa's heavy valuation is appropriate given the large profit margins and 17.81% year over year earnings-per-share growth. The low-cost tollbooth business model is a win for investors as the global economy transitions away from cash, providing plenty of growth for Visa during the transition.

What is the business model of Visa?

Visa's business model is similar to a tollbooth, where Visa makes money every time a consumer makes an electronic transaction. This cost-efficient business model drives the impressive operating margin of 66.3% per the recent first quarter, and net income margin of 54%, an eight-percentage point gain from 2015's net income margin of 45.59%.

How much does Visa charge for a $100 card?

merchants, which will charge e-commerce sites a higher rate from $1.90 to $1.95 for $100 card-not-present transactions, and a lower fee for supermarket transactions with a 33% drop for $50 transactions.

How many transactions did Visa process in 2014?

In 2015, the Nilson Report, a publication that tracks the credit card industry, found that Visa's global network (known as VisaNet) processed 100 billion transactions during 2014 with a total volume of US$6.8 trillion. It was launched in September 1958 by Bank of America (BofA) as the BankAmericard credit card program.

When did Visa and MasterCard settle?

In October 2010, Visa and MasterCard reached a settlement with the U.S. Justice Department in another antitrust case. The companies agreed to allow merchants displaying their logos to decline certain types of cards (because interchange fees differ), or to offer consumers discounts for using cheaper cards.

What is the new name for Visa?

For this reason, in 1976, BankAmericard, Barclaycard, Carte Bleue, Chargex, Sumitomo Card, and all other licensees united under the new name, " Visa ", which retained the distinctive blue, white and gold flag. NBI became Visa USA and IBANCO became Visa International.

What year did Visa change its name?

A 1976 ad promoting the change of name to "Visa". Note the early Visa card shown in the ad, as well as the image of the BankAmericard that it replaced.

How much is Visa worth in 2018?

Visa's shares traded at over $143 per share, and its market capitalization was valued at over US$280.2 billion in September 2018. As of 2018, the company ranked 161st on the Fortune 500 list of the largest United States corporations by revenue.

Why is Kroger not accepting Visa cards?

retailer Kroger announced that its 250-strong Smith's chain would stop accepting Visa credit cards as of April 3, 2019, due to the cards’ high ‘swipe’ fees. Kroger's California-based Foods Co stores stopped accepting Visa cards in August 2018.

What are the different types of visas?

Visa offers through its issuing members the following types of cards: 1 Debit cards (pay from a checking/savings account) 2 Credit cards (pay monthly payments with or without interest depending on a customer paying on time.) 3 Prepaid cards (pay from a cash account that has no check writing privileges)

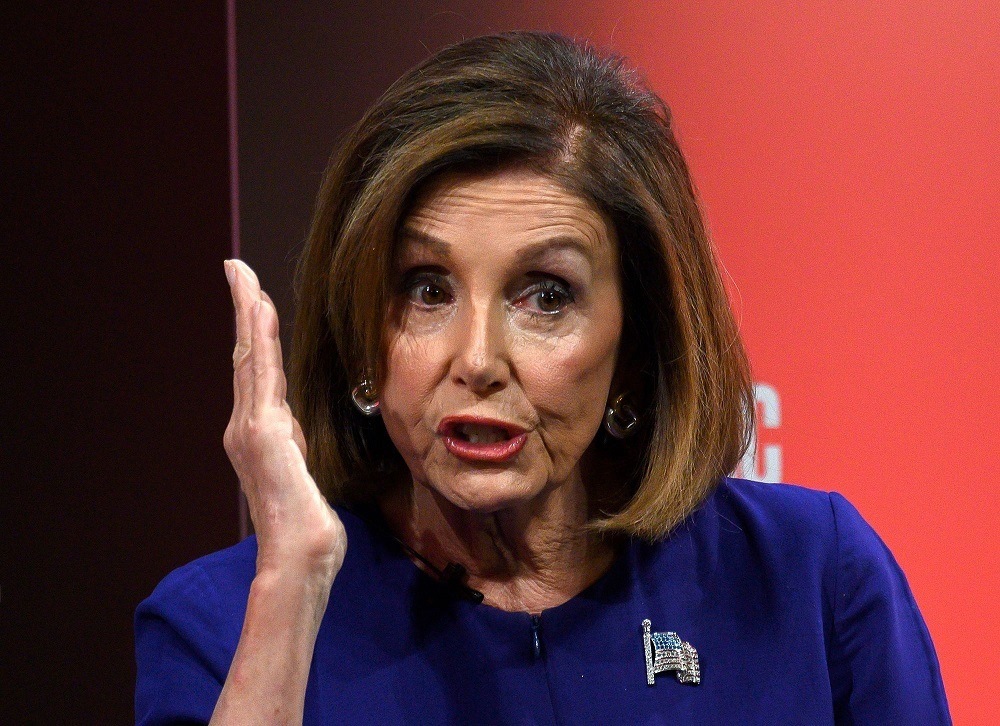

How much did Nancy Pelosi spend on the IPO?

Pelosi spent roughly $220,000 (excluding trading costs) on the Visa IPO. Considering the IPO was a then-record $17.9 billion, Pelosi’s take was vanishingly small. Much has been made of the fact that the stock popped to around $60 in the following days, netting Pelosi a cool $80,000. Of course, she didn’t sell her stock then.

Is initial public offering complicated?

Initial public offerings, moreover, are complicated business. We won’t bore you with the details here, but read the SEC’s worthy - and short - breakdown. We’ll point you toward this line:

Did Nancy Pelosi sell her stock?

Much has been made of the fact that the stock popped to around $60 in the following days, netting Pelosi a cool $80,000. Of course, she didn’t sell her stock then. In fact, Pelosi bought more. Much more.

When did the Class C stock transfer restrictions end?

All other class C common stock transfer restrictions terminated on February 7, 2011.

Can a group member of Visa International Service Association transfer to a stockholder?

To conduct transfers from a Group Member of Visa International Service Association to a stockholder, member or other equity holder in such Group Member ratably in accordance with such persons respective entitlements to dividends or other distributions from the Group Member, please use the following documents: