Is Visa stock a buy?

And global economic and legal/regulatory risks are ever-present. Bottom line: Visa stock is not a buy, as no discernible pattern has formed. Keep an eye on the Dow Jones card giant, as it compares favorably with many top-rated large-cap stocks to buy or watch.

Is visa the world's most perfect stock?

If you're looking for perhaps the world's most perfect stock, your search might end with payment processing giant Visa ( NYSE:V). Since the company went public in March 2008, shares of Visa have risen by 581%, inclusive of its split in 2015. Despite this strong move higher, there are plenty of reasons to believe there's more left in the tank.

Will Visa stock rise or fall in the next 3 months?

Given the current short-term trend, the stock is expected to rise 5.16% during the next 3 months and, with a 90% probability hold a price between $206.44 and $235.65 at the end of this 3-month period. The Visa stock holds buy signals from both short and long-term moving averages giving a positive forecast for the stock.

Is visa the best digital payments stock to buy?

The Dow Jones card giant has a commanding share in the fast-growing digital payments market. Visa earnings are rebounding as coronavirus headwinds subside and many people resume travel worldwide. Meanwhile, Visa is also a top payments stock in an industry group that is acting well. To be sure, competition in digital payments is intense.

See more

Should I invest in Visa stock?

On key earnings and sales metrics, Visa stock earns an EPS Rating of 91 out of 99, and an SMR Rating of A. The EPS rating reflects a company's health on fundamental earnings, and its SMR Rating measures sales growth, profit margins and return on equity.

Is Visa a strong buy?

Visa's analyst rating consensus is a 'Strong Buy. This is based on the ratings of 22 Wall Streets Analysts.

Is Visa still a buy?

Visa Inc. - Buy. Zacks' proprietary data indicates that Visa Inc. is currently rated as a Zacks Rank 2 and we are expecting an above average return from the V shares relative to the market in the next few months.

Is Visa a buy or hold?

Visa has received a consensus rating of Buy. The company's average rating score is 2.80, and is based on 16 buy ratings, 4 hold ratings, and no sell ratings.

What is the forecast for Visa stock?

Stock Price Forecast The 31 analysts offering 12-month price forecasts for Visa Inc have a median target of 261.00, with a high estimate of 296.00 and a low estimate of 220.00. The median estimate represents a +26.21% increase from the last price of 206.80.

Is Visa undervalued?

Free Cash Flow is likely to climb to about 4.9 B in 2022, whereas Enterprise Value is likely to drop slightly above 134.3 B in 2022. Visa Inc has a current Real Value of $237.53 per share. The regular price of the company is $207.98. At this time, the company appears to be undervalued.

Is Visa a blue chip stock?

Visa Inc. One of the best blue-chip stocks to buy according to billionaire Richard Chilton, his hedge fund holds 35,540 shares of the financial services company as of Q1 2022, amounting to a stake of $7.88 million.

Is Visa a good company?

On average, employees at Visa give their company a 4.1 rating out of 5.0 - which is 5% higher than the average rating for all companies on CareerBliss. The happiest Visa employees are Software Engineering Interns submitting an average rating of 4.2 and Senior Systems Administrators with a rating of 4.1.

What will Visa stock be worth in 5 years?

Visa Inc - Class A quote is equal to 206.670 USD at 2022-08-25. Based on our forecasts, a long-term increase is expected, the "V" stock price prognosis for 2027-08-20 is 293.916 USD. With a 5-year investment, the revenue is expected to be around +42.22%. Your current $100 investment may be up to $142.22 in 2027.

Is Visa undervalued?

Free Cash Flow is likely to climb to about 4.9 B in 2022, whereas Enterprise Value is likely to drop slightly above 134.3 B in 2022. Visa Inc has a current Real Value of $237.53 per share. The regular price of the company is $207.98. At this time, the company appears to be undervalued.

Which stock is better Visa or Mastercard?

Visa has a higher market share, higher revenues and higher valuation than Mastercard. On the other hand Mastercard has a higher revenue per share, EPS and revenue growth. Both stocks should be bullish in 2022 but Mastercard may provide better profitability because of its opportunities for growth.

Is Visa a good company?

On average, employees at Visa give their company a 4.1 rating out of 5.0 - which is 5% higher than the average rating for all companies on CareerBliss. The happiest Visa employees are Software Engineering Interns submitting an average rating of 4.2 and Senior Systems Administrators with a rating of 4.1.

When did Visa stock take a hit?

How much did Visa trade up in 2018?

Those facts, however, are already in the rearview mirror. The Visa stock price took a heavy hit in December 2018, and there's no shortage of critics who are wondering if the plastic-wielding powerhouse is capable of standing tall as a new wave of fintech-based digital payment providers sharpens their teeth on Visa’s ankles and look to aim higher in 2019.

How much did the V stock drop in December?

Still, Visa traded up approximately 15 for 2018 (it was up by 30 percent at one point) as business was – and is - robust for the payment colossus.

When will Visa end?

December was a decided downer of a month for V shareholders, as the stock price fell by almost 8 percent for the month, a slightly bigger decline relative to the S&P 500 index, which fell by 7.5 percent over the same time period.

Which is the strongest financial payment company?

Visa had a tough end of 2018, but analysts see clearing skies for the card payment giant in 2019.

Is there a visa headwind in 2019?

Visa is also the strongest financial payments company in terms of digital innovation and is leading the way in evolving toward a digital payment society.

Is Visa stock a good buy?

There are potential headwinds for Visa in 2019, particularly if the economy slows.

When did Visa buy out Europe?

Whether Visa stock is a good buy for investors moving forward depends on many factors, including the global economy and the company's ability to modernize its business. (Leon Neal/Getty Images)

What is a good example of a partnership between Visa and IBM?

But Visa has also been known, on rarer occasions, to supplement its growth through acquisitions. Perhaps its most notable purchase came in June 2016 when it completed its buyout of Visa Europe. The deal increased its merchant reach to 40 million, boosted its cards in worldwide circulation to around 3 billion, and brought its global payments volume to roughly $6.8 trillion annually. The innovation, scale, and added profits that Visa Europe brings to the table make Visa all the more attractive.

How many credit cards does Visa have?

Another good example is Visa's partnership with IBM 's ( NYSE:IBM) Watson. The idea behind this collaboration is that Visa may be able to use IBM Watson 's Internet of Things (IoT) platform to reach thousands of IoT client companies. For instance, USA Today describes an instance where a sensor in a car might alert the driver when it's time for a part replacement, allowing the driver to complete the order of the part using their car's dashboard.

How many countries does Visa operate in?

Visa also has 328 million credit cards in circulation in the United States, which is actually more than MasterCard (192 million), American Express (57.6 million), and Discover (58 million) combined!

Why did the APR on credit cards hit an all time high in September?

It's no secret that Visa relies on developed countries to provide the bulk of its revenue and profits, but the company today operates in more than 200 countries worldwide. This means that if the U.S., or any major developed country, enters a recession, Visa may be able to hedge its downside by leaning on purchasing-dollar growth in emerging-market countries, which may be unaffected by a global slowdown. Africa, Southeastern Asia, and the Middle East could play a big role in Visa's growth in the decades to come.

When did Visa go public?

Interestingly enough, though, the average credit card APR hit an all-time high in September, which is probably a result of lenders getting more aggressive with their interest rates since lending rates have been stuck near record lows for so many years. Long story short, as long as the Fed continues to walk on eggshells, Visa will likely benefit.

Is Visa a competitive industry?

Since the company went public in March 2008, shares of Visa have risen by 581%, inclusive of its split in 2015. Despite this strong move higher, there are plenty of reasons to believe there's more left in the tank.

Why does Visa (V) Matter?

A high barrier to entry in the industry. Some of the best investments are those that offer competitive advantages. While Visa is certainly not free of competition, there aren't any surprising new entrants into the payment processing industry.

Does Visa invest in innovation?

Visa has laid the groundwork to allow for system adoption anywhere in the world. Currently, Visa cards are used in over 200 countries and accept over 160 currencies. As the world becomes more interconnected and demand for financial services in developing countries continues to grow, Visa’s global reach means that they are the first choice of merchants, business owners, and customers around the world. One of the main reasons for this global appeal is their wide range of products and services to meet a variety of needs. Alongside their main card offerings, Visa has also branched and created a number of additional products and services to make transactions across the globe easier, safer, and faster. For example, the Visa payWave system, which allows users to wave their card over the machine to pay, is a perfect example of a simple solution that saves time and effort without sacrificing security. Another example of enhanced security features is the “neural network” system, which detects unusual activity on your card and alerts your financial institution.

Is Visa a financial company?

While Visa invests heavily into innovation internally, the company also actively looks externally for ways to strengthen their position through the acquisition of promising products . In 2020, Visa made a bid to acquire Plaid, a company that products a financial technology that allows popular applications like Venmo to interface with user bank accounts. Ultimately, the $5.3 billion deal fell through due to regulatory hurdles.

Why Visa is a Good Core Holding

Visa has stood at the top of the financial sector for almost half a century. Billions of transactions worldwide depend on their fast, secure, and easy-to-use system. The products and services offered by Visa will continue to play a huge role in facilitating commerce in economies around the world. Looking forward, the company is positioning itself well to fully embrace the next frontier of financial transactions. Despite increased competition from new fintech companies, the solid groundwork Visa has laid means that the company is likely to maintain a solid position in the ever changing financial sector.

How to Evaluate Visa's Valuation

Visa’s stock has outperformed the S&P 500 ( SPY) over the last decade. The company achieved that by growing revenue and earnings at a strong double-digit annual pace. With the company expected to grow earnings at a strong pace of 18% annually over the next five years ( consensus ), I think the stock will continue to outperform the S&P 500.

The Takeaway

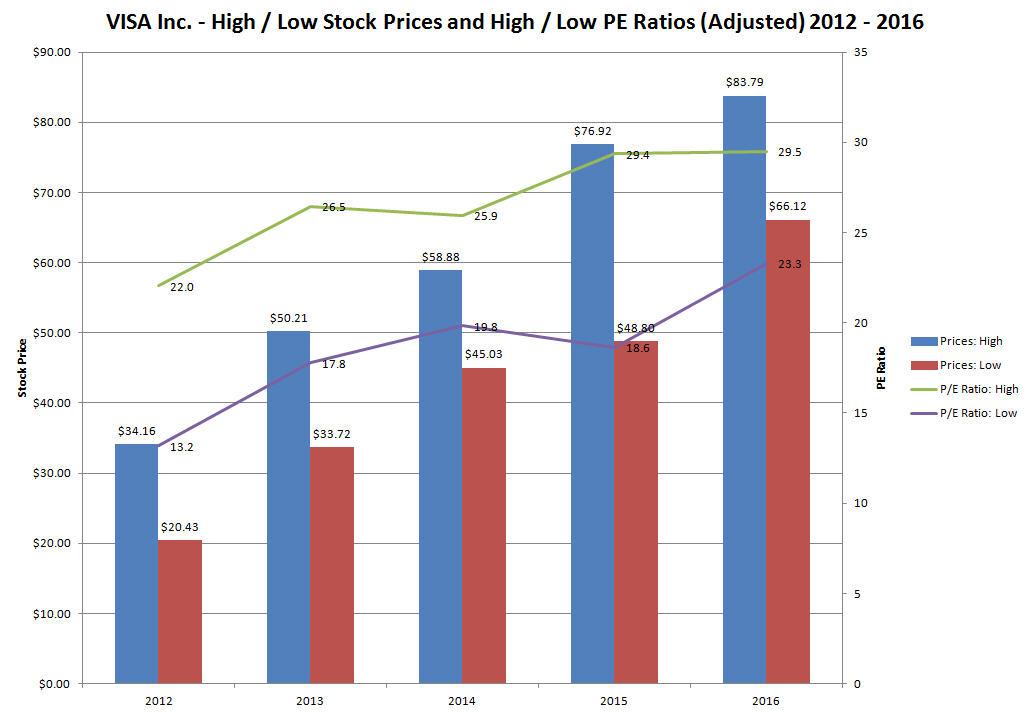

Some bloggers or analysts will point out that Visa’s forward PE of 25 is higher than the S&P 500’s forward PE of 19 and therefore the stock is overvalued. However, Visa will typically get a higher valuation than the market as a result of the company’s higher-than-average growth fundamentals.

How much money does Visa spend?

I am not necessarily saying that Visa will trade 50% higher than the S&P 500, but I am just trying to show how the market awards Visa an above average valuation for the company’s above average performance.

How much did Visa buy Cyperpunk?

According to its most recent annual report, Visa expects to move $17 trillion in consumer spending and $15 trillion-$20 trillion of business spending to cards and digital formats. Currently, much of that spending is still done in cash and checks.

What is the hardest hit category for a visa?

On Aug. 23, Visa said it had bought a CyperPunk NFT on Aug. 19 for around $150,000 in ethereum. The digital art piece is Visa's first foray into NFTs. A collection of nine rare CryptoPunks that were among the first 1,000 minted sold for nearly $17 million in Christie's auction last May.

How much will the payment volume increase in 2021?

The hardest-hit category for Visa includes travel, fuel, restaurants and entertainment. The segment comprises a third of Visa's U.S. payments volume.

What is the Dow Jones stock?

Payments volume grew 17% for the quarter and 16% for all of 2021. Cross-border volume surged 38% in Q4 and 9% for the year. Processed transactions increased 21% for the quarter and 17% for the full year.

Is Visa a stablecoin?

The Dow Jones stock dominates U.S. credit card networks by transactions and cards in circulation. It has ample room to grow in digital payments, while pursuing new bets in fintech and cryptocurrencies.

Does Visa accept USD coins?

On March 29, Visa said it would become the first major payments network to settle transactions in USD Coin, a stablecoin backed by the U.S. dollar, over Ethereum.

How much is Visa stock worth in 2021?

Working with Anchorage, the first federally chartered digital asset bank, Visa has launched a pilot that allows Crypto.com to send USD Coin to Visa to settle a portion of its obligations for the Crypto.com Visa card program.

What is Visa Inc?

The Visa Inc stock price fell by -2.76% on the last day (Friday, 26th Nov 2021) from $203.25 to $197.65. During the day the stock fluctuated 3.45% from a day low at $192.55 to a day high of $199.19. The price has been going up and down for this period, and there has been a -6.07% loss for the last 2 weeks. Volume fell on the last day along with the stock, which is actually a good sign as volume should follow the stock. On the last day, the trading volume fell by -1 million shares and in total, 11 million shares were bought and sold for approximately $2.17 billion.

What is the UBS rating for V?

Visa Inc., a payments technology company, operates an open-loop payments network worldwide. The company facilitates commerce through the transfer of value and information among financial institutions, merchants, consumers, businesses, and government entities. It operates VisaNet, a processing network that enables authorization, clearing, and settlement of payment transactions; and offers fraud protection for account holders and assured payment fo... Read more

Is Visa stock a sell signal?

On Nov 18, 2021 "UBS Group" gave "$275.00" rating for V. The price target was changed from $202.54 to 1.2% .

Is Visa Inc stock A Buy?

There are mixed signals in the stock today. The Visa Inc stock holds sell signals from both short and long-term moving averages giving a more negative forecast for the stock. Also, there is a general sell signal from the relation between the two signals where the long-term average is above the short-term average. On corrections up, there will be some resistance from the lines at $200.60 and $216.48. A break-up above any of these levels will issue buy signals. Volume fell together with the price during the last trading day and this reduces the overall risk as volume should follow the price movements. A buy signal was issued from a pivot bottom point on Monday, November 22, 2021, and so far it has risen 1.06%. Further rise is indicated until a new top pivot has been found. Furthermore, there is a buy signal from the 3 month Moving Average Convergence Divergence (MACD).