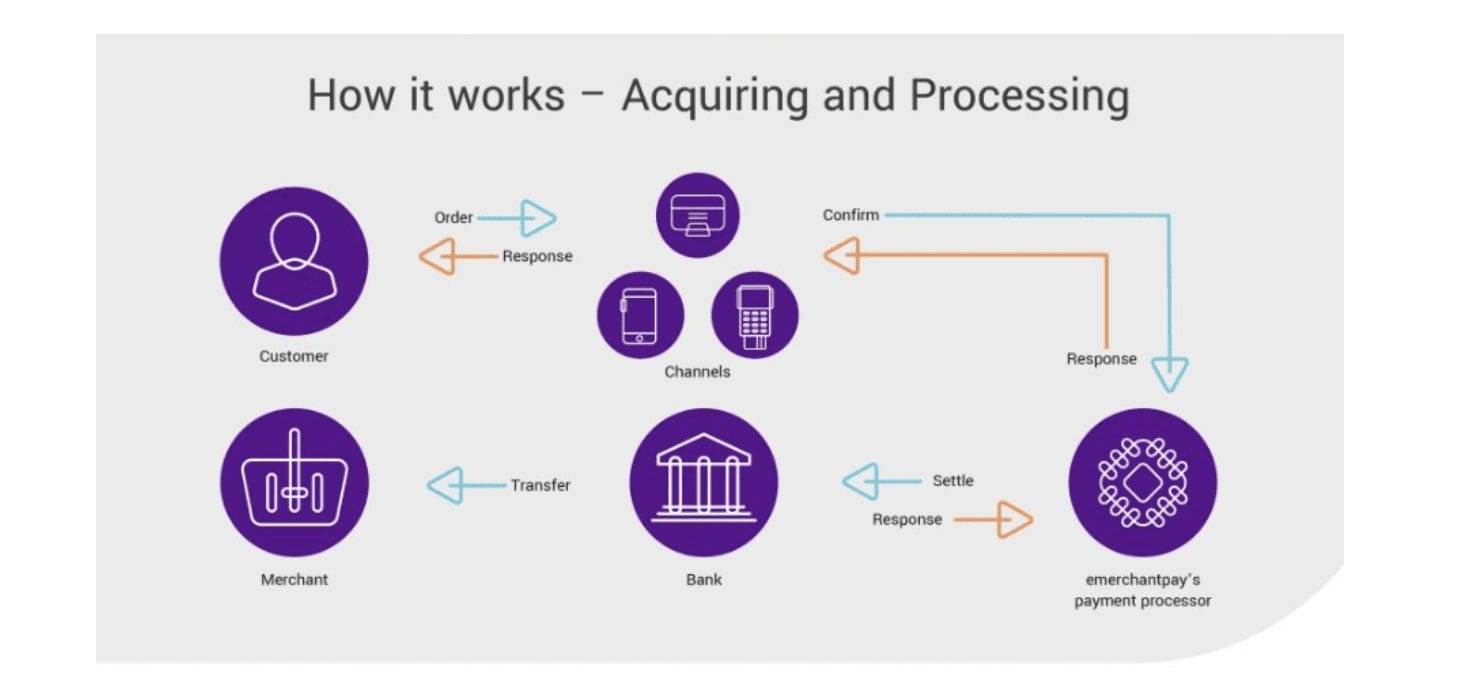

VISA & Master Card: As credit card processing became more complicated, outside service companies began to sell processing services to Visa and MasterCard association members.This reduced the cost of programs for banks to issue cards, pay merchants and settle accounts with cardholders, thus allowing greater expansion of the payments industry.

What banks are changing from visa to MasterCard?

What are banks changing from Visa to Mastercard? LONDON (Reuters) - NatWest has become the latest British lender to switch to issuing Mastercard debit cards from Visa, in an agreement that includes 16 million consumer and business customer cards. Which card is better Visa or Mastercard? Why is Visa better than Mastercard?

What is the relationship between Visa and MasterCard?

This means that all Visa and Mastercard payment cards are issued through some type of co-branded relationship. 2 While the two companies don’t extend credit or issue cards, they do partner to offer the broadest array of products encompassing credit, debit, and prepaid card options.

Why are visa and MasterCard turning the clock back?

The irony is that, in almost forcing customers to make a binary choice between them by striking exclusive deals with banks, Visa and Mastercard are turning the clock back. Until the mid-1970s, US laws appeared to block banks from joining both credit card issuers, obliging them to join either Visa or Mastercard.

Why do UK banks not accept Visa Debit cards?

A major factor was that the UK banks were part owners of the VISA debit card network. This changed in 2016 when VISA became the full owner. So that incentive to remain in the VISA network for debit cards disappeared.

See more

Is it better to have Visa or Mastercard?

For most people, it doesn't really matter whether they get a VISA or a MasterCard. Both are equally secure and offer similar benefits. While VISA has a slightly higher market share and greater amount of transactions worldwide, both VISA and MasterCard are equally well-accepted by merchants.

Why are Natwest moving from Visa to Mastercard?

We've decided to move to Mastercard as it allows us to offer a better overall service to our customers. We'll be launching the new cards this year and will let you know closer to the time when you can expect to receive yours through your letterbox.

Why are UK banks moving to Mastercard?

First Direct last year told its customers that moving to Debit Mastercard 'means we will be able to improve the digital payment options available to you in our app. ' High street banks have needed to step up their game with their digital offerings given the increasing number of more nimble challenger banks.

What are the benefits of Mastercard over Visa?

Visa vs. Mastercard benefitsTravel perksWorld MastercardEverything included in the Mastercard Titanium and Platinum tier, plus airport concierge access and hotel stay and lowest rate guaranteesWorld Elite MastercardEverything included in the Mastercard World tier, plus access to World Elite concierge services5 more rows•May 23, 2022

Are NatWest doing away with Visa debit cards?

NatWest has become the latest bank to switch all of its retail and business debit cards to Mastercard, moving away from Visa. The agreement includes all NatWest Group brands: NatWest, RBS, Ulster Bank and Coutts, totalling 16 million cards.

Has NatWest stopped using Visa?

LONDON (Reuters) - NatWest has become the latest British lender to switch to issuing Mastercard debit cards from Visa, in an agreement that includes 16 million consumer and business customer cards.

Is Mastercard as safe as Visa?

Is there a difference between Visa and MasterCard in terms of protection online? Yes, although both Visa and MasterCard offer protection when you shop online through their own online protection schemes. This is to protect you against fraud. MasterCard uses a protection scheme called Secured Code.

What is the difference between Visa and Mastercard?

The only real difference that stands between Visa and Mastercard is that your card works on the payment network that the company operates. A Visa card won't work on Mastercard's network, and vice versa. Ultimately, any other differences in cards come from the specific card you have.

Why is my new Santander card a Mastercard?

We're moving our debit cards from Visa to Mastercard. If you currently have a Visa debit card, the next card we send you will be a Mastercard. Your new Mastercard card will work in the same way as your old Visa card.

Why does Costco not accept MasterCard?

No, you can't use your Mastercard credit card at Costco, because Costco has a contract with Visa. You can, however, use your Mastercard credit card for purchases made at Costco.com and through the Costco app. For their warehouse locations Costco only accepts cards on the Visa network.

What is better Visa debit or MasterCard debit?

Cards are issued by all forms of banks, financial institutions and even high street shops will issue Visa or Mastercard® cards. For you as a consumer, there is no real discernible difference between Visa or Mastercard®. Both are simply forms of payments.

How many credit cards should a person have?

It's generally recommended that you have two to three credit card accounts at a time, in addition to other types of credit. Remember that your total available credit and your debt to credit ratio can impact your credit scores. If you have more than three credit cards, it may be hard to keep track of monthly payments.

Is NatWest credit card a Visa or Mastercard?

MastercardNatWest credit cards are part of the Mastercard network, so they're accepted in more than 35 million locations worldwide.

What is the difference between Visa and Mastercard?

The only real difference that stands between Visa and Mastercard is that your card works on the payment network that the company operates. A Visa card won't work on Mastercard's network, and vice versa. Ultimately, any other differences in cards come from the specific card you have.

Why are bank cards changing?

Why are the rules changing? The new checks are aimed at clamping down on bank card fraud, where criminals go on a spending spree using stolen details. What exactly is changing? From Monday, online retailers will be required to verify shoppers' identities before authorising a payment.

Which UK banks use Mastercard credit cards?

Here are a list of some of the largest credit card providers that use MasterCard:Amazon.Aqua.Capital One.Halifax.John Lewis.Lloyds Bank.M&S Bank.MBNA.More items...•

How are Visa and Mastercard similar?

The business models of both companies are very similar. Visa and Mastercard do not issue cards directly to the public but rather through partner member financial institutions such as banks and credit unions. The member financial institution then issues cards for individuals and businesses, either directly or in partnership with airline, hotel, or retail brands.

What is a Visa and MasterCard?

Visa and MasterCard are the two largest payment processing networks in the world. Visa and MasterCard do not issue cards directly to the public, as do Discover and American Express, but rather through member financial institutions. Member banks and credit unions issue Visa and Mastercard credit and debit cards directly to their customers ...

How do Visa and Mastercard earn their revenue?

Both Visa and Mastercard earn the majority of their revenue from service and data processing fees , but the two companies characterize these fees differently and have their own fee structures. Service fees are charged to the issuer and based on card volume.

How much money does MasterCard make in 2019?

In 2019, MasterCard generated total revenue of $16.9 billion, with a payment volume of $6.5 trillion. 12 MasterCard’s core products include consumer credit, consumer debit, prepaid cards, and a commercial product business. MasterCard has one reportable business segment known as Payment Solutions which is broken out by geographies across U.S. and other.

How many debit cards do Americans have?

Most Americans today have at least one debit and credit card. 3 Many people have a number of them, seeking to take advantage of all the rewards, cash-back opportunities, and promotional benefits that issuers have to offer.

Which payment processors are the only?

Visa and Mastercard are the only network payment processors involved in all three areas of the payments market. Working exclusively as network processors, these two companies have a unique edge, but they operate differently.

Which payment processors are involved in all three areas of the payments market?

Visa and MasterCard are the only network payment processors that are involved in all three areas of the payments market. Working exclusively as network processors, these two companies have a unique edge but operate differently.

When did Tsb switch to Mastercard?

TSB delayed their switch to Mastercard in 2018. Expect that will be on the cards soon.

Is NatWest a Visa?

NatWest and HSBC is much less of a surprise as they've only moved over to Visa from the Mastercard empire (namely Solo and Switch/Maestro) in the last 15 years.

Is Barclays switching to Mastercard?

Don't listen to rumours. Barclays signed a new "multi-year" contract with Visa only last year, so they won't be switching to Mastercard anytime soon.

Does Santander have a debit card?

Santander only switched because all their other banking divisions in Spain, Germany, Portugal, Poland and in South/Centro America issue debit mastercard, so it made sense to allign their UK operations with the same provider.

Does LBG issue Visa debit cards?

LBG only issues debit cards in the visa brand, all their credit cards across the 3 brands are mastercards, but as you said it is unlikely they would change due to their prominent brand campagines associated with the visa brand.

When will Santander start migrating debit cards to Mastercard?

Advertisement. Image: Santander will begin migrating debit cards to Mastercard from 2019. The deal, described at the time by Ajay Banga, Mastercard's chief executive, as a "significant win", made TSB Mastercard's largest debit card issuer in the UK.

Which bank is the provider of Visa in the UK?

The same laws did not apply elsewhere in the world but, nonetheless, most payments markets tended to follow the US example. This meant Barclaycard became the provider of Visa in the UK, while NatWest, Midland Bank (now HSBC UK) and Lloyds joined forces in 1972 to launch the Access card, which operated on the Mastercard network.

What is the irony of Visa and Mastercard?

The irony is that, in almost forcing customers to make a binary choice between them by striking exclusive deals with banks, Visa and Mastercard are turning the clock back.

Does Lloyds offer dual credit cards?

Shortly afterwards, Lloyd s announced it would start issuing debit cards on the Visa network, making it the first UK bank to offer "duality". Midland began offering both Visa and Access credit cards shortly afterwards but, with debit cards, it, NatWest and Royal Bank of Scotland joined forces to create their own network called Switch (now part of Maestro, owned by Mastercard).

Does Mastercard have peer to peer payments?

Mastercard, in particular, has sought to reduce its dependence on its core payments processing business, by expanding into other fields of payments in recent years, such as peer-to- peer payments.

Is Visa in reverse with Mastercard?

Over time, all three drifted across from Maestro to Visa, a process that now appears to be in partial reverse with Mastercard's fightback.

Does the UK use debit cards?

The vast majority of the UK population currently use debit cards that are run on the Visa network. However, that is starting to change, as a new front in the war between Visa and its deadly rival, Mastercard, is opened.