How does auto rental insurance work with a Visa card?

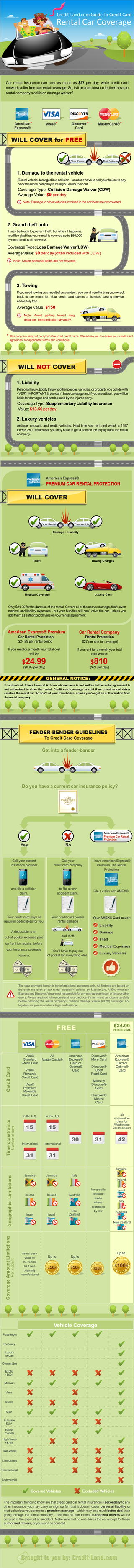

For the coverage to be applicable, the cardholder must decline the Collision Damage Waiver (CDW) or similar coverage offered by the auto rental company. When you use your Visa card to book a car and pay the full price of the rental, you are covered by this insurance.

How does the Amazon Rewards Visa Signature Card work for rental cars?

Decline the rental company’s collision insurance and charge the entire rental cost to your Amazon Rewards Visa Signature Card. Coverage is provided for theft and collision damage for most rental cars in the U.S. and abroad. In the U.S., coverage is secondary to your personal insurance.³

Which credit card companies provide rental car insurance?

Visa, Mastercard, Discover, American Express, and other major credit card companies provide rental car insurance to all cardholders. If you are a valid Visa credit card holder, then you are eligible for Visa’s Auto Rental Collision Damage Waiver, which means you have extra protection when renting a car.

Does my Visa card cover me for auto rental collision damage?

Visa cardholders are eligible for Visa’s Auto Rental Collision Damage Waiver (CDW), which provides added protection when renting a vehicle. However, depending on the type of Visa card you carry, your coverage varies.

Does Chase Amazon card have rental car insurance?

Protections for unexpected setbacks: The Amazon Rewards Visa Signature® credit card include Purchase Protection, Extended Warranty Protection, Auto Rental Coverage and more.

Does Amazon Prime credit card have trip cancellation insurance?

The best Amazon Credit Card benefits are its generous rewards and $0 annual fee. Cardholders also enjoy benefits such as travel accident insurance, lost luggage reimbursement, rental car insurance and concierge services.

What are the benefits of having an Amazon Visa card?

Rewards. 3% cash back at Amazon.com and Whole Foods Market; 2% back at restaurants, gas stations and drugstores; 1% back on all other purchases.Welcome bonus. $50 Amazon.com gift card upon approval.Annual fee. $0.Intro APR. None.Regular APR. ... Balance transfer fee. ... Foreign transaction fee. ... Credit needed.

Does Amazon store card have insurance?

Amazon offers purchase protection to its Visa Signature cards issued by Chase and the Amazon business credit cards issued by American Express. The coverage between these cards slightly varies: Amazon Rewards Visa Signature Card – $500 per claim, $50,000 per account for 120 days from the date of purchase.

Do all credit cards have travel insurance?

Travel protection and travel insurance benefits won't be available on every credit card, but if you use travel credit cards, they probably have an insurance-related perk or two. It's also typically the case that travel cards with annual fees usually offer more types and higher levels of coverage.

What bank is Amazon Prime visa?

Chase BankThe Amazon Prime Rewards Signature card is issued by Chase Bank, so it is a Chase credit card.

How many credit cards are too many?

How many credit accounts is too many or too few? Credit scoring formulas don't punish you for having too many credit accounts, but you can have too few. Credit bureaus suggest that five or more accounts — which can be a mix of cards and loans — is a reasonable number to build toward over time.

What credit score is needed for Amazon Prime Visa card?

740 or higherWhat credit score do I need for Amazon Prime Rewards Visa Signature Card? Generally speaking, you'll need excellent credit to qualify for the Amazon Prime Rewards Visa Signature Card. This typically means a credit score of 740 or higher.

What credit score do you have to have for a Amazon credit card?

700 or betterThe Amazon.com Credit Card credit score requirement is 700 or better. That means people with at least good credit have a shot at getting approved for this card. The Amazon.com Store Card one the other hand requires a 640+ credit score (fair credit).

What is the difference between Amazon store card and Amazon Prime store card?

The Amazon Prime Store Card is an excellent way to save 5% on your purchases or receive promotional financing. The standard Amazon Store card offers you the same financing options without the expense of a Prime membership, but without the ability to earn rewards.

Can I use my Amazon store card at Walmart?

No, you cannot use your Amazon.com Store Card at Walmart, either in-store or online. This card can only be used at Amazon and merchants that accept Amazon Pay, and Walmart currently does not accept Amazon Pay as a payment method.

Do you get free Prime with Amazon card?

Earn Cash Back With the Amazon Prime Rewards Visa Card At this time, no credit cards come with a complimentary Amazon Prime membership. Amazon, however, offers a Prime Rewards Visa Card and an Amazon store card.

What cards have trip cancellation insurance?

When you're traveling, it pays to have a credit card with trip cancellation insurance.Platinum Card® from American Express: Great for luxury travelers.Chase Sapphire Reserve®: Great for frequent travelers.Chase Sapphire Preferred® Card: Great for occasional travelers.More items...•

Does my Mastercard have trip cancellation insurance?

Travel accident and emergency medical insurance* For greater peace of mine when travelling, an eligible Mastercard offers emergency travel coverage anywhere in the world to you, your spouse and your dependent children, when travelling with either parent.

Does Visa cover trip cancellation?

Trip Cancellation / Trip Interruption Reimbursement When you purchase your travel ticket with a covered Visa Signature card and you must cancel or interrupt your trip, this benefit can help reimburse for the non-refundable cost of your passenger fare.

Does travel insurance cover non-refundable airline tickets?

You have to cancel your trip. Even if the airline, hotel, and activities don't refund your expenses, trip insurance reimburses all non-refundable expenses, so you don't lose the money you invested in your trip. If you have to unexpectedly cancel your trip due to unforeseen events, trip cancellation insurance can help.

My boss is threatening me with termination and punishment for medical insurance cost from my spouse, making the companies health insurance rates increase (Texas)

Please excuse my grammar ahead of time.. Yesterday my boss pulled me aside after work to talk to me about my past medical expenses ran through the insurance for the company. I'm on a medical plan through work and I have my spouse on the plan. We live in Texas, although we are not legally married, through "common law" she is considered my spouse.

Adjustor claiming car is total loss (8k repair bill estimate) on a 45k vehicle

Bit of context, I'm located in NY and we were hit with a flood. I drove through around 4 inches of rain when my car stalled. I was given a 8k repair bill by a certified BMW technician and my insurance (geico) adjustor just gave me a call and told me they are going to consider the car a total loss.

Insurance suspects fraud

My neighbor had his roof replaced and while the roofers were there I had them take a look at mine. They reported wind damage and cited the same date of a storm as my neighbors had. I filed a claim but now my insurance has an investigator asking questions that clearly seem like they're trying to say it's a fraudulent claim.

Buying with insurance money and immediately selling. Is this wrong?

My old riding lawn mower got damaged when a tree fell on it. My home insurance covered it as a total loss, directly paying a value equal to the "depreciated" value of the mower.

Dealer said they fixed roof leak. Came back from vacation to a wet smelly car. Insurance is thinking total loss. options?

A month ago I paid my dealer $600 to have a water specialist fix a rear cargo hatch roof leak on my 2014 Jeep grand Cherokee. They patched a few different spots supposedly. I’m a travel nurse and left for a month to work, only to return home to humid Boston to find my rear roof liner soaked with water and smelling like mold.

What is the benefit of Amazon Prime?

The most attractive benefit of this card is its high rewards earning rate on purchases through Amazon. Cardholders who have an eligible Amazon Prime membership receive 5 percent cash back on purchases from Amazon.com as well as Whole Foods Market, which is owned by Amazon.

How much is Amazon Prime Rewards worth?

With the Amazon Prime Rewards card, you’re actually earning points, not cash back. Each point is worth one cent. To earn $1 in rewards you’d need to spend $20 on Amazon.com or Whole Foods purchases, $50 on gas station, restaurant or drugstore purchases or $100 on anything else.

What is the benefits of a Visa card?

This card also offers competitive rewards rates for non-Amazon purchases at gas stations, restaurants and drugstores, and comes with a bevy of benefits—roadside protections, a concierge service, hotel perks and travel protections—that make it a great option for travelers.

How many hotels does Visa Signature have?

Cardholders have access to a curated list of more than 900 luxury hotels worldwide, known as the Visa Signature Luxury Hotel Collection. You’ll benefit from automatic room upgrades (based on availability), complimentary WiFi (where available), a $25 food or beverage credit, complimentary breakfast for two guests, late check-out upon request (when available) and VIP guest status.

Does Amazon give you a bonus on Prime?

Amazon also offers a “Prime Card Bonus” of up to 25 percent cash back on select Prime purchases. The digital retail giant has a special page where cardholders can browse hundreds of items that are eligible for an extra 10 percent to 25 percent back for a limited time.

Does Amazon Prime have foreign transaction fees?

The Amazon Prime Rewards card has many useful travel perks. For starters, this card doesn’t charge foreign transaction fees, so it’s a solid choice for international travel.

Does Amazon Prime have a Visa card?

If you’re a regular Amazon Prime shopper, having the Amazon Prime Rewards Visa Signature Card in your wallet is a no-brainer. This card rewards you with impressive cash back on Amazon and Whole Foods purchases, as well as at grocery stores, restaurants and drugstores. You’ll even receive access to exclusive limited-time cardholder offers of up to 25 percent back on select items from Amazon.com.

Auto Rental Insurance

When you use your Visa card to book a car and pay the full price of the rental, you are covered by this insurance. To access this coverage you must decline the Collision Damage Waiver (CDW/LDW) or similar coverage offered by the car rental company in its rental agreement.

Visa Luxury Hotel Collection

Enjoy exclusive benefits in the greatest hotels and resorts around the world.

No foreign transaction fees

You will pay no foreign transaction fees when you use your card for purchases made outside of the United States.

Travel Accident Insurance

When you pay for your air, bus, train or cruise transportation with your Amazon Rewards Visa Signature Card, you are eligible to receive accidental death or dismemberment coverage of up to $500,000.³

Lost Luggage Reimbursement

If you or an immediate family member check or carry-on luggage that is damaged or lost by the carrier, you’re covered up to $3,000 per passenger.³

Baggage Delay Insurance

Reimburses you for essential purchases like toiletries and clothing for baggage delays over 6 hours by passenger carrier up to $100 a day for 3 days.³

Travel and Emergency Assistance

If you run into a problem away from home, call the Benefit Administrator for legal and medical referrals or other travel and emergency assistance. (You will be responsible for the cost of any goods or services obtained.)³

Zero Fraud Liability

With Zero Fraud Liability, you will never be held accountable for unauthorized purchases on your Amazon Rewards Visa Signature Card.⁴

Auto Rental Collision Damage Waiver

Decline the rental company’s collision insurance and charge the entire rental cost to your Amazon Rewards Visa Signature Card. Coverage is provided for theft and collision damage for most rental cars in the U.S. and abroad. In the U.S., coverage is secondary to your personal insurance.³