Is mission Lane a good credit card to get?

However, these cards come with a starting credit limit of $300 which stays the same through the time you have these cards. So from a credit limit perspective, Mission Lane is superior to these cards. Reasonable Annual Fee - Mission Lane's annual fee is very reasonable for a credit card targeting those with poor/fair credit.

What's the difference between the mission Lane visa and a secured card?

A higher credit limit can make it easier to keep your credit utilization low, and the lower your utilization, the better your score. Whereas some secured cards let you put down $2,000 or more and get a matching credit limit, the Mission Lane Visa features a minimum starting credit limit of just $300.

What are the best alternatives to the mission Lane visa?

Here are some alternatives to consider: If you have fair credit or higher (a credit score of 580-plus), the Capital One QuicksilverOne card is a great option. Indeed, this cash back credit-building card beats out the Mission Lane Visa in nearly every category.

How do I apply for the mission Lane visa?

While you can apply for the Mission Lane Visa at CreditCards.com, you can’t apply directly through the issuer’s website unless you’ve received an invitation to apply. That’s because Mission Lane is currently accepting applications only on a limited basis.

Who is Mission Lane owned by?

Shane Holdaway, CEO of Mission Lane, on Life and Fintech.

What bank is Mission Lane credit card associated with?

Transportation Alliance Bank, Inc.The Card is issued by Transportation Alliance Bank, Inc. dba TAB Bank (“TAB”), Ogden, UT, pursuant to a license from Visa U.S.A. Inc. TAB is the creditor and Card issuer, and assigns its rights for servicing and other rights to Mission Lane LLC ("Mission Lane").

Does Mission Lane have an annual fee?

Annual Fee. We will charge an annual fee of $0 - $75 each year, whether or not you use the Account, and whether or not you have active charging privileges. Unless waived your first year, your annual fee will be charged upon the first transaction on the Account and then annually thereafter. Late Payment Fee.

What is the initial credit limit for Mission Lane Visa?

$300The Mission Lane Credit Card starting credit limit is $300. If you only qualify for this amount, keep in mind that your annual fee will be $75, which means your available credit will drop to about $225. Credit limits are generally calculated based on your income and credit history.

Does Mission Lane do a hard pull?

Yes, you'll face a hard pull of your credit when you apply for the Mission Lane Visa card.

Is Mission Lane a Capital One?

SAN FRANCISCO and RICHMOND, Va., Sept. 16, 2019 /PRNewswire/ -- Mission Lane, a purpose-driven credit card company, today announced that it has appointed Capital One veteran and ex-Barclays US Consumer Bank chief Shane Holdaway as its new CEO.

Is Mission Lane a credit card?

The Mission Lane Visa® Credit Card offers the chance to build or rebuild credit without paying a security deposit. Unfortunately, the annual fee and high variable purchase APR make this credit card rather risky for the few benefits it offers.

Is Mission Lane credit card secured or unsecured?

No security deposit required One of the Mission Lane card's best features is that it's an unsecured credit card for people with fair credit. This is impressive because card issuers take on more risk when they extend credit to borrowers with a limited or fair credit history without requiring a security deposit.

How many credit cards are too many?

Owning more than two or three credit cards can become unmanageable for many people. However, your credit needs and financial situation are unique, so there's no hard and fast rule about how many credit cards are too many. The important thing is to make sure that you use your credit cards responsibly.

Does Mission Lane do credit line increases?

You can only get a Mission Lane Visa® Credit Card credit limit increase when Mission Lane decides you're eligible and offers you one, as requesting a higher limit is not possible. Mission Lane will evaluate your account at least once within the first 12 months to see if you qualify for a credit limit increase.

Can you use Mission Lane credit card anywhere?

You can use your Mission Lane Credit Card anywhere Visa is accepted, which is basically almost every place that takes credit cards.

Can you use Mission Lane card at ATM?

Can I use my Mission Money Visa® Debit Card to withdraw cash from an ATM? Yes, you have surcharge-free access to over 55,000 in-network ATMs in our network across the U.S.

What credit score do you need for Ollo Mastercard?

You can qualify for one of the Ollo cards with fair credit The Ollo Platinum Mastercard considers applicants with average (aka "fair") credit, meaning those with FICO scores ranging from 630 to 689. That's notable because credit card options are relatively limited for those with fair credit.

What is ML tab bank?

Headquartered in Ogden, Utah, TAB Bank is an online- and mobile-based bank. It has a standard array of deposit account options for customers, including checking accounts, savings accounts, money market accounts and CDs.

Can you use Mission Lane credit card anywhere?

You can use your Mission Lane Credit Card anywhere Visa is accepted, which is basically almost every place that takes credit cards.

Is Mission Lane a unsecured credit card?

Straightforward credit-building One plus for cash-strapped credit-builders is that the Mission Lane Visa is an unsecured credit card, which means you won't have to put down a cash deposit to get started.

Does the Mission Lane Visa require a hard credit pull?

Yes, you’ll face a hard pull of your credit when you apply for the Mission Lane Visa card. This action may cause a temporary dip in your credit sco...

Does the Mission Lane Visa offer cash back?

No, the Mission Lane Visa card does not offer cash back or any other rewards. Its counterpart, the Mission Lane Cash Back Visa card offers 1 to 1.5...

How long does it take to get approved for a Mission Lane Visa?

You’ll most often get an instant decision when you submit your application for the Mission Lane Visa card.

What credit score do you need for the Mission Lane Visa card?

You can be approved for the Mission Lane Visa card with a bad to fair credit score (a FICO score of 300 to 670). However, if your score is in the f...

Does the Mission Lane Visa require a security deposit?

No, the Mission Lane Visa does not require you to put down a security deposit. There is, however, an annual fee you must pay to hold the card that...

Who We Are

Mission Lane is a next-generation financial technology company built for the people. We’re real humans on a mission to make a real impact, with inclusive products, thoughtful customer service, and a commitment to transparency (no surprise fees, no hidden agendas).

Our Leadership

Having helped over 1.5 million Americans access the credit they need, our experienced executive team is poised to redefine the financial industry for the better.

Join the Team

Come work with a bunch of passionate innovators, creative thinkers, and eager collaborators. We’re scaling fast, going far, and having fun while doing it. Learn more about life at Mission Lane.

Clear pricing & no hidden fees

Security deposit? Nope. Activation fee? Nope. Over-the-limit fees? Nope! We've got nothing to hide.

Higher credit lines over time

We see all your hard work, and when you're eligible, we'll bump up your credit limit.

The tools to help build your credit

We've got you covered with free anytime access to your credit score, credit-building education, and reporting to all three major bureaus.

Instant credit decision

Get an instant decision on your Mission Lane Visa ® Credit Card application. No more waiting for days or weeks to find out if you're approved.

By your side anytime, anywhere

Easily manage your account 24/7 through our website and mobile app. And there's never a cost to talk with one of our world-class team members on the phone.

What is Mission Lane Visa?

As a standard Visa card, the Mission Lane Visa automatically comes with a handful of benefits for cardholders, including zero liability for fraud, a 24/7 pay-per-use roadside dispatch and 24-hour support for lost or stolen cards. These are some of the bare minimum benefits you should expect with a credit card, however, so the Mission Lane Visa doesn’t earn any special praise with their inclusion.

How much money do you need to get a Mission Lane Visa?

Perhaps the Mission Lane Visa’s most appealing feature is its $0 deposit requirement. You’ll get access to a minimum credit limit of $300 without putting down any money beyond the card’s annual fee.

What is Bankrate's mission?

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

Is Mission Lane worth it?

Though the Mission Lane Visa card’s annual fee may be worth it for people with bad credit who want to avoid putting down a deposit in order to build credit, it’s unlikely to be your best option. A few other unsecured credit-building cards are available with no annual fee and some secured cards require a minimum deposit that’s lower than the Mission Lane card’s annual fee.

Does Mission Lane Visa require a deposit?

The Mission Lane Visa card charges a reasonable annual fee compared to most unsecured cards available with bad credit, is laudably free of the hidden fees common among subprime cards and doesn’t require you to put down any money as a deposit.

Is Mission Lane a secured card?

Though it carries a relatively low cost for an unsecured card available with a damaged or limited credit history, the Mission Lane Visa card will fall short of the typical no annual fee secured card for most credit-builders.

What credit bureaus does Mission Lane report to?

Reports to three major credit bureaus - Mission Lane reports to TransUnion, Experian and Equifax.

Does Mission Lane Visa have a monthly fee?

There are two features of the Mission Lane Visa which stands out. The first is that they only charge an annual fee and does not have any monthly fee or one-time application fee on top the annual fee. The second key feature is that after the first six months of timely payments, your card will be considered for credit limit increase. Hence, in this section, we will compare the Mission Lane credit card with other similar cards that only charge an annual fee and also one particular card that has a track record of credit line increases after a few months of timely payments.

What is the phone number for Mission Lane Credit Card?

Erwin Lozano. @erwin_lozano. The Mission Lane Credit Card phone number for customer service is 1-855-570-3732. You could also contact them online by signing in to your account. They are very responsive on Twitter and Instagram, too.

How much is the Mission Lane credit card?

The starting credit limit for the Mission Lane Credit Card is $300. If you only qualify for this amount, keep in mind that your annual fee will be $75, which means your available credit will drop to about $225.

What is the APR on Mission Lane?

The Mission Lane Credit Card APR is 3.25% - 29.99% (V). The V at the end stands for “variable” and tells you the APR can change based on the Prime Rate.

How to ask Mission Lane to reconsider?

Even if you're denied, it’s important to remember that there’s still hope. You can ask Mission Lane to reconsider your application by calling 1-855-570-373 and making your case. It’s not guaranteed they will change their mind, but it’s definitely worth a try. show more….

How far in advance do you have to send payment to Mission Lane?

Alternatively, you can send your payment via mail, just make sure to send it at least 5 days prior your due date. This way you could avoid being charged with a late fee. The Mission Lane payment address is:

Can you apply for Mission Lane credit card with invitation code?

The biggest downside of the Mission Lane Credit Card is that you can only apply for it with an invitation code. If you haven’t received a pre-approved offer with a code yet, you can join Mission Lane's waitlist. show more…. 1.

Is Mission Lane a good credit card?

Yes, the Mission Lane Credit Card is a good card for people looking to build or rebuild their credit. It doesn’t have any hidden fees, and the issuer offers periodical credit limit increases (if you use your card responsibly). You’re also given many credit-building tools such as: Free access to your credit score.

What is Mission Lane?

Mission Lane. Mission Lane is a new company dedicated to helping everyone have access to fair and clear credit. Mission Lane believes in creating a relationship where everybody wins. You do well when you succeed with its credit cards. The company does well when you prosper. It's that simple.

How can I pay my Mission Lane Credit Card?

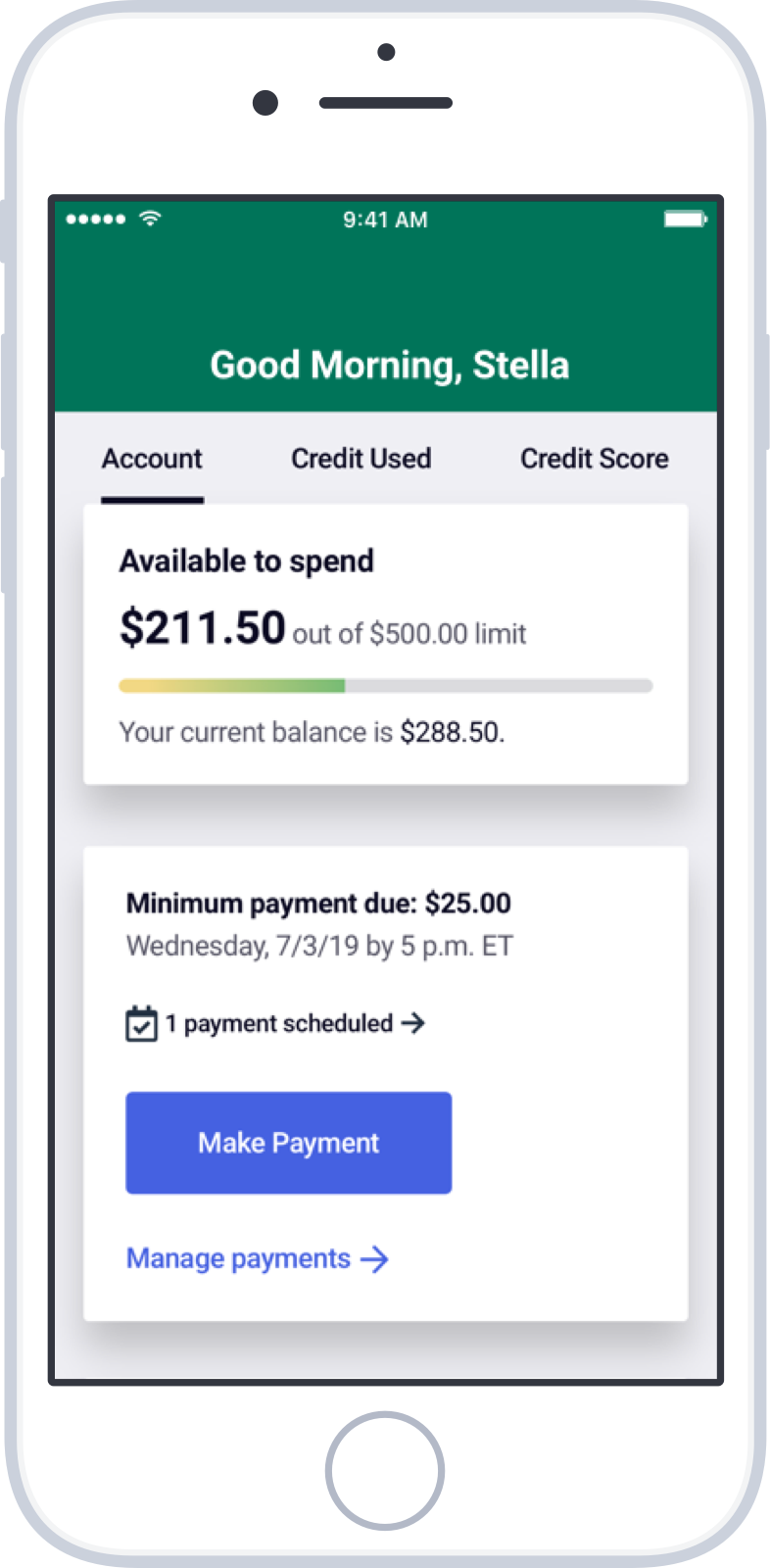

You can pay your Mission Lane Credit Card from your online banking account or via the Mission Lane app for iOS and Android.

How much is the starting Mission Lane Credit Card credit limit?

The Mission Lane Credit Card starting credit limit is $300. If you only qualify for this amount, keep in mind that your annual fee will be $75, which means your available credit will drop to about $225.

How often does Mission Lane reevaluate credit?

Credit limits are generally calculated based on your income and credit history. But Mission Lane will re-evaluate your account at least every 12 months to see if you're eligible for a credit limit increase. 1. 0.

How far in advance do you have to send payment to Mission Lane?

Alternatively, you can send your payment via mail, just make sure to send it at least 5 days prior your due date. This way you could avoid being charged with a late fee. The Mission Lane payment address is:

Can you apply for Mission Lane credit card with invitation code?

If you haven't received a pre-approved offer with a code yet , you can join Mission Lane's waitlist.

Is Mission Lane a good credit card?

Yes, the Mission Lane Credit Card is a good card for people looking to build or rebuild their credit. It doesn't have any hidden fees, and the issuer offers periodical credit limit increases (if you use your card responsibly). You're also given many credit-building tools such as:

Mission Lane Visa

Anyone had the Mission Lane Visa? Never heard of them. Credit Karma is advertising them to me. I screwed all the major creditors so not many options. I just got Merrick Bank. Looking for second card. At first glance Mission Lane seems like a normal card for people with a Ch7 Bk. High Apr ofcourse but nothing out of the ordinary for my situation.

Re: Mission Lane Visa

It used to be the LendUp and LendUP L card. They spun off the credit cards into Mission Bank. My LendUp was just converted last month.

Re: Mission Lane Visa

I've had my LendUp card, now Mission Lane, for close to a year now. No real issues with them. Started with $500 and got a CLI to $700a about a couple months ago. I just paid my bill today. Pretty decent company. As long as you PIF, as usually suggested on her, then you'll be good and they make for a great rebuilder.

Re: Mission Lane Visa

Well sadly I got denied. haha. They must be a little tougher to get then Merrick because they offer the card without fees unlike Merrick. I don't have many choices so I think I'm going to stick with only Merrick for now. I'm testing out how long Merrick takes to credit a payment.

Re: Mission Lane Visa

Ollo has been a great card for me. Approved a couple of months post bk. It's not the highest cl (500) but no insane fees etc.

Re: Mission Lane Visa

I have got this card recently with CL $750, since i couldnt get Credit One as i burned them in BK which was discharged in May 2019. It has $59 annual fee and APR is 29.99%

Re: Mission Lane Visa

Sorry to bring up an old thread but I thought it would be better than starting a new one for what might be a dumb quesiton.